Outlook Financial is an online bank in Canada offering some of the highest interest rates available on deposits.

Some of its close competitors in the digital banking space are Oaken Financial, EQ Bank, Achieva Financial, Hubert Financial, and Maxa Financial.

This Outlook Financial review covers their products and services and what you need to know about opening an account.

Who is Outlook Financial?

Outlook Financial is a division and the direct banking arm of the Assiniboine Credit Union.

Based in Manitoba, Outlook Financial offers savings and term deposit products to Canadians across the country.

Customers of Outlook Financial become members and part-owners of the Assiniboine Credit Union. They can vote for the Board of Directors and have a say in how the annual profits of the firm are distributed.

Also, customers can access thousands of “ding-free” ATMs across Canada.

Who is Assiniboine Credit Union?

Assiniboine Credit Union was founded in 1943. It is Manitoba’s second-largest credit union, with 139,000+ members and over $6 billion in assets under management.

Assiniboine Credit Union is featured alongside Steinbach Credit Union and Cambrian Credit Union in the top 20 largest credit unions in Canada.

Related: Best Online Banks in Canada

Outlook Financial Accounts

Outlook Financial offers savings and Guaranteed Investment Certificate products you can keep in non-registered or registered accounts.

High-Interest Savings Account

Outlook’s high-interest savings offer the ability to write cheques, make debit card payments, and pay bills online. You also get:

- No monthly account fees

- No minimum balance

- High-interest rate

- 1 free debit transaction ($1 after)

- 100% guaranteed protection

Their high-interest rate savings product is also available in a TFSA, RRSP, or RRIF account.

Read more about RRSPs and RRIFs.

Guaranteed Investment Certificate (GIC)

Term deposits can get you a higher interest rate when you don’t need funds for 1-5 years. You can keep a GIC inside a regular non-registered account or choose to use a TFSA, RRSP, or RRIF.

Some of the features of Outlook’s GICs are:

- No monthly account fees

- $1,000 minimum deposit

- 1-5 year terms

- High-interest rates

- Option to make an early withdrawal

A 1% interest discount applies when you withdraw GIC funds before the maturity date.

Related: EQ Bank: Best Online Bank in Canada?

How To Open an Outlook Financial Account

The primary way to manage your financial accounts with Outlook is through its online platform and the Outlook Financial Mobile App.

To become a member, you must:

- Be at least 18 years of age

- Provide a cheque drawn from a Canadian financial institution

- Purchase a one-time $5 equity share membership in Assiniboine Credit Union.

You can reach them by phone at 204-958-7333 (Winnipeg) or 1-877-958-7333 (outside Winnipeg) on Monday-Friday (8am to 8pm CST) and Saturdays (9am to 4pm CST).

Or by mail at Outlook Financial, Box 2, Station Main, Winnipeg, Winnipeg, MB R3C 2G1.

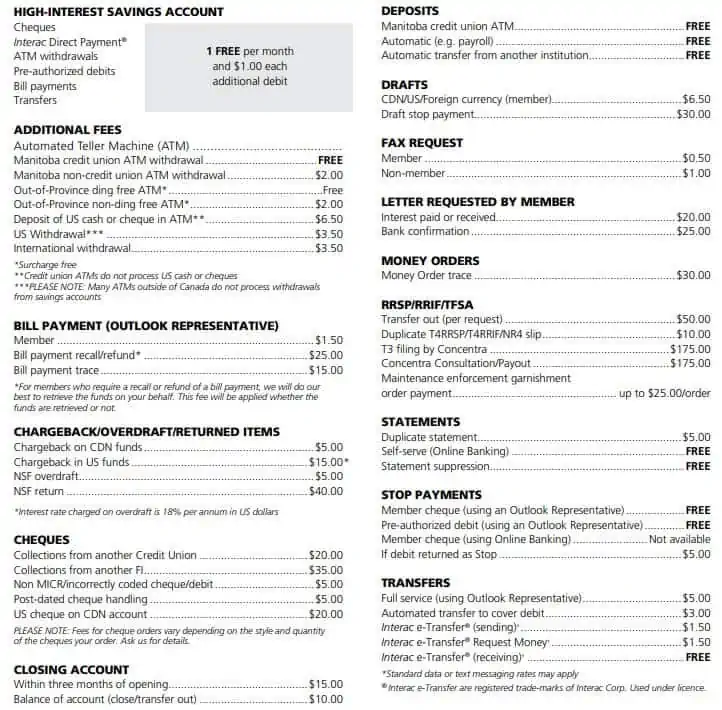

Outlook Financial Fees

While your accounts do not have a monthly maintenance fee, some services may apply.

Related: Top Savings Rates in Canada

Is Outlook Financial Safe?

Outlook Financial is a division of Assiniboine Credit Union which is a member of the Deposit Guarantee Corporation of Manitoba (DGCM).

This means that your deposits are guaranteed without limit (100%) should Outlook become insolvent.

Outlook Financial vs. EQ Bank

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

EQ Bank offers a high-interest savings account that’s one of the best in Canada. You can keep your deposits in a general savings account, TFSA, or RSP account.

The EQ Bank Savings Plus Account also provides chequing capabilities with unlimited free debit transactions, Interac e-Transfers, mobile cheque deposits, and more.

You can learn more about the EQ Bank Savings Account.

Conclusion

Online banks like EQ Bank, Outlook Financial, Simplii Financial, and Tangerine offer an opportunity to make your money work harder for you. They also have more favourable fees compared the traditional banks.

One downside of many digital banks is that they may have limited service options.

Related Reading

- Best Low Balance Transfer Credit Cards in Canada

- Tangerine 2% Cash Back No Fee Credit Card

- Best Apps To Save on Groceries

- 100 Best Money Lessons To Build Wealth

- Neo Financial Savings Account Review

Outlook Financial Review: Online Bank in Canada

Overall

Summary

Outlook Financial is an online bank in Canada offering a high interest savings rate. This Outlook Financial review covers what you need to know.

Pros

- Offers high interest rates on savings

- Competitive rates on GICs

- No monthly account fees

- Deposits are 100% guaranteed by the Deposit Guarantee Corporation of Manitoba

- Owned by an established credit union

Cons

- Only one free debit or Interac e-Transfer monthly

- Online-only financial institution

Outlook is the worst online bank I ever use. No response, no trust, such is a scan. My $10k transfer out from my TFSA at October 5, but till now on December, I still don’t see where is the money, I keep contacting them from early November, still don’t get answer, they never call me back like they promised, that is ridiculous….. How can I get my money back…