Investing in stocks can be a great way to make money, but it can also be a bit daunting for new investors. Stock advisor websites can be a great resource for both experienced and inexperienced investors in Canada.

These websites offer various services to help investors research stocks, find good investment opportunities and track their portfolios. Many also offer educational resources to help investors learn more about the stock market and how to make money from investing.

Canadian investors have easier access to stock advisor websites these days, and Motley Fool Stock Advisor Canada is one of the most well-known offerings. Motley Fool, as an organization, has been providing stock advice to investors for over 25 years, and their experience shows.

One big benefit of using a stock advisor website like Motley Fool is that they do all the research for you. They analyze companies and industries and make recommendations based on their findings. This takes much of the guesswork out of investing and can help you make more informed decisions.

Whether you’re a seasoned investor or just starting out, a stock advisor website like Motley Fool can be a valuable resource.

Their experience and expertise can help you make better investment decisions, and their range of services can make your life easier.

In this post, you will find our Motley Fool Canada review and will be able to decide for yourself if a Motley Fool Canada subscription is worth it.

What is Motley Fool?

The Motley Fool is an American multimedia financial services company that provides financial advice for investors through various stock, investing, and personal finance services.

The company was co-founded in 1993 by brothers David and Tom Gardner, along with Erik Rydholm, who left the company after a while. It is headquartered in Alexandria, Virginia.

The company’s name was taken from Shakespeare’s comedy As You Like It, in which the “fool” character is wise in ways others cannot see. The company’s mission is “to make the world smarter, happier, and richer.”

The Motley Fool offers various services, including Stock Advisor, Rule Breakers, Million Dollar Portfolio, and Motley Fool CAPS. Stock Advisor is a monthly newsletter service that provides stock recommendations and analysis that has outperformed the market by a wide margin since it launched in 2002.

Rule Breakers is a newsletter service that recommends stocks expected to break out and outperform the market.

Million Dollar Portfolio is a service that provides a portfolio of stocks to help investors reach their financial goals. Motley Fool CAPS is a stock rating and analysis service that allows users to rate stocks and compare their ratings to others.

The Motley Fool has been featured in several publications, including The New York Times, The Wall Street Journal, Businessweek, and Time.

What is Motley Fool Stock Advisor Canada?

Motley Fool Stock Advisor Canada is a subscription-based service that provides Canadian investors with stock recommendations. The service is managed by a team of investment experts and analysts at The Motley Fool, headed by legendary investor Iain Butler.

The Motley Fool Stock Advisor Canada team makes stock recommendations based on in-depth research and analysis. The team looks for companies that are undervalued by the market and have strong long-term growth potential.

The service provides Canadian investors access to a wide range of investment opportunities that are not typically available to individual investors.

For example, the Motley Fool Stock Advisor Canada team often recommends stocks listed on the Canadian or US stock exchanges that might have significant upside potential but might not be well known among ordinary investors.

Motley Fool Stock Advisor Canada Performance

Motley Fool Stock Advisor Canada has been one of the best-performing investment newsletters since it launched in 2013. Since then, the newsletter has provided nearly double the returns of the S&P/TSX Composite Index, while its average stock pick has returned over 50% from the time they were recommended.

In the past nine years, Stock Advisor Canada has given its members over 40 stock recommendations that have doubled in value. Twelve of those picks have tripled, and one stock pick has made 10x its original value.

Here are some of the best-performing stock picks from Motley Fool Stock Advisor Canada since its launch:

Shopify (SHOP): Up 1,153%

Shopify Inc. (NYSE:SHOP) is a Canadian multinational e-commerce company headquartered in Ottawa, Ontario. It is also the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems.

Shopify offers online retail, e-commerce, and point-of-sale (POS) systems that allow businesses to sell online, in-store, and everywhere in between.

Since going public in 2015, Shopify’s stock has been one of the top-performing tech stocks around the world. Despite the declines it has suffered recently, it is still up 1,153% from when Motley Fool Stock Advisor Canada recommended it in late 2015.

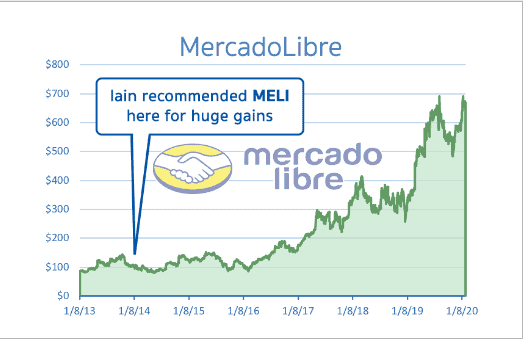

MercadoLibre, Inc. (MELI) : Up 566%

MercadoLibre, Inc. is an Argentine e-commerce company that operates in Latin America. It was founded in 1999 by Marcos Galperin, who is still its CEO, and was one of the first e-commerce sites in the region.

MercadoLibre has since become the largest e-commerce site in Latin America, with operations in 18 countries.

MercadoLibre went public on the Nasdaq in 2007 and has since grown rapidly. In 2017, it had revenues of $1.22 billion and a net income of $13.7 million.

The Motley Fool Stock Advisor Canada had recommended MercadoLibre as a long-term investment in early 2014 when its market capitalization was less than $5 billion, citing the company’s strong growth prospects.

Since then, MercadoLibre’s stock has skyrocketed, rising 859% in value. The company’s market cap now stands at $47.5 billion, making it one of the largest tech companies in Latin America.

MercadoLibre has been one of the biggest beneficiaries of the growth of e-commerce in the region. It has also expanded beyond its core marketplace business, launching MercadoPago, a payments platform, and MercadoShops, an e-commerce platform for businesses.

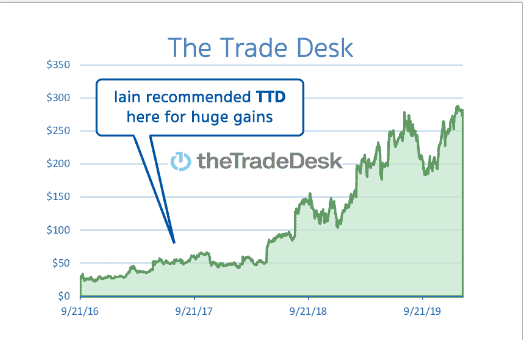

The Trade Desk (TTD)

The Trade Desk is an ad-tech company that helps brands and agencies automate the buying and selling of ad space in real time. TTD went public in 2016, and since then, its stock has soared.

In late 2016, Motley Fool Stock Advisor Canada recommended TTD, and since then, the stock has been up 720%.

TTD is benefiting from the shift to programmatic advertising, which is automated and data-driven. This is a more efficient way to buy and sell ad space, and it’s growing rapidly. TTD is the leader in programmatic advertising, and it’s well-positioned to benefit from this trend.

These are just a few of the many stocks recommended by Motley Fool Stock Advisor Canada and have gone on to provide its members with exceptional returns.

Motley Fool Stock Advisor Canada Cost

The Motley Fool is a well-respected investment advice website, and their Stock Advisor Canada subscription is a great deal at $299 per year.

However, right now, they are running a Motley Fool promotion where you can get a Motley Fool Canada subscription for just $99 per year. That’s a 66% discount!

This subscription gives you unlimited access to their stock recommendations, analysis, and research. Plus, you get a 30-day 100% membership refund period, so you can try it out risk-free.

If you’re looking for a way to get started in investing or want to brush up on your stock-picking skills, this is a great opportunity.

The Motley Fool has a proven track record of success, and at this price, we feel the subscription is a no-brainer for inexperienced and experienced investors.

What Do You Get With a Motley Fool Stock Advisor Canada Subscription?

Motley Fool Stock Advisor Canada is one of the most popular investment newsletters available today for Canadian investors. And for good reason – every stock pick they provide comes with premium analysis, a guide to basics, and 24/7 monitoring.

This makes it an incredibly valuable service for Canadian investors looking to take their portfolios to the next level.

With a Motley Fool Stock Advisor Canada subscription, you get two new stock picks every month and a “Best Buys Now” report with five high-conviction stock ideas published on 1st Wednesday of each month.

What sets Motley Fool Stock Advisor Canada apart is the quality of its analysis. The premium analysis is extremely helpful in determining whether or not a stock is a good buy.

The Motley Fool team does an excellent job of providing all the relevant information to make an informed decision. Additionally, “A Fool’s Guide to Investing in Canada” is an excellent resource for those who are new to investing or simply want to brush up on their knowledge.

But the best part of Motley Fool Stock Advisor Canada is the 24/7 monitoring. Every stock recommended by the company is constantly monitored by its team of analysts. So if a stock starts to underperform, you’ll be alerted and told when to sell.

This feature is incredibly valuable for investors who don’t have the time or expertise to constantly monitor their portfolios. And it’s one of the reasons why Motley Fool Stock Advisor Canada is one of the best investment advisory services out there.

Additional Features

When you subscribe to Motley Fool Stock Advisor Canada, apart from stock picks, you also get access to some of the best investment advice and analysis available.

For starters, you’ll receive over $810 worth of premium investing guides. These guides cover topics like top marijuana stocks to invest in, how to retire successfully and more.

Moreover, you’ll get access to the Stock Advisor Canada Knowledge Base. This is a 24/7 resource that gives you full access to all of the Fool’s Canada-specific stock research.

In addition, you’ll also get market news coverage and 24/7 access to the members-only Stock Advisor Canada community. This community is a great place to ask questions, get advice, and stay up-to-date on what’s happening in the Canadian stock market.

Motley Fool Stock Advisor Canada Alternatives

You can also check out these alternative stock advisor websites.

Motley Fool Stock Advisor Canada vs. Seeking Alpha

While both Seeking Alpha Pro and Motley Fool Stock Advisor Canada provide stock advisory services, we think Motley Fool Stock Advisor Canada is the better choice for most Canadians. Here’s why:

First and foremost, Motley Fool Stock Advisor Canada is focused on Canadian investors. All the stock picks and analyses are geared toward the Canadian market.

Second, Motley Fool Stock Advisor Canada provides direct stock recommendations, unlike Seeking Alpha Pro. With Seeking Alpha Pro, you mostly get access to stock analysis, opinions, and commentary, but you have to do your own research to determine which stocks to buy.

Third, Motley Fool Stock Advisor Canada is a better value. Seeking Alpha Pro costs $199 per year (or $25 per month), while a Motley Fool subscription costs $99 per year.

Motley Fool Stock Advisor Canada vs. Morningstar Premium

When it comes to choosing between Motley Fool Stock Advisor Canada and Morningstar Premium Subscription, it depends on what you are looking for in a service.

If you are mostly interested in ratings, research, and analytics, Morningstar is probably the better choice. However, if you are looking for direct stock recommendations, Motley Fool Stock Advisor Canada is the better and cheaper option.

Morningstar is a well-established brand known for its investment research and analytics. It offers a wide range of products and services to both individual and institutional investors.

Morningstar Premium Subscription is its flagship product, and it offers a comprehensive suite of investment tools and resources.

Motley Fool Stock Advisor Canada is a newer entrant into the Canadian market, but it has quickly gained popularity due to its straightforward approach to stock picking.

It provides direct stock recommendations at a fraction of the price of Morningstar Premium Subscription, which costs $249 per year.

Motley Fool Stock Advisor Canada vs. Stocktrades Premium

Besides Motley Fool Stock Advisor Canada, Stocktrades Premium is another stock advisory service focusing primarily on Canadian investors.

It costs $399.99 monthly.

Pros of Motley Fool Stock Advisor Canada

1. They have a great track record.

Motley Fool Stock Advisor Canada has been helping investors pick winning stocks for almost 10 years. During that time, it has consistently outperformed the market and helped its members make money.

2. They have a proven system.

The Motley Fool’s stock-picking system is based on fundamental analysis, and they have a famous philosophy of investing in great businesses over the long run. This proven system has helped them deliver superior returns for their members.

3. They have a team of expert analysts.

The Motley Fool Stock Advisor Canada team comprises experienced stock analysts who know how to find the best stocks to buy. They have a deep understanding of the Canadian market and are always on the lookout for the next big winner.

4. They provide great value for the price.

Motley Fool Stock Advisor Canada is one of the most affordable stock advisor programs. For just $99 per year, you get access to stock picks, research reports, and member forums. This is a great value for the price, especially compared to other programs that cost upwards of $500 per year.

5. They have a strong commitment to customer service.

The Motley Fool team is dedicated to providing the best possible experience for its members. They offer excellent customer service and are always there to answer any questions.

Get Motley Fool (66% Discount Offer).

Cons of Motley Fool Stock Advisor Canada

1. There is no guarantee of success.

Like any investment, there are risks involved. The past performance of Motley Fool Stock Advisor Canada stock picks is no guarantee that its future stock picks will also be as successful.

2. The service is not for everyone.

We think Motley Fool Stock Advisor Canada’s stock advisory service is geared toward individuals who are comfortable taking risks and willing to do their own research.

If you are someone who doesn’t have the time to look into individual stocks, then you can just invest in mutual funds or ETFs. Moreover, if you are someone who doesn’t have the risk appetite to invest in stocks directly, then the subscription won’t provide much value to you.

3. The Motley Fool library and forums can be overwhelming.

With 25 years in the business, the Motley Fool has created a vast library of stock research, blog posts, podcasts, and other infotainment content. It also has a very active community of several hundred thousand individual investors.

With so much information available, it can be difficult to find the information you could be searching for or just to separate the signal from the noise.

Motley Fool Canada FAQ

There are many different stock advisor programs, but we believe that Motley Fool Stock Advisor Canada is the best one for Canadian investors.

We believe Motley Fool Stock Advisor Canada is a safe and legitimate investing service because it has been providing stock recommendations and investment analysis to Canadians for almost 10 years now. The company has a team of experienced analysts who identify and recommend stocks that can outperform the market.

Motley Fool Stock Advisor Canada also has a strong track record of performance. It is a reputable company with a strong brand.

After factoring in the Motley Fool discount of 66%, the subscription costs just $99 per year.

Yes, the Motley Fool Stock Advisor Canada subscription is worth it for several reasons. First, the service provides Canadian investors access to Fool’s top stock picks and recommendations. Second, the Fool’s analysts are experienced and have a great track record for picking stocks. Third, the service offers a money-back satisfaction guarantee, so you can always cancel if you’re not happy.

We believe that Motley Fool Stock Advisor Canada is better than Zacks Premium for several reasons.

First, the Motley Fool has a team of analysts focused solely on finding the best Canadian stocks. They have a proven track record of outperforming the market, and they’re backed by a 30-day money-back guarantee.

Second, the Motley Fool offers many resources for its members, including educational articles, webinars, and an extensive online community.

Third, Motley Fool charges a much lower annual fee than Zacks premium. For just $99, you get access to all of their recommendations, compared to the $249 that Zacks charges.

Related: Best Investment Newsletters in Canada.