Stock advisor websites like Motley Fool help pick which stocks to invest in. This post covers the best stock advisor websites and apps in Canada.

When it comes to making money in the stock market, there is no shortage of options available to Canadian investors today.

However, with so many choices comes the need for research to select the right stocks. Stock picking is both an art and a science, and several different approaches can be taken.

One popular method of stock picking is known as fundamental analysis. This approach looks at a company’s financial statements to determine its actual value.

This information can be used to decide whether or not to buy or sell a particular stock.

Another common method is technical analysis. This approach uses charts and other data to identify patterns indicating a stock is about to move in a particular direction.

Technical analysis can be used to make short-term or long-term predictions about where a stock is headed.

There are a number of stock advisor websites in Canada that can help you pick the right stocks.

These websites provide research and analysis on various companies and can help you make informed investment decisions.

Best Stock Advisor Websites for 2024

- Motley Fool Stock Advisor Canada

- Seeking Alpha Pro

- Morningstar Premium

- Zacks Investment Research

- Stocktrades Premium

- Motley Fool Rule Breakers

- Wall Street Zen

- The Maley Report

- Trade Ideas

- Yahoo! Finance Plus

What is a Stock Advisor Website?

A stock advisor website is a website that provides investors with stock recommendations and stock advisory services.

Some of the best stock advisor websites in Canada and elsewhere in the world typically employ a team of analysts who research stocks and make recommendations.

Those recommendations may be based on various factors, such as a company’s financials, market trends, and news.

Besides providing the best stock picking service, many stock advisor websites offer other services, such as investment advice, news, and analysis.

Investment advice may include recommendations on how to invest in stocks, bonds, and other assets.

The news may cover topics such as economic indicators, company earnings, and market trends. And analysis may provide insights into a company’s financials, industry, and competition.

A stock advisor website can be a valuable resource for investors of all experience levels.

Beginner investors can find information on how to start investing in stocks, and more experienced investors can find tips on improving their portfolios. The website can also be an excellent place to find information on specific stocks, sectors, and companies.

Many stock advisor websites offer premium services for a fee. These services may include access to exclusive content, live chat with experts, or customized portfolio analysis.

Investors should carefully consider whether the fees are worth the value of the services.

Best Stock Picking Services in Canada

1. Motley Fool Stock Advisor Canada

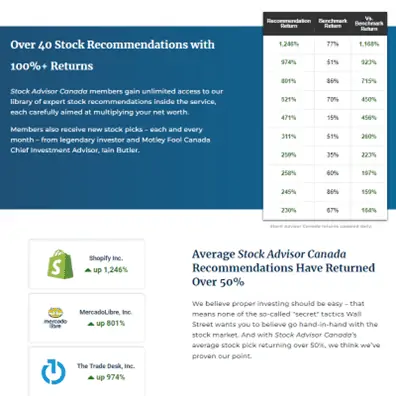

Motley Fool Stock Advisor Canada is a subscription-based investment service that provides recommendations for Canadian stocks. The service is run by Motley Fool, a well-known investment advisory firm.

The subscription fee for Motley Fool Stock Advisor Canada is $99 per year (discounted offer). This gives you access to all of the recommendations and analyses from the Motley Fool team.

The service is designed for long-term investors looking to build a portfolio of quality Canadian stocks.

The Motley Fool team has a strong track record of picking winning stocks. The average return of the stocks recommended by Motley Fool Stock Advisor Canada has been 50%.

This is significantly higher than the average return of the Canadian stock market over the same period.

What you get for your subscription includes access to the Motley Fool recommendations ( 2 new stock picks every month), dozens of stock reports, and access to Motley Fool’s online community. The Motley Fool website is a great resource for Canadian investors.

It includes a wide range of articles and analysis on investing, personal finance, and the Canadian economy.

Additionally, the email alerts sent by the website are a great way to stay on top of the latest stock recommendations from the Motley Fool.

Pros: The pros of Motley Fool Stock Advisor Canada include the strong track record, the quality of the recommendations, the resources available on the website, and the email alerts. It also offers a 66% discount when you join, costing only $1.90 per week.

Cons: Nothing, really.

Overall, Motley Fool Stock Advisor Canada is an excellent service for Canadian investors who are looking for quality stock recommendations.

The subscription fee is reasonable, given the strong track record and the quality of the recommendations. Learn more here.

Visit Motley Fool (get a 66% discount).

2. Seeking Alpha Pro

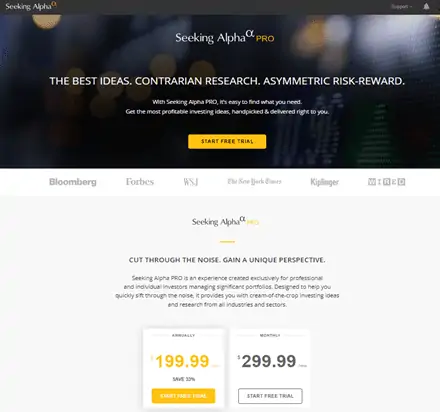

If you’re an active investor, you’ve probably heard of Seeking Alpha Pro. It’s a subscription service that provides access to detailed stock analysis, recommendations, and portfolios. It’s one of the most popular research platforms for active investors.

To get started with Seeking Alpha Pro, you first need to sign up for a free account. Once you’ve done that, you can subscribe to the service for either $25 per month or $199 per year.

Once you’re a subscriber, you’ll have access to a wealth of information, including:

• Detailed stock analysis on multiple stocks

• Handpicked articles from the PRO team at Seeking Alpha that are truly insightful.

• Real-time news and market data

• Top Ideas and exclusive content from Seeking Alpha’s team of experts

Pros: One of the best things about Seeking Alpha Pro is that it’s constantly updated with new information. You’ll never have to worry about missing out on the latest news or recommendations.

Another great thing about the service is that it offers a money-back satisfaction guarantee. If you’re not happy with Seeking Alpha Pro for any reason, you can cancel your subscription within the first 30 days and get a full refund.

Cons: It’s important to note that Seeking Alpha Pro is an investment research platform, not a stock-picking service. That means that you’ll still need to do your own due diligence before making any investment decisions.

3. Morningstar Premium

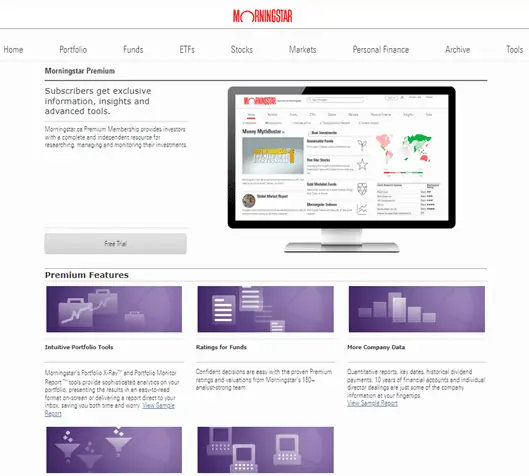

Investors have long been enamoured with Morningstar, the venerable research company that provides in-depth analysis of stocks, mutual funds, and exchange-traded funds.

While the company’s website offers some free content, the real value is found behind the Morningstar Premium paywall.

Morningstar Premium costs $249 per year when billed annually and $34.95 per month when billed monthly, which gives you access to all of the company’s research and data on stocks, funds, and ETFs. This includes in-depth analyses, ratings, and Morningstar’s famed “fair value” estimates.

Pros: One of the most useful features of Morningstar Premium is the “Portfolio X-Ray” tool, which allows you to see how your current holdings stack up against Morningstar’s recommendations. This is an invaluable tool for anyone looking to fine-tune their portfolio.

In addition to the comprehensive research, Morningstar Premium also gives you access to real-time data and portfolios. This is a must-have for any serious investor.

Cons: So what’s the catch? There are a few things to be aware of before you sign up for Morningstar Premium.

First, the $249 annual price tag is not cheap. If you’re on a tight budget, you may be better off sticking with the free content on Morningstar’s website because Morningstar is arguably the best free stock analytics website out there.

Second, Morningstar’s ratings and fair value estimates are not perfect. No research firm is, and you should always do your own due diligence before making any investment decisions.

Third, while Morningstar Premium is a great resource, it’s not a substitute for a financial advisor or the best stock-picking service one can find.

If you’re uncomfortable managing your own portfolio, you should seek professional help. Despite these minor caveats, we believe Morningstar Premium is a valuable resource for any serious investor.

4. Zacks Investment Research

Zacks is a leading investment research firm with a proven track record of delivering accurate, actionable and timely stock recommendations that have outperformed the market.

Over the last 34 years, Zacks’ proprietary ranking system, Zacks #1 Rank List, has consistently outperformed the S&P 500, generating an average return of +24.5% per year.

Zacks Premium is a stock picking and research service that offers several features to its subscribers, including the Zacks #1 Rank List, Style Scores, Focus List, and Industry Rank.

The Zacks #1 Rank List is a list of stocks rated as a “Strong Buy” by the Zacks research team. Style Scores are a set of metrics that are used to evaluate stocks based on their style (e.g. value, growth, etc.).

Subscribers also have access to the Zacks Earnings Expected Surprise Prediction (ESP) Filter, which is designed to help them find stocks that are likely to beat earnings estimates.

Zacks Premium costs $249 per year, which gives you access to all of the features mentioned above. In addition, you also get access to exclusive research reports, real-time alerts, and email notifications.

Pros: Access to exclusive research reports, Zacks #1 Rank List, Style Scores, Focus List, Industry Rank, and Zacks Earnings Expected Surprise Prediction (ESP) Filter

Cons: The subscription fee may be expensive for some investors. Also, the service may be too focused on U.S. stocks for Canadian and other international investors.

5. Stocktrades Premium

Stocktrades Premium is a Canadian investment research and information website that offers a subscription-based service and provides users with access to investment research, information, and tools.

Founded by self-directed investors Daniel Kent and Mathieu Litalien, with 40 years of combined experience, Stocktrades Premium has a community of 2,000 subscribers.

The Stocktrades Premium team follows a simple 3-step investment process for building a portfolio that it shares with its paid subscribers. That 3-step investment process consists of the following:

- Build Your Core: The team shares a list of 11 ‘foundational stocks’ from the Canadian market (has also introduced US Foundational Stocks).

These foundational stocks are those that the Stocktrades Premium team feel will outperform the broader market in the long run and should be the core of every investor’s portfolio. - Supplement Your Core: Once you have built a core portfolio consisting of blue-chip foundational stocks, Stocktrades Premium shares its ‘Bull Lists’ with you.

The Bull Lists consist of high-growth stocks that are meticulously maintained and short-listed. Make no mistake that Bull Lists consist of short-term trading calls.

Like the Foundational stocks, even the stocks the team curates in its Bull Lists are selected based on solid fundamental analysis, not momentum or short-term indicators.

Stocktrades Premium costs CAD 300 annually and, apart from the features mentioned above, includes an in-depth weekly newsletter with the latest news, analysis and research.

Pros: Private discord server, advanced stock screener, and focus on Canadian stocks.

Cons: It does not have a long enough track record to compare with other services, and the subscriber base is low.

6. Motley Fool Rule Breakers

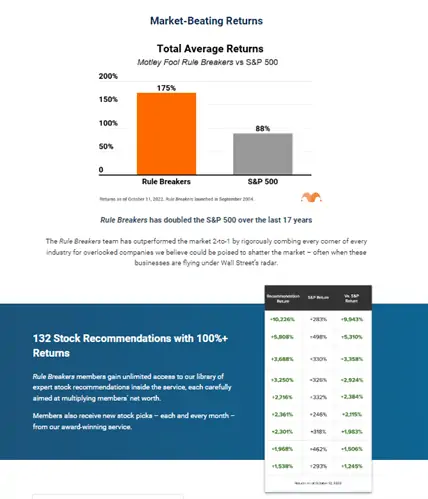

The Motley Fool Rule Breakers service is a stock advisory service that provides stock recommendations from Motley Fool co-founder David Gardner and his team. It is the US version of the Motley Stock Advisor product and costs $99 annually.

Gardner and his team look for companies that they believe are unconventional or innovative and have strong long-term growth potential.

They also seek companies that have a competitive advantage in their industry and are well-managed.

The Rule Breakers portfolio has delivered impressive returns since its inception in 2004. The portfolio has outperformed the S&P 500 index by several hundred basis points, returning 175% since its launch compared to 88% returns by the S&P 500 during that period.

While the Rule Breakers service is not for everyone, it can be a valuable resource for investors looking for high-quality stock recommendations.

The service provides access to Gardner and his team’s expertise and research, and the portfolio has a proven track record of outperforming the market.

Pros: The service has a good track record.

Cons: Considering its investment strategy of finding ‘rule breakers’, Motley Fool Rule Breakers is best for investors willing to take on more risk to potentially achieve greater returns.

7. Wall Street Zen

Wall Street Zen is a premier subscription service that provides investors access to research, analytics, and consensus estimates from some of the industry’s most experienced professionals and analysts.

For a yearly fee of $150, subscribers receive access to a wealth of analytics, including ‘Zen Score’ and due diligence checks for stocks, forecasts and recommendations from top-performing analysts, and one-sentence explanations of why the price of a stock moved on a particular day.

Pros: One-sentence explanation of price moves.

Cons: It is more of a stock analytics website than a stock advisory service.

8. The Maley Report

The Maley Report is a financial newsletter founded by Matt Maley, a Wall Street veteran with over 35 years of experience and currently the Chief Market Strategist at Miller Tabak.

In the newsletter, Mr. Maley combines his expertise in macro, fundamental and technical analysis to provide readers with actionable calls at key turning points of individual stocks and asset classes.

Apart from the newsletter, subscribers also get access to Mr. Maley’s resource pages, blogs and videos.

The Maley Report is available on the Marketfy website for an annual subscription fee of $490 or a monthly subscription fee of $49.

Pros: Written by a credible Wall Street veteran.

Cons: Track record or past performance data of recommendations is not readily available.

9. Trade Ideas

Trade Ideas is a stock analysis platform that offers real-time charting, backtesting, scanning, filtering, performance tracking and many more features.

It uses artificial intelligence and machine learning to identify trading opportunities.

It’s designed for both active traders and investors who want to stay on top of the markets and take advantage of opportunities as they arise.

The service offers both a Standard and a Premium subscription. The Standard subscription costs $84 per month ($999 annually), while the Premium subscription costs $167 per month ($1,999 annually).

Trade Ideas has a long track record. The platform has been used by professional traders for over 15 years.

Pros: It is an excellent tool for charting, screening and filtering stocks.

Cons: It is more of a stock analytics website than a stock advisory service.

10. Yahoo! Finance Plus

Yahoo! Finance Plus is a subscription service that gives users access to additional features and information not available for free on Yahoo! Finance website.

Yahoo! Finance Plus Lite costs $20.83 per month (billed annually), while Yahoo Finance Plus Standard costs $29.16 per month (billed annually). Both these plans come with a 14-day free trial.

Pros: Research reports from Morningstar & Argus, historical financials & statistics with CSV export, leading indicators on companies with unique insights, and enhanced charting with auto pattern recognition.

Cons: It is more of a stock analytics website than a stock advisory service.

How do Stock Advisor Websites Work?

Most of the best stock advisor apps and stock advisory services use a process, system or algorithm to filter stocks and generate a list of stock ideas.

These algorithms might take into account a variety of factors, such as the overall economic environment in a region, a company’s financial stability, earnings growth, and price-to-earnings ratio.

The list of stock ideas generated by the system or algorithm is then usually vetted by a team of human analysts.

This team of analysts will typically make certain adjustments and come up with a final list of recommendations based on their own analysis and expertise.

Once the recommendations are finalized, they are published on the website for users to see.

Some of the best investment advice websites will also send out email alerts or notifications to users when new recommendations are published.

Users can then decide whether or not to act on the recommendations. If they do, they can buy or sell the stocks directly from the website.

Several stock advisor apps and stock advisor websites in Canada also offer brokerage services that allow users to trade directly from the site.

Many stock advisor websites also provide users access to various tools and resources.

These resources can help users make more informed investment decisions. Some of the most popular resources that stock advisor websites offer include:

- Stock Screener: This tool allows users to filter stocks by a variety of criteria, including price, market capitalization, and sector.

- Charting Tools: These tools allow users to track the historical performance of stocks and other investment products.

- Financial News: Stock advisor websites often provide their users with access to financial news stories. This news can help users make more informed investment decisions.

- Portfolio Tracker: This tool allows users to track the performance of their portfolios.

Stock Advisor Canada

Unlimited access to expert stock recommendations

Almost doubled the S&P/TSX Index over last 9 years

New stock picks every month

50,000+ members

$1.90 weekly (66% discount)

How to Choose a Stock Advisor in Canada?

Whether you are looking for the best stock advisor for day trading or the best investment advice website, generally, when it comes to choosing a stock advisor, there are many things to consider.

With so many options available, it can be challenging to know where to start. However, by keeping a few key factors in mind, you can narrow your choices and find the best stock advisor for your needs.

- Location: One of the first things to consider when choosing a stock advisor is location. If you live in Canada, it makes sense to choose a stock advisor that is also based in Canada. This way, you can ensure they are familiar with the Canadian market and regulations.

- Experience: Another important factor to consider is experience. When it comes to investing, experience is key. Look for a stock advisor that has a long track record of success. They should also be able to provide you with references from satisfied clients, or you should be able to access some stock advisor reviews about them online.

- Accuracy: Accuracy is one of the most important factors to consider when you are trying to find the best investment research firms or the best investment advice website. You want to choose a stock advisor with a good track record of recommending stocks that go up in value. There are many ways to measure accuracy, but one way is to look at the percentage of stocks that the advisor has recommended that are currently trading above the price they were recommended.

- Methodology: When choosing a stock advisor, you should also consider the methodology that the advisor uses to generate recommendations. Some stock advisors use fundamental analysis, while others use technical analysis. Each approach has its own strengths and weaknesses, so you should choose an advisor that uses the approach that you are most comfortable with.

- Fees: Fees are also an important consideration when choosing a stock advisor. Make sure to ask about all fees upfront, so there are no surprises down the road. If the stock advisory services you are considering are run only on the Internet with no physical locations, you can mail them or call their customer care to ask for the fees. These fees can vary greatly, so it’s important to find an advisor that charges a fee structure that is suitable for your budget.

- Services: If you are looking for the best free stock analytics website to do stock research yourself, services might not be all that important to you. But, when it comes to choosing the best stock advisor service, it’s also essential to consider the services they offer. Some advisors only provide basic services, while others offer a full suite of services. Make sure to choose an advisor that offers the services you need.

By keeping these factors in mind, you can be sure to find the best stock advisor for your needs.

Are Stock Picking Services Worth It?

There are a lot of stock-picking services out there. Some are free, and some are subscription-based.

Some proclaim themselves as the best investment research firms, while others call themselves the best investment advice websites. But are any of them worth using?

There are a few things to consider when deciding whether or not to use a stock picking service. The first is whether or not the service provides good information.

There are a lot of services out there that simply provide stock tips but don’t give you any real analysis or research to back up their recommendations.

Another thing to consider is whether the service is worth the money. If you’re paying for a subscription, you want to make sure that the service is actually providing you with value.

There are a lot of free services out there that are just as good, if not better, than paid services.

Finally, it would help if you considered the risks of using a stock picking service. Even if the service provides good information, there’s no guarantee that you’ll make money on the stocks they recommend.

You could end up losing money if the stock market goes down.

Do your own research

The best way to ensure you get good information from a stock-picking service is to do your own research.

Don’t just take the recommendations at face value. Look into the companies and see if they’re worth investing in.

There’s no substitute for doing your own research. Even the best stock-picking services and the best stock advisor apps out there can’t give you the same level of insight as you can get by doing your own due diligence.

Consider the risks

There are always risks involved in investing, and you need to be aware of them before you start using a stock picking service.

Remember that even if the service provides good information, there’s no guarantee you’ll make money.

If you’re uncomfortable with the risks, you shouldn’t use a stock picking service. You should only invest in stocks if you’re willing to lose the money you put in.

Do your own research and consider the risks before using a stock-picking service.

Additionally, if you’re not comfortable with any of the stock-picking services or methodologies they use, then you’re better off doing your research and picking stocks yourself.

Top-Picks and Methodology

Motley Fool Stock Advisor Canada

After careful consideration, we concluded that Motley Fool Stock Advisor Canada is the best stock advisor website for investors in Canada.

They have a strong track record of picking winning stocks, and their research is top-notch. They also offer a great service for Canadian investors, with timely updates and a helpful community.

Moreover, while most other websites focus on investors elsewhere, the Motley Fool Stock Advisor Canada service focuses solely on investors in Canada.

Some of the features that make Motley Fool Stock Advisor Canada the best stock advisor website in Canada include their investment recommendations, stock analysis, and educational resources.

Their investment recommendations are based on a proven system that has outperformed the market over the last nine years.

Their stock analysis is thorough and considers various factors, including technical analysis, to identify the best stocks to buy.

Their top-notch educational resources include articles, videos, and podcasts that teach investors everything they need to know about investing in stocks. In addition to these great features, Motley Fool Stock Advisor Canada offers a satisfaction guarantee.

If you’re not happy with their service, you can get a full refund within the first 30 days. This is a great way to try it out and see if it’s right for you.

Conclusion

There are several factors investors should consider when choosing the best stock advisor websites in Canada.

The most important factor is the quality of the advice and information provided. Other factors to consider include the fees charged, the staff’s experience, and the website’s reputation.

If you’re looking for the best stock advisor website in Canada, we recommend Motley Fool Stock Advisor Canada.