The CIBC Aventura Visa Infinite card was designed with frequent travellers in mind.

It offers several travel benefits and insurance coverage that are not standard fare, and when you add in the flexibility of redeeming Aventura points and sign-up bonus offers, this card is easily one of the best travel credit cards in Canada.

This CIBC Aventura Visa Infinite Card review covers its most rewarding features, perks, limitations, and everything else you need to know.

CIBC Aventura Visa Infinite – Summary of Features

CIBC Aventura Visa Infinite Card

Great for travel insurance

Annual fee: $139

Rewards: Earn 2 points on every $1 spent on travel purchases.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Minimum income requirement: A minimum annual individual income of $60,000 or household income of $100,000.

Recommended credit score:

Good or better

On CIBC’s website

The CIBC Aventura Visa Infinite offers a combination of loyalty rewards when you spend using the card, as well as travel insurance benefits and perks that stand out in its category.

CIBC Aventura Visa Infinite Rewards

This card offers 2 points for every dollar spent on travel purchased through the CIBC Rewards Centre.

You also earn 1.5 points for gas, grocery, and drugstore purchases with an option to get an extra 3 cents off per litre of gas when you link your CIBC card to Journie Rewards.

There is an $80,000 limit for earning at the 1.5x reward rate, after which the earn rate for this spending category falls to 1 point per $1 spent.

CIBC Aventura Visa Infinite Travel Benefits

This card offers frequent travellers a couple of practical perks, including a complimentary Priority Pass membership and the rebate of Nexus application fees. The complimentary Priority Pass membership also includes six free annual airport lounge visits.

Considering that a Priority Pass membership costs $99 USD per year and each visit to an airport lounge cost $32 USD per person, this perk is worth approximately $291 USD every year.

A Priority Pass membership offers a gateway to more than 1,300 airport lounges worldwide. If you apply for a Nexus card and charge it to your card, the fee is rebated twice up to $50 USD every four years.

Cardholders also have access to the Aventura Travel Assistant, which offers travel booking planning and emergency support 24/7.

CIBC Aventura Visa Infinite Travel Insurance

The comprehensive travel insurance coverage provided by this CIBC credit card includes the following:

- Out-of-Province Emergency medical insurance of up to $5 million for the first 31 days of your trip if you are under 64 years of age (10 days for those aged 65 and older).

- Trip cancellation and trip interruption insurance with coverage up to $2,500 per insured person and $5,000 maximum.

- Flight delay and baggage insurance.

- Travel accident insurance up to $500,000.

- Hotel burglary insurance up to a maximum of $2,500 per occurrence.

- Car rental collision and loss damage insurance with coverage for up to a Manufacturer’s Suggested Retail Price (MSRP) of $85,000.

Other Perks

It also offers uncommon insurance coverage for damage to or theft of mobile devices up to $1,500 when you pay for a tablet or smartphone in full with your card.

Cardholders enjoy car rental discounts at participating car rental locations and can also access the 24/7 Visa Infinite Concierge.

Lastly, it offers purchase security for 180 days and an extended warranty for up to two years.

Downsides of the CIBC Aventura Visa Infinite

One main downside of this card is its annual $139 fee. While this fee is waived in the first year, it is payable in subsequent years. Also, supplementary cards cost $50 each.

You will need to earn at least $60,000 annually if you apply for the card based on your personal income. You can also join forces with a partner and apply using a combined household income of at least $100,000.

If you are looking for a no-fee card that offers travel rewards, check out this list of the best rewards credit cards in Canada.

How Aventura Rewards Work

Aventura Points can be redeemed for air travel, hotel stays, merchandise, gift cards, and vacation packages or to make payments towards your credit card balance, mortgage, investments, or line of credit.

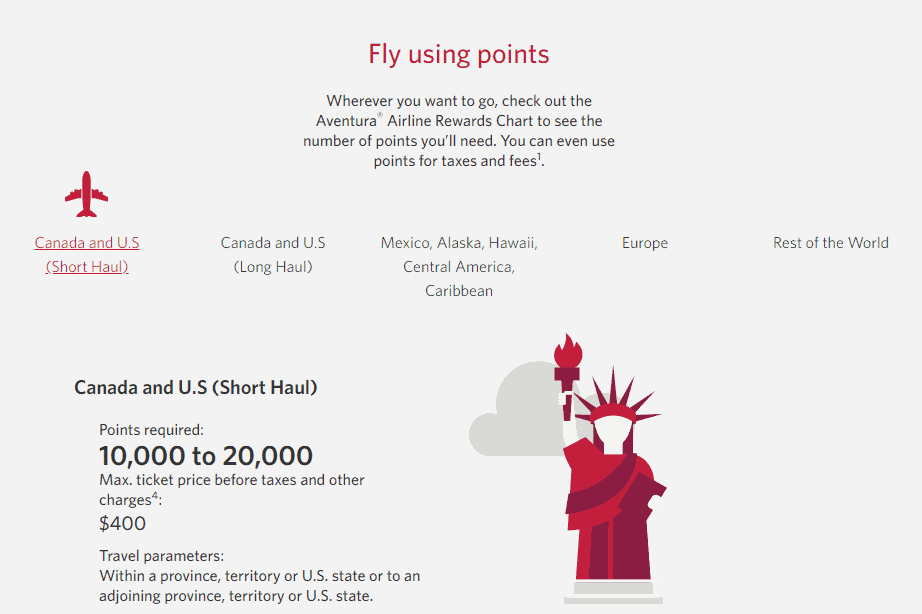

The standard redemption rate for travel rewards is 100 Aventura Points to $1. You can enjoy an even greater reward rate (>1%) depending on where you are flying.

For example, you could pay for a short-haul flight within Canada or the U.S. that is valued at $400 using just 20,000 points. This is double the standard value for a 2-4% return.

Another upside is that you can use Aventura Points to pay for taxes and other fees incurred during your booking.

To redeem your Aventura Points, visit cibcrewards.com or call them at 1-888-232-5656.

Is the CIBC Aventura Visa Infinite Worth It?

This credit card has an overall package that is commensurate with its $139 price tag. If you travel frequently, you could save a lot of money earning and redeeming your Aventura Points.

One card that ranks a bit higher on my list of travel cards is the Scotiabank Passport Visa Infinite card ($139). It offers comprehensive travel insurance, complimentary Priority Pass membership with six free visits annually (valued at $379 CAD), and no foreign currency transaction fee – a 2.50% savings when you purchase a foreign currency.

Learn more about this card in this Scotiabank Passport Visa Infinite card review.

Scotiabank Passport Visa Infinite Card

Rewards: Earn 2x Scene+ points/$1 on groceries, dining, entertainment, and daily transit; 1x points/$1 everything else; 6 free airport lounge passes/year; no FX fees.

Welcome offer: Get up to 40,000 points ($400 value).

Interest rates: 20.99% on purchases; 22.99% on cash advances.

Annual fee: $150 (waived in the first year)

The CIBC Aventura Visa Infinite offers rare mobile device insurance.

If travel rewards are not your focus and you prefer actual cash back, you should look at the no-fee Tangerine World Mastercard, which also offers free mobile device insurance.

Tangerine World Mastercard

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases; VIP perks.

Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value).

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

Lastly, you can check out the American Express Cobalt Card for premium travel and cash back rewards.

American Express Cobalt Card

Rewards: Earn 5x the points on food and drinks; 3x points on eligible streaming subscriptions, 2x points on travel; 1x points everywhere else.

Welcome offer: Get up to 50,000 bonus points in the first year.

Interest rates: 20.99% on purchases and 21.99% on cash advances.

Annual fee: $155.88

Related: