Africhange is a remittance app for sending money from Canada to Nigeria, Ghana, Kenya, Mexico, and the U.S.

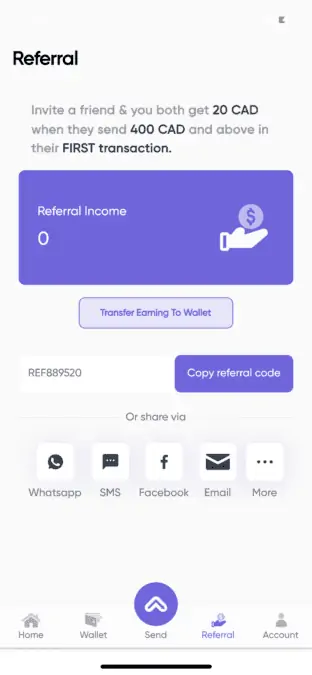

When sending your first money transfer of $400 or more, you can get a $20 bonus using this exclusive Africhange referral code: REF889520.

Read on to learn how Africhange and its referral program work.

Africhange $20 Promo Code

Africhange offers money transfer services from Canada to five countries.

When sending your first transfer of $400 or higher, you get a $20 bonus after applying a valid Africhange promo code, such as REF889520.

Visit Africhange here to get started.

How Does Africhange Work?

Africhange is similar to some other popular money transfer apps you can use in Canada, including Wise, MoneyGram, WorldRemit, Remitly, and Western Union.

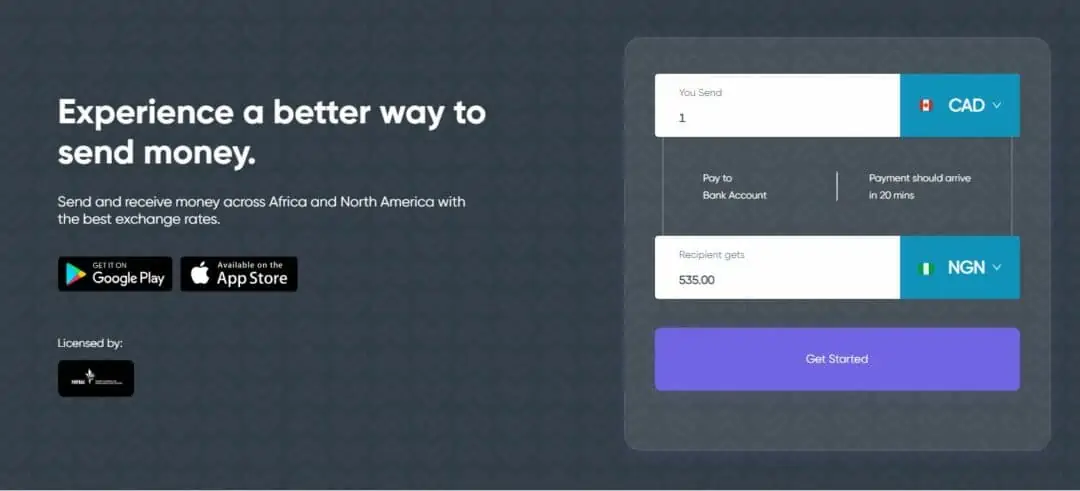

Where it differs is the exchange rate you get for the Nigerian currency, Naira (NGN).

Instead of the published exchange rate on Google, which does not accurately reflect the dynamics of a currency artificially pegged by the Central Bank, Africhange offers a more favourite rate.

For example, on December 27, 2022, the “mid-market exchange rate” for CAD to NGN was CAD1:NGN330.32.

The mid-market or Google/XE.com rate reflects the best exchange rate using official benchmarks.

Using a money transfer company like WorldRemit, you get a worse rate.

On the same date, the exchange rate offered by WorldRemit was CAD1:NGN205 (mobile top-up).

On the same day, Africhange was offering an exchange rate of CAD1:NGN535, a significant difference.

How To Sign Up With Africhange

Visit Africhange to sign up and use the referral code REF889520 (which may be applied automatically with the link) for a $20 bonus after your first eligible transfer.

Complete the verification process by uploading a government-issued photo ID, e,g, a driver’s license, and take a selfie.

Fund your Africhange wallet, add a beneficiary and their bank details. After that, review your transaction details and send the money within seconds.

It supports all the major banks in the countries you can send money.

Benefits of Africhange

The benefits of Africhange money transfer include:

- Fast money transfer within minutes.

- No hidden fees, as you know exactly how much your recipient will receive before completing the transfer.

- Best exchange rates for Canadian dollars to Nigerian Naira.

- Can compare rates and schedule transfers.

- Has a mobile app for iOS and Android devices.

- Registered with FINTRAC in Canada.

Downsides of Africhange

The company only supports five countries (Ghana, Kenya, Nigeria, Mexico, and the U.S.). If you are sending money to other countries, consider using Wise.

Is Africhange Legit?

Yes, Africhange Technologies Ltd is a legit company. It is based in Edmonton, Alberta, and was founded in 2020.

Africhange is registered with The Financial Technologies and Reports Analysis Centre of Canada (FINTRAC) as a Money Service Business (registration #M19773759). It is also licensed in Quebec by Revenu Quebec with license number 12705.