Update: HSBC no longer has chequing account offers or promotions. Here are some alternatives.

Newcomers to Canada can open bank accounts with HSBC and take advantage of the perks available through its Newcomers program.

In addition to the robust features offered by the bank’s Premier and Advance Chequing Accounts and a welcome bonus, new immigrants don’t pay monthly bank fees for up to 12 months when they meet the eligibility requirements.

Read on to learn about the HSBC Newcomers program and how it works.

HSBC Bank Canada Newcomers Program

The HSBC Newcomers Program is open to new permanent residents, work permit holders, and international students.

Depending on your banking needs, you could open one or a combination of accounts, including:

- Chequing accounts

- Savings accounts

- Credit card accounts

- Mortgage accounts

- Small business accounts

- Investment accounts and others

New immigrants need chequing accounts to conduct everyday transactions. Thinking about receiving your paycheck, paying bills, or sending money abroad? A chequing account is best suited for these transactions.

Two featured chequing accounts for newcomers at HSBC are the Premier Chequing and Advance Chequing accounts.

HSBC Premier Chequing Account

This is HSBC Canada’s most premium chequing account. Its top features include unlimited transactions, access to premium credit cards, priority customer support and a dedicated Premier Relationship Manager, and more.

Accountholders can easily access foreign currency savings accounts in multiple currencies and can open overseas accounts in other countries where HSBC operates.

The Premier Account has a $34.95 monthly fee; however, this fee is waived if you meet at least one of the following eligibility criteria:

- Maintain combined personal deposits and investments with HSBC Bank Canada and its subsidiaries that are valued at $100,000 or more.

- Have an HSBC residential mortgage with a starting value of $500,000 or higher.

- Receive monthly income deposits of at least $6,500 and have verifiable investment assets in Canada of $100,000 or higher.

- Are already Premier in another country where HSBC operates.

There are several other fee waivers available to newcomers (see the welcome offer section below).

Premier status benefits extend to your immediate family, including your spouse and children.

HSBC Advance Chequing Account

The HSBC Advance Chequing Account has a $25 monthly fee. However, this fee is waived if you:

- Have $5,000 or higher in your HSBC deposit or investment accounts, or

- Have a mortgage with HSBC with an original amount of $150,000 or higher

Features of the Advance account include unlimited day-to-day transactions (withdrawals, deposits, cheques, and Interac e-Transfers®).

Accountholders get 5 ATM convenience fee rebates each month when they use a non-HSBC Bank Canada or affiliated ATMs. Each rebate is capped at $2 per transaction.

HSBC Student Chequing Account

You can open a student account if you are enrolled as a full-time student at a Canadian post-secondary educational institution and are at least 17 years old. You must also be a resident of the country.

The HSBC Student chequing account has no monthly fees and includes unlimited transactions. You also won’t need to worry about minimum balance requirements as there are none.

Student accounts can be open for up to 5 years if you have proof of enrollment, with an extension for up to 2 years if eligible.

Two other personal chequing accounts at HSBC are the Performance Chequing (Unlimited and Limited packages).

Other HSBC Newcomer Accounts

For savings, new immigrants can open a High Rate Savings Account or Tax-Free Savings Account and enjoy competitive interest rates.

Foreign currency savings accounts are also available for U.S. dollars, British Pounds, Renminbi, Euros, and Hong Kong dollars.

For credit cards, new immigrants may be able to qualify for an HSBC Mastercard with up to a $25,000 credit limit with no credit history.

The bank also offers the HSBC Premier World Elite Mastercard to customers who meet its minimum income or investment threshold.

If you are looking to buy a home, HSBC has a New to Canada Mortgage program.

And for investments, you can access term deposits, Guaranteed Investment Certificates (GICs), mutual funds, and managed investment services. Self-directed investors can also trade various products using HSBC InvestDirect.

HSBC Newcomer Offers

You can take advantage of HSBC newcomer offers and get up to $1,650 in value as a new client.

The welcome bonus for a new chequing account is up to $500 as follows:

| Chequing Account | Premier | Advance | Student |

| Welcome offer | $300 | $300 | $50 |

| Digital account opening bonus | $100 | $100 | $100 |

| Premier bonus | $100* | N/A | N/A |

| Total cash back | $500 | $400 | $150 |

*The extra $100 Premier bonus is applied if you deposit $25,000 within 30 calendar days of opening your account and maintain it for 6 months.

To qualify for the Premier Chequing and Advance Chequing $300 welcome offer reward, you must complete two of four actions:

- Set up a recurring payroll deposit within 6 months of account opening

- Complete 2 pre-authorized debit transactions to different merchants within 3 months of registering

- Make 2 online bill payments to separate merchants within 3 months of opening your account

- Complete 2 outgoing Interac e-Transfers® to separate recipients within 3 months of opening your account

To qualify for the $50 newcomer offer for student chequing, you need a balance of $1,000 or higher within 30 calendar days of opening your account.

New clients can get up to an additional $1,168 in cash back and perks.

- The monthly fee for Premier and Advance accounts are waived for up to 12 months – valued at up to $419 in savings

- Get up to $649 in value when you qualify for an HSBC World Elite Mastercard. This includes up to $80,000 bonus points ($400 travel value), annual fee rebate for the first year ($149 value), and a $100 annual travel enhancement credit

- Get $50 after sending at least two FX wire transfers internationally in the first 6 months

- Get $50 when you open a safety deposit box in the first 6 months

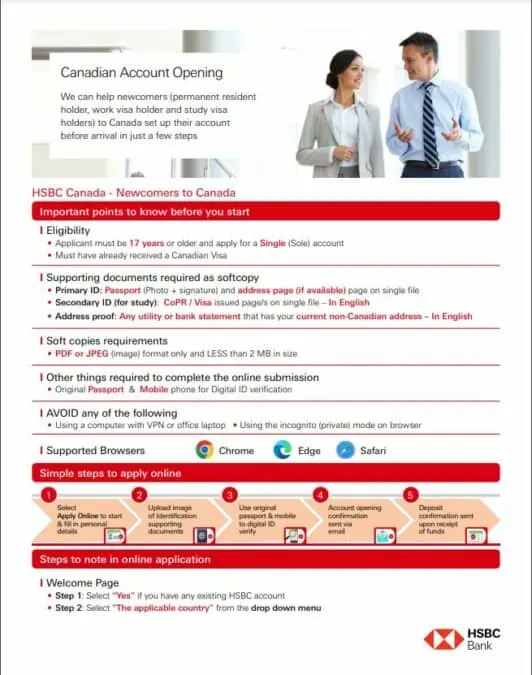

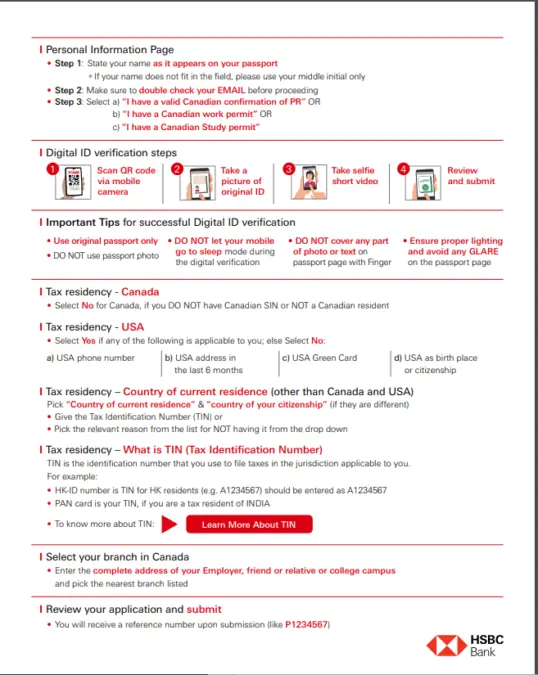

How To Open an HSBC Bank Canada Chequing Account

You can open an account online, by phone, or by visiting an HSBC branch.

This process can be started even before you arrive in Canada, and after landing, the New To Canada offers are applied to your account.

In general, newcomer applicants need to provide the following information:

- Email address, mobile phone number, and primary residential address(es) for the last 3 years

- Employment information and annual income

- Identification documents, such as a passport

- Proof of legal residency in Canada, e.g. Confirmation of Permanent Residence, Work permit, study permit, etc.

- Proof of address, such as a driver’s license

- Social Insurance Number (SIN) is applicable

A step-by-step flow chart diagram is provided below, showing how the process works.

Pros of HSBC Newcomer Accounts

Benefits of the HSBC Newcomer Program include:

- Access to an international bank that makes it easy to move your money between accounts in over 30 countries

- No monthly bank fees for up to 12 months

- Welcome bonuses, cash back, and savings valued at up to $1,650

- Full-fledged bank so you can keep all your financial accounts in one place

- Access to Mobile and Online banking

- 24/7 customer support in multiple languages

- Premier account comes with exclusive perks

- Access to thousands of free ATMs across Canada

Cons of HSBC Newcomer Accounts

Some constraints of this account are:

- Minimum investment, income, or mortgage qualification thresholds can be on the high side depending on your financial situation

- Monthly fees of $34.95 or $25 apply on Premier and Advance chequing accounts if you do not meet the eligibility requirements (after the 12-month offer period ends)

- Other service fees may apply depending on the transactions you conduct

HSBC Bank Canada Overview

HSBC is one of the largest financial institutions in the world. Founded in 1865, it had almost $2 trillion in assets as of 2021.

Its Canadian subsidiary, HSBC Bank Canada, was established in 1981 and has its headquarters in Vancouver.

In 2022, the bank won an award for the “Best International Onboarding Experience – Canada” in the Cosmopolitan The Daily Business Awards.

Alternative Newcomer Banking Programs in Canada

In addition to HSBC’s newcomer offer, some other Canadian banks also offer banking packages designed for newcomers.

These include offers from RBC, CIBC, TD, Scotiabank, and BMO.

Conclusion

The newcomer account packages and offers from HSBC are worth checking out.

With HSBC Advance Chequing, the $25 monthly fee continues to be waived after the first year if you maintain deposits or investments worth $5,000 or more. In the long run, these fee savings and the perks you enjoy can save you a lot of stress.

Even better, if you have the required income or asset base, the Premier Account provides even greater convenience and privileges with no monthly fee.

Account opening chart for newcomers

Related: