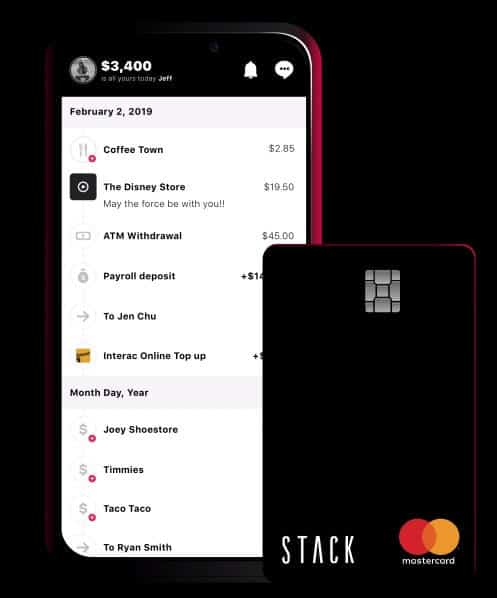

This STACK Mastercard review covers how it works, its pros and cons, rewards, and how you can get a free $5 referral bonus when you sign up and fund your account with at least $300.

STACK is one of the best prepaid cards in Canada.

The STACK card and app continue the trend to save bank clients from having to pay ridiculous fees at every turn, as is evident in today’s traditional banking system. Another great reloadable prepaid card and app that functions like STACK is KOHO.

Update: STACK shut down on September 11, 2023.

Featured Alternative Cash Back App

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

What is STACK?

STACK is a fin-tech company based in Toronto and founded in 2017.

The STACK Mastercard is not a credit card. Rather it is a reloadable prepaid card that makes it easy for you to spend money at home and abroad.

The company has a partnership with People’s Trust, a financial institution with more than $6.9 billion in assets under management.

STACK Mastercard Benefits

- No monthly account fees (terms apply)

- Free and fast STACK-to-STACK transfers

- Automated savings plan

- Free replacement card

- Free budgeting tool in-app

- Worldwide acceptability of Mastercard and Zero Liability Protection

- Everyday rewards

How Does The STACK Mastercard Work?

Opening a new STACK account is easy…it took me only about 3 minutes.

You will need your phone to download the STACK app and create an account after entering your basic personal details (No SIN is required).

After you receive your card in the mail, you can activate it and load funds using either Interac e-Transfer, Visa Debit, direct payroll deposit, or free STACK-to-STACK transfers. You can also load cash up at a participating Canada Post or retailer with your STACK QR code.

Since the STACK Mastercard is not a credit card, you do not need a good credit score to sign up.

There are many reasons why Canadians choose to add the STACK Mastercard to their wallet, from zero foreign transaction fees when travelling abroad to meaningful rewards on everyday purchases.

1. Monthly Fees: STACK has a $7.99 monthly fee that is rebated if you spend at least $350 each month.

2. No Foreign Exchange Fees: Banks make money from foreign currency transactions. In addition to the poor FX rate you get abroad, they also slap on a 2.5% – 3.5% foreign currency conversion fee.

While there are options to avoid FX conversion fees when you use a no foreign transaction fee credit card, there are no debit or prepaid cards in Canada that waive this fee.

Not so with STACK. When you pay with your STACK Mastercard, you pay ZERO foreign exchange fees if you make a minimum of $350 CAD monthly purchases. Note that only FX fees on up to $1,000 CAD of FX spent outside of Canada per month are reimbursed.

3. ATM Withdrawal Fees: There is a $1.99 fee for domestic ATM use and $2.99 for international ATMs. These fees are rebated if you spend $350 or more each month using the card.

4. Automated Savings: The STACK app makes it easy to set a savings goal, and it can automatically round up your purchases to the next $1, $2, $5, or $10 and save the difference. You can cash out your savings at any time.

5. Financial IQ: The STACK app has a financial IQ feature that analyzes your weekly and monthly spending and provides useful insight into how your money is being spent.

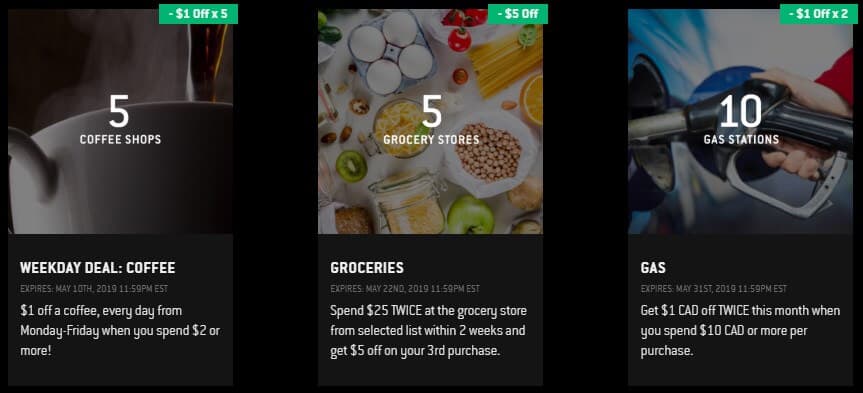

6. Everyday Rewards: STACK does not offer points or a cash back loyalty program. Instead, members receive offers they can easily redeem, such as free membership to Amazon Prime and discounts on coffee, groceries, and gas.

7. Receipt Capture: If you are tired of losing receipts, you can save them with STACK. After completing a purchase, select the transaction, and click the ‘+’ button to take a photo of your receipt.

Note that the STACK Prepaid Mastercard is now available in Quebec.

Is STACK Right For You?

If you are looking at cutting your transaction fees within and outside of Canada, the STACK Prepaid Mastercard comes in handy.

When abroad, it saves you the 2.5% foreign transaction fee and ATM withdrawal fees ($350 minimum spend with the card applies). You also get a fair currency exchange rate.

The app makes it easy to reach your savings goals through an automatic savings plan and the ability to round up your purchases. It is also great for getting a snapshot of your spending habits.

Are you wondering where all your money is going? The STACK app tells you where and when.

You get the occasional offer to save on your morning coffee, weekly groceries, gas, entertainment, and more. They offer great customer service, and you can chat with them via the app or call them at 1-877-STACK-01.

Lastly, you get cash bonuses when friends sign up using your referral link.

Downsides of STACK Mastercard

The downsides of the STACK Prepaid Mastercard are:

- It is not a credit card, so if you were hoping to use it to build a credit rating, that is not possible.

- It now requires a minimum monthly spend of $350 to get the monthly and FX fees waived. Otherwise, you pay the standard $7.99 and 2.50% FX fees, respectively.

- Also, FX fees are only reimbursed for a maximum of $1,000 CAD spent each month abroad.

- Lastly, you must load your new account with at least $300 to get the $5 sign-up bonus.

If you want the best prepaid card in Canada, look at the Neo Money card ($20 welcome bonus after depositing $50).

You can also check out my review of KOHO vs. STACK.

STACK Mastercard Review (Plus a $5 Sign-up Bonus)

-

Zero Monthly Account Fees

-

No FX Fees

-

Automated Savings

-

App Versatility

-

Everyday Rewards

-

Referral Program

Overall

Summary

STACK offers a reloadable prepaid Mastercard and app that helps Canadians to save on bank fees at home and abroad. Get a $5 welcome bonus when you sign up using the link below and fund with $300 or more.

Pros

- Get approved with any credit

- Can help you save on FX fees

Cons

- Hefty monthly fee

- Offerings are not as competitive when compared to KOHO

- Cash load has a fee

Hi, I just got this card by using your link (yes mobile) but I don’t see $25 credit yet. Do you know how long it will take to get a credit or should I already see it?

@David: You should see the $25 cash bonus after you have activated your physical STACK Mastercard.

Hi,

I’m traveling to Vancouver end of September for 6 months. Since I am Swiss, am I eligible to a Stack card? and where can I get a physical card in Vancouver. In other words can I just simply convert cash into a Stack prepaid?

Thanks a lot (interesting reading you by the way).

Nathan

Hi Nathan,

I believe you need to be considered a Canadian ‘resident’ to be able to apply for STACK.

As per their website:

“Who can apply for STACK?

Any Canadian resident outside of Quebec who is the age of majority or older in their province can apply for a STACK Prepaid Mastercard and STACK account.”

Safe travels!

Enoch

Hi,

Do you know if Stack checks with the CRA for Canadian tax residency status? I’m Canadian citizen with Canadian address Ontario driver license Canadian banks account (both credit bureau states my address is in Ontario) but I’m not a Canadian tax resident since I only spent 2-3 months per year in Canada.

@Reda: I’m not sure how STACK classifies Canadian residency for their card application/eligibility. You can give it a try and see what happens…or give them a call.

Hi,

Does stack card charge any other kind of fee? I know they don’t charge for exchange rate. suppose I load 500 dollars on my card and want to use 500 dollars at different times. that money still be there or do need to load some extra money for their fees?

I want to use their card for a long trip in New Zealand. Is it a good idea or i will risk to have a lot of decline with local store and groceries ?

Someone has a feed back of their card use in foreign country ?

Stack is crap. They don’t honour what they promise. Card was declined multiple times, even though enough funds were in the account. Customer service very rude. Highly do not recommend.

I have had issues with authourizations as well. It is usually an address issue – but when i speak to the merchant, or Stack, there are no solutions. Biggest problem is then money is held for 5 business days – which sucks. So i’m always nervous to use it because I’m never 100% confident it will work.

They change conditions on promotions without informing you. They update their terms and conditions and you are suppose to read it every month. When you talk to customer service they are rude and refuse to help you and if you cancel card they will hold your money for 45 days any balance that you have since its prepaid card.

Same thing happened to me. It is my money and they are withholding it for 45 days. They don’t honour their promotions either. Find another card.

I just received my Stack card and noticed that despite this article pointing out that “the company has a partnership with People’s Trust which is a CDIC-insured financial institution with more than $6.9 billion in assets under management”, the Stack cardholder agreement specifically states “Funds loaded onto the Card are not insured by the Canada Deposit Insurance Corporation.” I suggest the article be updated to know longer imply that Stack is CDIC insured.

@Frosty: Updated.

We have had Stack in Europe for around 6 months.

A lot of machines in airports set the exchange rate and you have choice, ie, you pay full bank fees.

You are limited to 2000 CAD a month, so if you load 5000 CAD on it will take 3 months to withdraw. Kind of like a ponzie scheme, Stack has your money, you can not use it. Yes some is for money laundering but 2k a month.

Warren, you’re right. According to https://support.getstack.ca/hc/en-us/articles/360021337253-Card-Limits-and-STACK-Cardholder-Agreement the “Maximum Monthly Cumulative Amount ATM” is $2000. That’s an absurd restriction.

Can you take my surname off above post

Signed up through your referral link but didn’t notice anywhere where I had to enter anything about a specific referral. Is the referral $5 promo still on?

@Abe: Yes, I believe so. You should get your bonus after your card arrives and it is activated.

I was all prepared to apply for the card until I read your comments. Thank you for posting and saving me grief!

@CJ: Thanks for reading!

Just a quick note to mention that people may have different experiences with the STACK Mastercard depending on their peculiar needs and expectations. I have personally used the card several times abroad, including in Africa and Europe and have always been able to access my cash.

Same here. Got it because I was tired of getting ripped off on foreign currency exchange. Great rates. Haven’t had a problem yet, but so far use it mostly (though not exclusively) for on-line purchases. People that don’t have problems don’t tend to seek out & post on blogs like this. I think that’s why the comments are skewed a tad.

hola nathan. I would like to know how Stack makes any money from this. too good to be true!

There is no credit risk on their part. They get to hold on to your money (for free) until you spend it.

This card is great in an ideal sense however I have just had the pleasure of dealing with them twice in less than 3 days about cancelled or declined transactions with merchants and the card still processing the charge and showing up as ‘pending’ on their end but still taking the money regardless. Their customer service solution is to just ‘wait’ for the money to be returned onto the card as the ‘pending’ will drop and the money will show up again…… So while that’s all great in theory, if the cancelled transaction was a $1000 hotel room and STACK still takes the charge and money anyways…. You’re stuck waiting over 10 days for them to ‘return’ it to you….. Because we are all money trees?? With tons of money to just be held hostage because they can’t come up with a better system on their backend to not process declined or cancelled transactions by the merchant?? How does that make any logical sense. Absolutely ridiculous and makes the card look pointless if you’re stuck with tons of ‘pending’ declined transactions with money held up because the card will sometimes work or not work at foreign merchants… Which is the whole point of the card????? FOREIGN TRANSACTIONS??

SarahH, yes, it sucks. But this isn’t specific to Stack. It’s the nature of regular credit cards and pre-paid cards too.

Absolutely horrible and canceling. It’s never available. You add funds and automatically get a ‘sorry, etransfer isn’t working’. Always- this last time no notice, nothing – simply not loading. I’m lucky I have other options but I would NEVER recommend this to someone that will depend on it for traveling or actually having to use it as their only source. It simply is aweful. They do not allow reviews on their only social channel (Facebook), not surprising but truly hope people research before wasting their time. Revolt was way better and sadly is gone from Canada.

So I signed up last week to use this card. I tried to access my account I used the ID and Password (it is 100% correct. I wrote it down and have been using it) it says invalid credentials.

Like… Is this thing even possible? They just blocked me randomly. I have money loaded in the card too..

Horrible Customer Service Experience. Had the card for 3 years, used the card mostly for traveling outside of Canada but did monthly bill payment transactions to keep the card active, had my card cancelled with a simple email indicating the account was closed due to the Cardholder Agreement. Called to speak to a representative who had no idea why the card was cancelled only to state another department made that call (perhaps the company that bought out Stack?)

Having never been with an issue, have likely 20 active credit cards (not prepaid cards) you would think I have been consistent, honest and used the account in good faith. I will state they likely did not get enough money off of me with the intercharge fees they look to benefit from but not even a warning for a long serving customer. Apparently you do not get any respect for being a loyal customer. All I can say is that a major bank or institution would not have the flexibility that this FinTech has. Something worth considering when doing business with Stack. Customer be warned.

i just got an email saying that stack will implement 2.5% FX fees as of Feb 1, 2022 🙁

They are adding this condition:

0% FX on purchases up to $1000 CAD, when you spend $350 CAD or over each month. This will come as a 2.5% FX cashback that will be automatically credited to your account in the following month (For example, if you spend $500 internationally in February, you will receive $12.50 in FX cashback in early March).

So this card is only worth it situationally now; if you’re just making occasional and small foreign purchases, consider a different card.

@dav: Yeah, you are right. The card is not as attractive as it once was for all users.

Do you know if taking $350+ cash out of an atm with Stack card counts as “spending” in this context?

@Clare: I am not sure whether that counts, but doubt it.

Hi Enoch,

Stack looked great for my use case… until it wasn’t. I spend most of my time in a single foreign country where I have banking. But Stack was the solution to ATMs in third countries because it did not charge the dreaded foreign transaction fee (FTF).

And then they introduced the FTF, charging it when you make a purchase, then rebating it if you spend between $350 and $1000 that month. (I checked with Stack… ATM withdrawals do NOT count towards that spend.) They also charged to fund the account if you didn’t spend $350 during the month of the transfer.

I started to use the Stack card in the country where I spend most of my time. Unlike other posters, I had no problem with vendor acceptance. But it rapidly became a chore tallying up whether I’d hit the $350 threshold. When I didn’t pay attention last month, the FTF and account funding fees (normally rebated) were applied.

For the benefit of travelling to 3rd, 4th and more countries on occasion, Stack is not worth the hassle.

But then they make it difficult to cancel the card without leaving money in your account. You’re supposed to drop your balance to zero, since they won’t transfer out of the account.

Someone asked how Stack makes money. Yes, they have the unspent balances of all their customers to play with. That should have been enough. But then they decided to nickel-and-dime cardholders to death.

I’m going for a Wise card. It has a $350 / mo. maximum without FTF charges and can hold multiple currencies.

Another strategy for foreign ATMs — load a positive balance on a backup no-cost Canadian CREDIT card. (Primary no-FTF card for everything except ATMs.) When I used that in a foreign ATM, the exchange rate was the going Mastercard rate (no FTF). No interest charges, because I was not borrowing money. ATM usage charges applied.

@Eric: Yes, STACK has lost its main selling point. I also use the Wise Card now. Interesting angle with your backup plan…I assume you are referring to a no-foreign transaction credit card? Most of these have an annual fee.

Hi Enoch,

I’m did my experiment with a card that introduced an FTF after my experiment. Now, I’m looking at the plain vanilla Brim Mastercard. No fee. No FTF. One percent cashback, even on foreign currency purchases.

If Brim didn’t work for some reason, I would revert to the old travel hacker trick of getting a premium card with one year fee waiver. Use it as “backup” for the year, then cancel and get another one.

I already use the Scotiabank Passport VISA for purchases, travel insurance, lounges etc. By maintaining a minimum $5k balance, I am not charged for the card and other service package fees.

@Eric: I often forget about the Brim Mastercard (a good option for no annual fees and no FX). If you already get Scotiabank Passport Visa for free, then it looks like you are well covered on that front.