The CIBC Air Canada® AC conversion™ Visa* Prepaid Card is one of a few options for minimizing your stress and costs when you have to make payments abroad using foreign currencies.

If you are a frequent traveller, then you know about the hassles of having to make transactions in a foreign currency and the fees that come with it. These include exchange rates that change on a whim and the standard 2.5% or so in foreign conversion fees that apply.

While a few credit cards do not charge foreign transaction fees in Canada, they are not many and often charge hefty annual fees.

This CIBC AC Conversion Card review covers how it works, its benefits, downsides, and alternatives like KOHO Premium.

How Does the CIBC AC Conversion Visa Prepaid Card Work?

The CIBC Air Canada AC Conversion Visa Prepaid Card is not a credit card. It’s a prepaid card that allows you to load and hold up to 10 currencies simultaneously on one card.

You lock in an exchange rate, load up the currency you want, and spend your preferred currency when needed without incurring additional foreign transaction fees.

Considering the typical transaction fee of 2.5% charged by credit cards, you are saving about $25 CAD in fees for every $1,000 CAD in equivalent foreign currency spending. This is on top of any savings you may or may not have on the foreign exchange rate you get.

There is no need to hold (in cash) thousands of dollars worth of Canadian dollars in foreign currencies when you are travelling to save on foreign exchange (FX) fees…and no need to look for an FX bureau when you need local currency.

This card does that for you safely and more conveniently.

For a limited time, you earn 1% cash back on all purchases you make with the card.

Currencies You Can Load on the CIBC AC Conversion Card

You can carry up to ten (10) foreign currencies on your card, which allows you to pay for purchases like a local resident in about 45 countries!

This makes the AC Conversion Visa Prepaid Card one of the best multi-currency cards in Canada.

The currencies you can load are:

- Canadian dollars (CAD)

- U.S. dollars (USD)

- Euros (EUR)

- British pounds (GBP)

- Mexican pesos (MXN)

- Hong Kong dollars (HKD)

- Australian dollars (AUD)

- Japanese yen (JPY)

- Turkish lira (TRY)

- Swiss francs (CHF)

How to Load and Reload the CIBC AC Conversion Card

You can easily load or reload your card with your preferred currencies using your online account at acconversion.aircanada.com or the AC Conversion app. For account balance checks, you can also do this online or call and use their automated service.

The exchange rate at which you lock in your currencies stays the same and will not change regardless of what happens in the FX markets. For this card, CIBC also offers an exchange rate that is generally more competitive than what’s on offer in the branch.

You can look at the current exchange rates here to know how much CAD you need to convert to get your preferred currency.

A few transaction limits to take note of:

- Maximum load amount (single transaction): $2,999.99 CAD equivalent

- Maximum balance: $20,000 CAD equivalent

- Daily (24-hour) maximum point of sale limit: $2,999.99 CAD equivalent

- Daily (24-hour) maximum ATM withdrawal: $2,000 CAD equivalent

When conducting a transaction using your card, it will first try to pay using funds from a “supported” currency (to save you money). If you do not have sufficient funds in a particular supported currency, it will move on to the other currencies you have loaded on your card.

When you have to pay for goods and services using a currency not loaded on your card, the typical 2.5% foreign transaction fees apply.

Related: Best Credit Cards for Groceries.

CIBC AC Conversion Visa Prepaid Card Fees

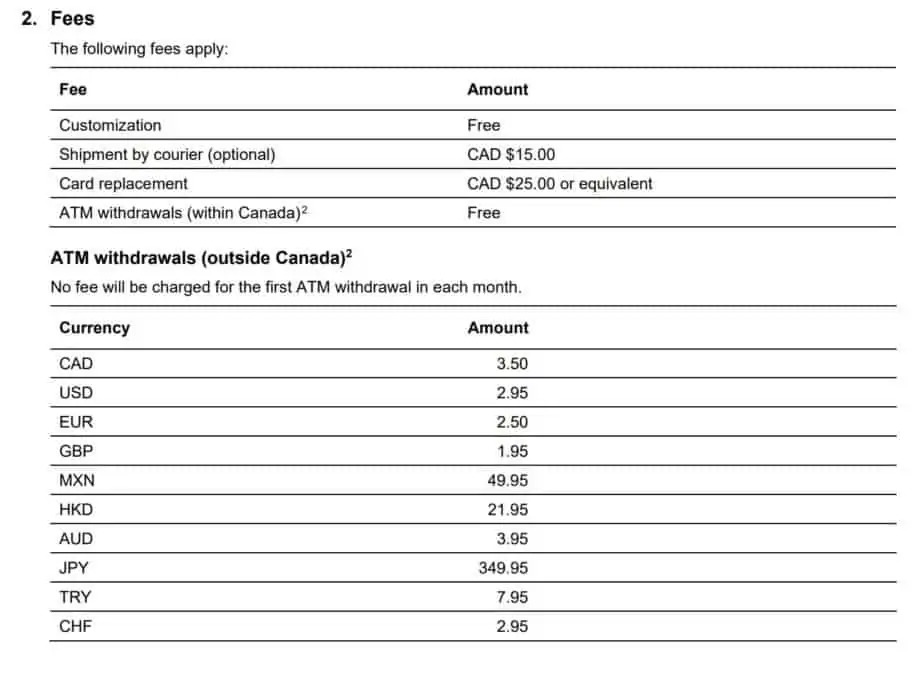

Applying for your initial card is free of charge. However, if you lose your card and need a replacement, use ATMs a lot outside Canada, or pay for transactions denominated in currencies that are not on your card, other fees may apply as shown on their website below:

Pros of the CIBC AC Conversion Card

In addition to its convenience and potential fee and exchange rate savings, the CIBC AC Conversion Card offers some other benefits, including:

- You do not need to be a banking client of CIBC to own the card.

- If you lose your card, you can order a replacement card and transfer your balance over to it. There is 24/7 support available, and you can always call them at 1-800-482-8347.

- The card is protected using chip-and-pin technology to deter fraud. They also offer an emergency card replacement and emergency cash service.

- The card is not connected to your other personal or banking information. If you become a victim of theft or scam, you will not potentially lose your entire bank account, unlike a debit card.

- You have online access to your account 24/7 worldwide, which means you can always load your preferred currency anywhere.

- When you refer a friend, you both get a $10 bonus.

Cons of the CIBC AC Conversion Card

Downsides of the CIBC Air Canada® AC conversion™ Visa* Prepaid Card include:

- It is not a credit card. If you want to spend money you don’t currently have, this card will not do it for you. You must have the funds already loaded on the card.

- Purchasing currencies and loading on the CIBC AC Conversion Card using a credit card and earning points or rewards on the credit card is possible. However, this transaction may appear as a cash advance on some credit cards and cost you cash advance fees.

- You may still need access to cash in the local currency. The card comes with one free ATM withdrawal per month outside Canada; after that, ATM fees apply.

CIBC AC Conversion vs EQ Bank Mastercard

One other card that gets the job done is the EQ Bank Prepaid Mastercard. This card waives FX fees and provides free ATM withdrawals in Canada.

It pays 0.50% cash back on all purchases, and users earn high-interest rates on their balances.

EQ Bank Card

Earn up to 4%* interest on your balance

0.50% cash back on purchases

No monthly account or FX fees

Free ATM withdrawals

CIBC AC Conversion vs Wealthsimple Cash Card

The Wealthsimple Cash Card does not charge a fee when you spend abroad…you only pay the currency conversion and fees charged by Mastercard.

This Mastercard works alongside the Wealthsimple Cash App, a free instant money transfer app you can use to send money within Canada.

It also offers a 1% cash back on all purchases, making it one of the best no-fee cash back cards in Canada. And it comes with a virtual card you can use for online purchases and add to Google Pay or Apple Pay.

Wealthsimple Cash Card

Prepaid Mastercard

1% cash back on all purchases

Free money transfer app

Access to virtual and physical card

CIBC AC Conversion Card vs KOHO Extra Mastercard

You can also check out the KOHO Prepaid Mastercard.

For a $9 monthly fee or $84 per year, you can get the KOHO Extra Mastercard Prepaid Card and save on FX fees when you spend abroad.

KOHO Premium offers the following benefits:

- 2% cash back on groceries, restaurants, and transportation purchases

- No FX fees

- 1 free international ATM withdrawal each month

These are in addition to the benefits you get with the regular/free KOHO Prepaid Mastercard.

Wrapping Up

If you go on vacations abroad or travel frequently, the CIBC AC Conversion Card is one option to manage the volatility of foreign exchange rates, save on fees, and conveniently pay using local currencies worldwide.

You can lock in rates when they are favourable to utilize the currencies at a later date. Better still, the card has no annual maintenance fees.

You can also check out the EQ Bank Mastercard or Wealthsimple Cash Card for spending abroad.

Lastly, the recently launched Wise Debit Visa Card offers ways to spend money and make payments abroad without paying FX fees.

Related Posts:

- Best No Fee Cash Back Credit Cards in Canada

- Best Tangerine Credit Cards Review

- Best No FX Fee Credit Cards in Canada

- Which Banks Use TransUnion in Canada?

CIBC AC Conversion Card Review

-

Annual Fees

-

Foreign Transaction Fees

-

Versatility

-

Overall Value

Overall

Summary

The CIBC AC Conversion Card is one of a few card options out there that minimize your stress and costs when you have to make payments abroad using foreign currencies. Another card worth checking out for zero FX fees is the KOHO Premium Visa.

Pros

- Pay no foreign currency conversion fees

- No annual fees

- Accepted at millions of locations worldwide

- Supports 10 currencies

Cons

- Limited rewards

- Not a credit card

The card worked well for me for almost three years. Now, for some reason, it was declined three times on, 11 November. I checked my account when I returned to the hotel and found that the transactions had gone though and the money deducted. Now the crap I have to go through to get the money back is a joke. I am afraid to use the card again.

Loading this card is not easy. It doesn’t accept all Visas and Mastercards but I wasn’t able to find a list of which ones are accepted. I have this card but I’m unable to load it.

@ Micheline: It may be best for you to contact them at 1-800-482-8347 to report this issue. Cheers.

Overall, I’ve had good experiences with the card. I use a CIBC VISA, Triangle M/C and a Capital One M/C to load the card and it does NOT register as a cash advance for any of them.

However, for the life of me I can’t understand why their tech. dept. can’t correct the surname on my card. I legally changed my surname after I was sent the card. I sent in all the required documents and they updated my profile which I could see when I login online or call the call centre. The problem occurs when the retailer prints my receipt. My old surname shows up on the receipt in black & white. On one occasion I had to convince the retailer that’s it’s in fact my card. The last time I called in to the CIBC AC Conversion card call centre, I suggested they start from scratch as if I’m a new customer to update the surname…..I’m still waiting.

@Eldean: Thanks for leaving a comment and sorry to hear you have been having issues lately with the card. I hope you are able to sort out the name change soon!

I want to load my card using a debit card but it will not accept without an expiration date or cbc. How do I correct.

@Jarle: Please contact them at 1-800-482-8347 to report this issue.

Anyone know if you can load this card with another prepaid credit card? I have a prepaid Visa card with a balance that I’d love to convert to another currency.

@Ray: I very much doubt that this payment option is available. However, it’s best to give them a call to find out.

They deactivated my AC Conversion card 2 weeks before I am going on a trip to Mexico and was going to use it. There is no way to reactivate it, I have to pay to get a new one, except my email address is associated to the old card and their system won’t let me change/delete my email. I tried signing up for a new card and their form says my date of birth doesn’t match my card or something? No more AC Conversion card for me. Not worth the hassle.

I have 35.00 on this card so I tried to buy something online, but it got declined. So I phoned CIBC acc and they told me that card was blocked due to security issues and they said they won’t unblock the card until I give them 2 pieces of ID and email them to CIBC.

CSR was rude to me as well. Going to be closing this account

This card has been useless and frustrating for me. It is not easy to do one simple step online. I just shredded it to keep my sanity. A’int nobody got time for this crap!

The exchange rate is really poor on this card. For CAD to US, the market shows 0.76 but the card wants to convert at 0.72. And that’s the only way to load foreign currency.

BEWARE! Somehow my card # was used, my U.S. acct wiped clean. When checking the transactions on line it was a charge in Florida in May 2019. I wasn’t even there and I still have my card in my possession. I filed a dispute and after 4.5 months they came back and told me my dispute was denied. I am so angry. How can they promote this statement on their FAQ’s on their website…” Protection from unauthorized use of cards or account information” I called the number on their website but was told they couldn’t help me and I would have to email the dispute resolution office…they do not have a phone #.

I thought this card would ideal for travel, but recently I tried to make a reservation on line, something happened and the transaction was declined. The card was blocked and after calling customer service I was informed I would need to email to pieces of I.D and proof of address to unblock the card, and the process could take 5 days! great if your travelling! Most card companies can unblock a card over the phone with the correct information!

I just got my card to test their no-fee claim and use it if true. I did this test and found out that whether you buy euros, for example, from a bank (that charges that 2.5% fee) or load this card with the same amount of euros, the total in CAD is the same. So, this no-exchange-fee claim is totally BS. If one does want to carry a prepaid card loaded with a number of currencies an alternative would be Wise; check that out and compare it with the other alternatives listed above in the article. Now, if only there is a way of cancelling this AC card. Maybe it will be cancelled by itself if never used.

I sent money to the card for the first time and already they cannot locate the money. Buyer beware.

I am in limbo between my bank and CIBC ACC conversion trying to locate my money. What a waste of time.

CIBC do better.

I was forced to switch to this card as CIBC was shutting down their prepaid card (which worked amazingly by the way), I have had nothing but issues with this card so far. I will be looking for other options and based on the previous comments I will be doing it sooner than later.

Very disappointed!

@Lisa: Sorry to hear about your experience with the card.

Why did CIBC switch from using a card that was compatible with Google Wallet to one that isn’t? I can’t load this card into Google wallet which now means any taps I do are less secure, and less convenient. I won’t be using this card nearly as much as the nice one CIBC had in their Smart Prepaid card. I don’t know why they just wouldn’t offer both.

We thought this card would be great for our daughter travelling for 3 months. She took to the cibc bank to help her load funds. The bank teller didnt know what she was doing and loaded far more than the allowed 3000. So then shes out of country and now the card will not let her withdraw funds but visa happily took out over 250.00 for an admin fee. So now somehow we need her money off this card and returned to her debit account ….. are you kidding me ? I wish we never got this card what a joke

The new CIBC conversion card is not like the CIBC currency cards, that this card replaced. The card is not seen within your CIBC banking umbrella like the old CIBC currency cards (I had a CIBC EURO card) and your day to day CIBC cards. It is not easily loaded as you load by creating AC Conversion & account # as a “Payee” then load the card as you would paying bills. It takes longer then 2-3 days to see funds show up on your CIBC AC Conversion card. The old CIBC currency cards could be loaded every evening and it was instant but all done within the umbrella of CIBC.

I think I will zero the card on our next trip and move on to something else, or use my debit car and take bits of cash out daily.

The one major negative issue I find with the Conversion Card is the delay for loading funds. Three banks used for transfer two took over a week and one is still pending after 24hours

@Andrew: Yes, that seems to be a recuring issue.