Online-only banks like Tangerine and Simplii Financial offer a streamlined suite of banking services and financial products and have become increasingly popular due to a lack of the monthly account fees charged by traditional banks.

Choosing an online bank is easily a savings of over $200 per year on fees!

The accounts offered by the main digital banks are similar to what you get with big banks and include:

- Chequing account

- Savings account

- Investment accounts, e.g. TFSA, RRSP, RRIF, GICs

- Credit cards

- Mortgages

This Simplii vs Tangerine comparison covers what you need to know about their offerings to make an informed choice.

Tangerine Bank vs. Simplii Financial

I have banked with both Tangerine and Simplii, and this comparison/review is based on my personal experiences with them over the years and information that is publicly available on their websites.

While their offerings are similar, it is important to note why one may choose an online-only bank over their brick-and-mortar counterparts.

Chequing accounts offered by digital banks like Simplii Financial and Tangerine Bank have no fixed monthly fees – they are free! Not only that, but they also pay you interest on your chequing balance.

Their savings account is often referred to as ‘high-interest savings accounts’ because they offer a savings interest rate that is significantly higher than what the big banks offer.

You may also be able to obtain a more competitive mortgage rate with online banks.

Tangerine and Simplii are owned by much bigger banks – Scotiabank and CIBC, respectively. These digital banks can offer better deals than their parent banks because they have less overhead to account for.

Other popular online banks in Canada are EQ Bank and Motive Financial.

Tangerine Bank Overview

Tangerine Bank is a subsidiary of Scotiabank and was formerly known as ING Direct Canada. It was originally founded in 1997.

Ways to Bank

Tangerine is an online bank with a few cafes and pop-up locations in major cities across the country. You can conduct your day-to-day banking using their website or mobile app.

Customers have free access to over 3,000 ATMs that operate on the Scotiabank network, and if you need to talk to someone, they have customer service representatives who are available 24/7 via phone (1-888-826-4374).

Accounts

There is no shortage in the types of accounts offered by Tangerine. Their financial products include:

1. Savings Account: They have multiple savings accounts depending on your needs. Their high-interest savings account is the most popular as it offers one of the most competitive rates available in Canada. Currently, it earns a 0.70% rate.

There are no monthly fees and no minimum balance. This account also allows you to save money stress-free using their Automatic Savings Program. Other available savings accounts are:

- Tax-Free Savings Account

- RRSP Savings Account

- US$ Savings Account

- RIF Savings Account

If you are looking for one of Canada’s best savings rates, you should check out the EQ Bank Personal Account (currently up to 4.00%*) or Neo Financial HISA at 4.00%. Alternatively, you can take advantage of the short-term high savings rates offered by Simplii Financial or Tangerine.

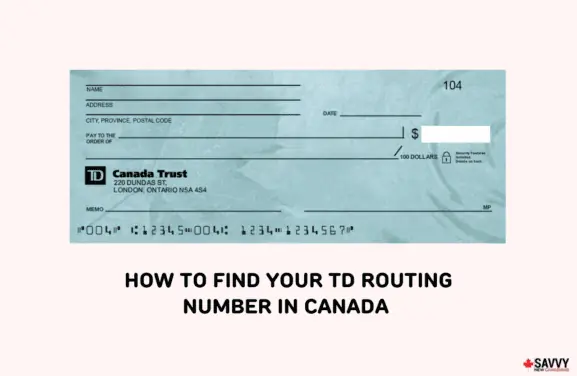

2. Chequing Account: Tired of paying monthly fees on your chequing? Tangerine’s No-Fee Daily Chequing Account does not have a monthly fee. Its features include:

- Zero monthly fees

- Unlimited free debits, bill payments, email money transfers, and pre-authorized payments

- Interest is paid on your account balance (up to 0.10%)

- Free access to 3,500 ATMs in Canada and 44,000 worldwide

- Free first chequebook (50 cheques)

- Mobile deposit deposits

3. Credit Card: The Tangerine Money-Back Credit Card is a no-fee card that rewards you with 2% cash back on up to 3 categories of spending ($100 bonus offer).

4. GICs: Tangerine offers high interest GIC rates, with terms from a few months to several years.

5. Investment Funds: They offer several low-fee index funds that can be used to design a TFSA, RRSP, RRIF, or other non-registered investment portfolio. Read my review of the Tangerine Investment Funds.

6. Mortgage, Home Equity Line of Credit (HELOC), and RRSP Loan.

Read our review of Tangerine Bank.

Simplii Financial Overview

Simplii Financial is a subsidiary of CIBC and was formerly referred to as PC Financial.

Ways to Bank

Like Tangerine, Simplii is an online bank. Customers can conduct their online banking through their website or by using the Simplii mobile app.

You also have free access to thousands of CIBC ATMs nationwide and can speak to a customer service representative 24/7 at 1-888-723-8881.

Accounts Offered

Similar to Tangerine, Simplii offers a host of financial products that meet the needs of an average bank client.

1. High-Interest Savings Account (HISA): The HISA at Simplii earns 0.40% to 5.5%, and they have the occasional promotional offer that pays a bonus rate for a limited time (e.g. 6.00% interest for 5 months).

There are no monthly fees, no minimum balance, and you can set up automatic deposits. They also offer RRSP and TFSA savings accounts.

2. Chequing Account: The Simplii No-Fee Chequing account has a lot of attractive features like:

- Up to $400 welcome bonus when you meet the eligibility requirements

- Zero monthly fees

- Unlimited free debit purchases, bill payments, Interac e-Transfers, and withdrawals

- Earn interest on your account balance up to 0.10%

- Free Interac e-Transfer

- Free access to over 3,400 ATMs in Canada

- Free cheques

3. Credit Card: The Simplii Financial Cash Back Visa card has no annual fees and is worth checking out if you need a cashback credit card.

4. Mortgages, personal loans and lines of credit

6. Investments: GICs and index mutual funds for both registered and non-registered investment accounts

Read our Simplii Financial review.

Simplii Financial vs. Tangerine Comparison

These two online banks are very similar in their product offerings. A few things to note:

A. Savings Interest: The basic non-promotional savings rates offered by Tangerine and Simplii on their HISA accounts are not as competitive as some other online banks. While promotional bonus offers may be available to new customers, they are short-lived.

Simplii Financial = Tangerine.

B. Chequing Interest: You can earn interest on your Tangerine and Simplii chequing balances. Both banks also offer sign-up bonuses when you open a new chequing account.

For example, you get a $400 bonus when you open a Simplii Chequing account and set up a direct deposit of at least $100 for three months or longer.

In addition, Simplii Financial offers unlimited free personalized cheques.

Winner: Simplii Financial.

C. Convenience: Tangerine is owned by Scotiabank and Simplii by CIBC. CIBC and Scotiabank have ATMs all over Canada, so finding a free ATM should not be a problem. They both offer 24/7 phone support.

Tangerine Bank = Simplii Financial.

D. Bonuses/Referral Program: Simplii has a referral program that pays you $50 for each referral (no limits). Tangerine also has a referral program where you earn up to $50 per referral for up to three yearly referrals.

Winner: Simplii Financial.

E. Are They Safe? Both banks are insured by Canada Deposit Insurance Corporation (CDIC), which means that your deposits are insured for up to $100,000 per account type.

Simplii Financial = Tangerine.

Related Reading:

- Top High-Interest Savings Account in Canada

- The Best GIC rates in Canada This Year

- How To Save on Investment Fees

- KOHO vs Tangerine

Simplii Financial vs Tangerine: Closing Thoughts

Both Tangerine and Simplii work if you want to pay lower banking fees. Even if you want to keep your current account or miss the face-to-face transactions they provide, you can still take advantage of the higher savings rates offered by digital banks.

A higher savings interest, interest earnings on chequing, and $0 monthly chequing fees all equate to more money in your pocket.

If you want to earn some of the best interest rates available on savings accounts (outside of promotional rates), check the EQ Bank Savings Plus Account or Neo HISA.

A great combo to take advantage of high non-promotional savings rates while getting access to a no-fee chequing account is to open both a Simplii Chequing Account and an EQ Bank Savings Account or Neo HISA.

You can also replace Simplii’s chequing with Tangerine’s.

Thanks for the great comparison Enoch! question: are both the Tangerine and Simplii debit cards usable abroad? Tangerine I believe uses the Scotiabank’s Global ATM Alliance (so can be found in multiple countries and free in those machines), but what about Simplii’s debit card?

I’m planning to travel to multiple countries, so the above is a consideration. Although I really plan to use my STACK Prepaid Mastercard to get cash out through the Cirrus network. The Simplii/Tangerine card would be the backup option. But because of using STACK, I have to also consider the Interact e-transfer fee (to fill up the card), because STACK no longer offers Visa Debit 🙁

@Pylin:

Good question. I was unable to find any reference to potential free ATMs outside of Canada when you use the Simplii debit card. From their FAQs;

“Can I withdraw money outside Canada?

Yes, you can withdraw money from most ATMs outside Canada displaying the Interac® or PLUS* signs. Additional costs may apply, including any fees from the owner of the other machine.

For foreign currency withdrawals, a converted Canadian dollar amount will be posted to your account based on the conversion rate CIBC pays on the date of conversion. The currency conversion may not happen on the date of your withdrawal. Administrative fees also apply. We can’t guarantee access to your Simplii Financial accounts through ATMs outside Canada for a few reasons:

– Some ATMs may not recognize accounts called “Other” and “Savings”

– Some ATMs may have withdrawal limits that prevent you from withdrawing the amount you request

– You may exceed the daily maximum on the account because of foreign exchange rates.”

To confirm for sure, you can probably give them a call at 1-888-236-6398.

I’m tired of paying $11.95/month (reduced rate) at TD and have been looking into alternatives. A few questions:

1) How can I withdraw US$ or EURO when I travel?

2) How long & how difficult is the process of transferring over my paycheque & bill payments to a new online account? Any tips?

3) My mortgage and LOC is with TD (currently). Do you think there would be any issues if I closed my TD chequing account?

4) Do you think TD would waive their fees to keep my custom?

5) and finally… I have 3 TFSA accounts with Tangerine (savings/investments) already so I doubt I would be entitled to receive a new account bonus. Is it better in this case to choose Simplii for the $200? Or maybe suggest to Tangerine to sweeten the deal to have me switch?

I’ve been reading you for awhile after coming across a post on Pinterest. Your website is now saved in my favourites! I learned a lot about TD e-series from you after reading about index funds in several library books. It was great advice & I changed over my MFs to eSeries (but with a lot of hassle). Thanks! 🙂

@Anita: A few answers:

1) Not sure. Simplii now has a foreign cash service, however, it appears you can only order within Canada.

2) Usually not that difficult. You may need to pay an account closure fee in some cases to your current bank.

3) There should be no problems with your mortgage. They will require you set up another means of payment for your mortgage payments.

4) I would say give it a shot…if you also have a mortgage with them, they may be willing to budge…just a little.

5) I would go with Tangerine so you can at least consolidate your accounts in one place…easier to manage.

Glad you found my posts on TD e-series useful.

Cheers!

Apparently Simplii does not charge for Interac e-transfers but Tangerine does. Surprised this isn’t mentioned.

Tangerine doesnt charge Etransfer fee anymore.

@Tushar: Thanks for bringing my attention to this!

Tangerine does NOT charge for etransfers so I have no idea what your talking about

Needs more comparison and info on their credit cards and perks or limitations that come with it the credit cards. E.g. Tangerine comes with the car insurance on the world car. That car insurance was previously only available on Scotiabank gold card, so it’s a pretty good perk.itol

Also, Simplii doesn’t offer any USD account. Tangerine does offer Savings USD. Not a full checking account and no longer withdrawals possible since Tangerine took down their last USD ATM machine.

Simplii also offers USD saving account now. Some other thoughts:

1. Tangerine does have a better mobile app with real-time transaction notification IMO.

2. It’s easier to setup bank-to-bank transfer in Tangerine (Simplii asks you to send a void cheque to setup)

3. Tangerine uses VISA debit so it can be used anywhere VISA is accepted. Simplii is restriced to interac network, and many online merchants do not accept interac payment.

One advantage of Simplii is it shares same SWIFT code with CIBC so you can receive international wire transfer. Tangerine does not have SWIFT so it’s not possible at all.

For the above reasons, I think it’s better to keep both Tangerine and Simplii 😃

@Johnny: Thanks for your insight…didn’t know that Tangerine does not have SWIFT.

Between Tangerine Chequing vs Simplii Chequing, which one is the best option for me and why?

International transfers to and fro between US,UK and Canada.

Better Savings and Investment Options

Better foreign exchange

Better line of Credit

Better Credit Card

Finally which one of them would be a better option for a future mortgage.

Between Tangerine Chequing vs Simplii Chequing and Neo financial which one is the best option and why?

International transfers to and fro between US,UK and Canada.

Bank Drafts

Better Savings,TFSA ,Retirement Saving and Overall Investment Options

Better foreign exchange

Better line of Credit

Better Credit Cards for Cashbacks

Finally which one of them would be a better option for a future mortgage.

@William: It will depend on which of these features you consider more important, as none of them fit the bill perfectly. Simplii is great for international money transfers and has a decent stack of investment options (GICs and mutual funds). Tangerine offers more investment products, but won’t be as useful for global money transfers. Both Simplii and Tangerine offer lines of credit with competitive rates. The Tangerine credit card is more versatile. Neo offers a higher interest rate on savings that’s non-promotional…

I have been a Simplii customer for many years. (PC days included) I can’t say enough good things about the no fee chequing account. The savings accounts used to be good, but in recent years with the rising interest rates, I’ve found other banks are offering equivalent, and sometimes even higher rates.

I decided to join Tangerine a couple of years ago, and have found many things are very good there as well.

Here is my list of pros and cons for both Simplii and Tangerine:

Simplii and Tangerine both are not offering “good” promotional interest rates for their existing customers lately.

They are both good for no fee accounts if you are comfortable with banking online for the savings you get.

They are both difficult to acquire “specialty items” such as bank drafts, or other things that work much better with an actual box bank/teller.

Cons with Simplii:

Simplii does NOT offer GICs for TFSAs for some very strange reason.

It is very difficult dealing with any Mutual Investments with Simplii, as they must ALL be done through their parent bank, CIBC. I had an extremely hard time withdrawing mutual funds from Simplii to invest in other ways. (GICs-with other banking institutions, OR even other Simplii accounts!) I spent WAY too many hours, talking to WAY too many people and it took WAY too long to resolve the issues. (months!)

Simplii does NOT provide maturity dates, nor interest rates for your specific GICs online ANYWHERE. (you must “manually” keep track of renewal dates, and interest info, although they have “attempted” to fix this with more timely renewal notices being sent ahead of time in the past year or so…still NOT as convenient as other banks, including Tangerine and “the Big Five”)

Electronic transfer of funds between banks (not e-transfers through one’s chequing account, as that seems to work well, and is free) appears to take longer than with other institutions.

Cons with Tangerine:

Only the first 50 cheques are printed free for a chequing account. (Simplii is unlimited…so far)

Electronic transfer of funds between banks is limited to $25,000 per business day ordinarily. (You ARE able to make arrangements for a higher amount to be transferred by phoning them ahead of time however.)

Pros with Tangerine:

All of the products Tangerine offers are handled by Scotiabank, so there is less hassle with mutual funds. (you can talk to the same person to handle everything.)

Everything online is MUCH more transparent than Simplii. (eg GIC maturity dates, interest earned are ALL available information)

I appreciate the ability to bank online. I’ve had MORE than my fair share of grief, dealing face to face with tellers at the big box banks, although in fairness, there are also many capable employees at these banks.

I have not always found “competent” agents when dealing with online banks if something cannot be resolved without speaking to a “live person” either. The wait time for the online banks can sometimes be horrendous.

All in all, I will maintain accounts with “box banks” for things they can provide much easier than online.

I will also continue taking advantage of the lower/nil fees offered by online banks and invest in the products they offer that are to my benefit. That’s what it’s all about!

Tangerine: Free first chequebook (50 cheques)? Ridiculous, when Simplii gives unlimited. However, who writes cheques anymore? I rarely do.

Simplii is paying out a disgraceful 0.01% interest on your chequing accounts while Tangerine is paying 0.5%? Nothing like taking customers for granted? And their “High” interest savings account rate is not much less of a joke at 0.4% when Tangerine is paying 1%! And, all this when the B of C has increased rates like crazy! You can fool some of the people some of the time but you cannot fool all the people all the time!

Neither of them have a callback system, customary for so many “world-class” organizations today – I guess they are not world-class! Who the hell wants to hold for an hour, or two, or has the time to? These two don’t seem to care about their customers’ valuable time. It is not their fault these guys are swamped.

I am a customer of both but also use TD so that I can get to a teller on those rare occasions when I do need one.

@Harry: Both Simplii and Tangerine pay up to 0.10% interest on your chequing. They could certainly both do better with the ‘regular’ rates they have for their high interest savings accounts.

It would be far more helpful if everything was tabulated in table form as at:

https://loanscanada.ca/banking/simplii-vs-tangerine/

This way, one can see everything at one glance instead of scrolling up and down.

Good point. We will keep that in mind.