When your income passes a threshold the government sets annually, your Old Age Security (OAS) benefits may be clawed back.

Read on to learn about strategies for minimizing the OAS clawback in 2024.

Key Takeaways

- OAS is an income-tested retirement benefit for seniors aged 65 and older.

- In 2024, a portion of your OAS payments are clawed back when your net world income exceeds $81,761.

- At the maximum income threshold of $142,609 for those aged 65 to 74 and $148,179 for those 75 and older, OAS payments are reduced to $0.

OAS Clawback in 2024

The maximum monthly basic OAS payment for the January to March 2024 quarter is $713.34 if you are 65 to 74 and $784.67 if you are 75 and older.

When your net income exceeds the income threshold set by the government, the OAS paid to you becomes subject to a clawback (or Recovery Tax as it’s officially referred to). The income threshold amount is updated every year.

For the July 2023 to June 2024 pay period, OAS clawback is triggered when your net income is $81,761 or higher, which is based on your 2022 tax return.

OAS clawback results in a reduction of OAS benefits by 15 cents for every $1 above the threshold amount and is essentially an additional 15% tax.

Clawback Example: Assume Clark, age 65, is recently retired. His net individual income (including the OAS pension) is $95,000 for 2021. Since his net income exceeds the threshold amount of $81,761, he would have to pay back some of his OAS pension.

Net income: $95,000

Minus threshold amount: $81,761

Excess income: $8,239

Clawback (15% on excess income): $1,235.85 or approx. $102.98 per month.

Unlike other benefits available to low-income seniors, income from OAS is taxable. For 2023, if your income exceeds $142,609 (age 65 to 74) or $148,179 (age 75 and older), your OAS benefit is reduced to $0.

The OAS pension is a taxable monthly payment from the Government of Canada to eligible seniors who are 65 or older. Here are the eligibility requirements.

In addition to the OAS, low-income seniors may be eligible for additional benefits, including the Guaranteed Income Supplement.

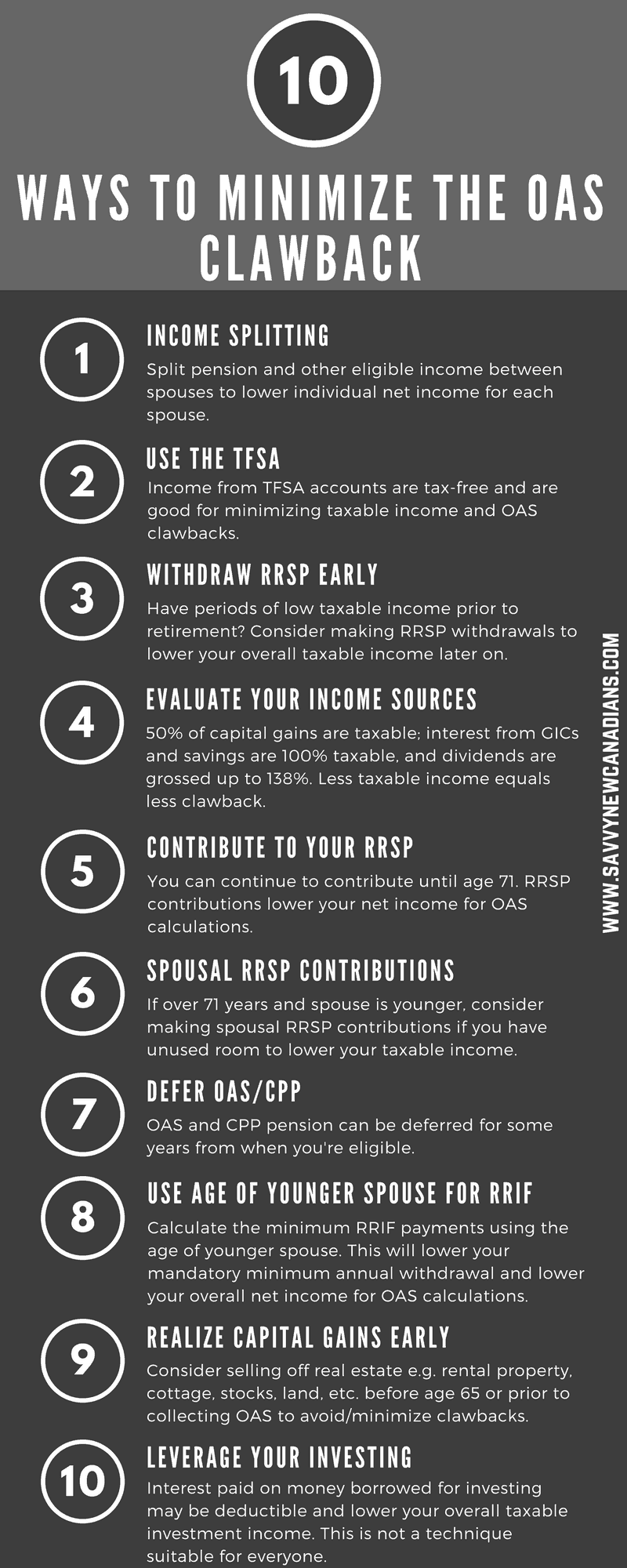

How To Minimize The OAS Clawback in 2024

1. Income Splitting

Splitting of pension and other income, such as Registered Retirement Income Funds (RRIF), annuity payments, and CPP pension sharing between spouses, can lower individual income for either spouse and help them limit or avoid OAS clawbacks.

2. Evaluate Your Income Sources

Income derived from non-registered investments is treated differently when it comes to taxation. For example, only 50% of capital gains are included in taxable income; interest from GICs and savings are fully taxable, and dividends are grossed up to 138% before tax.

When a greater portion of your investment income is taxable, your overall income may be pushed over the income threshold.

3. Prioritize TFSA

Income from investment or savings in Tax-Free Savings Accounts (TFSA) is tax-free, making TFSAs an excellent tool for minimizing your taxable income and OAS clawback. You can also use your TFSA to hold most types of investment assets.

4. Early RRSP Withdrawal

Consider withdrawing funds from your Registered Retirement Savings Plan (RRSP) funds before age 65 if you have periods with low taxable income before retirement.

RRSPs are only tax-deferred, and taxes are due at withdrawal. Depending on your circumstances, the reduction in RRSP funds available later on may maximize the OAS benefits you qualify for.

Funds withdrawn from your RRSP can be re-invested in a tax-efficient account like the TFSA.

5. Contribute To Your RRSP

Even in retirement, you can continue to contribute to your RRSP (until you turn 71) if you have a contribution room or have any employment income. RRSP contributions lower your net income for OAS calculations.

Related: Understanding the Defined Benefit Pension Plan

6. Spousal RRSP Contributions

If you are over age 71 and your spouse is younger, you can make spousal RRSP contributions to their RRSP if you have unused contribution room. This contribution will lower your taxable income.

7. Defer OAS/CPP

Seniors can defer OAS pension for up to 5 years from eligibility. With a deferral, you become eligible for a higher monthly pension later, with an increase of up to 36% at age 70.

This strategy works if your income level between the ages of 65 and 70 pushes you into the income threshold for OAS clawback. CPP can also be deferred.

8. Use Younger Spouse Age For RRIF

Use the age of the younger spouse to calculate your minimum RRIF payments. This will lower the mandatory minimum annual withdrawal requirement and lower your overall net income for OAS calculations.

9. Realize Capital Gains Early

Consider selling off real estate, like your rental property, cottage, land, stocks, etc., before age 65 or before collecting OAS to avoid triggering OAS clawbacks.

10. Leverage Your Investing

If you borrow to invest, the interest paid for the loan may be deductible and lower your overall taxable investment income. Note that leveraging always comes with its own risks!

Related:

- How Much Money Will You Need in Retirement?

- RRIFs Explained

- Understanding RRSP Transfers

- CPP and OAS Benefits for Surviving Spouses and Children

- LIRA, LIF, LRIF, PRIF and Their Uses in Retirement

- TFSA Withdrawal Rules

I appreciate very much your expediency in remitting my CPP & OAS benefits so far, month in n month out.

Best regards from Sarajevo – Bosnia.

what about Federal employee’s most of us will be under the 77k however; I still be clawed back even when am under that amount. How do change that

@Martin: Check to ensure that your overall net income (including CPP, other pensions, and investment income) is under the threshold amount. You should not see a recovery tax if this is the case.

I was receiving old age pension when I turned 65 and suddenly my benefits was stop last 2019 without any explanation.I have been here and work here since 1973 …Thanks for your reply

Very informative thank you

@Stella: You are welcome!

my old age pension has been clawed back about $400.00 for July 2019. Why

@Clifford: It is difficult to say what the reason is. Increased taxable income above the threshold amount? Best to contact Service Canada directly to find out why.

Greetings, I’m not clear if combined family income is a factor in OAS benefit calculations…or is it simply personal income

@SMRStars: Your OAS benefit calculation is based on how long you have lived in Canada after age 18. You can read more here:

https://www.savvynewcanadians.com/understanding-the-old-age-security-pension/

When calculating individual NET INCOME for each member of a married couple

Is it AFTER income splitting or BEFORE?

Very well explained with concise statement on what to consider.

hello..i have a 19 year old daughter living with me, I am 66 yrs old and receiving OAS/GIS/Gains for a

total of (OAS/GIS/$1317.00/Gains $83.00. i gave birth to sarah when i was 46 yrs. old in 1996. she works

full time occasionally but finds part time employment most often. i noticed that private income includes

a single person, married or living together couple. of course there is no mention of a single senior living

with an adult dependent. she contributes to the food expenses and pays for her own clothing, etc. if she finds full time work does this count as income and affect my benefits. i am able to meet the rent, bills and food for myself but need sarah to contribute to the food to be able to support us both. she wants to move out on her own but for now must remain with me. any information you can give me would be

helpful. thanks..nancy domstad

Hi I’m just my husband passes away 6 years ago. I received the survivor supplement. I am on social assistance as our 22 year old daughter is on disability and I am her main caregiver. Totally dependent on me. I received the widow pension of $280 a month. Welfare claws that back. So what I get from welfare is $515 a month. Should i am turning 61 this January 2020. Should I take cop now or wait. I don’t know what to do. Thank you. I love reading your page.

Hello. I will be 72 in March 2020. I am widowed and just received my first RRIF payments this month. I am currently receiving Guaranteed Income Supplement which is a major big asset for me. How do I know how much income I can make in 2020 without losing my GIS? Do I still continue to receive the Survivors Benefits? Thanks for your expertise.

@Marcia: Currently, If you are a single senior, you are can receive the maximum GIS with a total annual income of less than $18,600.

You can read more here: https://www.savvynewcanadians.com/guaranteed-income-supplement-allowance-and-allowance-for-the-survivor/

Good information but contains an error. CPP is not eligible for income splitting with a spouse. RRIF and Pension are but CPP is not eligible.

@Gary: I have reworded that paragraph to make it clearer. Spouses can use CPP sharing to minimize or avoid OAS clawback.

How much money are you allowed to make when you receive old age security benefits without being penalized.

Thanks

@Singh: OAS is clawed back starting from $79,054 (in 2020) at the rate of 15 cents for every $1, and it reduces to $0 by the time you earn $128,137.

Would you happen to know for how many months the CRA applies OAS recovery tax? I find it odd that the month after my 65th birthday (April 2020), my OAS was completely clawed back. Why are the basing my income on 2018 or 2019? I just turned 65 this year, and sure as heck could of used the money in May; will also be making far less income in 2020. Seriously don’t get this; I expect it will sort itself out come tax time but thats not of any help to me now. Am re-considering if taking this now and may try to defer it if possible.

Will capital gain on principal residence affect your OAS and trigger a clawback?

Hi Enoch, Will capital gain on principal residence affect your OAS and trigger a clawback?

@Amy: No, unless the sale does not qualify for the principal residence exemption.

I started receiving OAS last year after I turned 65. I only realized there would be a clawback now that I am doing my 2020 taxes. I looked at the 10 options for lowering my net income but they do not apply to me. Is there any way to stop OAS payments now that I have been receiving them for 10 months (then start again when I turn 70 or my wife retires so we can income split)?

@J McLean: I am not aware of any options that allow you to stop and restart OAS once you have started receiving the benefit.

Does postponing my OAS to age 70 change the claw back thresholds?

@Alex: No, it does not change the threshold per say. If your income is lower starting at age 70, this could help you avoid the clawback.

Is the tax free $500 bonus for older seniors counted in a clawback situation?

Please help me! I am a retired single female senior. My sources of income are the CPP, OAS/SV, and OMERS which total just a little over $2,500 as of January 2021. The issue that I am now dealing with is that the government has reduced my OAS/SV pension effective this month from $860.09 to $626.49, which is and will be a reduction of $233,60 a month. I am so distraught – I was already struggling with living on my small monthly pension income, so I was only paying tax on my CPP of $30.00 a month.

I had a home but was forced to sell it in October of 2019 because of the property taxes had increased to over $6,000 by that year. The sale was reported on my 2020 Income tax as requested by the government. My profit from the sale of my home was about $65K, but that money is for the down payment on the purchase of my new home, which I have not found as yet and I do not use that money. How can I now live on my pension incomes that now totals $2,285.28 a month and I am paying $1,000 a month for rent. I think the federal government want me to commit suicide.

Good day.

What in the world is going on with my husband’s OAS? 275.33 less a month..? And for how long..this government must think we are made of money ! So here’s a 8 $raise seeing as we have neglected you since 1973..but hold on let’s take your hard earned money back..that you had worked your entire life for..and this pension is the ONLY INCOME WE HAVE. No savings,no home, no retirement money..how can they do this?

@A Manning: Did his income increase above the minimum threshold for OAS clawback last year? If that doesn’t explain it, I would advise you to contact OAS for an explanation.

My oas last month was reduced by $558.88. Why. I am a single widowed woman and now once bills and rent is paid I do not have enough for food. How do you expect me to live??

@Diane: Sorry to hear. It’s best to contact OAS directly to find out why your benefit was cut.

I have just retired in sept 2021. Tax year 2021 will probably be $80-85,000. Am already taking CPP .

If I request OAS in Jan 2022 I shall be clawed back based on 2o20 or 2021 tax returns ? However 2022 income will be around $40-50,000 with pensions and rrsps used.

Can you recover the OAS recovery or is that lost until a newer tax return happens ?

If I cash in one-half of my non-registered investment, what percent of my capital gains should I use to figure out if I will avoid a clawback?

I am 74; my wife is 70. My RRSP deduction limit for 2021 is $3000. My wife’s “contribution room” for 2021 is 0 (Zero). Can I still contribute $3000 to her RRSP?

I enjoyed your 10 point article very much..

Thank you

Don

@Don: Your spouse’s RRSP contribution room is not affected by your spousal contribution, so that is still possible. Note that the funds must go into a spousal RRSP account created on her behalf. You get to take the deduction on your tax return.

Hi.

I have recently had a bizarre encounter with the folks at CPP, and have learned something you might want to highlight for your readers.

In a nutshell: I turned 65 in August, and without any input from me, CRA started sending me OAS benefit cheques in September. Because of my income, I neither needed nor wanted OAS payments, so I just wanted them to stop sending it, and to cancel the cheques they had already sent While I await confirmation from the CRA, and I am hopeful that has finally been accomplished, it turned out to be much, much harder than it should have been.

If the aim is to gouge as much tax out of people as they can, and to limit the amount paid out to seniors in OAS benefits, this initiative is evidently a good idea (for them, the government). For me, the recipient, not so much: In addition to the “clawback” of $349/mo, the remainder ($293.25/mo) is taxed at top marginal rate, and because the payments (would have) started at (my) age 65, my maximum monthly benefit (assuming I wait until I turn 70) will have been effectively reduced by ~42%. This is the damage that would have been inflicted upon me.

While I expect to still not need my pension and OAS five years hence, at least my penalty (for having been successful and responsible) will be greatly reduced; because I will probably have considerably less taxable income by then, I will therefore incur a much lower recovery tax, on a benefit that will, by then, be 42% greater.

My rough calculations show that had I not insisted that CRA cancel and reverse its unilateral actions, I would have been hit hard over the next five years, in three ways: (Assuming annual decline in my other income by ~10-20% per year.)

1/ I estimate the recovery tax alone would have cost me ~$16,000;

2/ Taxing the remainder at top marginal rate would have been ~$10,500;

3/ Preventing me from waiting until age 70 to start receiving benefits (assuming I live to 85), comes to ~$37,200.

So… the net penalty to me at age 85, had I not vigorously resisted CRA’s unwelcome initiative, would amount to ~$63, 700. think it’s a

Jamie Simm

j.simm@rogers,.com

What is the impact on the clawback if I request the total OAS payment to be deducted as income tax?

Can I withdraw a lump sum from my Rif and invest it in kind to a TFSA. I realize it’s taxable.

@Dona: Yes, you can do whatever you want with funds you withdraw from your RRIF, including contributing it to a TFSA if you have contribution room. Taxes are paid on the RRIF withdrawal amount.

Oas is clawed back for 2021 based on 2020 income. If your income in 2021 is considerably lower can you recoup the clawback for 2021?

@Diane: The lower income in 2021 can help you avoid or lower OAS clawback in the future. I don’t think it is used retroactively.

I am curious and cannot find the answer, but if you delay OAS to you are 70, does the same clawback rate apply?

“OAS clawback results in a reduction of OAS benefits by 15 cents for every $1 above the threshold amount and is essentially an additional 15% tax.”

If so, would the amount of income you can make before receiving zero OAS be higher?

Thanks

Doug in Toronto

@Doug: I believe the clawback applies regardless of when you take OAS and the minimum threshold does not change. As such, it may not make sense to delay OAS if your income will increase significantly.

Hello, both my Wife and l are receiving a state pension from the British goverment. We are not taxed on it from the UK goverment, do we have to declare it on our Canadian tax forms and is it liable to be taxed in Canada.

@Steve: I would think so.

I retired last year (2021) and with my retirement income was high my OAS was totally clawed back.

This year I have only pension and will have a bit of rental income after expenses ( mortgage interest, property tax & maintenance).

As my net income for tax year 2022 will be less than the clawback threshold, is it possible to apply for OAS requesting them to consider before I file my tax return in 2023 for 2022.

I think your 2022 tax return will only impact your benefits starting during the next payment period which is July 2023 to June 2024. So, your tax filing in April should reflect in your OAS amounts/clawback automatically by then.

I have never received a full OAS payment. Actually as of July /22 I am completely clawed back. Will I be able to have my file re- evaluated in January of 2023 since my income is more line with the threshold of 81,761 or do I need to wait for July/23?

@Josie: You may need to wait until the next benefit cycle starting July 2023.