This VEQT review covers its holdings, fees, pros and cons, how to purchase VEQT in Canada, and how it compares to XEQT.

A one-fund solution ETF such as the Vanguard All-Equity ETF portfolio (VEQT) eliminates the hassle of rebalancing when you make new contributions or when portfolio assets perform at different levels.

Also known as “one-ticket funds,” these all-in-one solution ETFs are great for beginners and experienced investors alike and also offer:

- Global diversification

- Low management fees compared to mutual funds

- Low-entry barrier with purchase possible using an online discount broker

- Hands-free portfolio management

- Accommodation for various risk profiles

What is VEQT?

This Vanguard ETF portfolio comprises 100% equity holdings and is the most aggressive portfolio in their line of all-in-one ETFs.

The Vanguard All-Equity ETF Portfolio “seeks to provide long-term capital growth by investing primarily in equity securities.” It is a fund of funds, meaning that the VEQT basket holds several other Vanguard equity ETF funds.

VEQT is traded on the Toronto Stock Exchange under the ticker symbol “VEQT” and was launched on January 29, 2019. Vanguard rates the risk (volatility) of VEQT as “medium”.

Some of its key facts as of April 24, 2023, include:

- Net assets: $2.59 billion

- Eligible accounts: RRSP, RESP, RRIF, TFSA, DPSP, RDSP, non-registered accounts

- Management fee: 0.22%

- MER: 0.24%

- Listing currency: CAD

- Return on Equity: 12.2%

- Price/Earnings ratio: 13.2x

- Price/Book ratio: 1.7x

- Earnings Growth Rate: 9.4%

In addition to VEQT, Vanguard Canada also offers the following asset allocation ETFs:

- Vanguard Balanced ETF Portfolio (VBAL)

- Vanguard Growth ETF Portfolio (VGRO)

- Vanguard Conservative ETF Portfolio (VCNS), and

- Vanguard Conservative Income ETF Portfolio (VCIP)

VEQT Holdings

VEQT is an all-stock ETF and an aggressive portfolio. “Aggressive” in this case refers to the risk profile of the portfolio. It is more sensitive to market fluctuations than a “growth” or “balanced” portfolio.

If VEQT makes up 100% of your portfolio, you’d be expected to have an above-average risk tolerance and an investment plan to hold the ETF long-term.

As of March 31, 2023, VEQT had a 99.86% stock and 0.14% cash allocation. The underlying funds making up the portfolio as of this date are:

| ETF | Allocation |

| Vanguard US Total Market Index ETF | 42.85% |

| Vanguard FTSE Canada All Cap Index ETF | 29.54% |

| Vanguard FTSE Developed All Cap ex North America Index ETF | 20.14% |

| Vanguard FTSE Emerging Market All Cap Index ETF | 7.34% |

The top-5 sector weightings for the stocks held by the funds are Financials (20.5%), Technology (15.95%), Industrials (13.24%), Consumer Discretionary (11.72%), Healthcare (8.5%), and Energy (8.49%).

VEQT consists of a total of 13,666 equity holdings.

Related: Best Investment Accounts in Canada

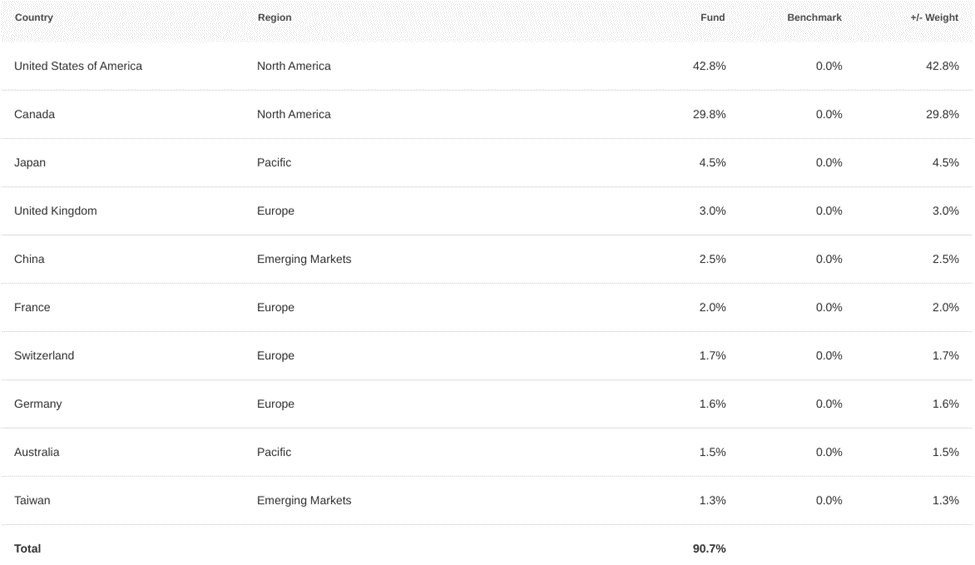

A look at the geographical distribution or market allocation shows it is widely spread over 50 different markets as of March 31, 2023.

VEQT Returns

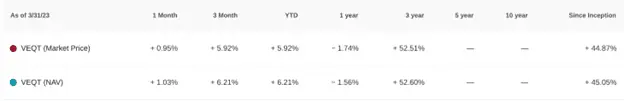

As of March 31, 2023, the fund has returned +6.21% year-to-date and 44.87% since inception based on its market price.

It is important to add a disclaimer at this point that historical returns do not guarantee future results.

VEQT Fees

VEQT has a 0.22% management fee, and its management expense ratio rounds up to 0.24%.

This fee structure is significantly lower than what you pay for a similar equity mutual fund which can top 2% in annual fees.

If you opt for a robo-advisor to help you manage your portfolio, the average fee is approximately 0.70% (e.g. Wealthsimple Invest).

You can save on investment fees by purchasing ETFs directly using a discount brokerage account.

With all-in-one ETFs, you are spared the hassle of rebalancing; however, you should take note of the trading fees. If your broker does not offer commission-free trading, your overall investment costs can become expensive.

Commission-free ETF purchases are offered by Questrade. Wealthsimple Trade extends the no-fee trading to stocks as well.

Review: Questrade vs. Wealthsimple

Benefits and Downsides of VEQT

I hold VEQT and love that it is truly hands-free. I don’t have to worry about re-aligning target allocations when I invest new money; it works for my long-term retirement account.

Also, since I have no plans to sell any portion of my holdings soon, I don’t need to worry about incurring trading fees.

On the flip side, you should note that VEQT is an all-equity portfolio. As we have seen in recent times, when the stock markets go crazy, investors with higher weighting in stocks will experience greater fluctuations in the value of their portfolios.

There are opportunities to save a little bit of extra money if you are okay with holding a basket of two or more different low-cost Vanguard index ETFs and rebalancing them when needed.

An equivalent all-in-one fund, such as the iShares Core Equity ETF Portfolio (XEQT) offered by Black Rock, has a lower 0.20% management expense ratio.

How To Purchase VEQT in Canada

You can easily purchase VEQT using Questrade or Wealthsimple.

1. Wealthsimple Trade: This trading app is offered by Wealthsimple, a leading robo-advisor platform in Canada. It offers free trades (both buy and sell) for ETFs and stocks.

Wealthsimple Trade is available as a mobile app and desktop platform. When you open an account and deposit $150+, you receive a $25 bonus.

Wealthsimple Trade

Trade stocks and ETFs for free

Great trading platform for beginners

$25 cash bonus when you deposit $200+

Transfer fees waived up to $150

2. Questrade: ETF purchases are free; however, you incur a trading commission when you decide to sell ($4.95 to $9.95 per trade).

Questrade is available via a web interface on your computer, tablet, or smartphone. They also have a decent mobile app. This brokerage platform is very versatile and offers access to real-time stock quotes and multiple financial products, including options.

To get started, open an account here and use our promo code SAVVY50 to get $50 in free trades after you fund your account with at least $1,000.

Questrade

Trade stocks, ETFs, options, FX, bonds, CFDs, mutual funds, etc.

Get $50 trade credit with $1,000 funding

Low and competitive trading fees

No quarterly inactivity fees

Access to advanced tools and trading data

Top platform for advanced traders

Transfer fees waived

VEQT vs. XEQT

Launched on August 7, 2019, XEQT is an all-equity ETF portfolio offered by BlackRock. Similar to VEQT, the fund is 100% stocks and seeks to provide long-term capital growth.

XEQT is made up of four underlying ETFs, including:

- iShares Core S&P Total U.S. Stock ETF (ITOT)

- iShares MSCI EAFE IMI Index ETF (XEF.TO)

- iShares S&P/TSX Capped Composite ETF (XIC.TO)

- iShares Core MSCI Emerging Markets ETF (IEMG)

XEQT has a management fee of 0.18% compared to 0.22% for VEQT and an MER of 0.20% compared to 0.24% for VEQT.

Is VEQT a Good Investment?

VEQT is designed for investors with above-average risk tolerance who are okay with a portfolio entirely invested in stocks.

An all-equity portfolio such as VEQT will fluctuate in value with the market; however, the increased risk can result in higher returns over time.

Aggressive portfolios are not suitable for everyone.

Related reading:

Which is better VEQT or XEQT does owning one over other have any Pros or Cons?

@Manoj: The ETF portfolio that’s better is the one that’s in line with your risk tolerance, returns expectation, and investment timeframe. It is impossible to rank one over the other without taking these three factors into consideration.

From your previous VGRO review, you mentioned that there is no exchange fee.

You also mentioned in this review that you hold VEQT. Do you pay US/CAD Exchange fee on VEQT? If no, then how Wealthsimple Trade earn its money from Vanguard ALL-in-One ETF portfolios ?

@Jacques: No, you don’t pay currency exchange fees when you buy VGRO, VEQT or VBAL. If you end up buying other investment assets listed in USD, WT makes some money from the FX fees. I guess you could consider the CAD listed products as “loss leaders”. I haven’t checked for Wealthsimple Trade, however, no-commission trading platforms in the U.S. also make money from selling the Order Flow to institutional investors, etc.

Are there any Ex-Financials Socially responsible ETFs in Canada? Does any broker offer that at all ?

In additional SRI interested in Ex-Financials but am not able to find it.

@Irfan: Wealthsimple has two SRI ETFs: WSRI and WSRD. I haven’t looked at them closely, but plan to review them soon.