The Wealthsimple Cash Card is one of the best prepaid cards in Canada.

You can easily apply for the card in-app if you have a Wealthsimple Cash account and start earning 1% cash back on all purchases.

This Wealthsimple Cash Card review covers how it works, fees to watch out for, and how to earn cash back when you shop.

Wealthsimple Cash Card Overview

Wealthsimple Cash Card

Prepaid Mastercard

1% cash back on purchases

Free money transfer app

Access to virtual and physical card

The Wealthsimple Cash Card is a prepaid Mastercard (previously a Visa card) offered by Wealthsimple Payments Inc. via its partnership with People’s Trust Company and Mastercard.

Also referred to as Cash Card, the Wealthsimple Mastercard is a key feature of the company’s P2P money transfer app known as Wealthsimple Cash.

While the app is primarily for receiving and making payments instantly, the Cash Card makes it possible to withdraw money at ATMs, make POS payments, waive FX fees, and earn cash back effortlessly.

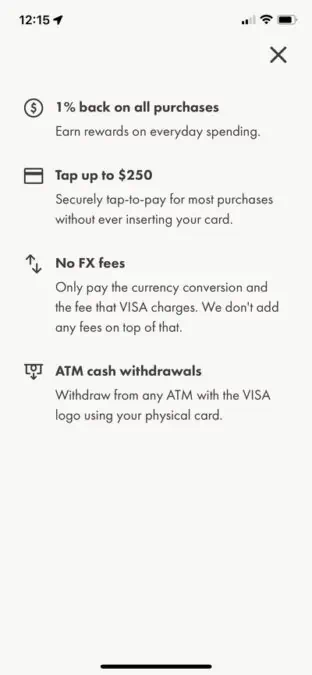

Wealthsimple Visa Prepaid Card Benefits

No Annual Fees: The Wealthsimple Cash Card has no monthly or annual fees. This makes it a great option if you are looking for a no-fee cash back credit card.

Earns Cash Back: The average prepaid card is only for convenience and doesn’t offer rewards. Not so with the Cash Card. You earn 1% cash back on all purchases when you pay using your card. Cash back earned is paid out within seven business days of completing the transaction.

ATM Cash Withdrawals: Use your physical prepaid card to withdraw cash at any ATM, like a debit card.

Earn Interest: You earn interest on your balance.

POS Payments: This card can be used at millions of locations where Visa cards are accepted. Simply tap to make POS payments up to $250.

Apple and Google Pay Compatible: This card works with Apple, Samsung, and Google Play, making it easy to complete purchases while on the go.

Virtual Card: In addition to the physical card, you get a virtual Wealthsimple Card in-app that you can use. There’s no need to carry the physical card around.

Save on FX Fees: The Cash Card does not charge extra fees when you use your card for purchases abroad or make payments in currencies other than the Canadian dollar. Standard Visa fees still apply.

Downsides of the Wealthsimple Cash Card

If you were expecting a tungsten metal Wealthsimple Cash card, you may be disappointed. The limited-edition metal card is not available to all users.

Prepaid cards don’t affect your credit score, so don’t expect to use this card to build your credit score.

How To Use The Wealthsimple Cash Card

If you don’t have a Wealthsimple Cash account, you can easily sign up online. Cash is now part of the same app for stock trading and investments. When you sign up for the Wealthsimple App here, you receive a cash bonus after funding the new account.

It may take 2-3 weeks to get your card in the mail. In the meantime, you can use the virtual Cash Card on the app.

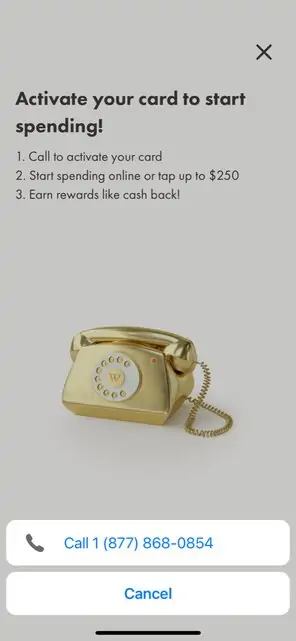

When you receive the physical card, call 1-877-868-0854 to activate it and set your PIN.

Note the following transaction limits when using your card:

| Per Transaction | Per Day | |

| Transaction limit | Unlimited | Unlimited |

| Maximum spending limit | $3,000 CAD | $5,000 CAD |

| ATM withdrawals | $500 CAD | $1,000 CAD |

Wealthsimple Cash Card Fees

The Wealthsimple Cash Card does not charge fees for:

- Foreign currency purchases

- ATM withdrawals in Canada

- ATM withdrawals outside Canada

Note that fees may be charged by ATM operators and other financial institutions that are involved when you make a transaction.

For example, the standard ATM withdrawal fee in Canada is up to $3.

Is Wealthsimple Cash Card Safe?

This card is issued by People’s Trust Company, a Canadian financial institution based in British Columbia. People’s Trust also issues the prepaid cards offered by KOHO.

The cash in your Wealthsimple Cash account is held in a custodial account with Canadian Western Trust Bank (CWB).

Since CWB is a member of the Canada Deposit Insurance Company (CDIC), this means your deposits are protected up to $100,000 if it becomes insolvent.

Wealthsimple Cash Card vs. KOHO Mastercard vs. EQ Bank Card

EQ Bank Mastercard

The new EQ Bank Card provides access to a high-interest savings rate and unlimited 0.50% cash back on all purchases.

In addition, this free prepaid/debit card offers free ATM withdrawals anywhere in Canada and no-FX fees when you make payments abroad.

EQ Bank Card

Earn up to 4%* interest on your balance

0.50% cash back on purchases

No monthly account or FX fees

Free ATM withdrawals

KOHO Prepaid Mastercard

This reloadable prepaid Card is offered by KOHO and comes with a free budgeting app. The regular KOHO Card is free; however, you can upgrade to a paid plan for more features.

Users earn up to 1% cash back on some purchases.

| Features | Wealthsimple Cash Card | KOHO Prepaid Mastercard | EQ Bank Card |

| Monthly fees | $0 | $0 to $19 monthly | $0 |

| Earn cash back | 1% cash back on all purchases | Up to 1% cash back | 0.5% on all purchases |

| FX fees | Waived | 1.5% (waived for KOHO Extra) | 0% |

| Earn interest on your balance | Up to 5% | Varies | Up to 4% |

| Mobile app | Yes | Yes | Yes |

| Virtual card | Yes | Yes | No |

| Apple/Google Pay | Yes | Yes | Yes |

| Credit card | No | No | No |

| Card type | Mastercard | Mastercard | Mastercard |

| Welcome bonus | n/a | – | n/a |

Conclusion

Wealthsimple offers several innovative financial products that help Canadians save on fees and increase their net worth.

The Wealthsimple Cash Card and app aim to revolutionize how we spend, send and receive money while saving money and earning rewards.

Wealthsimple Cash FAQs

The Wealthsimple Cash Card is a prepaid card that works like a debit card. You can use it to pay for purchases or withdraw money at an ATM.

Sign up for a Wealthsimple Cash account and apply for the Wealthsimple Cash Card.

Yes, new Wealthsimple clients get a cash bonus when they open an account and fund it. The cash bonus varies from $5 to as high as $3,000.

No, the Wealthsimple Cash Card is not a credit card, and it has no effect on your credit score.

The standard Wealthsimple Cash Card is plastic. That said, metal Wealthsimple Cash Cards have been provided on a limited basis to some users.

Related:

Wealthsimple Cash Card review

-

Ease of use

-

Cash back rewards

-

Fees

-

Eligibility

Overall

Summary

The Wealthsimple Cash Card offers cash back on all purchases. This Wealthsimple Cash Prepaid Card review covers its benefits, downsides, fees, and whether it is safe.

Pros

- Earn 1% cash back on purchases

- No monthly or annual fees

- Eligible for deposit insurance

Cons

- No welcome bonus

- Does not improve credit score

Its worse now that they made it a prepaid MC, no move visa debit network