Wealth One Bank of Canada is a Schedule I Bank that provides online banking services to Canadians and face-to-face banking through its retail branches in Ontario and British Columbia.

While the bank is open to all residents of Canada, its vision is to become a “preferred bank for the Chinese Community in Canada.”

Wealth One Bank of Canada is regulated by the Office of the Superintendent of Financial Institutions (OSFI). For this year, the bank made it to my list of the best savings accounts in Canada.

Wealth One Bank of Canada Accounts

Wealth One offers a variety of personal and business banking products and services, including:

Personal Accounts

1. WealthONE High-Interest Savings Account: This account offers:

- High-interest savings rate

- No monthly fees

- No minimum balance requirement

- Unlimited transactions, including ten free bill payment transactions per month

- Automatic savings program

- Eligibility for TFSAs and RRSPs

- Deposit insurance by CDIC

2. WealthONE Residential Mortgages: It offers both fixed and variable-rate mortgages.

- Competitive fixed rates (1-5 years) and variable rates (3-5 years)

- Up to 30 years of amortization

- Flexible payment plans, including penalty-free prepayment options

3. WealthONE GICs: The bank has a variety of GIC products with up to a 5-year fixed term.

- A minimum deposit of $1,000

- Eligible for TFSA and RRSP accounts

- Deposits are eligible for CDIC insurance

Related: EQ Bank – Is This The Best Savings Account in Canada?

Business Accounts

1. WealthONE High-Interest Business Savings Account:

- $1,000 minimum deposit

- Automatic savings plan

- Free transfers to linked external accounts and up to 10 online bill payments per month

2. WealthONE Commercial Mortgage: Starting at $500,000.

3. WealthONE Business GICs: 1-5 year non-redeemable GICs. Interest is paid annually or at maturity.

How To Open a WealthONE Bank of Canada Account

There are three ways to open a Wealth One account. You can fill out the online application here for personal accounts or mail them at [email protected] for business accounts.

Alternatively, you can open an account by calling them at 1-866-392-1088 or visiting one of their two locations in North York and Vancouver.

You will need to provide your basic personal info, social insurance number, and employment details. You must also be 19 years or older and a resident of Canada.

Related: The Best GIC Rates in Canada

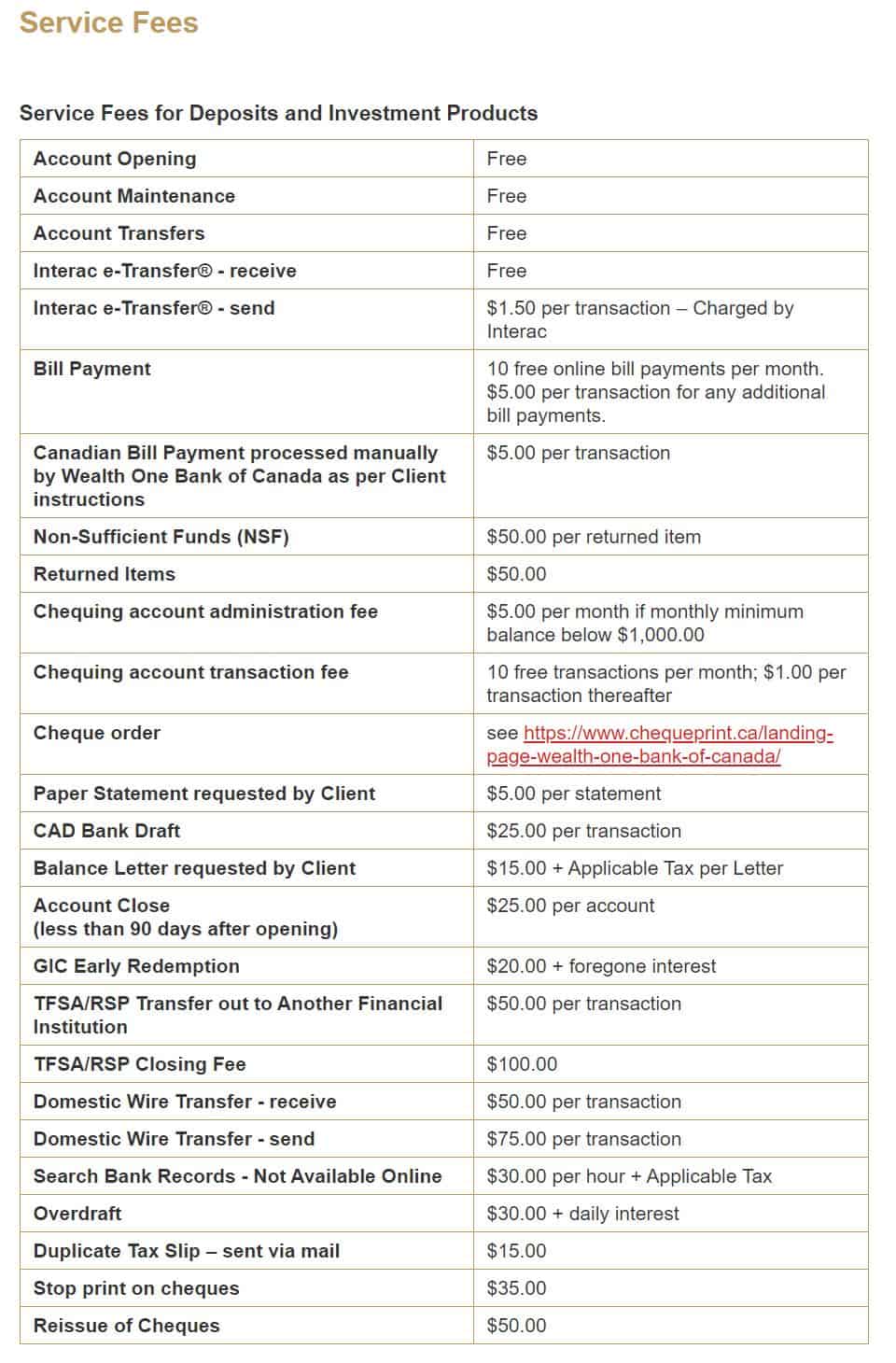

WealthONE Bank of Canada Fees

Here are some of the fees for its savings and investment products:

Is WealthONE Safe?

Wealth One Bank of Canada is a Canada Deposit Insurance Corporation member.

This means your deposit in savings accounts (including TFSA and RRSP) and GICs with terms of 5 years or less are protected up to $100,000.

It should be noted that FINTRAC recently fined Wealth One Bank of Canada for “administrative violations.”

High-Interest Savings Accounts in Canada

Online-only banks and credit unions currently offer the best savings rates available in Canada. If you are looking to put your money in an account that potentially beats inflation, you can also check:

- EQ Bank

- Simplii Financial

- Neo Financial

EQ Bank Personal Account

Up to 4.00%* interest rate

Unlimited debits and bill payments

Unlimited Interac e-Transfers

No monthly account fees

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

Simplii High-Interest Savings Account

6.00%* rate for 5 months

Unlimited debits and bill payments

Unlimited Interac e-Transfers

$400 cash bonus offer with a free chequing account

Is Wealth One Canada For You?

Digital banks have their pros and cons.

Savers like them for their high-interest savings rates and no-monthly-fee general banking. On the flip side, if you conduct transactions that are easier done face-to-face, having to call or navigate an online website for answers can be annoying.

Wealth One Bank of Canada has some branches in Ontario and Vancouver, which means those living in these places can go to a branch to get assistance.

Canadians of Chinese origin/background may find the bank particularly appealing given the focus they give to the Chinese Canadian community.

Some downsides to Wealth One are the lack of a credit card or more robust investment options. This makes it difficult to consider them a one-stop shop for all your banking needs.

Also, unlike the EQ Bank Savings Plus Account, which offers unlimited debit transactions and Interac e-Transfers, you only get ten free monthly debits with WealthONE.

That said, if you are looking for a savings account that pays much more than the big banks, Wealth One Bank of Canada is worth checking out.

Wealth One Bank of Canada Review

Overall

Summary

Wealth One Bank of Canada is a Schedule I bank that provides online banking services to Canadians and face-to-face banking through their retail branches in Ontario and British Columbia.

Pros

- High interest rates on savings

- High interest rates on GICs

- Easy online access

Cons

- Does not offer a credit card