Wealthsimple is more than a robo-advisor. It also offers savings accounts, a stock and crypto brokerage account, tax software, and a cashback prepaid card.

Using a Wealthsimple high-interest savings portfolio or Cash account, you can earn up to 5% interest on your deposits.

This review covers how the company’s HISA works, fees to watch for, and their pros and cons.

For a limited time, you earn four times the regular bonus when you sign up for a Wealthsimple Cash account (use code E0U3RG).

Wealthsimple High Interest Saving Account

You can use any of the three Wealthsimple savings accounts below to earn competitive interest rates:

- Wealthsimple Save

- Wealthsimple High Interest Savings Portfolio (managed)

- Wealthsimple Cash

How much you earn with the managed Wealthsimple HISA varies based on the performance of the Purpose High Interest Savings Fund (PSA).

For Wealthsimple Cash accounts, your rate depends on your account balance.

Wealthsimple Save (1.5% Interest rate)

Wealthsimple Save is the standard savings account offered by Wealthsimple. It pays 1.50% (or 1.10% for business accounts).

Interest is calculated daily and is paid on the 5th business day of each month.

Related: Wealthsimple Save review.

Wealthsimple High-Interest Savings Portfolio

This Wealthsimple account invests your fund in the Purpose High Interest Savings Fund (PSA) which is a HISA ETF.

You earn a much higher interest rate on your deposits and can cash out anytime without the lockup period associated with non-redeemable GICs.

As of this writing, the PSA had a 5.30% net yield. That said, you pay Wealthsimple a 0.40% to 0.50% management fee:

- Account less than $100,000: 0.50%

- Account over $100,000: 0.40%

You can invest in the high-interest savings portfolio using a registered (RRSP, TFSA, or RESP) or non-registered investment account.

Visit Wealthsimple to open a managed account here.

Wealthsimple Cash Account (Up to 5% Interest)

Wealthsimple Cash is a hybrid account, i.e. similar to a chequing account that pays interest.

You earn 4% to 5%, depending on your account level.

- Standard Wealthsimple account with no minimum balance: 4% interest

- Premium Wealthsimple account: 4.5% interest (requires a Wealthsimple asset balance of at least $100,000).

- Wealthsimple Generation: 5% interest (requires a Wealthsimple asset balance of at least $500,000).

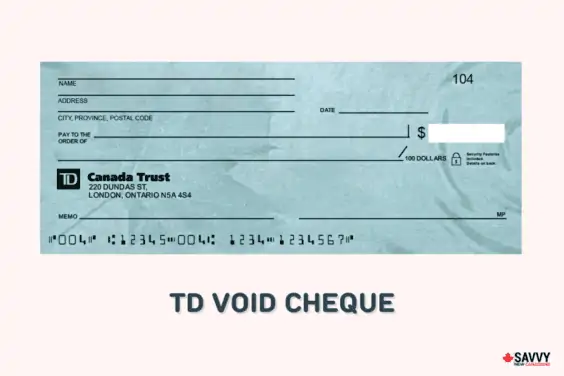

A Wealthsimple Cash account comes with a prepaid Mastercard you can use for online and in-person transactions. You can also use it for Interac e-transfers, direct deposits, and bill payments.

Wealthsimple Savings Account Fees

There are no monthly fees for Cash and Save.

If you have a managed HISA, you pay 0.40% to 0.50% management fee annually. Your returns are also net of the ETF management expense ratio.

Wealthsimple CDIC Coverage

The balance in your Wealthsimple Cash account is eligible for CDIC deposit insurance coverage up to $300,000. This is possible because your money is held at multiple CDIC member institutions.

Managed accounts are protected by the Canadian Investor Protection Fund within specified limits if the company becomes insolvent.

Wealthsimple Save accounts are also eligible for CDIC insurance up to $100,000.

Wealthsimple High Interest Savings Alternatives

You can also consider the following banks for high interest savings rates:

Neo Savings Account

4.00% non-promo interest rate

No monthly fees

Unlimited free transactions

Access to a no-annual-fee credit card

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

Simplii High-Interest Savings Account

6.00%* rate for 5 months

Unlimited debits and bill payments

Unlimited Interac e-Transfers

$400 cash bonus offer with a free chequing account

Scotiabank MomentumPLUS Savings

1.40% regular interest rate, plus bonus interest for a limited time

No monthly fees

Big Five Bank account

Access to other products