Despite the rise of passive investing, stock picking retains its relevance for individual investors in today’s landscape.

While passive strategies offer diversification and cost-effectiveness, investors can potentially achieve higher returns by picking individual stocks with the help of some of the best stock research websites.

Even if you have little to no knowledge of investing and Finance, these stock research websites can empower you to make your own decisions instead of relying on third parties.

Best Stock Research Websites for 2024

- Motley Fool Stock Advisor Canada

- Seeking Alpha

- Motley Fool Rule Breakers

- Benzinga Pro

- Morningstar

- Zacks Investment Research

- Trade Ideas

- Stock Rover

- The Wall Street Journal

- Stocktrades Premium

- Bloomberg

Best Stock Analysis Websites

1. Motley Fool Stock Advisor Canada

Motley Fool Stock Advisor Canada is a leading investment research service designed specifically for Canadian investors, offering a wealth of features and expert insights to assist in making informed investment decisions.

The service provides subscribers with two new expert stock recommendations every month. In addition, subscribers also get access to “Best Buy Now,” a list of the top stock picks curated from the recommendations of Motley Fool’s seasoned analyst.

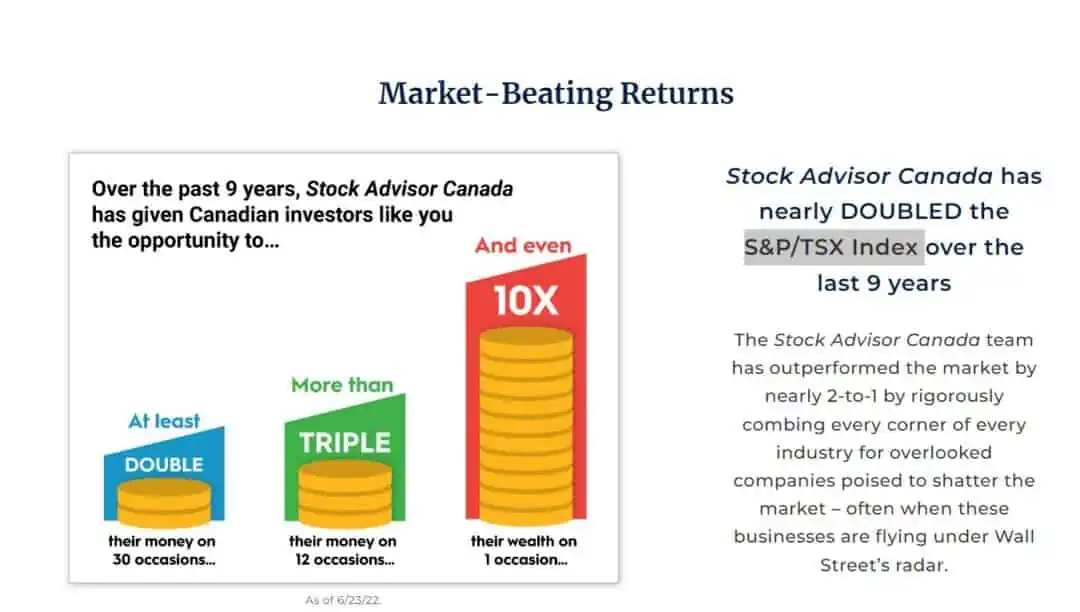

In the last 9 years since the service launched, the Motley Fool Stock Advisor Canada team has generated double the returns of the S&P/TSX Index, with over 40 stocks they recommended generating returns of more than 100%.

Subscribers of this service also gain access to all the archives and articles from the Motley Fool and an entry into Motley Fool’s elite online community.

Pricing: A Motley Fool Stock Advisor Canada subscription will cost you $99 per year with our exclusive 66% discount (a significant discount from the $299 regular pricing) and comes with a 30-day money-back guarantee. This translates into only $1.99 weekly.

Pros:

- Focuses on Canadian Stocks

- Regular updates on recommendations

- Access to thousands of articles and knowledge resources

- A thriving online community

Cons:

- At this price, none.

Stock Advisor Canada

Unlimited access to expert stock recommendations

Almost doubled the S&P/TSX Index over last 9 years

New stock picks every month

50,000+ members

$1.90 weekly (66% discount)

2. Seeking Alpha

Seeking Alpha is a highly renowned and widely visited stock analysis website globally. While many features and tools on the website are freely accessible, Seeking Alpha also offers Premium and Pro subscriptions for a more comprehensive investment experience.

As a Seeking Alpha Premium subscriber, you unlock numerous advantages, including exclusive articles from seasoned contributors and in-depth analyses of individual stocks. The Premium subscription also grants access to the extensive library of archived articles, analyst ratings, real-time quant ratings, and dividend grades for individual stocks.

Taking it a step further, the Seeking Alpha Pro subscription encompasses all the benefits of the Premium subscription and more. With Pro, you gain coveted access to Seeking Alpha’s “Top Ideas,” expertly curated high-conviction long or short investment recommendations with unique risk/reward profiles selected by their in-house team of analysts.

Additionally, Pro subscribers enjoy membership to the Short Ideas portal and receive exclusive PRO content and newsletters.

Pricing: Seeking Alpha Premium costs $239 annually, whereas Seeking Alpha Pro costs $2400 annually.

Pros:

- Contributions from top analysts and industry experts

- Coverage of a wide range of industries, sectors, and assets

- Exclusive quant and analyst ratings

Cons:

- The cost of Seeking Alpha Pro may be a deterrent for some investors, especially those seeking lower-cost alternatives.

3. Motley Fool Rule Breakers

The Rule Breakers is another investment research offering from the stable of Motley Fool. With a focus on disruptive companies and innovative industries, Rule Breakers identifies stocks with the potential to deliver significant long-term returns. The service was launched in 2004 and has outperformed its benchmark (the S&P 500 TR Index) by a wide margin since then.

As a Motley Fool Rule Breakers subscriber, you gain access to a wide range of exclusive features and resources, including 2 new stock recommendations handpicked monthly by Motley Fool’s top analysts. You also get a “Best Buys Alert” every month with a list of 10 stocks previously recommended by the Rule Breakers team, which they think still have room to go up.

The service provides in-depth analysis and recommendations on high-growth stocks, highlighting companies that are challenging conventional norms and driving industry transformation. Through their team of seasoned analysts, Rule Breakers offers expert insights, research reports, and updates on recommended stocks to keep you informed about the latest developments.

Pricing: Same as Motley Fool Stock Advisor Canada, the yearly subscription of Motley Fool Rule Breakers costs CA$ 99 and comes with a 30-day money-back guarantee.

Pros:

- A long track record of outperformance

- Regular updates on previous recommendations

Cons:

- Some features like stock analysis and charting tools are missing.

