Looking to close your BMO bank account online, by phone, or in person? This article covers how to close your BMO account and the applicable closing fees.

BMO is one of the largest banks in the country, and it offers a complete banking package, including chequing, savings, loans, lines of credit, mortgages, investments, and business accounts.

You may be considering closing your current bank account for various reasons. If it is due to bank fees, there are now several options for no-fee chequing accounts these days.

Read on to learn about how to close your BMO account.

How To Close a BMO Bank Account

BMO does not allow customers to close their accounts online. To close your BMO account, you will need to:

- Visit a BMO branch and tell them you want to close your account, or

- Call their customer service at 1-877-225-5266 (or 1-877-CALL-BMO)

If you are closing your BMO credit card, call 1-800-263-2263, and for a line of credit, the number to call when closing your account is 1-800-363-9992.

For all account closures (chequing, savings, credit card, investments, or line of credit), you can get the job done by visiting a branch.

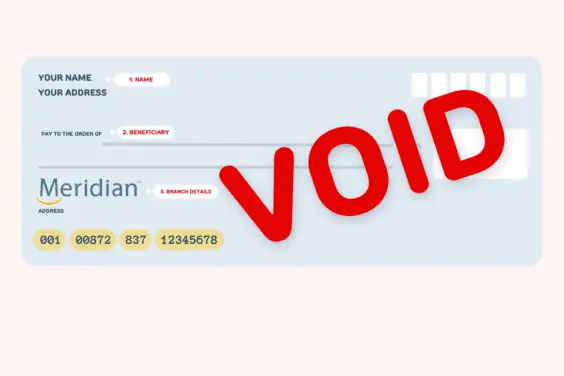

Withdraw your deposits before calling or visiting a branch to expedite the process.

BMO Account Closing Fees

It is free to close your account at BMO if the account has been opened for longer than 90 days.

For an account closed within 90 days of opening it, you incur a $20 fee.

If you want BMO to transfer your chequing or savings account balance to another financial institution, there’s a $20 fee.

If your account has been inactive for two years, it becomes inactive, and dormancy fees apply as follows:

| Dormancy period | Inactivity fee |

| 2-year notice | $20 |

| 5-year notice | $30 |

| 10-year transfer to the Bank of Canada | $40 |

If you acknowledge the 2- and 5-year notices within 60 days, the dormancy fees are waived. After 10 years of inactivity, your funds will be sent to the Bank of Canada.

Things To Do Before Closing Your BMO Bank Account

You should take these steps before closing your BMO account:

1. Open a New Bank Account

Open a new bank account that meets your needs at another financial institution.

You can also look at this list of the best banks in Canada to see what’s available for chequing and savings accounts.

For a no-fee self-directed account, check out the top commission-free brokerages in Canada.

For low-fee managed investment services, this robo-advisor review covers some of the best ones.

2. Update Recurring Payments and Banking Information

Review your bank transactions to find recurring payments that occur automatically and update your payment details for these services/bills.

If you have outstanding cheques from your old bank account that haven’t cleared, you should wait until they clear to avoid NSF fees.

Contact your employer to update your payroll direct deposit details.

If you receive government benefits like the OAS pension, Canada Pension Plan, Canada Child Benefit, GST/HST Credit, Ontario Trillium, etc., you should ensure your banking details are updated there as well.

3. Transfer Your Money

Move your money out of BMO into your new bank accounts.

You can choose to keep BMO credit cards, investments, lines of credit, and loan accounts open, as these are separate from your chequing or savings account.

4. Download Bank Statements

Download your bank statements so you have a record of your transactions in case you need to refer to them in the future.

5. Close Your BMO Account

Allow a few weeks to ensure that all pre-authorized payments have been updated before closing your bank account.

You can also proceed to destroy your old bank cards and chequebook.

How To Close a BMO InvestorLine Account

Before closing your BMO InvestorLine account, transfer your assets to another financial institution or withdraw them as cash.

To transfer registered accounts such as RRIF, RRSP, TFSA, or RESP, you may need to complete transfer forms before your accounts are transferred to another bank.

There are also transfer fees as follows:

- Full account transfer fee: $135

- Partial account transfer fee: $50

Contact a BMO InvestorLine representative toll-free at 1-888-776-6886 to close your account.

Close BMO Account FAQs

No, you are unable to close a BMO account online. To close your BMO account, you will need to call their phone number at 1-877-225-5266 or visit a BMO branch.

Call 1-877-225-5266 to close your BMO account by phone. A customer service representative will assist you after confirming your identity. For account closures via phone, you should have a zero balance or can transfer your balance to another BMO account.

Your credit score should not be impacted when you close your BMO savings or chequing accounts. If you close a BMO credit card, it could impact your credit score if it lowers your credit limit and/or shortens your credit history.

You may need to pay a $20 fee to transfer your BMO account to another financial institution.

Related: