Steinbach Credit Union is Canada’s eighth-largest credit union and the largest credit union in Manitoba. Other popular credit unions in Manitoba are Assiniboine, Cambrian, and Access Credit Unions.

This review of Steinbach Credit Union covers the many financial products and services it provides to its members.

Want to find out more about credit unions in Canada? Check out my guide to Canadian Credit Unions.

What is Steinbach Credit Union?

Steinbach Credit Union was established in Manitoba in 1941. It currently serves over 100,000 members and has more than $7 billion in assets under management.

The credit union has 3 locations – headquarters in Steinbach and branches in Linden Ridge and Lagimodiere (both in Winnipeg).

Steinbach Credit Union offers banking services to personal, business, and agricultural members. These members have access to 1800+ free ATMs across Canada.

Steinbach Credit Union Accounts

Steinbach CU Savings Accounts

Regular Savings: No minimum balance requirement and no fees; 1 free withdrawal and $1.00 after. This account is best for long-term savings. Interest is calculated monthly and paid annually on December 31.

Plan 24 Savings: Interest is calculated daily and paid every month; there is no minimum monthly balance, one free withdrawal, and $1 after.

Monthly Savings: Interest is calculated and paid out monthly.

Save Wise: Free transactions. This account is converted to a regular savings account at the age of 15.

Steinbach CU Chequing Accounts

Standard Pack Chequing: 1 free debit monthly per $500 balance, then $0.65 each; no monthly fee, and earn 0.05%* interest.

Value Pack Chequing: $8.95 monthly fee. Enjoy 35 free monthly transactions, a $5 discount on a safety deposit box rental, and one free order of cheques every year; earn 0.05%* interest.

Classic Chequing: $15.50 monthly fee, unlimited free transactions, and a $5 discount on safety deposit boxes.

E-Pack Chequing: $5 monthly fee and 15 free transactions/month. The account does not earn interest.

U.S. Chequing: No monthly fee, one free cheque or deposit per $1,000 balance, and earn 0.05%* interest.

Student Chequing: Two types ($0-$10 monthly account fee), 35 to unlimited free transactions/month, and earns interest.

On Track Pack Chequing: For members aged 19 to 24. $5 monthly fee, 35 free transactions, and earns interest.

Golden Chequing: A senior’s account (60+ years): Free transactions, one free order of personalized cheques/year, discount on a deposit box rental, and no monthly fee.

Steinbach CU Investment Accounts

They offer popular investment accounts and assets.

- TFSA: Fixed-rate GICs, U.S. Dollar GICs, and index-linked GICs

- RRSP: RRSP variable savings, RRSP GICs, and mutual funds

- RRIF: RRIF variable savings and RRIF GICs

- RESP: Variable savings and GICs

Online investing: Self-directed investors can use the Qtrade Investor Online Brokerage. Members who would rather pay for professional portfolio management can use VirtualWealth, a robo-advisor.

Steinbach Credit Union also has a partnership with Aviso Wealth Inc. to provide wealth management services.

Borrowing and Credit Cards

They offer lines of credit, personal loans, and mortgages. The personal credit cards are:

- SCU Cash Back Mastercard

- SCU Centra Visa Gold Card

- SCU Classic Mastercard

- SCU Travel Rewards Gold Mastercard

- SCU US Dollar Mastercard

- SCU World Mastercard

Insurance

- Loan and line of credit insurance

- Mortgage insurance

- Home insurance

- Travel insurance

Related: Best Credit Cards for Travel Rewards in Canada.

Steinbach Credit Union Business and Agriculture Accounts

Savings Accounts

- Regular Savings: Interest calculated monthly and paid annually on December 31, 1 free withdrawal and $3 after.

- Plan 24 Savings: Interest calculated daily and paid monthly; 1 free withdrawal, and $3 each after.

- Monthly Savings: Interest calculated and paid monthly.

- Agri-Invest Savings

Chequing Accounts

- Standard Pack Chequing

- Quality Pack Chequing: $16.50/month

- Premium Pack Chequing: $30/month

- Premium Pack II Chequing: $62/month

Investing: Guaranteed Investment Certificates.

Borrowing: Loans, mortgages, and lines of credit.

Credit Cards

- SCU Collabria Visa Infinite Business Card

- SCU Collabria Low-Rate Visa Business Card

- SCU Collabria No Fee Cash Back Business Mastercard

Ways To Bank

Members of Steinbach Credit Union can conduct their banking transactions in person at a branch, online, or via telephone.

For general inquiries, you can reach the member contact centre on Monday-Friday (8am-8pm) and Saturday (8am-4pm).

Steinbach Branch Contact:

- 333 Main Street, Steinbach, MB R5G 1B1

- Phone: 204-326-3495

- Toll-free: 1-800-728-6440 (for all branches)

Linden Ridge Branch:

- 2100 McGillivray Blvd., Winnipeg, MB R3Y 1X2

- Phone: 204-222-2100

Lagimodiere Branch:

- 1575 Lagimodiere Boulevard, Winnipeg, MB R3W 0B9

- Phone: 204-661-1575

Steinbach Credit Union also has a mobile app you can download on iPhone and Android devices. Members have access to over 1,800 free ATMs within Canada.

Related: Passive Income Ideas To Make Money in Canada

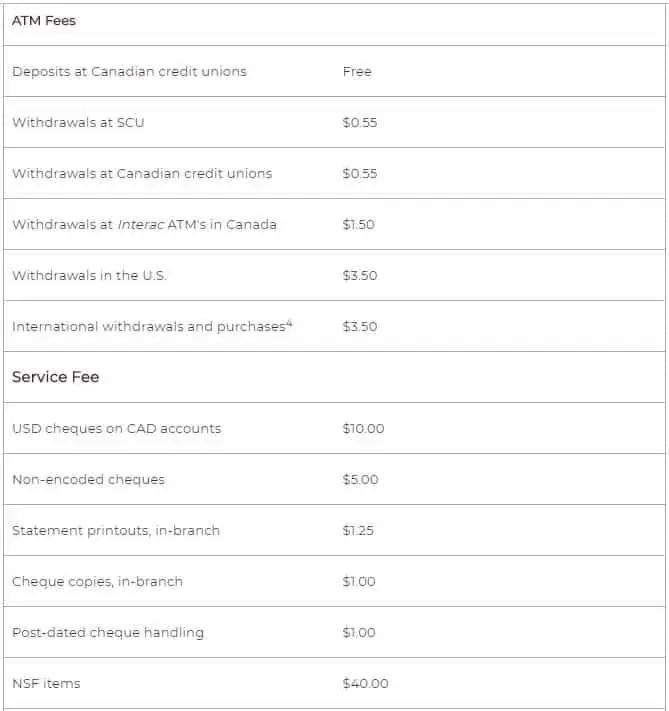

Steinbach Credit Union Fees

Other service fees may be applicable in addition to the general account fees. Some of them are captured in the screenshot below. For a full and updated list, visit their website.

Is Steinbach Credit Union Safe?

Steinbach Credit Union is a member of the Deposit Guarantee Corporation of Manitoba. This means that your deposits are 100% guaranteed should the credit union fail.

This includes your savings and chequing accounts, RRSPs, RRIFs, TFSAs, and term deposits.

Conclusion

This Steinbach Credit Union review is part of a series on Canada’s Credit Unions.

It highlights the services credit unions provide, how to earn higher rates on your savings while paying lower fees and how they are viable alternatives to the big banks.

Related:

- Hubert Financial Review

- Achieva Financial Review

- Assiniboine Credit Union Review

- Outlook Financial Review

- Neo Financial Review

Are you a member of Steinbach Credit Union? Tell us your experiences in the comments below.