4. Benzinga Pro

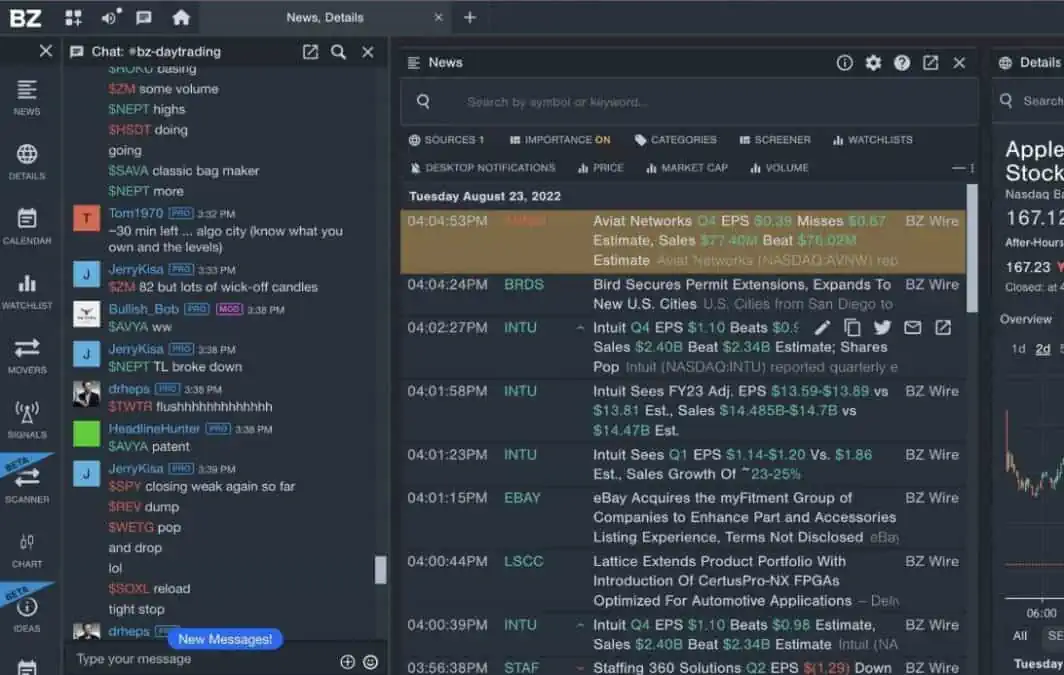

Benzinga Pro is a comprehensive market research and news platform designed for traders and investors. With a Benzinga Pro subscription, you gain access to real-time news alerts, analyst ratings, market-moving rumours, economic indicators, and more. The platform also includes a customizable newsfeed, advanced charting capabilities, and a stock screener to identify potential trading opportunities.

Benzinga Pro offers different types of membership to cater to the diverse needs of traders and investors. You can sign up for Benzinga Pro free membership and access Nasdaq Basic 15-minute delayed news quotes, charting tools, watchlist, and B.Z. Wire Newsfeed (only – search, no filters). However, their paid subscription plans – Basic and Essential – offer a lot more.

With a Benzinga Pro Basic Tier membership, you can access Benzinga Premium articles, the full newsfeed, the chat feature, movers from all sessions, and watchlist alerts. The Essential membership offers you Nasdaq Basic real-time quotes, advanced newsfeed (filter by price, volume, etc.), audio squawk (equity & options), real-time scanner, calendar, and signals features.

You can check out this review to learn more about Benzinga Pro.

Pricing: Benzinga Pro Premium and Benzinga Pro Essential cost $27 and $197 monthly, respectively.

Pros:

- Superfast Newsfeed with advanced filtering options.

Cons:

- The cost of Benzinga Pro Essential may be a deterrent for some investors, especially those seeking lower-cost alternatives.

5. Morningstar

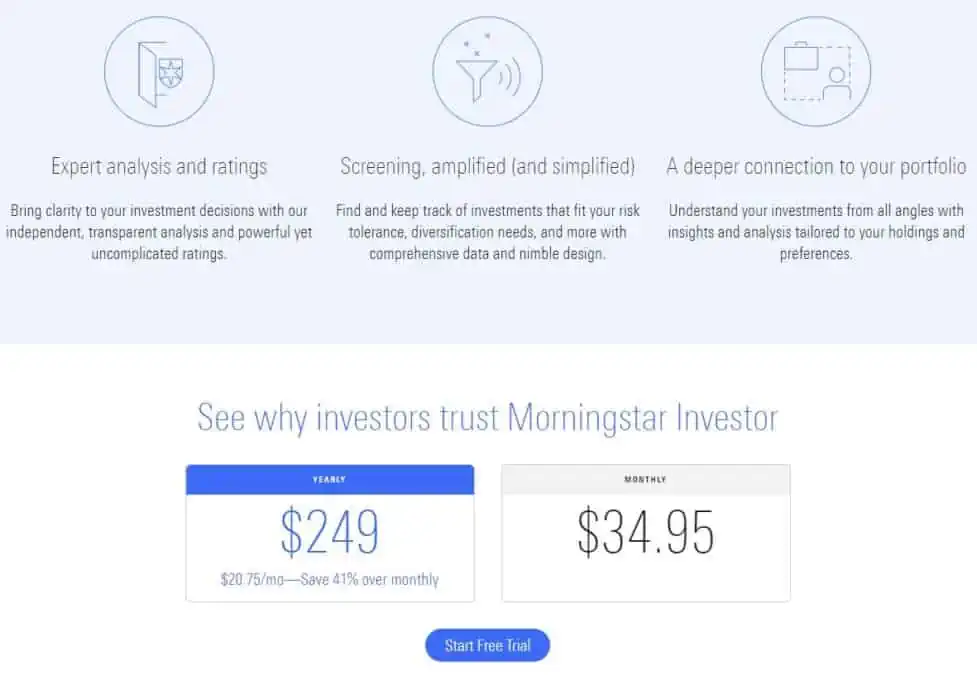

Morningstar is a renowned financial services company that provides investment research, data, and insights to investors worldwide. Morningstar Investor subscription offers a range of benefits to investors looking to make informed decisions about their portfolios. With this subscription, you gain access to a wealth of financial data, research, and tools to support your investment journey.

