Oaken Financial is an online bank in Canada offering a high-interest savings account and Guaranteed Investment Certificates (GICs).

Like its competitors (i.e. Tangerine, EQ Bank, Motive Financial, and Alterna Bank) on the digital-only banking front, Oaken has very limited physical locations where you can conduct face-to-face transactions.

Online banks flourish in Canada because they offer a better savings rate than the big banks, and their chequing accounts (when applicable) do not have a monthly fee.

The higher interest savings rate and lower bank fees are possible because digital banks save on overhead costs that come with maintaining physical branches.

This review of Oaken Financial covers their product offerings and what you can expect when you bank with them.

About Oaken Financial

Oaken Financial was launched in 2013 and is the direct banking arm of Home Bank, which is a subsidiary of Home Trust Company. Home Trust is Canada’s largest independent trust company and was founded in 1987.

As a digital bank, Oaken Financial is modelled to provide all its services principally online. However, they also operate a few offices in Vancouver, Calgary, Toronto, and Halifax.

You can reach their customer representatives by phone Monday – Friday between 8 am and 8 pm ET at 1-855-625-3622.

Related: EQ Bank: Best Savings Account in Canada?

Oaken Financial Accounts

Oaken Financial offers two main products – a savings account and GICs.

Oaken Savings Account

This high-interest savings account comes with the following features:

- Zero monthly fees

- High-interest rates

- Free unlimited transactions

- No minimum balance

Oaken Financial Guaranteed Investment Certificates

GICs are savings vehicles that guarantee your principal and the interest rate you earn over a specific timeframe. GIC options available at Oaken Financial include the following:

- Non-registered GICs – personal and commercial

- Registered GICs – TFSA, RRSP, and RRIF

The minimum deposit for GICs is $1,000.

If you are interested in purchasing a GIC, compare GIC rates across multiple online banks to find the best rates currently available in Canada.

How To Open an Oaken Financial Account

It is easy to open a new savings or GIC account at the bank. You can apply through their website, call them on phone, drop by one of their few offices, or complete the application form and mail it in.

Their mailing address is Oaken Financial, 145 King Street West, Suite 2500, Toronto, ON M5H 1J8.

New customers will need their Social Insurance Number, two pieces of ID, and one void cheque to set up a funds transfer. A personal cheque for $1 is required to confirm your identity when your application is completed online.

Oaken Financial does not have a dedicated mobile app; however, you can do online banking through their website using your smartphone, tablet, or computer.

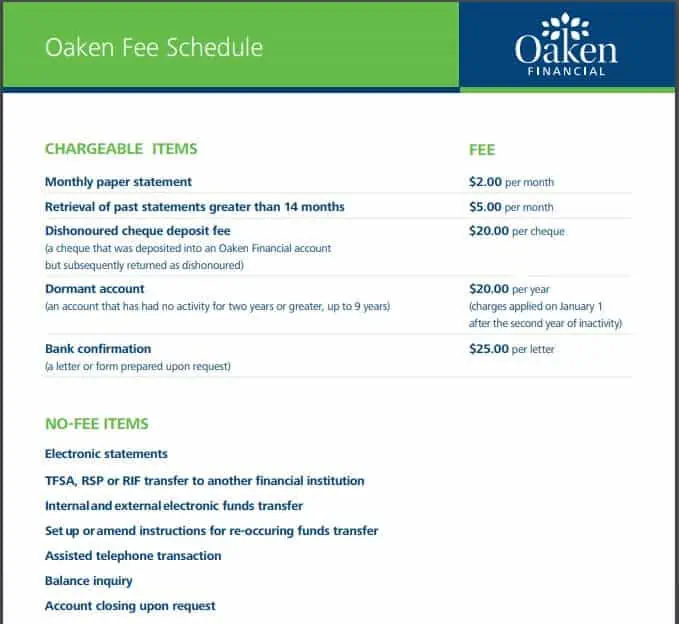

Oaken Financial Fees

While they do not charge monthly fees on your GIC or savings account, there are a few fees that may become applicable.

Is Oaken Financial Safe or CDIC Insured?

Your deposits at Oaken Financial are insured by Canada Deposit Insurance Corporation (CDIC) up to $100,000 per account category.

This is because your money is deposited with either Home Bank or Home Trust Company, both of which are members of CDIC.

On account opening, you are given the option to have your funds deposited with either Home Bank or Home Trust Company.

Related: The Best Children’s Savings Accounts in Canada

Oaken Financial vs. Tangerine vs. EQ Bank

Oaken Financial, EQ Bank, and Tangerine are all considered online-only banks in Canada. All three offer high-interest savings accounts and GICs. As of today, the interest rates they offer on savings are:

- Oaken Financial: 3.40%

- EQ Bank: 2.50%

- Maxa Financial: 2.95%

- Simplii Financial: 0.40% to 2% (5.25% promo rate for a limited time)

- Canadian Tire Bank: 3.00%

- Alterna Bank: 2.50%

- Wealthsimple Save: 1.50%

- Neo Financial: 2.25%

- Tangerine: 1.00%

The savings account at EQ Bank is a hybrid account that functions like a combination of chequing and savings, and you can also open a TFSA or RSP savings account.

Other competing banks that are either online-only or are credit unions include Simplii Financial, Motive Financial, People’s Trust, WealthOne Bank of Canada, AcceleRate Financial, and Outlook Financial.

Is Oaken Financial For You?

Digital banks can offer a higher interest rate on savings and a free chequing account because they have a lower running cost.

If you rarely need to enter a branch for your day-to-day banking transactions, an online bank like Oaken Financial may suit your needs.

One downside with Oaken is that it only offers a savings account, and the investment product is limited to GICs.

Related Posts

do you know if it’s available for quebec residents? EQ, Saven, Alterna aren’t..and those have probably the best % of the country

@isa: I could not find this information on their website. You may have to contact their support to confirm.

Applied one month ago over the phone and provided all needed info and ID/void check. Never heard from them again. The account still nit opened. Called them several times. No one seems to understand the reason for this delay. Considering cancelling my application. If it takes me so long to invest with them how long will it take me to withdraw my money from them?

I have been with Oaken for about a year and I find them easy to deal with. Their online service is generally fast and efficient and the customer service is very good unlike EQ bank which can be a bit hit and miss in terms of product and procedure knowledge. Getting set up for transfers, especially TFSA’s etc can be lengthy and frustrating but once it’s done you are basically set.

Strange, it was very easy for us to get/.open a GIC account.

Hi Enoch,

We are shopping for a one year non redeemable GIC. Would you recommend Oaken Financial? How easy is open a GIC account (joint)?

@Manish: I don’t have an account with Oaken. From using similar online banks, you may have to send them some documents by mail (usually the completed application form and void cheque), and things should go smoothly from there. Overall, I think they usually offer one of the best GIC rates.

WARNING. Any one with Oaken RRIFS.

Oaken has changed their method of paying the mandatory amount.

I have not had a payment on the new scheme.

Once they start taking money from one or more GICs it is very difficult to to know from your own calculations what the matured value is. But I can come close to it but am not confident to use my calculations to discuss the differences. My last one shows a shortage of $1300. <= but is flaky.

I would suggest that you keep records, say once a month of what the current value of your GIC is. Then track those figures and dates against the matured value on the letter that is mailed as what i found was there was growth every month but in the months before maturity minimal growth and negative growth and according to their numbers, I was absolutely shorted.

i’ve been with oaken for 3 years now and no problems. I HOOKED UP MY ACCOUNT WITH ONE FROM RBC IN MY HOME TOWN AND CAN TRANSFER MONEY USUALLY LESS THAN 2 DAYS BEFORE IT ARRIVES. THEY OFFER SOME OF THE BEST RATES IN THE COUNTRY. I DID MAIL MY APPLICATION IN BY MAIL WITH WHAT I NEEDED AFTER TALKING WITH THEM AND HAD NO PROBLEM. I’VE PHONED THEM ONCE AND WASN’T PUT ON HOLD FOR ANY LENGHT OF TIMR, SO FAR SO GOOD AND I AM HAPPY TO HAVE MOVED WITH THEM DO TO THEIR GREAT RATES.

I was about to join up but you need to send a cheque to make a money transfer. I haven’t used cheques in 20+ years!

@Lynda: Yes, that’s a downside for sure.

Tried to set up a GIC about a week ago, when I checked the summary section, there was nothing there. Checked pending section to find only a saved file, deleted it and started all over again. At the end, two GICs were set up. Called Oaken and was told it would take up to a max of 3 days to investigate, it’s more than a week now and not a single word from them. I find their program most difficult to use comparing to that of TD and Tangerine, some questions were difficult to understand and or confusing. The few more interest dollars don’t worth the stress at this stage of my life, so, I changed all my Oaken GICs with renewal to cash out. Unfortunately, it will take many months before cutting ties with Oaken completely.