Vancity is one of the largest credit unions in Canada, with more than $28 billion in assets and over 540,000 members.

It offers chequing accounts, savings products, mortgages, credit cards, loans, insurance, and more.

While cheques are not as popular as they once were, you may need to provide a Vancity void cheque to your employer or a client, so they can pay you by direct deposit.

Vancity cheques or direct deposit forms may also come in handy when you need to make payments using pre-authorized debits, such as your mortgage or insurance payments.

How To Get a Vancity Void Cheque

If you have a Vancity chequebook, you can simply write “VOID” across the front of one of the cheques using a pen. This action voids the cheque, and you can provide it to the person looking to pay you or get paid by you (e.g. an employer or insurance company).

If you don’t have a chequebook, you can order one from Vancity by visiting your nearest community branch or by calling the Member Services Branch.

You can order cheques online from Vancity by following these steps:

- Sign in to Online Banking

- Click on “Account Services”

- Click on “Order Cheques” and complete the form that is presented to you

- Choose the account you need a cheque for, the quantity of cheques and a unique design if needed

- Your cheque is delivered within 2-4 weeks

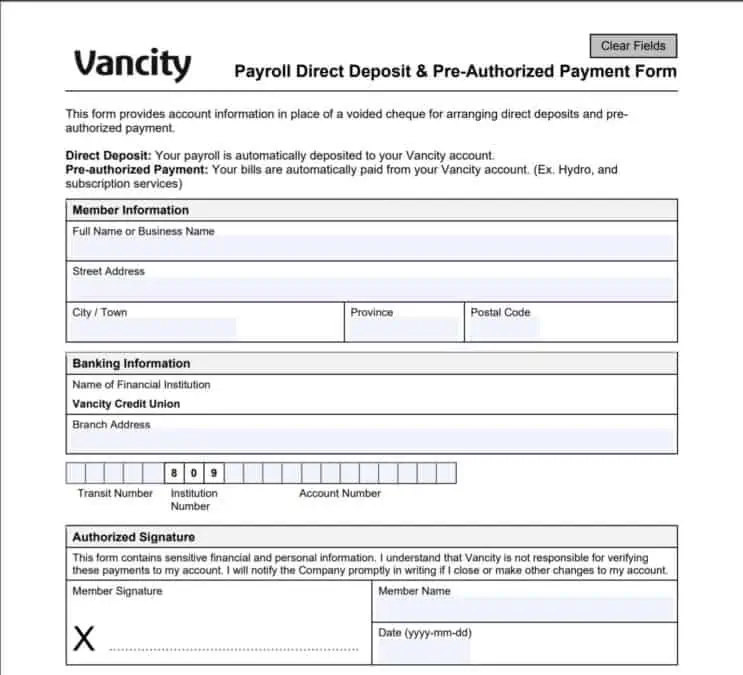

Alternatively, if you don’t have a chequebook and don’t want to spend money on getting new cheques, you can provide a direct deposit form to anyone who wants to pay you, or pre-authorized debit form if you need to pay bills via this method.

You can get a Vancity direct deposit form by downloading it online here.

You will need to complete the form and provide your full name, address, banking details, your signature, and date.

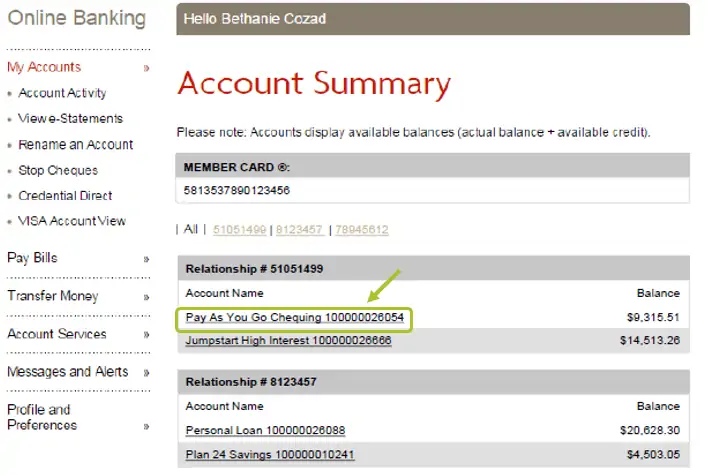

You can find your bank account information via online banking.

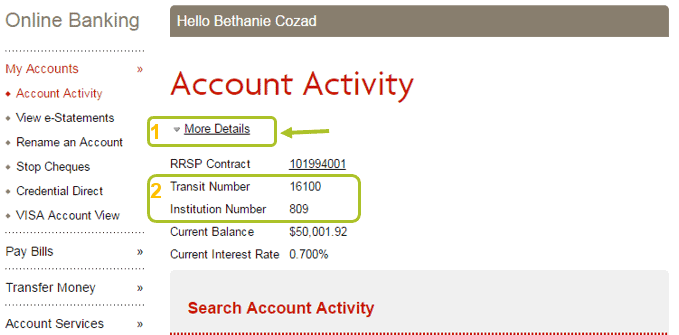

For example, to locate your transit number, institution number, and account number on online banking using a desktop:

- Log in to online banking and select the bank you want to pay bills from

- Copy your 12-digit account number

- Click on “More Details” to see your transit number and Vancity’s institution number

You can follow similar steps to get your details using the Vancity mobile app.

For the address of your branch, you can either use Google Search or check it using the Find Branch/ATM tool.

Related: Best Bank Accounts for Kids in Canada.

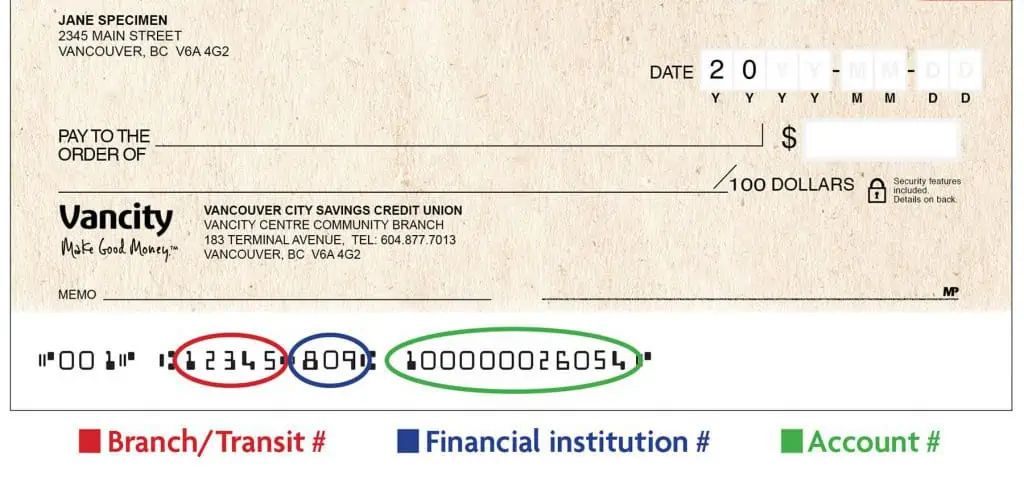

How To Read a Vancity Void Cheque

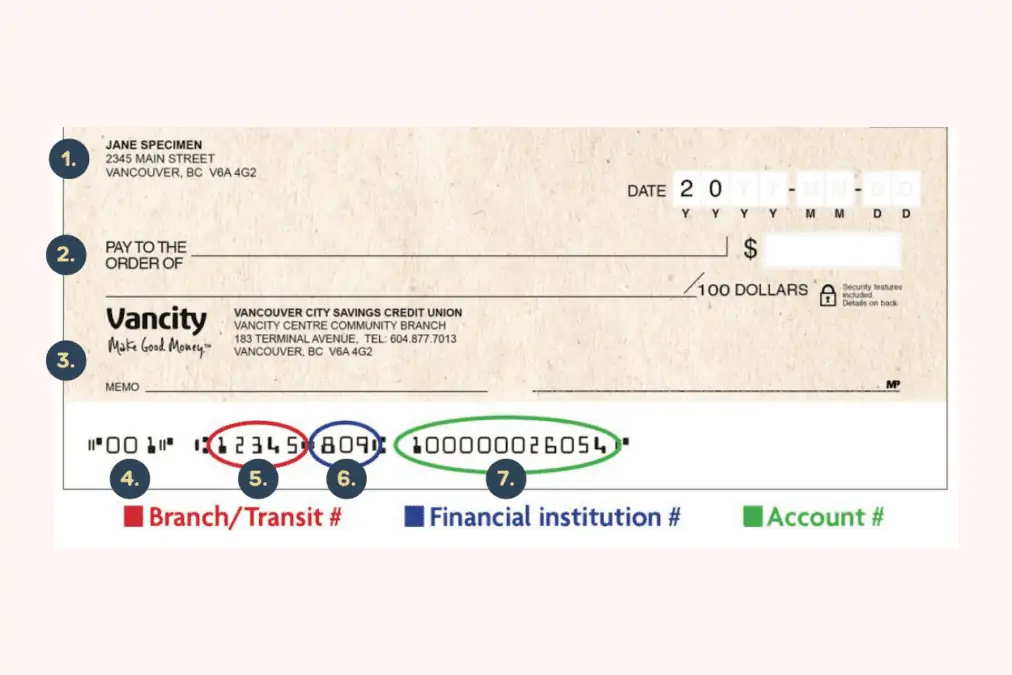

Canadian cheques look alike for the most part with similar information.

A sample cheque is often required when you need to set up direct deposits to your credit union or bank account or pre-authorized debits (such as loan repayments, rent, or childcare).

Since cheques contain all your bank account information, the recipient can easily use the numbers on them to set up a connection to your bank account – for both deposits and withdrawals.

A Vancity void cheque sample is also referred to as a Vancity “specimen” or “sample” cheque.

So, what information does a Vancity void cheque provide?

1. Name: Your name is printed at the top of the cheque. This indicates you (the “drawer”) who owns the credit union account from which funds are being withdrawn. Your home address is also printed under your name.

2. Beneficiary (payee): This section is where you write the name of the individual or organization to whom you are making a payment. For a void or sample Vancity, this section is left blank.

3. Bank account and branch details: This section includes the bank name and the address of the bank branch where your account is held.

4. Cheque number: This 3-digit number is what the bank uses to identify the cheque transaction in your bank statement. On your Vancity cheque, it is the first set of numbers on the MICR (Magnetic Image Character Recognition) encoding line as well as on the top right corner of the cheque.

5. Transit (branch) number: This 5-digit number refers to the specific credit union branch where you initially opened your account. Financial Institution transit numbers are maintained by Payments Canada, and you can view the entire list via its Financial Institutions Branch Directory (FIBD).

6. Financial institution number: This 3-digit number is also referred to as the bank code. Vancity’s institution code is 809.

7. Account number: This 7-12 digit number identifies your bank account. Vancity’s bank account number is 12 digits long.

When you combine Vancity’s institution number and transit number and add a leading zero “0”, you get your routing number.

For example, using the sample void cheque above, the routing number for Vancity is 080912345.

Related: How To Save on Banking Fees.

How To Write a Vancity Cheque

Follow these steps to write a Vancity cheque:

- Write the date on the right-hand corner where you have “DATE.”

- Write the name of the person you are paying on the line where you have “pay to the order of.”

- Write the amount of the cheque in dollars and cents in the line below “Pay to the order of.” For example, if you are paying them $150.50, you can write “One hundred and fifty dollars and 50/100”. You should also write the amount in figures in the box where you have the $ sign.

- Include the reason for the cheque in the “MEMO” line.

- Finalize your cheque by signing it on the line in the bottom right corner.

Your Vancity cheque is now ready to be cashed by the bearer.

Vancity Void Cheque FAQ

Vancity does not provide a void cheque on its online portal. You will either need to use an existing paper cheque and write “VOID” across it, or you can download a direct deposit form that serves the same purpose.

You can download a Vancity direct deposit form here. Complete the blank areas with your account information (name, address, transit number, and account number), sign and date the form before giving it out.

The institution number for Vancity Credit Union is 809.

Log in to the Vancity mobile app and select “Deposit” on the main screen. Choose the account where the funds are being deposited by selecting it in the “Deposit to” field and enter the amount being deposited. Write “For deposit only to Vancity Financial Account #——-” with your account number on the back of the cheque and sign it. Take photos of the front and back of the cheque by pressing “Take Photo”. Tap on “Continue” to complete the process.

Related: