DIY investors who purchase ETFs directly using an online brokerage account can potentially save thousands of dollars in fees over time compared to buying traditional mutual funds.

Fees matter, and in the long run, they impact your overall returns.

Building your investment portfolio using individual ETFs is not a very difficult task; however, you will need to rebalance your ETF portfolio every now and then manually.

If the idea of portfolio rebalancing causes you to break out in a cold sweat, asset allocation ETFs such as Vanguard’s Growth ETF (VGRO) are way more convenient.

They are automatically rebalanced and globally diversified. Even better, they have a lower management fee than mutual funds or robo-advisors and are designed to suit different investment risk profiles.

This VGRO review covers its composition, returns, fees, top holdings, pros and cons, how to purchase Vanguard ETFs in Canada, and how it compares to XGRO.

Vanguard All-in-One ETF Portfolios

Vanguard is a household name when it comes to investment management. The firm has more than USD $8.1 trillion in assets under management and is a global leader in the ETF industry.

In addition to other fee-saving investment products they have pioneered over the years, Vanguard now has a line of all-in-one ETF portfolios, including:

- Vanguard Conservative Income ETF Portfolio (VCIP)

- Vanguard Conservative ETF Portfolio (VCNS)

- Vanguard Balanced ETF Portfolio (VBAL)

- Vanguard Growth ETF Portfolio (VGRO), and

- Vanguard All-Equity ETF Portfolio (VEQT)

One-stop portfolios such as the ones listed above offer convenience to beginner and experienced investors alike, and they work well in registered investment accounts.

Related: What is an ETF?

VGRO Overview

VGRO is Vanguard’s growth portfolio designed to provide long-term capital by investing in equity and fixed-income securities.

It is made up of several other Vanguard Index ETFs and has a target allocation that is approximately 80% equity (stocks) and 20% fixed income (bonds).

The risk rating for VGRO is low to medium, and it trades on the Toronto Stock Exchange under the ticker symbol “VGRO.”

Here are some of the key facts about this fund as of March 2023:

- Inception date: January 25, 2018

- Net assets: $3.760 billion

- 12-month trailing yield: 2.06%

- Distribution yield: 2.32%

- Distribution Frequency: Quarterly

- Eligible accounts: RRSP, RRIF, RESP, TFSA, DPSP, RDSP, non-registered accounts

- Management fee: 0.22%

- Management Expense Ratio (MER): 0.24%

- Listing currency: CAD

VGRO Asset Allocation

As of January 31, 2023, the asset allocation was 80.82% stocks, 19.14% bonds, and 0.04% cash and cash equivalents.

The underlying funds making up the portfolio as of this date are:

| VGRO Fund Holdings | Allocation |

| Vanguard US Total Market Index ETF (VUN) | 34.69% |

| Vanguard FTSE Canada All Cap Index ETF (VCN) | 24.11% |

| Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) | 16.22% |

| Vanguard Canadian Aggregate Bond Index ETF (VAB) | 11.34% |

| Vanguard FTSE Emerging Markets All Cap Index ETF (VEE) | 5.83% |

| Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged (VBG) | 3.96% |

| Vanguard US Aggregate Bond Index ETF CAD-hedged | 3.85% |

An 80:20 equity to fixed income ratio signifies an above-average level of risk tolerance. That said, the overall risk profile of the VGRO portfolio is low-medium.

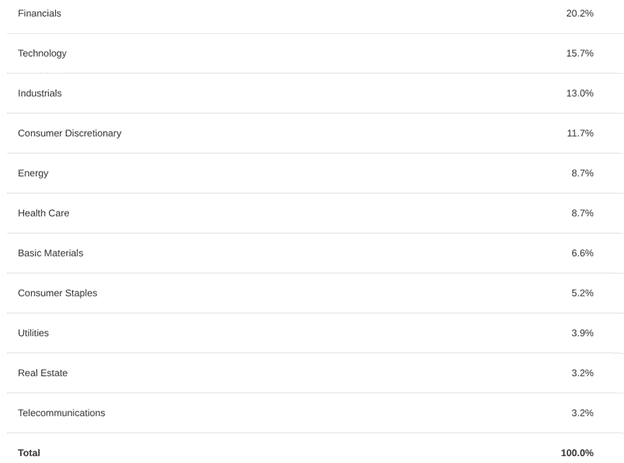

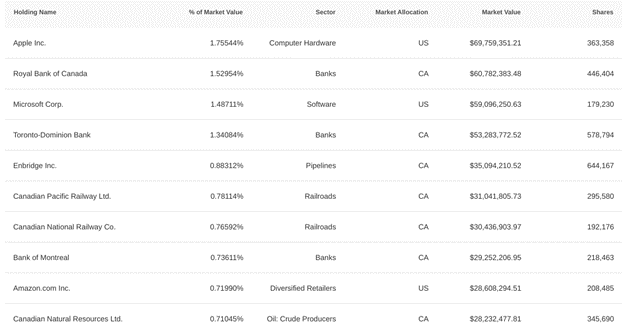

The large-cap equity allocations weigh heavily towards financials (e.g. RBC and TD) and technology (e.g. Microsoft and Apple), and the bond component is composed mainly of AAA-grade bonds, e.g. Canadian government bonds.

VGRO offers investors access to industry diversification. As of January 31, 2023, it held 13,625 individual stocks and 18,066 bonds.

It is simply impossible and/or impractical to build a portfolio as diversified as an asset allocation ETF from scratch on your own.

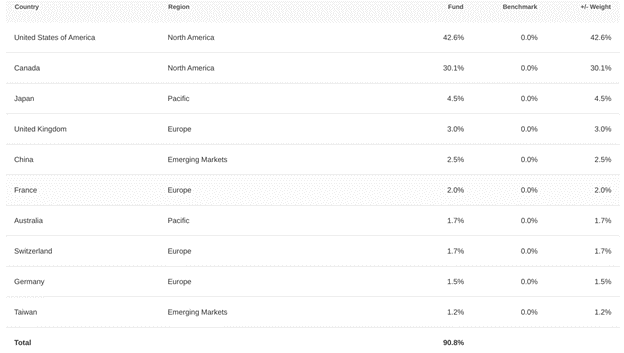

VGRO is also globally diversified, with its top-10 market allocation for equities in March 2023 as follows:

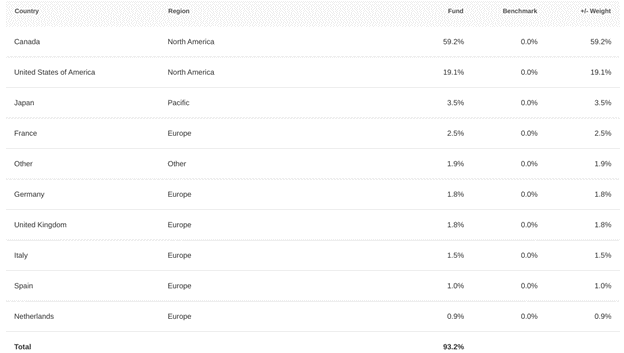

And the top-10 market allocations for VGRO fixed-income assets are:

Related: All-in-One ETF Portfolio Options

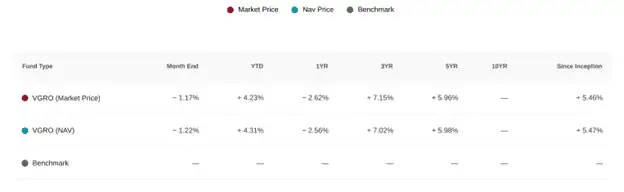

VGRO Returns

How has VGRO performed since its inception?

This all-in-one portfolio is quite new and does not have a lengthy returns history. VGRO returned 10.89% in 2020, 14.90% in 2021, and a loss of -11.19% in 2022.

So far, in 2023, it has had a year-to-date return of +4.23% (as of March 2023).

VGRO Fees

VGRO has a management fee of 0.22%, and the MER is 0.24%. Compared to the 2% or higher MER cost of comparable equity mutual funds, you are saving a lot in fees.

How does it compare to robo-advisors?

Robo-advisors such as Wealthsimple have a 0.40% to 0.50% management fee. Add in the ETF MERs, and you pay a total of 0.60% to 0.70% in fees per year.

For index funds, I like the TD e-Series funds. Depending on your portfolio mix, this option will cost you roughly 0.45% per year.

Lastly, VGRO is also much cheaper than the one-stop solution funds offered by Tangerine. Tangerine investment funds have an MER of 1.06%.

The fee comparisons above do not account for trading fees. If you make regular purchases of VGRO, your trading fees can add up. Trading fees for ETFs range from $0 to $9.99 per trade, depending on your broker.

A self-directed online brokerage such as Questrade offers commission-free ETF purchases, and you only pay to sell.

For Wealthsimple Trade, there are no trading commissions for buy or sell trades, and VGRO does not trigger currency exchange fees because it is listed in CAD.

Related: Commission-Free Stock Trading Platforms

Pros and Cons of VGRO

We hold VGRO, VEQT, and VBAL in different accounts and love them for their low-fee structure and almost hands-free ongoing management.

Pros

- Low-cost management fee compared to mutual funds and robo-advisors. The MER includes the management fee, taxes, trading fees, etc. Lower costs can lead to improved returns over time.

- Hassle-free management with no need for manual rebalancing.

- Offers tax efficiency, especially in a TFSA or RRSP.

Cons

- If you don’t mind playing around with asset allocations, purchasing individual ETFs can save you some money.

- Frequent small trades can become costly if your broker charges a trading commission.

VGRO vs XGRO

Blackrock’s iShares Core Growth ETF Portfolio (XGRO) is an all-in-one growth portfolio similar to VGRO.

XGRO has a target allocation of 80% stocks to 20% bonds and has been around since 2007 under a different name – iShares Balanced Growth CorePortfolio Index ETF (CBN).

Here are the underlying ETF funds that constituted XGRO as of March 2023:

| XGRO Fund Holdings | Allocation |

| iShares Core S&P Total U.S. Stock Market ETF (ITOT) | 36.91% |

| iShares MSCI EAFE IMI Index ETF (XEF) | 20.15% |

| iShares S&P/TSX Capped Composite Index ETF (XIC) | 19.95% |

| iShares Core Canadian Universe Bond Index ETF (XBB) | 12.17% |

| iShares Core MSCI Emerging Markets ETF (IEMG) | 3.86% |

| iShares Core Canadian Short-Term Corporate ETF (XSH) | 3.07% |

| iShares Broad USD Investment Grade Corporate Bond ETF (USIG) | 1.91% |

| iShares US Treasury Bond ETF (GOVT) | 1.91% |

Compared to VGRO, XGRO has a management fee of 0.18% (vs. 0.22%) and a management expense ratio of 0.20% (vs. 0.24%).

Both XGRO and VGRO have a low-medium risk rating.

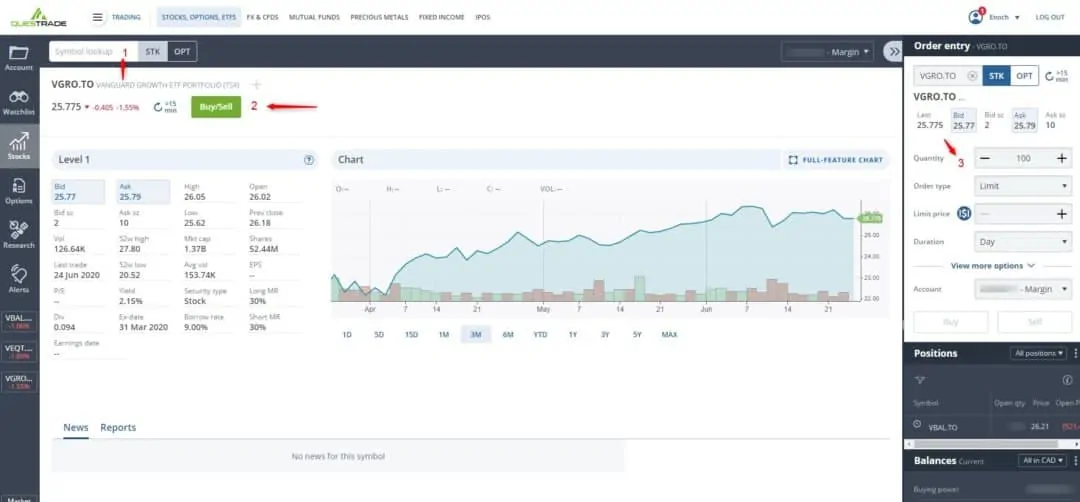

How To Buy VGRO ETF on Questrade

Questrade is Canada’s premier discount online brokerage service. They offer investors access to multiple investment products, including ETFs, mutual funds, stocks, options, bonds, and more.

Purchasing an ETF on the platform is easy, and you do not pay trading commissions when buying ETFs. I show an example using VGRO below.

Sign in to your Questrade account. If you don’t have one, you can register here and get $50 in free trades after funding your account with $1,000 or more. You can also use the promo code SAVVY50.

1 – Click on “Trading” and enter the ticker symbol of the ETF you want to purchase in the “Symbol lookup” box.

2 – Click on the Buy/Sell button.

3 – The order entry box is populated with the bid and ask prices.

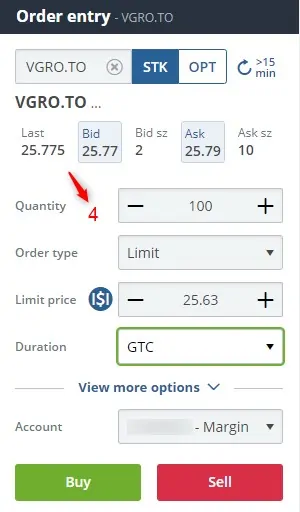

4 – In this example, I am entering an order to purchase 100 units of VGRO at $25.63 using a “limit order” and setting the trade duration to GTC (good till cancelled).

A limit order specifies how much I want to pay per unit of VGRO.

The “Bid price” of $25.77 is the highest price that traders are willing to pay for VGRO as of when I placed this trade, while the “Ask price” of $25.79 is the lowest price that traders are willing to sell VGRO.

In this example, I set my limit price at $25.63, just one cent above the lowest price recorded so far that day of $25.62.

You can choose to buy VGRO at the market price, i.e. whatever price is currently available, or you can choose a limit, limit-on-open, limit-on-close, stop, stop-limit, trailing-stop, or trailing-stop-limit order.

Get more details about the platform in this Questrade review.

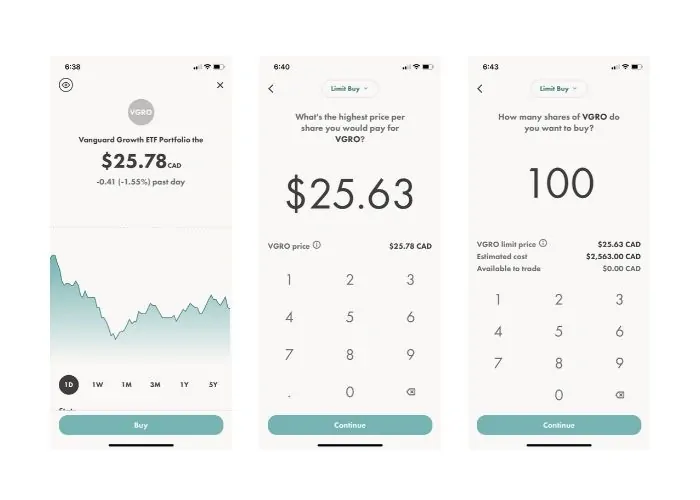

How To Purchase VGRO ETF on Wealthsimple Trade

Wealthsimple Trade is Canada’s only commission-free brokerage platform for when you are buying and/or selling ETFs and stocks. You can open a Wealthsimple Trade account here (includes a $25 bonus after depositing your first $150 or more).

To purchase VGRO on the platform, sign in to your account and search for “VGRO.”

- Click on buy and select either market buy, limit buy, or a stop-limit buy

- Enter your preferred price, e.g. $25.63, if you are using a “limit buy”

- Enter the number of VGRO shares you want to buy, e.g. 100 units

- Place your trade

VGRO FAQs

DIY investors who have little or no time for rebalancing will find VGRO to be very convenient to purchase and manage. Its 80:20 stock to bond split is a bit aggressive; however, it is not as aggressive as the all-equity VEQT ETF. You should take note of its high stock component (risk) and ensure it is in line with your risk tolerance. All investments carry an element of risk.

VGRO has a low cost of 0.25% per year, saving you more than 1% in fees annually compared to the average equity mutual fund.

VGRO is regularly rebalanced to ensure it maintains its target asset allocations and to keep its risk level at the appropriate level. As a VGRO investor, you don’t need to worry about rebalancing your portfolio, as it is done automatically.

VGRO is an Exchange Traded Fund (ETF) that trades in a similar way as a stock on an exchange, with prices moving up and down throughout the day. Index funds, on the other hand, are similar to mutual funds, and they trade once at market close. Examples are Tangerine funds and TD e-Series.

Index funds aim to replicate the returns of their benchmark index, and they are passively managed. The VGRO all-in-one portfolio comprises several index ETFs.

ETFs can save you a tonne of money in investment fees paid to portfolio managers. They are diversified (reducing risk), are tax-efficient (as they have a low portfolio turnover and don’t trade too often), can improve your returns (lower fees), and are easy to purchase online.

Vanguard's all-in-one Growth ETF Portfolio

Overall

Summary

VGRO is Vanguard Canada’s all-in-one growth ETF portfolio. Learn about VGRO holdings, returns, pros and cons, how to purchase VGRO on Questrade and Wealthsimple Trade, and how it compares to XGRO.

Pros

- Low-cost management fee compared to mutual funds and robo-advisors.

- Hands-free portfolio management with no need for manual rebalancing

- Tax-efficient in registered accounts e.g. TFSA or RRSP.

Cons

- Purchasing individual ETFs may be cheaper.

- Trading commissions add up if your broker does not offer commission-free trading.

Thanks for a good article. The Vanguard all-in-one ETFs make for a simple portfolio.

One note: the inception date of VGRO is January 25, 2018, not Jan 24, 2020.

See https://www.vanguardcanada.ca/individual/mvc/loadImage?country=can&docId=12396

@Jeremy: Good catch. I have updated the typo – Thanks.

My husband and I both have defined benefit pensions which we are currently receiving and we are trying to decide whether to go with VBAL or VGRO for our TFSAs and RRSPs or perhaps both ETFs, one for each. The TFSA for VBAL etc. Any input would be greatly appreciated.

@Cathay: I think you would benefit more by chatting with a financial advisor so they can look at your overall financial picture to determine what level of risk is appropriate.

That said, in general, I would not suggest VGRO as an option for investing when you are already in the decumulation phase of retirement. VBAL is a bit less volatile, however, an even lower risk portfolio such as VCNS or VCIP may be preferable if you are reliant on the income.

As Cathy and her husband have defined benefit plans these would be considered safe like fixed income allowing them to have more in the equity all in one ETF’s. VCNS many not be required to de-risk their investments in retirement, limiting long term growth.

Hello Enoch,

I have held mutual funds for over 30 years and had an Advisor to invest for me and so I am not familiar doing online trading of ETFs or stocks for that matter. My question is what if there isn’t any Sellers willing to sell ETF VGRO shares for the price you are willing to buy at $25.63 as in your example? Will the request expire at closing of the market (4 pm). Does GTC (good till cancelled) mean cancel request by end of day or continue into the next day? What are the other options duration period from pull down menu you can set ?

Given that example in Questrade, you mentioned, “I set my limit price at $25.63, just two cents below the lowest price recorded so far that day. ” I see the low price as 25.62 (and high as 26.05) next to the chart. Am I missing something here because I don’t see the low price of $25.65 on your print shot or was this during another time of the day when it was lower?

Unfortunately, I missed the opportunity to pay lower fees for ETFs for those years and have 5 years till I retire. However, my wife is 5 years younger, so she has more time. I would like for her to switch over her Bank TFSA and RRSP accounts to either Questrade or WealthSimple and buy VBAL or VGRO ETFs or even QuestradeWealth managed ETFs and or combination of. Then, when she converts to RRIFs go with conservative ETFs like VCN and VCIP you mentioned above. But not sure if WealthSimple have RRIF holdings….I believe they do?

Lastly, I believe the best option for her is to liquidate (sell) off the mutual funds at Bank side and have a cash account setup in her RRSP and TFSA. This will avoid her paying the $9.95 transaction charge to sell each individual mutual funds to buy ETFs from Questrade and if she buys from WealthSimple, well, she will have to liquidate them anyways to cash since they don’t manage mutual funds. Am I on the right track here?

I thank you in advance and appreciate clarifying for me my questions.

@Ed:

If there are no sellers willing to sell the ETF at your preferred price, you will need to place a limit order which means that if that price is reached over a time period specified by you, the transaction goes through. GTC means that your order remains in place until you cancel it. For example, you can keep open your order to buy VGRO at $25.63 until the price falls or rises to that level – this may take days, weeks, months, or even years to happen. On Questrade, you can also set a GTD (Good Till Date) order which keeps your order active until a specified date.

Good observation on the limit price I set. It should read 1 cent above the lowest price for the day. I have updated the article to reflect this.

With regards to your wife, if you are looking at using the robo-advisor option (Wealthsimple Invest), she can transfer the account directly to WS and have them invest it on her behalf based on her risk tolerance and investment objectives. You could also go the DIY route, but it will take more work.

Hi, Enoch.

Do you have an article on (as they have a low portfolio turnover and don’t trade too often) Tax-efficiency? What taxes do people pay in non-registered accounts? What is portfolio turnover and how does that affect taxation? How do securities that are frequently traded affect taxation?

@Abiola: The tax you pay on a non-registered account depends on the type of investment. If it is savings, the income earned (i.e. interest) is added to your total income for the year and this is taxed at your marginal rate. If it is an ETF or stock, if you sell and earn capital gains, 50% of the gains are taxed. If you earn dividends, this is also taxed at a specific rate depending on your income tax bracket.

Frequent trading (i.e. buying and selling) can dampen your returns because you are potentially creating tax events with each round-trip transaction (buy and sell trades). If you are paying trading fees with each transaction, you are potentially cutting into your long-term gains as these fees add up. Lastly, if you are trying to time the market by buying and selling securities frequently (i.e. day trading), the chances are you will lose money.

Hi,

For the Vanguard all in one ETFs, how does it work for your taxes if the ETF is in a non-register account. Does Vanguard keep track of ABC?

Thanks,

Jeff