Sending money overseas is easy with wire transfers, but the costs that come with it may be high.

Wire transfer fees vary from bank to bank and typically depend on factors like the type of transfer and the amount sent or received.

In this article, we will cover the wire transfer fees at major Canadian banks and the fees charged by alternative online bank wire transfer services.

What Are Wire Transfer Fees?

Wire transfer fees are the cost of sending or receiving money through a wire transfer.

The costs of receiving a wire transfer may include primary and intermediary bank fees, foreign conversion fees, and miscellaneous charges.

Transactions made through a wire transfer involve a secure electronic transfer of funds from one bank account to another without the need to exchange cash.

Also called wire payments, it allows money to be moved quickly and securely, either domestically or internationally.

The wire transfer fees your bank charges will depend on whether you are the sender or the recipient and if the transaction is domestic or international.

Domestic wire transfers are generally cheaper than international wire transfers since there are fewer bank systems to deal with.

International wire transfer fees are higher because it is more complicated, and the wire processing services may vary from country to country.

Wire Transfer Fees for the Big 5 Banks

Here are the fees that Canada’s top big 5 banks charge for wire transfers:

BMO Wire Transfer Fees

BMO’s fee for incoming wire transfer payments is $14. For outgoing wires, you pay 0.2% of the wire value, with a $15 minimum and $125 maximum charge. There is also a $10 communication fee.

Starting on July 5, 2023, incoming wire payments will cost $16, and outgoing wires will cost $40, plus a $10 communication charge.

These fees are higher than BMO’s Global Money Transfer, which costs $5 (flat fee) per transaction. The bank waives the service fee if your money transfer is to BMO in the United States or if you are in any of these BMO bank plans:

- Premium Plan

- Platinum Plan

- Performance Plan under the NewStart Program

- Bank at Work

RBC Wire Transfer Fees

The Royal Bank of Canada wire transfer fees are categorized into two: incoming and outgoing.

The fees for Incoming wire payments are:

- From an RBC Royal Bank unit located in Canada – Free

- From another financial institution worldwide ($50.00 CAD/U.S. and under) – Free

- From another financial institution worldwide over $50.00 CAD/U.S. – $17.00 CAD or $17.00 U.S., depending on the currency of the incoming wire payment

For outgoing wire payments, the RBC wire transfer fees are as follows:

- Within Canada or to other countries (most currencies) – Starting at $45.00

- If outgoing payment is not delivered as instructed – Free

- If outgoing payment is delivered as instructed – Starting at $25.00 plus GST

Wire Transfer Fees for TD

The TD Canada Trust wire transfer fee for incoming wire (domestic and international) is $15.00 and $30.00 for outgoing wire (domestic).

The TD international wire transfer fee is $50.00 (outgoing wire), plus exchange rate, taxes and correspondent fee(s).

CIBC International Wire Transfer Fees

The fee for incoming wire payments at CIBC is $15 per wire payment for any amount.

For outgoing wire payments, the charges are as follows:

- $10,000 or less – $30 per transaction

- $10,000.01 to $50,000 – $50 per transaction

- Over $50,000 – $80 per transaction

Scotiabank International Wire Transfer Fees

At Scotiabank, the amount you will pay for outgoing wire transfers will depend on whether you conduct the wire transfer online or through a branch.

For incoming wire transfer fees to Scotiabank identified as pension payment costs $1.50 per transfer.

All other incoming wire transfers cost $15.00 CAD/USD per transfer. All fees are charged in the currency of the account.

Online Bank Wire Transfer Fees

The following are online bank wire transfer options and their corresponding fees:

Simplii Financial Global Money Transfer Fees

Simplii Financial does not charge transfer fees when you send money internationally to over 130 countries.

EQ Bank Wire Transfer Fees

EQ Bank does not offer wire transfers at the moment. It sends international money transfers through Wise, a money transfer platform that converts money using the mid-market exchange rate.

Wise charges a conversion fee based on the amount of money you are sending and the currency you have chosen.

Manulife Bank Wire Transfer Fees

The fee for sending a wire transfer to Manulife Bank depends on the amount of the transfer:

- Up to $10,000 – $30

- $10,000.01 to $50,000 – $50

- More than $50,000 – $65

For an incoming wire transfer, Manulife charges $15 to deposit the funds into your account.

Wire Transfer vs. e-Transfer in Canada

Aside from wire transfers, another way to transfer funds securely in Canada is through an Interac e-transfer.

An Interac e-Transfer is an electronic means of sending money from your bank account to another using a bank’s online platform or mobile app.

Below is a comparison table showing the primary differences between a wire transfer and e-transfer in Canada.

| Description | Wire Transfer | Interac e-Transfer |

| Availability | Domestic and international | In Canada only |

| Speed | Same-day arrival for domestic payments | Funds typically arrive in under 30 minutes |

| International payments may take 3 to 5 days, depending on the location | Not available internationally; Limited to Canada only | |

| Cost | More expensive than other ways to send money | Fees may range from $0.50 to $1.50, depending on the bank, amount, and type of account. Some online banks offer free and unlimited e-transfers |

| Transfer processing | Fast processing when transfers hit cut-off times | Transfers are instant but can take up to 30 minutes, depending on your financial institution. |

| Limits | No limit on how much you can transfer to Canada | Lower transaction limits |

| Convenience | Yes | Yes |

Who Pays Wire Transfer Fees?

Whether you are sending or receiving a wire transfer, you are responsible for the fees your financial institution charges in transferring and wiring the money.

In short, both the sender and the receiver may pay wire transfer fees. The charges will usually cover fees paid to your bank, an intermediary bank, the receiving bank, and conversion costs.

How To Avoid Wire Transfer Fees in Canada

While it is not likely you can avoid wire transfer fees altogether, it is possible to minimize the costs significantly by following the tips below.

- Find a bank that offers to waive wire transfer fees.

- Transact online rather than in a bank branch.

- Choose an alternative way to transfer money, such as an independent money transfer service like Wise.

- Use peer-to-peer payment services in sending and receiving payments, such as KOHO, Wealthsimple Cash, and PayPal.

FAQs

Canada does not regulate or tax gifts of cash sent to Canada, so Canadians can receive as much money without paying capital gains tax. But if you receive funds from selling assets, you will be required to pay capital gains tax.

Using Wise international transfer services to send money to Canada is usually the cheapest option because it charges low fees with no hidden costs. It also uses the mid-market exchange rate, or the real exchange rate, and does not mark up the rate as most banks do.

Wire transfer costs in Canada vary by service provider but generally cost $15 to $50. The fees depend on whether you are sending or receiving the money and the amount involved. Some banks waive wire transfer fees as part of an account package.

Yes, PayPal lets you send money to Canada for a fee. Log in to your PayPal account, provide the required details, enter the amount and send the money with the click of a button.

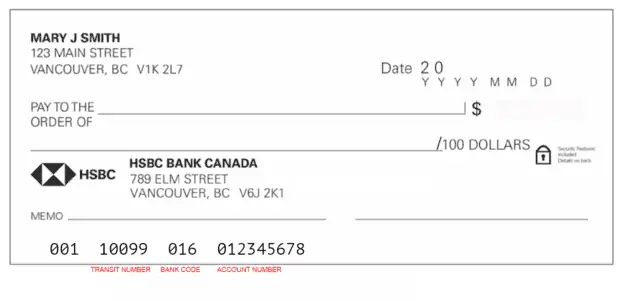

I was very pleasantly surprised to be able to complete an interprovincial wire transfer for a house purchase online at no charge with HSBC. I was shocked, actually. I needed a bit of telephone assistance and they happily provided it as well.