The increasing popularity of financial technology companies like Wealthsimple, EQ Bank, and KOHO, with their hybrid account offerings, is good news for consumers who are cashing in on great rates and lower banking fees.

A hybrid account is a high-interest savings account combined with a chequing account and used to conduct everyday bank transactions, from purchases to bill payments.

EQ Bank Savings Plus, Wealthsimple Save, and KOHO are three of the most popular hybrid accounts in Canada offering high-interest rates, unlimited free bill payments and e-transfers, no minimum balance and other features.

Find out in this post what other benefits they offer Canadians and how each compares to the other.

EQ Bank Savings vs. Wealthsimple Save vs. KOHO

| Financial Provider | Wealthsimple | EQ Bank | KOHO |

| Account name | Wealthsimple Save | EQ Savings Plus account | KOHO Prepaid Mastercard |

| Interest Rates | 1.50% (higher for Cash account) | 3.00% | Variable interest on your balance |

| Features | Low-fee investing, free online brokerage service, online tax returns, fee-free cash account, no monthly account fees or minimum balance | Deposit money, make bill payments, send unlimited e-transfers, no monthly account fees, no minimum balance required, unlimited debits and bill payments, unlimited electronic fund transfers; unlimited free Interac e-Transfers, free ATM withdrawals | No monthly fees on a regular account, free unlimited transactions and e-Transfers, cash back when you shop at select partners |

| CDIC Protection | Yes | Yes | Yes |

Below is a comparison of the three most popular hybrid accounts in Canada as well as their other features and perks.

EQ Bank Savings Plus, Wealthsimple Save, and KOHO are hybrid accounts that combine savings and chequing features in ways we haven’t seen before.

Interest Rates: Of the three, EQ Bank generally offers the highest interest rate.

The savings rates available through these hybrid accounts often beat anything the big banks. Even better, they are not teaser rates.

Flexibility: EQ Bank Savings, Wealthsimple Cash, and KOHO offer free and unlimited transactions and electronic bill payments.

One-Stop Solution: When you bank with KOHO, you still need a separate bank for your investments (e.g. TFSA and RRSP accounts) as it does not offer these accounts. With EQ Bank, you can save inside a TFSA or RRSP account. With Wealthsimple, you can also invest in low-cost ETFs and get a $25 cash bonus when you open an investment account.

Insurance: EQ Bank, KOHO, and Wealthsimple Save keep your funds with custodians who are CDIC members. CDIC protects your deposits from member firm insolvency up to $100,000.

Other Features and Perks:

An EQ Bank Savings Plus account can be used to send money abroad through Wise. It also offers a US Dollar Savings Account. If you request the free EQ Bank Mastercard, you can earn 0.50% cash back on all your purchases with the card.

Wealthsimple also offers a roundup option that automatically invests your spare change and a free platform for trading stocks and ETFs, aka Wealthsimple Trade.

KOHO pays cash back on eligible purchases, and the app can automatically round up and save your spare change.

Hybrid Bank Accounts in Canada

Last year, 76% of Canadians conducted most of their banking online. So, the rise of digital banks and hybrid online accounts appears to be a natural evolution of the banking and financial industry as a whole.

While online-only banks like Tangerine and Simplii have been paying interest on chequing accounts for some time, a hybrid account takes convenience a step further.

They offer a more fluid approach to saving, spending, investing, and banking in general.

If you keep a high chequing balance at your traditional bank to avoid the expensive monthly account fees, you now have alternatives.

1. EQ Bank Savings Plus

EQ Bank is the online banking arm of Equitable Bank, a Schedule I bank in Canada.

Their EQ Savings Plus account is a hybrid account that allows you to deposit money, make bill payments, send unlimited e-transfers and earn a high-interest rate.

Here are some of its top features:

- A high-interest savings rate… one of the best non-teaser rates you will find in Canada

- No monthly account fees

- Unlimited free bill payments and electronic fund transfers

- Unlimited free Interac e-Transfers

- Free mobile cheque deposits

- No minimum balance required

- Cheap international money transfers

- Deposit protection by the Canada Deposit Insurance Corporation (CDIC)

- Joint accounts available

You will be hard-pressed to find better interest rates in Canada that are not promotional or only available for a limited period of time.

Note: This account is not available in Quebec. There is also a maximum balance of $200,000 per customer.

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

Related posts:

2. Wealthsimple Save

Wealthsimple is Canada’s most popular online wealth manager, with over $15 billion in assets under management.

The company offers low-fee investing in registered and non-registered accounts, a free online brokerage service, online tax returns, and, more recently, a fee-free cash account.

Wealthsimple Save offers:

- A competitive interest rate

- No monthly account fees or minimum balance

- CDIC protection up to specified limits

Wealthsimple Save is available in all provinces and territories of Canada. Learn more in this review.

In addition to Wealthsimple Save, you can also open a free Wealthsimple Cash account and transfer money instantly to anyone on your contacts list who has a Wealthsimple Cash account. Wealthsimple Cash pays a higher interest rate.

Related posts:

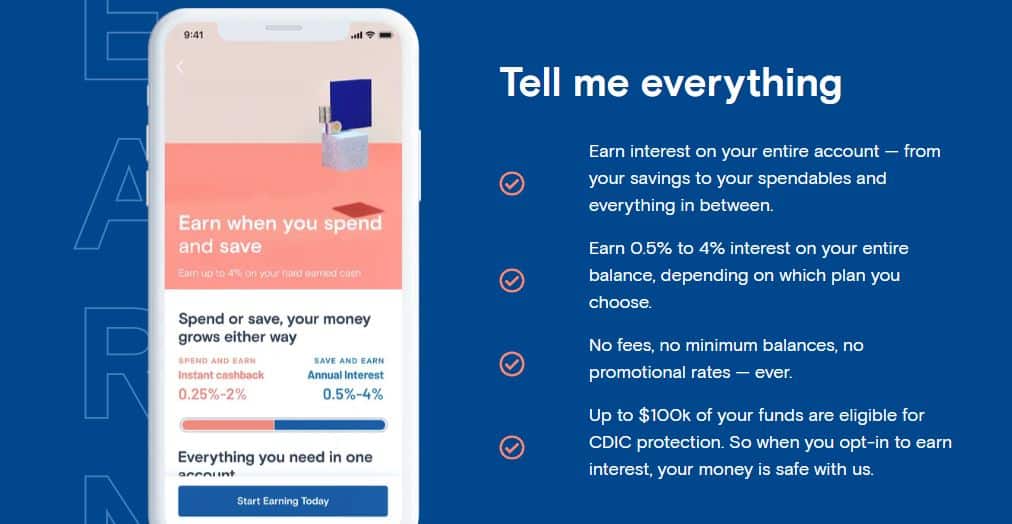

3. KOHO

KOHO is one of the most popular free online hybrid accounts in Canada.

Along with its snappy prepaid Visa and app, KOHO offers access to a bunch of perks, including cash back reward on purchases.

Your KOHO account also offers:

- 1% cash back on grocery purchases and transportation

- Interest on your balance

- No monthly fees for a regular account

- Free unlimited transactions and e-Transfers

- Automatic savings via Roundup

- Joint accounts

- Access to a Credit Builder Program (costs $10 monthly)

Related posts: