If you are in the market for a premium chequing account, you are in luck.

Scotiabank offers up to a $350 cash bonus to new clients who open a Scotiabank Preferred Package or Scotiabank Ultimate Package chequing account.

This promotion is available until October 31, 2023, and the eligibility requirements are straightforward.

These two accounts also provide access to some of the best credit card promotions for premium cards in Canada.

Read on to learn about the best Scotiabank promotions and other juicy bank promotions that are worth checking out.

Scotiabank $350 Promotional Offer

To qualify for the sign-up bonus, you will need to open an eligible Scotiabank chequing account by October 31, 2023, and complete two of the following three tasks:

- Make an eligible $50 bill payment through online or mobile banking

- Set up at least 2 eligible separate recurring pre-authorized transactions that are $50 or more, which will recur monthly for a minimum of 3 consecutive months

- Set up an eligible recurring deposit that will recur monthly for a minimum of 3 consecutive months

After you have met these conditions, your bonus is deposited into your account within 2 months.

The promotional link to take advantage of this offer is:

- Scotiabank Preferred Package ($350),

- Scotiabank Ultimate Package ($350)

Students who open a Student Advantage Banking Plan account can earn up to a $100 bonus.

Below is a summary of the offers that are currently available:

| Scotiabank Account | Sign-up Bonus |

|---|---|

| Scotiabank Ultimate Package | $350 |

| Scotiabank Preferred Package | $350 |

| Scotiabank Student Advantage Banking | $100 |

Scotiabank Preferred Package Review

The Preferred Package is Scotiabank’s most popular chequing account. It is a great option if you want unlimited transactions without paying the top monthly rate.

It offers:

- Unlimited debit transactions and Interac e-Transfers

- First-year fee rebate on select credit cards (up to $150)

- Earn a high savings rate for a limited time with the MomentumPLUS Savings Account

- Earn 1 Scene+ point for every $5 you spend on debit purchases

- Cheap International Money Transfer

This account has a $16.95 monthly fee; however, you can waive it completely by maintaining a minimum daily closing balance of $4,000.

Promo Offer: Get $350 when you open a Preferred Package plan by October 31, 2023.*

Scotiabank Ultimate Package Review

This account is Scotiabank’s premium chequing account. While it has a $30.95 monthly fee, you can waive this fee by maintaining a minimum balance of $5,000 throughout the month. It offers the following perks:

- Unlimited debit transactions and Interac e-Transfers

- Unlimited non-Scotiabank ATM withdrawals worldwide

- Free Scotia International Money Transfers

- Earn an extra 0.10% on your Momentum PLUS Savings account

- Free personalized cheques and drafts

- 10 free equity trades at Scotia iTrade and 5 free equity trades every year after

- Ultimate rates on GICs

- Annual fee rebates on select credit cards (up to $150/year)

- $55 annual fee waiver on a small safety deposit box

Promo Offer: Get a $350 cash bonus when you open an Ultimate Package account by October 31, 2023.*

* Terms and conditions apply.

The following cards qualify for a fee rebate if you open either a Preferred or Ultimate banking account:

- Scotiabank Gold American Express

- Scotiabank Passport Visa Infinite

- Scotiabank Momentum Visa Infinite

- Scotiabank Value Visa card

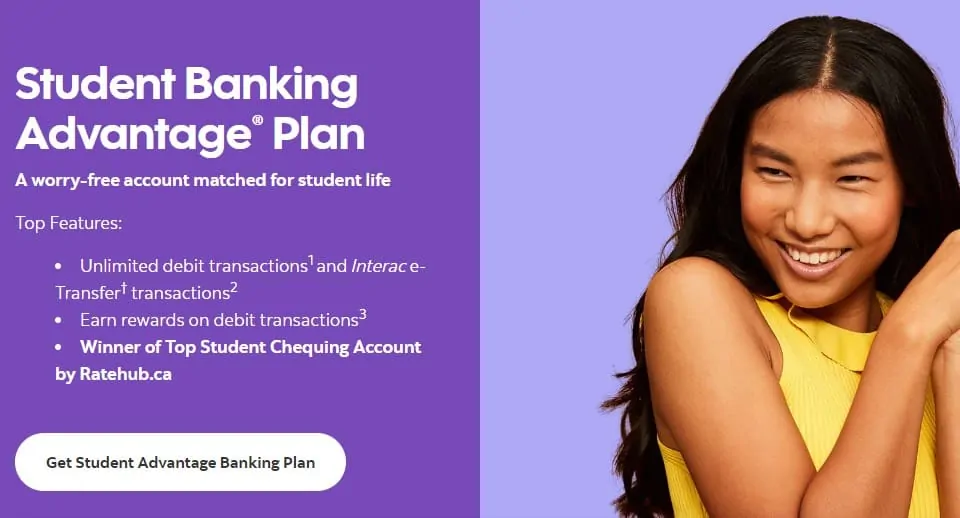

Scotiabank Student Banking Advantage Plan Review

This student bank account offers unlimited transactions and Interac e-Transfers to individuals who are enrolled in full-time post-secondary education.

It has no monthly account fee, and you earn Scene+ points on debit purchases. To apply, you must show proof of enrollment at an eligible educational institution.

Promo Offer: Get a $100 bonus when you open a Student Bank Account and complete one of the following:

- Set up a payroll deposit to your account, or

- Set up a minimum of 2 separate recurring pre-authorized transactions for a minimum of $25 per transaction for 3 consecutive months.

| Scotiabank Accounts | Scotiabank Ultimate Package Plan | Scotiabank Preferred Package Plan | Scotiabank Student Banking Advantage |

|---|---|---|---|

| Monthly fee | $30.95 | $16.95 | $0 |

| Minimum balance to waive fee | $5,000 | $4,000 | N/A |

| Number of free transactions and Interac e-Transfers | Unlimited | Unlimited | Unlimited |

| Credit card fee waiver | Annually (up to $150) | First-year only (up to $150) | N/A |

| Other perks | Free global non-Scotiabank ATM withdrawals; Free global money transfer; Free cheques and drafts; No monthly overdraft protection fee; Earn Scene+ points | Cheap money transfer; Earn Scene+ points | Earn Scene+ points; Free paper statement |

| Promo offer | $350 cash | $350 cash | $100 cash |

| Review | Learn More | Learn More | Learn More |

Bank Account Promotions in Canada

Some of the other new bank account promotions worth looking at in Canada include offers from big banks, international, and online banks.

Simplii Financial Offer ($400 Bonus)

Get a $400 bonus when you open a Simplii no-fee chequing account (limited-time offer).

To qualify for the cash reward, you must add a direct deposit of at least $100 for 3 consecutive months. This direct deposit payment can be your paycheck, government benefit, or pension.

The Simplii No-Fee Chequing Account includes unlimited debit transactions and Interac e-Transfers, free cheques, mobile cheque deposits, and you also earn interest on your balance.

Simplii also has a high-interest savings account that is currently paying a 6.00% interest rate.

Apply for the free Simplii Chequing Account or read our detailed review.

HSBC Chequing Account Promotions

HSBC Bank offers up to a $500 bonus* when you open a new HSBC chequing account online and meet the eligibility requirements.

The three accounts eligible for the offer are:

- HSBC Premier Chequing Account: $34.95 monthly fee (fee is waived when you meet eligibility criteria)

- HSBC Advance Chequing Account: $25 monthly fee (fee is waived when you meet eligibility criteria)

- HSBC Student Chequing Account: No monthly fee

BMO Promotions

BMO New Account Offer

Up to $350 cash bonus offer

Waive monthly fees by keeping minimum balance

A premium account with unlimited transactions

Includes credit card fee rebate & free identity theft protection

The Bank of Montreal offers up to $350 when you open a BMO Performance Chequing or Premium chequing account plan by October 31, 2023.

The BMO Performance Chequing has a $16.95 monthly fee, and the BMO Premium Chequing has a $30 monthly fee. Both monthly fees can be waived if you keep a minimum balance of $4,000 and $6,000, respectively.

To qualify for the promo, you must meet the eligibility requirements. Here’s a review of BMO Chequing accounts.

Related: Best BMO Credit Cards in Canada.

EQ Bank Promotions

EQ Bank offers a hybrid account that works like a high-interest savings and chequing account combined. You get unlimited free debits, Interac e-Transfers, and bill payments. There is also no monthly fee.

The EQ Bank Savings Plus account offers a 2.50%* savings rate.

If you want to open an EQ Bank TFSA or EQ Bank RRSP, the savings rate is 3.00%*. Learn more in our EQ Bank review.

Tangerine Promotions

New Tangerine clients can earn a cash bonus when they set up payroll deposits to their new Tangerine Chequing account.

Your first payroll must be deposited within 60 days of opening the account and should continue for at least 3 consecutive months.

You can also open a new savings account at the same time. Learn more about Tangerine Bank.

Are Bank Promos Worth It?

If you need a new bank account, a bank promotional offer is one way to get free cash for something you need anyway.

Note that “unlimited” chequing account packages typically have a $15-$30 monthly fee.

While you can waive this fee by keeping a minimum daily closing balance, having your account drop below the minimum threshold for even one day means you are on the hook for the monthly fee.

Also, pay attention to the terms and conditions required to qualify for the cash bonus. Generally, you won’t be able to cut and run for a few months to a year.

You can take advantage of the $350 offer from Scotiabank by signing up below:

Signed up for Scotia’s preferred chequing package in March as I changed banks recently. So should see the promo offer money in May/June as I’ve met the requirements.

Surprised that only 20 countries are currently available for their international money transfers, but perhaps this will change.

Currently using WISE and at cheaper rates anyways for money transfers.