One of the key features of the Morningstar Investor subscription is access to Morningstar’s comprehensive database of investment information. This includes in-depth analysis and ratings for thousands of stocks, mutual funds, and exchange-traded funds (ETFs). You can explore detailed reports on individual securities, track performance, and evaluate their potential for your investment strategy.

The subscription also provides access to Morningstar’s research articles, market insights, and expert analysis from their team of experienced analysts. Additionally, Morningstar Investor Subscription offers portfolio management tools to help you track and analyze your investments.

Pricing: Morningstar Investor’s monthly subscription costs $34.95, while the annual subscription costs $249.

Pros:

- Provides ratings and fair value estimates for an extensive selection of stocks, mutual funds, and ETFs

- Trusted by institutions and money managers across the world

Cons:

- The analysis and ratings can seem complex to novice investors and may require a certain level of financial knowledge and expertise to fully understand and utilize.

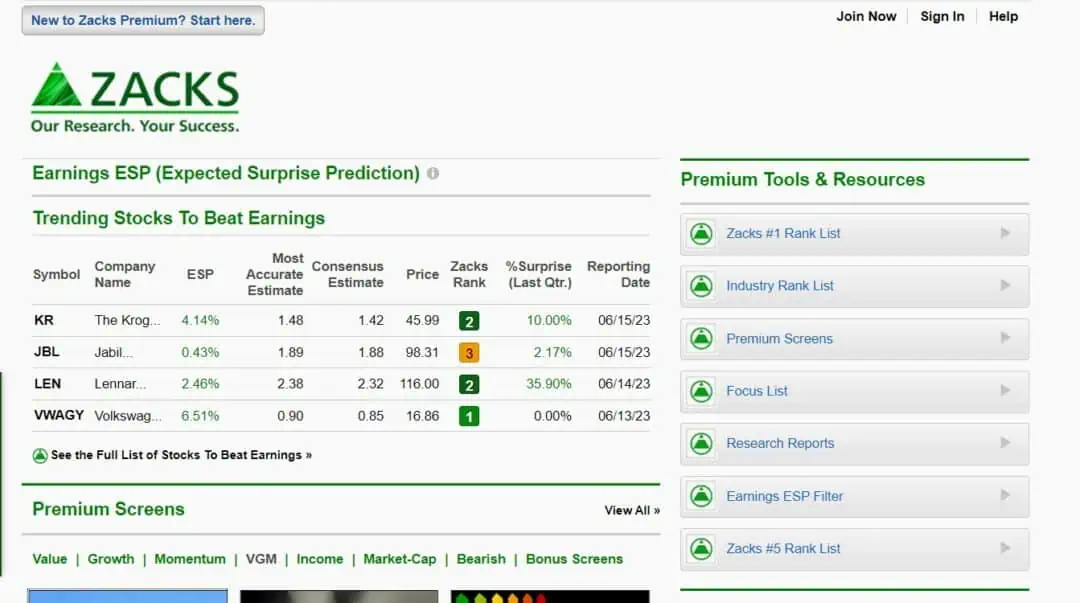

6. Zacks Premium

Zacks, a prominent investment research firm, has built a strong reputation for providing accurate, timely, and actionable stock recommendations that consistently outperform the market.

Zacks Premium, their comprehensive stock picking and research service, offers a range of valuable features to its subscribers. These include access to the highly regarded Zacks #1 Rank List, which comprises stocks rated as a “Strong Buy” by Zacks’ research team.

The service also provides Style Scores, a set of metrics that evaluate stocks based on their particular styles, such as value or growth. Additionally, subscribers gain access to the Focus List, Industry Rank, and the Zacks Earnings Expected Surprise Prediction (ESP) Filter, designed to identify stocks with a high likelihood of exceeding earnings estimates.

Pricing: Zacks Premium costs $249 per year.

Pros:

- Curated opportunities through the Zacks Earnings Expected Surprise Prediction (ESP) Filter, Focus List and Industry Rank.

Cons:

- Coverage may be heavily skewed toward U.S. stocks

- The ranking system and recommendations often focus on short-term performance indicators.

7. Trade Ideas

Trade Ideas is a comprehensive stock analysis platform equipped with a wide range of features such as real-time charting, backtesting, scanning, filtering, and performance tracking.

By harnessing the power of artificial intelligence and machine learning, Trade Ideas aims to identify lucrative trading opportunities. It caters to the needs of both active traders and investors who seek to stay informed and capitalize on emerging market prospects.

The platform offers two subscription options: Standard and Premium. The Standard subscription provides access to essential features, including charting, real-time streaming trade ideas, and price alerts.

In addition to the features provided in the Standard plan, the Premium subscription offers several advanced capabilities. These include the proprietary Artificial Intelligence-based Holly AI and backtesting simulator, which enables users to test and refine their trading strategies using historical data.

Pricing: The Standard subscription is priced at $84 per month or $999 annually, while the Premium subscription is available at $167 per month or $1,999 annually.

Pros:

- Excels as a versatile tool for charting, screening, and filtering stocks.

Cons:

- Primarily functions as a stock analytics website. Does not provide stock research reports, recommendations, or insights from experts.

8. Stocks Rover

Stock Rover is a versatile stock research platform that caters to investors of all levels. The platform focuses on the USA and Canadian markets, providing market data, scoring, ranking, and analysis specifically tailored to these regions.

At its core, Stock Rover offers a powerful stock screener capable of filtering through a vast database of 10,000 stocks and 44,000 ETFs. The screener covers an extensive range of fundamental data points, including over 650 data points and scoring systems for stocks, along with 96 criteria for ETFs.

Stock Rover provides comprehensive company ratings, offering insights into value, growth, quality, sentiment, and financial strength. Additionally, it offers pre-built screeners, including the popular Buffettology screener, and integrates fair value and margin of safety rankings, making it a valuable tool for value investors.

Stock Rover offers three plans to cater to different investment needs: Essentials, Premium, and Premium Plus.

Pricing: The Essentials plan costs $7.99 per month or $79.99 per year, the Premium plan costs $17.99 per month or $179.99 per year, and the Premium Plus plan costs $27.99 per month or $279.99 per year.

Pros:

- Extensive coverage of North American stocks, ETFs, and funds

- Robust stock screening capabilities, including ranked screening

Cons:

- Advanced features and additional metrics available only in higher-tier plans

- No real-time news feed or social chat/community features

- Lacks technical analysis tools and advanced charting capabilities

9. The Wall Street Journal

As a leading business publication, the Wall Street Journal (WSJ) provides comprehensive coverage of financial markets, economic trends, and corporate news.

With in-depth analysis and insights from experienced financial journalists and industry experts, the WSJ goes beyond reporting, offering valuable perspectives on market events and company performance.

Subscribers gain access to real-time updates, breaking news, and a wealth of market data, including stock quotes, charts, and financial ratios.

The WSJ also features opinion pieces from renowned experts, providing additional insights into investment strategies and market trends. Specialized sections dedicated to specific industries offer in-depth coverage of sector-specific news and investment opportunities.

Pricing: A subscription to WSJ for a regular user costs $38.99 + tax per 4 weeks.

Pros:

- Trusted and reputable source

- Comprehensive market coverage

- Expert insights and analysis

Cons:

- Subscription cost

- US-centric focus

- Potential bias

- Limited coverage of advanced technical analysis

10. Stocktrades Premium

Stocktrades Premium is another stock research platform tailored specifically for Canadian investors. Founded in 2016 by investors Daniel Kent and Dylan Callaghan, with nearly 40 years of self-directed investment experience, this stock analysis website has over 2000 premium subscribers.

Stocktrades Premium subscribers get a list of Canadian and U.S. “Foundational” stocks that form the core of their portfolio. These stocks are usually less risky than benchmarks and have provided investors with steady returns.

To boost the performance of their portfolio, subscribers also get a list of Canadian and U.S. “Growth” stocks, which comprise companies on a strong growth trajectory.

As a Stocktrades Premium subscriber, you will also get exclusive access to the Stocktrades Discord server, where you can engage in dynamic discussions with a community of like-minded investors. The Stocktrades.ca Discord server serves as a hub for valuable insights, real-time market updates, and interactive conversations about investment strategies and opportunities.

Access to the platform’s brand-new stock screener, its Q&A section and in-depth research reports are some of the other benefits you get as a Stocktrades Premium subscriber.

Pricing: Stocktrades Premium subscription costs CAD 300 annually and comes with a 30-day money-back guarantee.

Pros:

- Focuses on Canadian Stocks

- Private Discord Servers

- Founders engage in discussions and analysis regularly

- Powerful stock screener

Cons:

- No long-term track record to gauge performance

11. Bloomberg

Bloomberg is a renowned global financial information and media company that provides a wide range of services. Their website serves as a valuable resource for investment research and analysis.

Bloomberg.com offers comprehensive real-time and historical data on stocks, bonds, commodities, currencies, and more. Investors can access a vast database of financial information to analyze market trends, track performance, and make informed investment decisions.

Additionally, the website provides up-to-date news, articles, and analysis from Bloomberg’s team of experienced journalists and financial experts. Subscribers gain access to exclusive content, in-depth market coverage, and insights into various industries, helping them stay informed about relevant news that can impact their investments.

Subscribers also benefit from Bloomberg’s extensive research capabilities, including research reports, industry analysis, and expert insights.

Pricing: Bloomberg’s monthly subscription costs $34.99, while the annual subscription costs $299 ($149 for first year).

Pros:

- Comprehensive financial data and real-time market information

- Access to expert analysis, research reports, and industry insights

Cons:

- Expensive subscription fees

- Overwhelming amount of information that may require filtering and focus

Best Free Stock Research Websites

12. EDGAR

EDGAR is an online database maintained by the U.S. Securities and Exchange Commission (SEC). It offers access to public company filings like annual and quarterly reports, proxy statements, and more. With EDGAR, investors can search and analyze these filings to gain insights into a company’s financials, operations, and risks.

The system provides timely and reliable information, ensuring investors have access to the latest disclosures. One of the key benefits is that EDGAR is free, eliminating the need for paid services. It promotes equal access to information for all investors, levelling the playing field.

While paid platforms offer additional tools, EDGAR serves as a valuable resource for independent research, offering direct access to official company filings.

Investors can save on costs, analyze company information, and access the same fundamental data as professional investors by utilizing EDGAR.

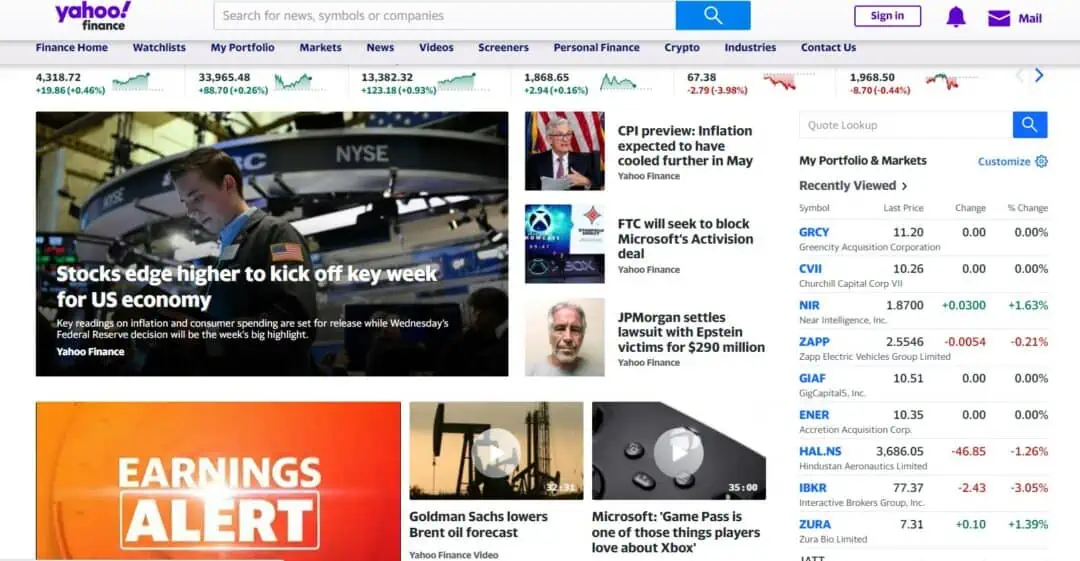

13. Yahoo! Finance

Yahoo! Finance is one of the best free stock research websites available today that provides a wealth of information. On Yahoo! Finance, you can access comprehensive market data, including stock quotes, charts, and historical prices.

The website offers detailed company profiles, financial statements, key statistics, and analyst estimates. Yahoo! Finance also provides its users with interactive charts with customizable indicators and overlays.

Additionally, Yahoo! Finance features a free stock screener feature that allows you to filter stocks based on various criteria, such as market capitalization, sector, valuation ratios, and dividend yield.

That’s not all. The website aggregates news articles from various sources, providing comprehensive coverage of market-related news and events.

You can access opinion pieces, expert analysis, and insightful articles that can help you gain valuable insights and make informed investment decisions.

14. Investing.com

Investing.com is another well-known free stock analysis website. Like Yahoo! Finance, Investing also provides you with comprehensive market data, but it covers more assets and exchanges than the former.

The website offers extensive financial news coverage, delivering timely articles, analysis, and market insights. Moreover, users can access a wide range of technical analysis tools and charting capabilities on the website for free.

Investing’s Pro Stock Screener is one of the most powerful stock screeners out there that you can access for free. It allows you to screen similar asset classes across multiple exchanges worldwide. You can also download your results for free by signing in with your Google or Facebook account.

What differentiates Investing from Yahoo! Finance are its educational resources. Investing.com provides a range of educational resources, including tutorials, articles, and webinars, to help investors enhance their understanding of investing concepts, strategies, and market dynamics.

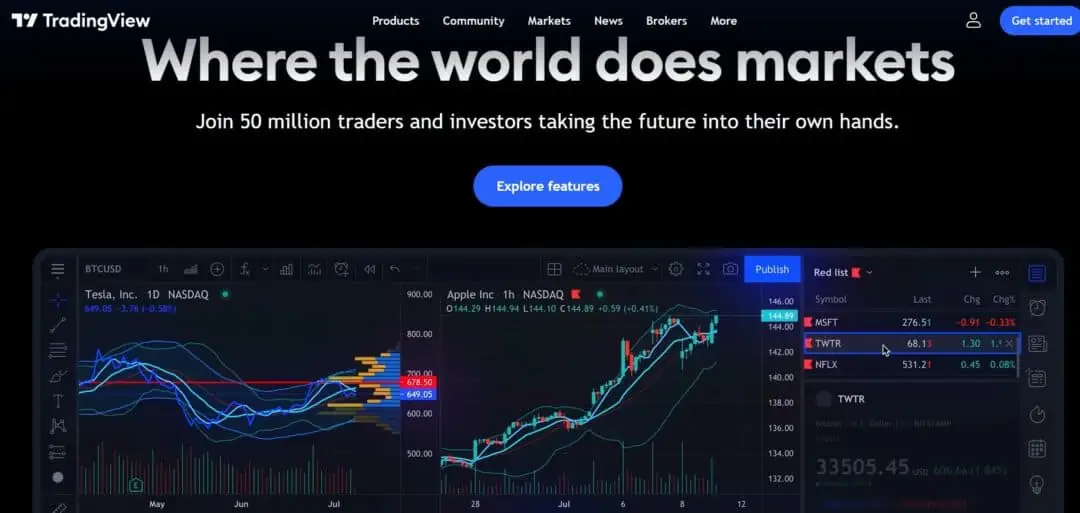

15. TradingView

TradingView is a powerful and user-friendly website for technical analysis. With TradingView, you gain access to a vast array of financial instruments, including stocks, forex, cryptocurrencies, and more.

The platform provides real-time and historical market data, enabling you to stay updated on price movements and trends.

One of the standout features of TradingView is its advanced charting capabilities. You can create interactive and customizable charts with a variety of technical indicators, drawing tools, and chart types. These charts allow you to conduct in-depth technical analysis and identify potential entry and exit points for your trades.

In addition to charts, TradingView offers a strong social community where you can interact with other traders, share insights, and discuss investment ideas. This collaborative environment can provide valuable perspectives and foster learning.

Another notable feature is the availability of trading ideas and strategies shared by experienced traders. You can explore a vast library of published ideas and analyze their performance.

16. TradeStation Analytics

TradeStation Analytics is a desktop trading platform offered by TradeStation Technologies that you can access for free even without a brokerage account.

The platform offers one of the most capable charting tools to analyze stocks, ETFs, options, futures, and crypto markets. You can use its RadarScreen® feature to rank more than 1,000 symbols based on 180 technical and fundamental indicators.

Other features include EasyLanguage®, which allows you to design, create, test and automate custom indicators and strategies, and Portfolio Maestro®, which allows you to perform portfolio-level backtesting.

How Investment Research and Stock Analysis Websites Work

When it comes to investing in stocks, knowledge is power. Investment research and stock analysis websites serve as your treasure troves of financial data, offering comprehensive insights into a company’s revenue, earnings, and other critical metrics.

Armed with this information, you can assess the financial health and performance of companies you are interested in, empowering you to make well-informed investment decisions.

But that’s not all! These websites also provide you with market trends and analysis tools that make sense of the ever-changing stock market landscape. Interactive charts, graphs, and historical data allow you to track the performance of stocks over time.

By analyzing these trends, you gain valuable insights into patterns and future price movements, helping you make timely and strategic decisions for your investments.

Another standout feature that some of the best stock analysis websites provide today is access to expert insights and top stock picks. Seasoned industry professionals and experienced analysts share their expertise and recommendations, highlighting stocks with significant growth potential.

This expert guidance can help you align your investment strategies with well-researched opportunities and potentially outperform the market.

Some of these websites also offer portfolio management tools to make your investing journey even smoother. With user-friendly interfaces, you can conveniently track and manage your investments all in one place.

Keep a close eye on your portfolio’s performance, make necessary adjustments, and stay focused on your financial goals.

How To Choose a Stock Research Website in Canada

Choosing a stock research or recommendations website in Canada requires thoughtful consideration to find the right fit for your needs. Here are some key factors to consider:

Coverage: While there are many stock research websites that focus on U.S. stocks, there are very few of them that also cover Canadian stocks. Investors should look for a platform or website that also provides comprehensive coverage of Canadian stocks and offers accurate, up-to-date data on companies listed on Canadian exchanges.

Research Tools and Analysis: Assess the research tools and analysis features offered by the website. Look for features like stock screeners, interactive charts, financial ratios, technical indicators, and fundamental analysis tools.

Track Record: While past performance is not an indicator of future results, investors should still consider the track record and past performance of a stock recommendation service before signing up for one.

News and Market Insights: Consider the quality and timeliness of the news and market insights provided by the website.

Community and Support: Look for websites with a community or discussion forums where you can interact with other investors and seek support if needed.

Pricing and Subscription Options: Evaluate the pricing and subscription options, considering your budget and the value you expect to receive from paid features.

Are Stock Research Websites Worth It?

Stock research websites can be worth it for investors seeking comprehensive information, analysis tools, stock recommendations, or educational resources.

These platforms save time by providing aggregated data and analysis in one place, helping investors make informed decisions. They may also offer community features for collaboration and support.

However, the worth of these websites depends on individual preferences and investment goals. Some investors may find value in paid subscriptions, while others may prefer free resources.

It’s important to assess each website’s features, benefits, and costs to determine if it aligns with your needs and provides sufficient value for your investment journey.

Methodology

We considered various factors to determine the best stock research websites, with coverage of Canadian stocks and providing value to Canadian investors being key considerations. We evaluated websites based on their features, tools, expert insights, pricing, stock recommendations, and performance.

Best Stock Research Websites and Tools: Conclusion

In conclusion, stock picking remains relevant for individual investors, and the best stock research websites can empower them to make informed investment decisions.

These websites provide comprehensive financial data, market trends, and analysis tools to assess the performance and potential of stocks. They also offer expert insights, top stock picks, and portfolio management tools to align investment strategies with well-researched opportunities.

By leveraging these websites and platforms, investors can enhance their knowledge and potentially outperform the market with their stock picks.

Related: