The Rogers World Elite Mastercard offers up to 3% cash back and ranks as one of the best cash back credit cards in Canada.

Competitive cash back rates on all purchases, zero-foreign transaction fees on US dollar purchases, and travel insurance are some benefits offered by this card.

This Rogers World Elite Mastercard review covers all you need to know if you consider adding it to your wallet.

Rogers World Elite Mastercard Summary

Rogers World Elite Mastercard

Best credit card for USD cash back

Annual fee: $0

Rewards: 3% unlimited cash back in U.S. dollars, 1.5% unlimited cashback on other purchases.

Welcome offer: $25 in cashback on the first purchase made within three months.

Interest rates: 19.99% for purchases, and 22.99% for cash advances

Minimum income requirement: $80,000 minimum income or $150,000 household income.

Recommended credit score:

Very Good

On Rogers’s website

Rogers World Elite Mastercard Benefits

1. No annual fee: For a card that offers up to 3% unlimited cash back and premium travel perks, it is remarkable that no annual fees apply.

2. Generous cash back Rewards: The cash back rewards for cardholders are:

- 3% unlimited cash back on eligible purchases in US dollars

- 1.50% unlimited cash back on all other purchases

3. $25 welcome bonus: You are eligible for $25 cash back rewards when you make a purchase within three months of receiving your card.

4. Travel insurance benefits including:

- Out-of-Province/Out-of-Country emergency medical coverage

- Trip cancellation

- Trip interruption and trip delay

- Rental car collision/damage insurance

5. Purchase protection and extended warranty.

6. Access to Mastercard Airport Experiences through Lounge key.

7. Access to Boingo Free Global Wi-Fi with over 1 million hotspots worldwide.

The cashback rate of 1.50% offered by the Rogers World Elite Mastercard on all general purchases is much better than the 0.5% to 1% available on most no-fee cards. An alternative card is the Tangerine Money-Back card, which offers unlimited 2% cash back on purchases in up to 3 categories.

The Tangerine World Mastercard is another excellent alternative. It offers a 2% regular cash back on up to 3 categories of spending, plus mobile device insurance, Mastercard Airport Experiences provided by Loungekey, rental car collision insurance, global Wi-Fi, and more. It also has no annual fees.

No fee, no foreign transaction fee cards like the Home Trust Preferred Visa are scarce in Canada.

While the Rogers World Elite Mastercard charges the general 2.5% foreign transaction fee, you get 3% in cash back on all your eligible spending in the U.S. This leaves you with 0.5% cash back in gains when you spend US dollars.

However, for other foreign currencies, many of the cards on our no-foreign currency transaction fee credit card list are way better.

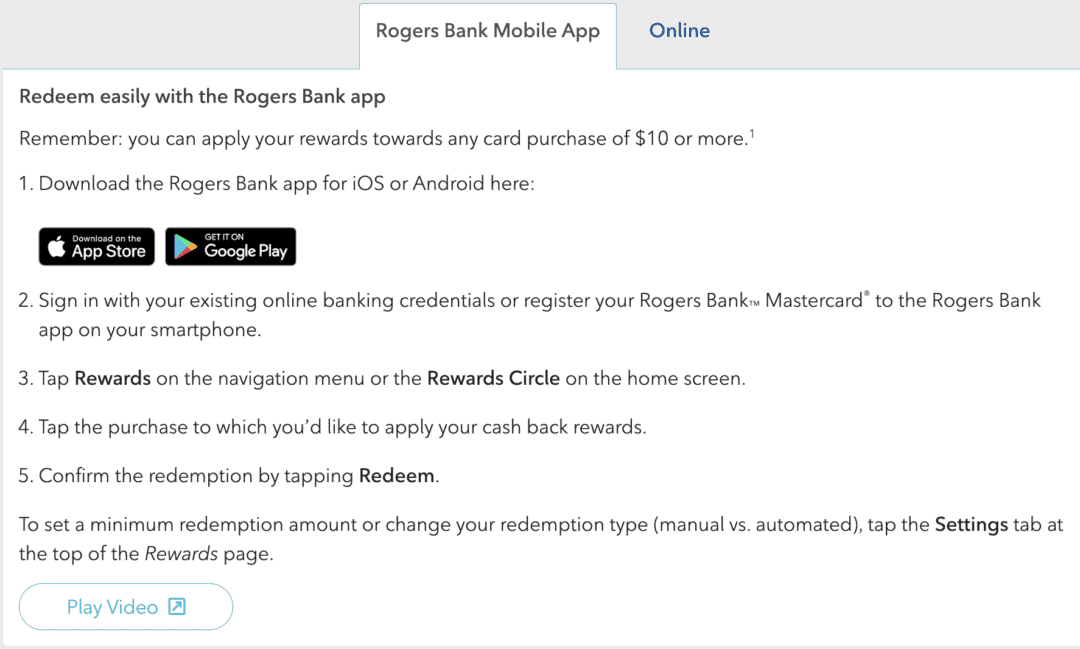

How To Redeem Your Rewards

There are many options to redeem cash back earned with this card.

1. Redeem cash back using the Rogers Bank mobile app (or online).

You can automatically (or manually) apply your cash back rewards toward any eligible purchases you have made using your cards. The minimum redemption amount is $10.

The Rogers Bank mobile app is available on the App Store and Google Play.

2. You can choose to wait till the end of the year and request that an annual statement credit be applied to your card balance. Give them a call to set this up at 1-855-775-2265. You can also use the online customer support service.

Downsides of the Rogers World Elite MasterCard

The main downside of the Rogers World Elite Mastercard is that it has a high-income requirement.

To apply for this card, you must have a personal income of $80,000 per year or $150,000 for household income. This income requirement puts the card outside the reach of many Canadians.

Also, you now have to spend at least $15,000 annually to remain eligible for this card.

No-fee cash back cards with a less stringent income requirement include the Tangerine Credit Card and SimplyCash Card from American Express.

Is The Rogers World Elite Mastercard For You?

If you do a lot of travelling to the U.S., the Rogers World Elite Mastercard can save you some money. While it charges the standard 2.5% foreign transaction fee, you get 3% cash back on US dollar purchases that pay the FX fees plus a gain of 0.5% in rewards.

After downgrading the card to offer cashback on only US dollar purchases, frequent travellers who need a no-FX credit card will have to look elsewhere.

The 1.50% cash back rewards on all other purchases remain competitive for a no-fee card.

The SimplyCash Card from American Express pays a nice 1.25% cash back on most purchases (+bonus cash back when you first join) and has no annual fees.

The insurance package that comes with this card is good for a no-fee credit card.

SimplyCash Card from American Express

Rewards: Earn 1.25% cash back on all purchases.

Welcome offer: 4% cash back in your first 6 months (valued at $200).

Interest rates: 19.99% on purchases and 21.99% on cash advances.

Annual fee: $0

As always, I am a proponent of maximizing rewards by combining compatible cards. For example, if you spend a lot on groceries, you could consider the Tangerine Money-Back card and earn up to an unlimited 2% cash back on purchases.

When combined, you can then use the Rogers World Elite Mastercard to earn a higher 1.50% rewards rate on all your other purchases.

Tangerine Money-Back Credit Card

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an extra 15% cash back on up to $1,000 in spending in the first 2 months ($100 value).

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

Related:

Rogers still advertises its rebates as 4% on all foreign purchases and 2% for Rogers products and 1.75% for all else. In fact as soon as I signed up, I received notice that the rebates are dropping to 3% for U.S. only – no other foreign purchases qualify. The other two rebates are reduced to 1.5%. Very misleading even as of today Mar 30 2020.

Redemption of cash back as a credit to the account can only be by calling into them, which is not convenient. they want you to download an app and then apply your rebate towards a purchase from the past 90 days. Not convenient.

My CURRENT (May 1, 2020) actual cash back rewards are:

USD transactions – .5% (3% minus 2.5% foreign currency fee!)

CAD transaction – 1.25 %

The 4% and 1.75% is OLD news!

@Barry: That is quite interesting given that their website still carries the 4% and 1.75% rates?

I do my M/C review and payment online. I have been a customer since 2016 but haven’t been able to get on to the website for a month. This is the third such incident in 18 months. There system wont send MFA to either of my emails and they dont have an SMS text option. No success with Help desk. Can’t collect cashback rewards. Can’t see my bills unless I revert to paper? Not cool.