One way to save money on gas while facing ever-increasing costs of living is to use a gas cash back app.

Although popular gas discount apps like Upside and TruNow are unavailable in Canada, there are apps that offer cash back rewards when you pay using a prepaid or credit card or upload a gas receipt.

You can also take advantage of the loyalty programs offered by some gas stations.

Best Gas Cash Back Apps for April 2024

- Neo Financial

- KOHO

- Tangerine

- GasBuddy

- Caddle

- Triangle Rewards

- PC Financial

- Checkout 51

- Gas Rewards Loyalty Programs

1. Neo Financial

The Neo Financial app can be used to manage its credit and prepaid cash back cards.

Both Neo Credit and the Neo Money card offer an average of 5% cash back on purchases at over 12,000 retail locations, and users get up to 15% cash back on their first purchases.

While the regular Neo Cards have no annual or monthly fees, you can upgrade to Premium for even more perks.

Pros

- Average of 5% cash back at over 12,000 retail locations.

- No monthly fees for regular Neo Credit or Neo Money card

- Earn 2.25% interest on your account balance.

- Enjoy Mastercard Zero Liability protection.

- Up to 15% cash back on your first purchases at participating stores.

Cons

- No insurance coverage for standard card

App Store rating: 4.8/5.

Offer: Get a $25 bonus when you are approved for Neo Credit or a $20 bonus when you get Neo Money and make your first purchase.

2. KOHO

KOHO is a free rewards app that pays 1% cash back on gas and other transportation expenses like train or bus tickets and rideshares.

It comes with a reloadable prepaid Mastercard, and you can add funds to it using e-Transfers or direct deposit.

To earn cash back on gas, simply pay for your gas purchase using the KOHO Prepaid Mastercard at any gas station.

Pros

- Earn 1% cashback on gas and grocery purchases. Also offers cashback on transit cards, bus tickets, and Uber.

- Earn up to 5% cash back at partner stores.

- Pays 3.00% interest on your account balance.

- Includes free e-Transfers.

You can upgrade this gas cashback app by subscribing to KOHO Essential or Extra ($4 to $9 monthly fee). These plans pay a higher cash back rate for some purchases and include several other perks.

Cons

- No insurance coverage

App Store rating: 4.8/5; Google Play rating: 4.6/5.

Offer: Get a $20 sign-up bonus when you open an account using our CASHBACK referral code and make your first purchase.

3. Tangerine

Tangerine Bank’s credit cards are excellent for earning cash back on gas.

Whether you opt for the entry-level Tangerine Money-Back Credit Card or the higher-tier Tangerine World Mastercard, there are no annual fees to worry about, and you earn up to 2% cash back on gas.

To get the most from this cash back gas app, choose gas as one of your two 2% money-back categories.

Pros

- Earn up to 2% cash back on gas, public transportation, and parking.

- No annual fees.

- Includes extended warranty and purchase protection.

- Easily add to your mobile wallet (Apple Pay, Google Pay, and Samsung Pay).

- Versatile mobile app to manage your banking products in one place (savings, chequing, credit cards, etc.).

Cons

- Interest fees apply if you don’t pay off your balance.

- The 2% cash back category is limited to 2-3 purchase categories.

App Store rating: 4.7/5; Google Play rating: 4.4/5.

New users get a $100 bonus on the first $1,000 they spend in the first 2 months.

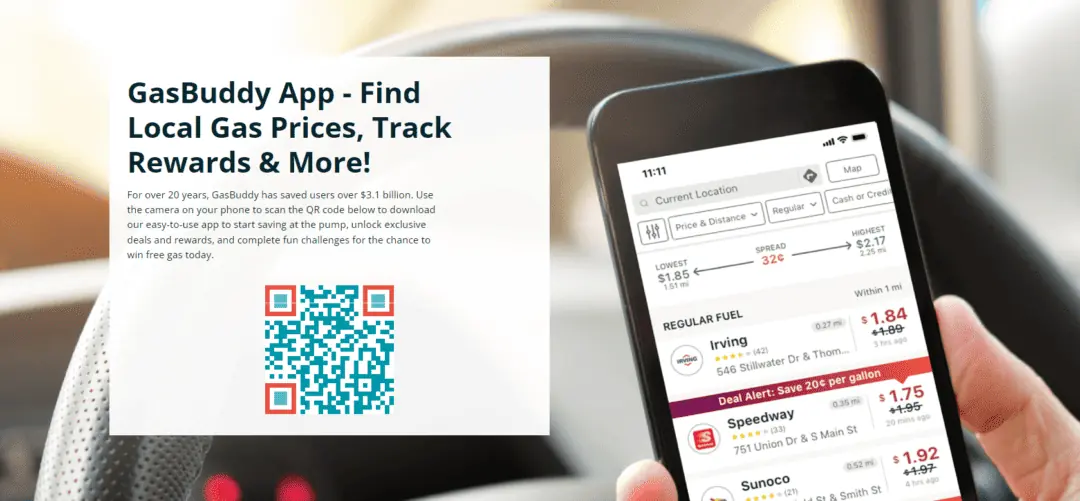

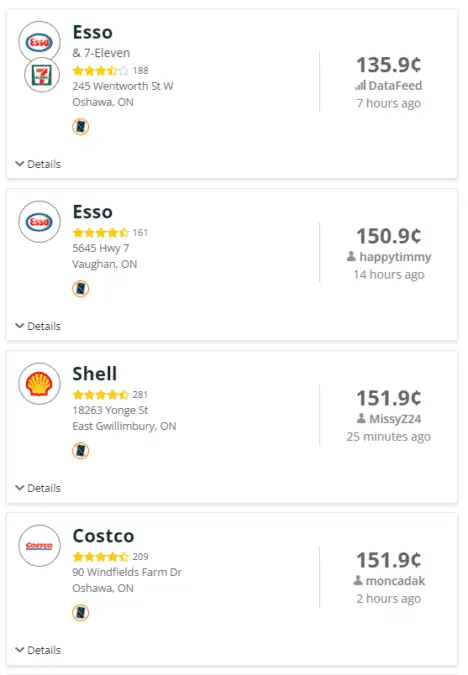

4. GasBuddy

Use the GasBuddy app to find cheaper gas in your area.

This gas-saving app shows the cheapest gas stations at locations in the US and Canada, with real-time gas prices for over 150,000 stations.

In the US, you can also pay using the GasBuddy payments card and get up to 25 cents off per gallon.

Pros

- Free to use.

- Prices are updated several times daily.

- Offers other tools to track gas prices over time.

- You can set up alerts in the app.

Cons

- GasBuddy payment card is not available in Canada.

- Prices may not be displayed for gas stations in smaller towns.

App Store rating: 4.7/5; Google Play: 4.1/5.

5. Caddle

Caddle is a grocery and gas cash back receipt app for Canadians.

If you buy your gas at Costco, this app often lets you upload your receipt to earn cash back.

Simply use your phone to snap a picture of the receipt and click on upload.

Pros

- Free app.

- Offers cash back and discounts on everyday purchases.

- Low payment threshold of $20.

Cons

- Cash back on gas is not always available.

- Hassle to keep and upload receipts.

App Store rating: 3.9/5.

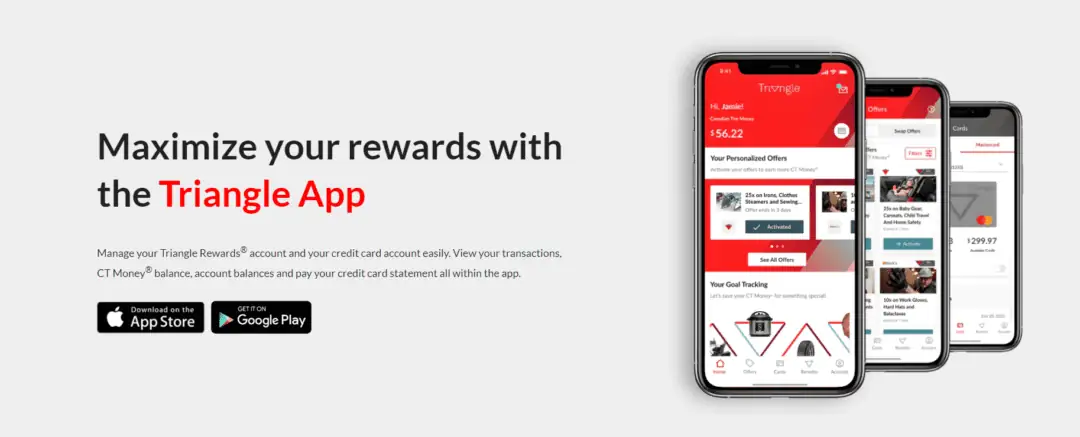

6. Triangle Rewards

Triangle Rewards is the Canadian Tire loyalty program that offers members rewards when they shop at participating stores, including:

- Canadian Tire

- Sportchek.

- Mark’s

- Party City, and others.

Triangle Rewards members collect 3 cents per litre of gas purchased at Gas+ and Essence+ locations in Canada.

Cash back earned is paid out in Canadian Tire (CT) Money, and $1 in CT Money can be redeemed for $1 in free stuff.

If you pay for gas using a Triangle credit card, your gas cash back increases to 5 cents to 7 cents per litre.

Triangle Rewards recently introduced a premium subscription program, Triangle Select, that offers even more discounts.

Pros

- Earn 3 cents per litre of gas purchased at Gas+ and Essence+ stations.

- Redeem CT Money for purchases at Canadian Tire, Atmosphere, Mark’s, Party City, Sports Expert, etc.

Cons

- Limited Gas+ and Essence+ gas stations.

- You can’t redeem CT Money outside of Canadian Tire and its affiliated stores.

App Store rating: 4.8/5; Google Play rating: 4.6/5.

7. PC Financial

For a free cash back gas app that also offers savings and discounts on groceries, consider the PC Financial app and its PC Optimum loyalty program.

Members earn PC Optimum points when they purchase fuel at Esso and Mobil stations across Canada. This is in addition to points earned on grocery purchases at the Real Canadian Superstore, Shoppers Drug Mart, No Frills, Independent, and Wholesale Club locations.

Every 10,000 points is worth $10, and you can redeem points for gas, car washes, and groceries.

You can register for PC Optimum online or at a participating store.

Pros

- Earn points when you buy gas at Esso and Mobil stations.

- Easily redeem points for gas, car washes, and free groceries.

- Earn at least 3 cents per litre (30 points/litre) when you pay with a PC Mastercard.

- Free to join.

Cons

- PC Optimum points can only be redeemed at Loblaw-owned stores.

- The minimum redemption amount is $10.

App Store rating: 4.7/5; Google Play rating: 4.4/5.

8. Checkout 51

Checkout51 is one of the free gas discount apps you can use in 2024.

Each week, the app adds new offers and discounts for groceries, and you may also spot participating gas stations.

After completing an offer by making a purchase, take a photo of your receipt and upload it to the app to earn cash back.

Pros

- Offers are renewed weekly.

- App is free to use.

Cons

- Purchase receipts must be uploaded within a timeframe which can be a hassle.

- The minimum payout threshold is $20.

Here’s a detailed review of Checkout51.

App Store rating: 4/5; Google Play rating: 4.2/5.

9. Gas Loyalty Programs

In addition to Triangle Rewards and PC Optimum, there are other gas rewards programs you can join to save on gas.

Shell: Get 1 Air Mile per 10 litre of Shell V-Power fuel, and 1 Air Mile per 20 litres of Shell regular and diesel fuel. You can double up on your gas rewards by using an eligible Air Miles credit card.

Petro-Canada: Save 3 cents per litre and earn 20% more Petro-Points when you buy gas at Petro-Canada using an eligible RBC credit or debit card. An example is the RBC Ion Visa.

Journie Rewards: Save up to 10 cents per litre when you use an eligible CIBC credit card with Journie Rewards, plus an extra 7 cents/litre every time you earn 300 Journie points.

Eligible CIBC credit cards include the CIBC Dividend Visa Infinite Card.

Other Ways To Save Money on Gas

Here are some additional ways to save on gas:

- Carpool with friends and co-workers.

- Keep your car tires inflated to the manufacturer’s recommended pressure.

- Buy a fuel-efficient vehicle or an electric car.

- Avoid rapid acceleration and abrupt breaking.

- Don’t pay for premium gas unless your vehicle needs it.

- Minimize idling and lighten the load you carry around in your trunk.

- Service and tune up your vehicle regularly.

Related: