The BMO Performance Plan is one of the best BMO chequing accounts, offering unlimited transactions and up to a $40 rebate for eligible BMO credit cards’ annual fees.

This article covers the details of the BMO Performance Plan, including its main features, fees, minimum balance, and pros and cons. Read along to know whether this account is suited to your needs.

Key Takeaways

- The top features of the BMO Performance plan are unlimited transactions, a waivable monthly fee, and up to $40 rebates on the annual fee of eligible credit cards.

- Some downsides of the BMO Performance Plan Chequing account are having a slightly expensive fee of $16.95 and not having overdraft protection included.

- You can waive the monthly fee of the BMO Performance Plan if you maintain a minimum balance of $4,000.

BMO Performance Plan Overview And Features

The BMO Performance Plan is the bank’s most popular chequing account.

It costs $16.95 a month, but this monthly fee can be waived as long as you maintain the BMO chequing account minimum balance of $4,000.

With this bank account, you’ll enjoy unlimited debit and Interac e-Transfer transactions and complimentary OnGuard Identity Protection, a service that helps you detect identity theft before your account is compromised.

This plan also provides rebates, special discounts, and welcome bonuses to its users.

Top Features Of The BMO Performance Plan

Unlimited Transactions

Carry out banking transactions as often as you need without worrying about additional fees. These transactions include debit card purchases, Interac e-Transfer transactions, withdrawals and bill payments.

Waivable Monthly Fee

You won’t have to pay the regular monthly fee of $16.95 if you maintain the minimum balance of $4,000.

BMO Family Bundle Eligibility

After opening a BMO Performance Plan chequing account, up to 3 of your family members can create their own BMO bank accounts for no extra charge. You’ll qualify for this program if your household has two or more adults.

Credit Card Rebates

You’ll receive up to a $40 rebate on the annual fees of eligible BMO credit cards. The following cards qualify for the maximum rebate:

- BMO AIR MILES World Elite Mastercard

- BMO CashBack World Elite Mastercard

- BMO Ascend World Elite Mastercard

- BMO AIR MILES World Mastercard

- BMO CashBack World Mastercard

- BMO Eclipse Visa Infinite Card

On the other hand, the BMO Preferred Rate Mastercard gets a $29 rebate.

Note: This feature’s limit is one rebate per Performance Plan per person. If the bank account is joint, with both accountholders having an eligible credit card, the rebate is only applied to the card with the higher annual fee.

Complimentary OnGuard Identity Theft Protection

BMO’s Onguard protection is included in all BMO Performance Plan chequing accounts. This service safeguards your personal information from fraud by scanning public and underground websites for suspicious activity that may be using your stolen identity.

You’ll save over $150 a year by getting this service for free.

BMO Performance Chequing Account Fees

Apart from the monthly fee of $16.95, which is waived if you maintain the required minimum balance, you can expect several BMO Performance chequing account fees.

The table below shows what those fees are.

Other BMO Performance Plan fees

| Type of Fee | Number of Free Transactions (Per Month) | Amount |

| Global Money Transfer | 0 | $5 Each |

| Standard Overdraft Protection | 0 | $5/Month or Transaction |

| Non-BMO ATM Withdrawals In Canada | 1 | $2 Each Thereafter |

| Non-BMO ATM withdrawals Outside Of Canada | 0 | $5 Each Thereafter |

What is the BMO Chequing Account Minimum Balance?

The minimum balance requirement to waive the BMO Performance Plan’s fee is $4,000.

Remember, though, that if you’re using the BMO Family Bundle, the balance in your family members’ accounts doesn’t count towards the minimum balance of your main Performance Plan account.

The entire $4,000 should be in your Lead Account or the account you designate to pay the standard fee of the Performance Plan.

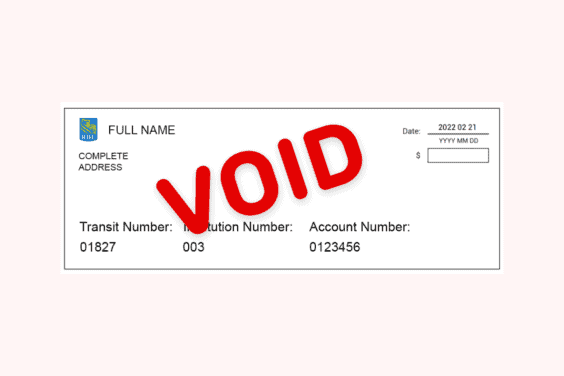

How To Open A BMO Performance Plan Chequing Account

To open a BMO Performance Plan chequing account, you’ll need your Social Insurance Number (SIN) and address in Canada.

Once you have those 2, you can open your BMO Performance Plan online or visit one of the bank’s offline branches. Alternatively, you can call BMO’s telephone customer support.

Canadian residents of any age can open a BMO Performance Plan Chequing account. If you’re the age of majority in your province, you can do this process yourself. However, a parent or guardian must create your account if you’re part of the minority age.

Pros And Cons Of The BMO Performance Plan Chequing Account

This bank account has several advantages and disadvantages. Below’s a brief overview of both sides to help you determine whether this bank account is best for you.

Pros

- Eligibility for the BMO Family Bundle

- Annual credit card rebates (up to $40)

- Unlimited day-to-day banking transactions

- The OnGuard Identity Theft protection is included

- Waivable monthly fee (if you maintain the minimum balance of $4,000)

Cons

- Costly monthly fee of $16.95

- Overdraft protection is not included in the plan

- A high minimum balance is required to waive the monthly fee ($4,000)

BMO Performance Plan Student Offer

For individuals enrolled full-time in post-secondary programs, BMO offers its Performance Plan for zero monthly fees with a signup cash bonus.

All the features of the regular Performance Plan account are included in this student offer.

Students can enjoy this free account for up to 12 months after graduation. After that, the regular $16.95 monthly fee applies unless the user continues to waive it by maintaining the required minimum balance.

To apply for this offer, you must show proof of registration of your full-time student status. This must be done in a BMO branch simultaneously if you register in person or within six months of opening an account online.

Along with the Performance Plan student offer, BMO also provides lines of credit for students and exclusive offers for medical and dental students and residents.

Other BMO Bank Plans And Fees

If you’re interested in what else this bank can offer, here are other BMO Bank plans and their corresponding fees:

BMO Plus Chequing Account

The BMO Plus Chequing account is an excellent option for those looking for a cost-effective account and does not require frequent bank transactions. This account only costs $11.95, which can also be waived if you maintain a minimum balance of $3,000 in your bank account.

This chequing account offers 25 transactions a month. Additional ones will be charged $1.25 each.

BMO Premium Plan Chequing

If you want an upgraded version of the BMO Performance Plan, this Premium Chequing account might be the best for you.

On top of giving you unlimited debit transactions and Interac e-Transfers, this chequing account allows you unlimited free withdrawals from non-BMO ATMs worldwide. You also enjoy up to $150 rebates on eligible BMO credit cards’ annual fees, along with free cheques, drafts, and money orders.

The BMO Premium Plan Chequing account costs $30 per month, but you can waive this monthly fee by maintaining a minimum balance of $6000.

BMO Performance Plan Chequing Account Alternatives

The RBC Signature No Limit Banking, Simplii No Fee Chequing, and EQ Bank Savings Plus Account are bank accounts you can consider as alternatives to the BMO Performance Plan.

Like BMO’s Performance Plan, each of these accounts offers unlimited debit transactions and Interac e-Transfers.

Apart from that, though, their features vary. So, use the table below to see the similarities and differences between these three alternative bank accounts.

| RBC Signature No Limit Banking | Simplii No Fee Chequing | EQ Bank Savings Plus Account | |

| Monthly Fee | $16.95 | Free | Free |

| Minimum Balance To Waive Fee | N/A | N/A | N/A |

| Overdraft Protection | Included | $4.97/month | Not Available |

| Non-bank ATM withdrawal Fee In Canada | $2 or $3 | $1.50 | Free |

| More details | Read Review | Read Review | Visit Website |

Simplii No-Fee Chequing Account

$400 cash bonus offer

No monthly account fees

Unlimited transactions & Interac e-Transfers

Free personalized cheques

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

FAQs

The minimum balance to waive the monthly fee of a BMO chequing account depends on the specific plan you choose. For the Performance Plan, the minimum balance is $4,000, while BMO Plus Chequing Account requires $3,000.

A Performance chequing account is a type of bank account offered by the Bank of Montreal (BMO). It offers unlimited transactions and up to a $40 rebate on the annual fees of eligible credit cards.

To change your BMO chequing plan, ask for assistance in a local BMO branch. Alternatively, you can call the bank’s customer support.

A chequing account is meant for everyday transactions, where your money comes in and out consistently. On the other hand, a savings account is best for setting money aside for longer periods, hence the name savings.

Related: