Key Takeaways

- WorldRemit supports several transfer options like cash pickup, bank transfer, mobile money, airtime top-up (mobile recharge), and cash home delivery.

- Most of these transfer options only take a few minutes.

- This platform supports 70 currencies and despite its markup fees (usually between 1% to 3%), WorldRemit offers competitive transfer rates compared to Western Union, Xoom, and MoneyGram.

WorldRemit is one of the cheapest and fastest options for sending money abroad to friends and family.

Sending small amounts of money through a bank wire to recipients in foreign countries quickly gets expensive when you consider the bank’s flat-rate wire transfer fees and unfavourable exchange rates.

By using a cheap money transfer service like WorldRemit or Wise, you not only save on fees, but your recipient gets the funds faster and almost instantly in some cases.

Wise (formerly TransferWise) used to be my go-to for transfers; however, after recently suspending its activities in Nigeria, I now use WorldRemit and others for money transfers to Nigeria.

This WorldRemit review covers how the platform works, its pros and cons, fees, exchange rates, alternatives, and whether it is safe.

WorldRemit vs. Wise

| WorldRemit | Wise | |

| Transfer fees ($1,000) | CA$2.99 | CA$8.58 |

| Markups ($1,000) | CA$25.75 | None |

| Instant Cash pickups | Yes | Unavailable |

| No of countries | 130+ | 50+ (excluding Nigeria, Cuba, Zimbabwe, etc) |

| App | Yes | Yes |

| Safe | Yes | Yes |

How Does WorldRemit Work?

Sending and receiving money through WorldRemit is straightforward.

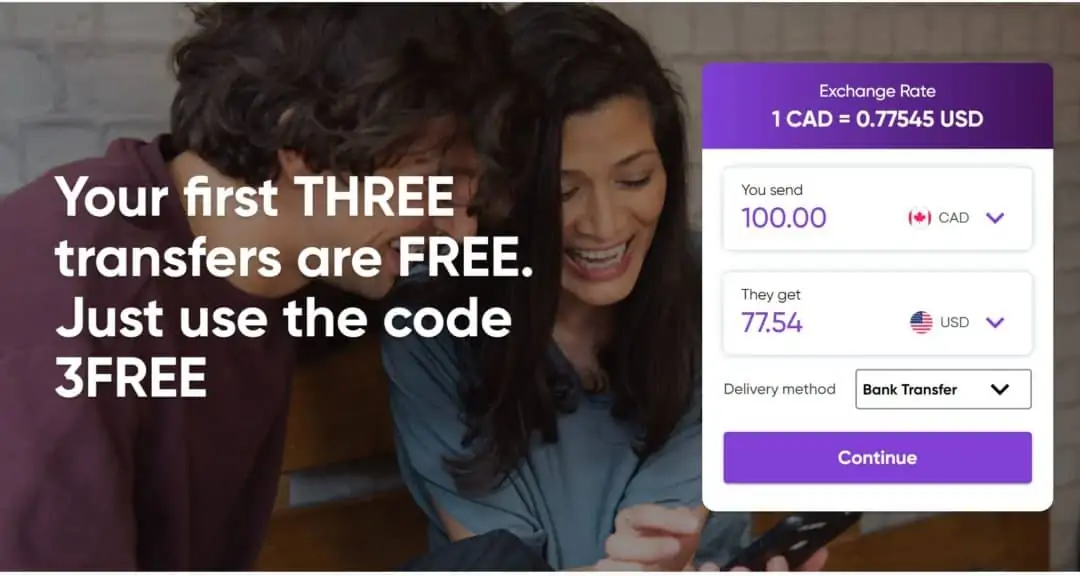

1. To start, create a free account and provide your email address (Use the promo code 3FREE along with the link to get a 100% discount on your first three transfers).

2. Select the country you are sending money to and how you want the funds to be delivered.

Delivery options vary by country and include:

- Cash Pickup: This option is almost instant, and your recipient can collect the funds within minutes from an agent’s location.

- Bank Transfer: Money is deposited directly into their bank account.

- Mobile Money: This is an electronic wallet service, and users can receive, transfer, or hold money using their smartphone.

- Airtime Topup: Also known as mobile recharge, you can add talk time or data to the recipient’s phone based on their network provider.

- Home Delivery: Cash can be delivered to the home of your recipient (only available in Vietnam)

For cash pickups, your recipient must present a valid government-issued photo ID that shows their full name and the transaction reference they received via SMS.

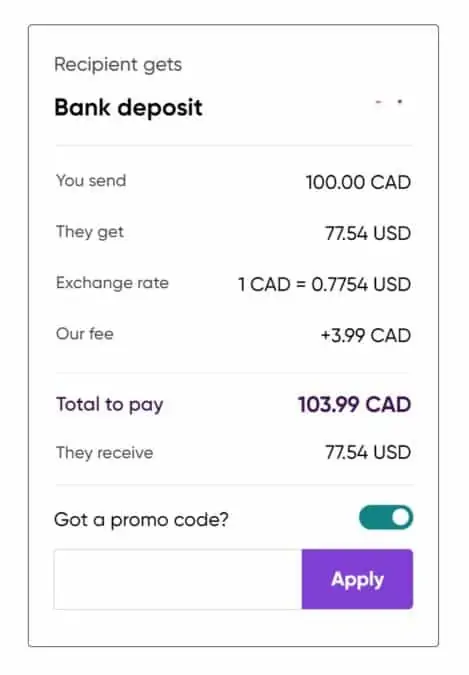

You can see the exchange rate at which funds are being converted. In this example, 1 CAD = 0.77545 USD.

Transfer fees are also shown. For my transfer, the fee is $3.99 CAD.

3. Provide your recipient’s details, including their name as shown on their valid ID, location, phone number, and email address.

4. Choose a payment method to fund your transfer. The options available vary by country:

- Debit card

- Credit card

- Interac

- Poli

- IDEAL

- Apple Pay

- Trustly

- Sofort

- Mobile Money

After funding your transfer, you can complete the transfer and let your recipient know to expect payment.

Related: Best Money Transfer Apps in Canada.

How Long Do WorldRemit Transfers Take?

The factors that impact your payment delivery time include the type of transfer, funding type used, time of day or week, and how the recipient receives the money.

Average delivery times based on the transfer type are:

- Bank Transfer: Within minutes

- Cash Pickup: Almost instantly

- Airtime Topup: Within minutes

- Mobile Money: Within minutes

- Home Delivery: 24 hours to 7 days

Transfers may take longer if further verification of your identity or that of the recipient is required.

IDs accepted for Canadians include a passport, driving license, or residence permit. If you need to verify your address, acceptable documents include a bank statement, utility bill, or your Notice of Assessment.

WorldRemit Exchange Rate and Fees

WorldRemit’s transfer fees are very competitive when compared to alternative digital payment platforms like MoneyGram, Western Union, Xoom, Remitly, and Ria Money Transfer.

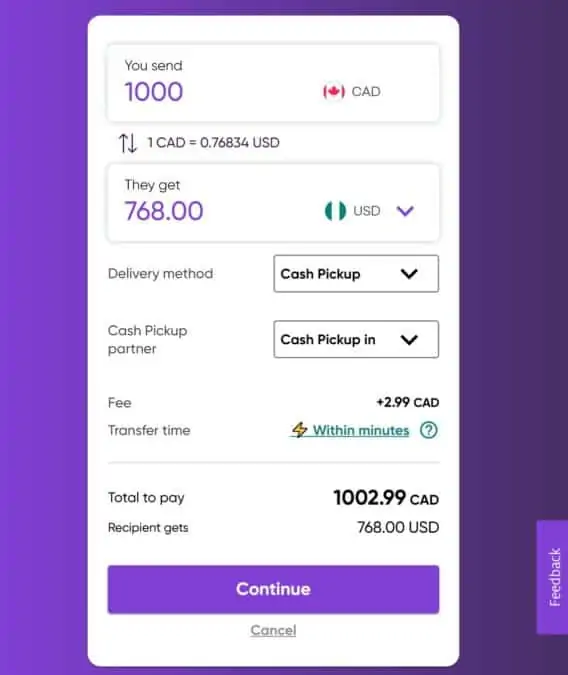

For example, the transfer fee for my $100 CAD transfer to Nigeria was $2.99 CAD. If I were to send $1,000 CAD, the transfer fee remains $2.99 CAD.

That said, WorldRemit also adds a markup to the exchange rate that can range between 1% and 3% or even higher.

The most competitive exchange rate is referred to as the “mid-market” or “interbank” rate. This is the rate that banks charge each other when they trade currencies between themselves.

You can find out what the mid-market rate for your currency pair is by searching on Google or visiting xe.com.

Most international money transfer companies make money by adding a margin or markup to the mid-market exchange rate and offering you a lower rate (less competitive rate).

This markup is an additional fee on top of the transfer fee.

A money transfer company that uses the mid-market rate when you transfer money abroad is Wise.

WorldRemit Money Transfer To Nigeria Fee Example

Using my example above, when transferring $1,000 CAD to Nigeria (recipient gets funds in USD), WorldRemit’s exchange rate was 1 CAD = 0.76834 USD.

When I checked the mid-market rate on Google, it was 1 CAD = 0.79 USD.

As you can see, the rate offered by WorldRemit had a markup of 2.74%, i.e. (0.79 – 0.76834 )/0.79 x 100%

This is equivalent to an additional $22 in transfer fees.

Currencies Supported by WorldRemit

While you can send money to more than 130 countries in Africa, Asia, Europe, Australia, New Zealand, North and South America, and the Middle East, transfers can be initiated from only 50 countries.

The countries you can send money from and their currencies are:

| Country/Currency | Country/Currency | Country/Currency | Country/Currency |

| Burkina Faso (XOF) | Oman (OMR) | Czech Republic (CZK) | Malta (EUR) |

| Ivory Coast (XOF) | Philippines (PHP) | Denmark (DKK) | Netherlands (EUR) |

| Rwanda (RWF) | Qatar (QAR) | Estonia (EUR) | Norway (NOK) |

| Senegal (XOF) | Saudi Arabia (SAR) | Finland (EUR) | Poland (PLN) |

| Somaliland (USD) | Singapore (SGD) | France (EUR) | Portugal (EUR) |

| South Africa (ZAR) | South Korea (KRW) | Germany (EUR) | Romania (RON) |

| Brazil (BRL) | Taiwan (TWD) | Gibraltar (GIP) | Slovakia (EUR) |

| Canada (CAD) | United Arab Emirates (AED) | Greece (EUR) | Slovenia (EUR) |

| United States (USD) | Guam (USD) | Hungary (HUF) | Spain (EUR) |

| Bahrain (BHD) | Australia (AUD) | Iceland (ISK) | Sweden (SEK) |

| Hong Kong, China (HKD) | New Zealand (NZD) | Ireland (EUR) | Switzerland (CHF) |

| Japan (JPY) | Austria (EUR) | Italy (EUR) | United Kingdom (GBP) |

| Jordan (JOD) | Belgium (EUR) | Latvia (EUR) | |

| Kuwait KWD) | Bulgaria (BGN) | Lithuania (EUR) | |

| Malaysia (MYR) | Cyprus (EUR) | Luxembourg (EUR) |

How To Contact WorldRemit

If you need to contact customer support at WorldRemit, you can do so by:

Live Chat: Contact their agents via the chatbox on your account.

Phone: Their customer service phone number in Canada is +1 833 596 0890 or +1 833 719 0499 (French)

For general inquiries about how the platform works, you can also check their FAQs to see whether your question has already been answered.

If you want to track your transfer, you can easily view it under the “Transfers in progress” section of your account.

Pros and Cons of WorldRemit

The things I like about WorldRemit:

- Has great coverage with a transfer service to 130+ countries.

- Offers a cash pickup option in many countries which means your recipient doesn’t need to have a bank account.

- Most transfers (90%) are completed within minutes.

- Multiple ways to fund your transfer (e.g. debit card, credit card, Interac, and more).

- Has a versatile mobile app with good reviews: Google Play (4.2/5 rating) and App Store (4.7/5 rating).

- Good customer service.

Some downsides of using WorldRemit are:

- It does not use the mid-market rate, which means your total fee outlay may be higher than you think due to markups.

- The maximum transfer amount per transaction for debit or credit cards is $4,000 CAD. There is also a maximum 24-hour limit of $40,000 CAD.

- You can’t hedge foreign currency transactions using FOREX risk management strategies like forward contracts or limit orders.

- Does not offer dedicated accounts for small businesses.

Related: How To Send Money From Canada to India.

Is WorldRemit Legit and Safe?

WorldRemit has been operating since 2010 and is registered with various financial authorities and regulators worldwide.

For example, it is registered as a Money Service Business with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)- with registration # M11556765.

Per the company, it uses strict verification processes to identify customers and has procedures in place to “prevent accounts from unauthorized login attempts and transfer fraud.”

On Trustpilot, WorldRemit has a 4/5 rating from over 48,000 reviews.

WorldRemit vs. Wise (Formerly TransferWise)

Wise uses the mid-market exchange rate when you send money abroad. This rate is more favourable than what WorldRemit offers and has no markups or margin added.

For transfer fees, Wise charges a variable fee that’s based on your payment type and a fixed fee.

Wise’s transfer fees appear to be higher than WorldRemit’s; however, after you calculate the currency exchange markup added by WorldRemit, you get a different picture.

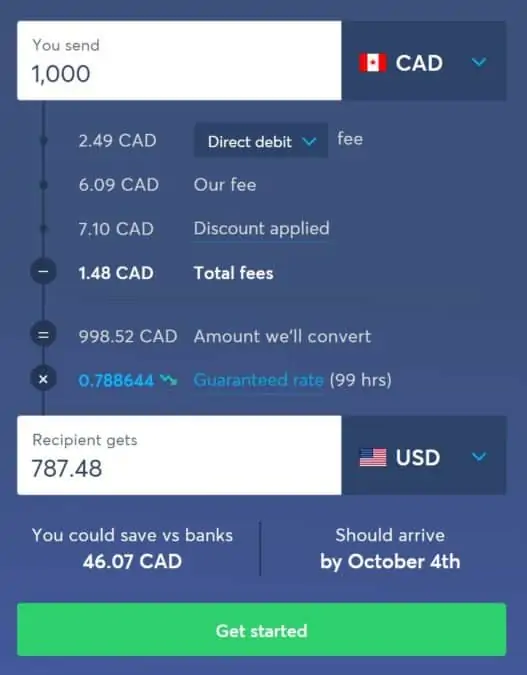

Using a $1,000 CAD transfer example, the exchange rates and fees by Wise and WorldRemit as of this writing were:

- WorldRemit: 1 CAD = 0.76834 USD (fee: $2.99 CAD)

- Wise: 1 CAD = 0.788604 USD (fee $8.58 CAD)

Compared to the mid-market rate used by Wise, WorldRemit had a 2.57% markup, equivalent to $20.30 USD.

After converting the $20.30 USD markup to CAD ($25.75 CAD), the total transfer fee through WorldRemit = $25.75 + $2.99 = $28.74

Conclusion = Wise is cheaper overall. It also guarantees your rate for 48 hours.

While Wise generally has a lower total transaction fee for transfers, it has some downsides you should be aware of, including:

- It does not offer cash pickups. Transfers are sent to the recipient’s bank account and may take longer.

- Wise is available in 50+ countries, while WorldRemit operates in 130+ countries. Your recipient may live in a country where Wise money transfer is not available, such as Nigeria.

Get more details in my detailed Wise Review, or send up to $800 CAD free with your first transfer.

WorldRemit Canada FAQs

When you sign up here and use the promo code 3FREE, your first three money transfers on the platform are free.

Canada is one of the 50 countries you can send money from using WorldRemit.

After ending your first transfer, you can copy your unique WorldRemit promo referral code and share it with friends. When they sign up and send $150 CAD or more using your code, you both receive a $30 CAD voucher you can use on your next money transfer.

Yes, WorldRemit is a registered Money Service Business under the category of transfer of funds with FINTRAC and The Autorité des marchés financiers.

You can send money through WorldRemit to over 130 countries, including India, Nigeria, Ghana, Kenya, Ethiopia, Morocco, the Philippines, and several others.

Yes, you can download the WorldRemit app on your Android or iPhone smartphone device.

WorldRemit transfer types depend on your location and include cash pickups, bank deposits, airtime top-ups, mobile wallets, and home delivery.

You can send up to $40,000 CAD using debit, credit, prepaid card, or Apple Pay within a $24 hour period. If paying by Interac, the maximum 24-hour send is $40,000 CAD.

Related: Best International Money Transfer Apps.