Tim Hortons is introducing a more convenient way to enjoy its rewards program through the newly-released Tims Credit Card.

This no-annual-fee Mastercard is powered by Neo Financial and allows you to earn Tim Rewards Points on your eligible purchases within and outside Tim Horton restaurants.

In this article, you’ll learn everything important about the new Tim Hortons Mastercard, including its features, requirements, and application process.

Key Takeaways

- The Tim Hortons Credit Card is a no-annual-fee Mastercard that’ll let you earn Tims Points for every dollar spent on eligible purchases.

- For those who have limited or no credit score, a secured version of the Tims Credit Card will be offered.

- The Tims Credit Card will fully integrate with the Tim Hortons app, allowing you to conveniently check your transactions, balances and Tims rewards from your phone anytime.

What is the Tim Hortons Credit Card?

The Tim Hortons Credit Card is a no-annual-fee Mastercard powered by Neo Financial.

Developed and operated by Tims Financial, a newly established division of Tim Hortons, this product functions like any other credit card, allowing you to make regular purchases and build your credit score.

However, it sets itself apart by offering the added benefit of earning Tims Rewards Points on your everyday expenses. These Points can be redeemed for free coffee, beverages and food at Tim Hortons restaurants.

Note that there will be two different versions of Tim Hortons Mastercard. The primary version will be offered to those who already have a solid credit history. The secured version, on the other hand, will help students, newcomers, or those with limited credit history build their credit scores.

Secured credit cards are backed by cash deposits by cardholders, acting as collaterals in case they can’t make their payments on time.

The Tim Hortons Credit Card charges a minimum APR of 20.99% on purchases and a minimum APR of 22.99% on cash advance payments, depending on the user’s credit score. Those who get the secured version are more likely to get higher interest rates.

Tims Credit Card Features

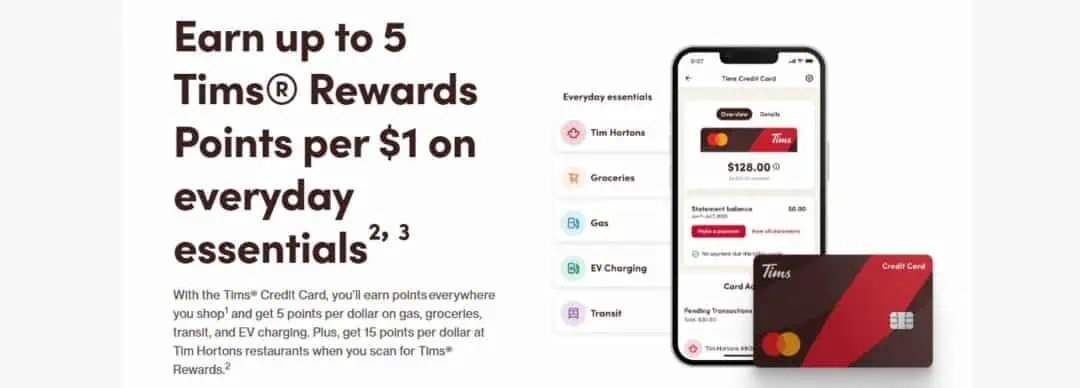

Earn Tims Rewards Points

Unlike the Tim Hortons app, the Tims Credit Card allows you to earn Tims Rewards Points wherever you shop. You’ll earn 15 Points per dollar at Tim Horton restaurants, 5 Points per dollar for eligible gas, groceries, and transit purchases and 1 point per $2 spent everywhere else.

No Minimum Credit Score

The Tim Hortons Credit Card application will be open to students, newcomers, and anyone who has no solid credit history yet, making it a great first credit card option for coffee lovers.

Digital Wallet Integration

Like many credit cards, this Mastercard can be loaded into digital wallets such as Apple Wallet, allowing you to pay for your purchases using your phone instead of a physical card.

Full Integration With The Tim Hortons App

Not only can you use the Tim Hortons app to apply and get approved for the Tims Credit Card, but you can also use it to check your Mastercard’s balance and Rewards Points conveniently.

Extended Warranty And Purchase Protection

The Tims Credit Card offers the benefit of doubling the manufacturer’s warranty of your purchased products and protecting them against loss, theft and damage.

How Does The Tims Credit Card Work?

The Tims Credit Card functions just like any other credit card. You can use it to make purchases, pay bills, and withdraw cash from ATMs that accept Mastercard.

Moreover, just like many credit cards that allow you to earn points or cash back for your eligible purchases, the Tims Credit Card also lets you earn Tims Rewards Points even on transactions made outside Tim Hortons restaurants.

Tims Credit Card Requirements

Requirements for this card are pretty simple. To apply, you must meet the following criteria:

- Be a Canadian citizen or a permanent resident

- Reach the age of majority in your province or territory of residence

- Be an existing member of the Tims Rewards program

You don’t need a specific credit score to qualify for this credit card. However, if you have limited or no credit history, you may be offered a secured version of the credit card instead, which requires an initial deposit.

How To Apply For The Tims Credit Card

The Tims Credit Card has not been released yet. However, you can now join the waitlist at Tims Financial’s official website to get a reminder when this Mastercard is available for the public.

Note, however, that to apply for the card, you must already be a Tims Rewards member.

That said, if you want a smooth Tims Credit Card application process in the coming months, I recommend creating an account in the Tim Hortons app before the card’s official release date.

How To Earn And Redeem Tims Points

Although the Tims Credit Card is not yet available, you can already earn Tims Points by joining Tim Horton’s loyalty program through its mobile app.

Through this application, you can earn 10 Points for every dollar you spend on eligible purchases at Tim Horton restaurants. Your accumulated Points can then be redeemed for your favourite Tims treats, including coffee, beverages and food.

How is the Tims Credit Card different from the existing Tim Hortons app?

Well, it definitely brings more opportunities to earn Tims Points at the table. After all, when using the card, you can earn Tims Rewards for your everyday, regular purchases, even outside the Tim Hortons restaurants.

Not to mention, you can also earn 15 Tims Points for every dollar you spend on eligible purchases at Tim Hortons, not just 10 Points.

Despite the expanded earning opportunities, the redemption process when using the Tims Credit Card is still similar to that of the app. The more Tims Points you accumulate, the more Tim Hortons treats you can enjoy for free using your Tim Hortons app.

Here’s a table that shows what food or drinks you can get using your accumulated points.

Tim Hortons Reward Levels

Here are the current reward levels:

| Number of Accumulated Points | Redeemable Food and Drinks |

| 300 | Classic Donuts, Hashbrowns, Specialty Donuts, and Cookies |

| 400 | Brewed Coffee, Tea, Bagels, Dream Donuts, and Baked Goods |

| 600 | Hot Chocolate, Iced Coffee, French Vanilla, and Wedges |

| 800 | Cold Brew, Real Fruit Quenchers, Classic Iced Capp, Box of 10 Timbits, Frozen Beverages, Yogurt and Espresso Drinks |

| 1100 | Breakfast Sandwiches and Soups |

| 1300 | BELT, Farmer’s Wrap, Lunch Sandwiches and Chili |

| 1800 | Loaded Bowls & Wraps |

Pros And Cons Of The Tims Credit Card

Pros:

- It has no annual fee.

- You can apply for this credit card even with limited or no credit history.

- You can earn Tims Points on your everyday purchases, not just at Tim Hortons restaurants.

- The credit card is fully integrated with the Tim Hortons app, making it easy to monitor your transactions, balances and Rewards Points.

Cons:

- The Annual Percentage Rate on purchases and cash advance transactions is not exactly low.

- If you have limited or no credit history, you can only apply for the secured version of the credit card, which requires you to make a cash deposit.

Is the Tims Credit Card Worth It?

Honestly, as a credit card, the Tims Mastercard does not have much to offer. Its interest rates are not particularly low, and its features can be arguably seen as limited compared to other credit cards in the market.

However, if you’re an avid customer of Tim Hortons, getting this credit card can be worth it. It’s completely free, and you can regularly enjoy free coffee and treats at Tims through the card’s Rewards Points.

I just don’t recommend using this Mastercard on big purchases, as low-interest cards would most likely allow you to save more money than the Points Tims offers.

Tims Credit Card Alternatives

For higher cash back rates on food and other purchases, consider these no-fee credit cards:

Tangerine Money-Back Credit Card

Get 0.50% to 2% cash back on purchases

Cash back is paid out every month

Has no annual credit card fees

Easy to qualify for

Neo Credit card

Rewards: Average of 5% cash back at 12,000+ partners and a guaranteed minimum of 0.50% cash back across all purchases

Welcome offer: Get up to 15% cash back on your first-time purchases, plus a $25 welcome cash bonus.

Interest rates: 19.99% – 29.99% on purchases; 22.99% – 31.99% for cash advances.

Annual fee: $0

KOHO Easy Prepaid Mastercard

$20 sign up bonus after first purchase (use CASHBACK promo code during sign-up)

Earn up to 5% unlimited cash back

3.00% savings interest on your entire balance

Free budgeting app

$0 monthly fee

FAQs

Currently, the Tim Hortons Credit Card is not yet available to the public. However, once it’s released, you can apply for it through the Tim Hortons mobile application.

Yes, the Tim Hortons Credit Card is free. However, if you have limited or no credit history, you may be offered the secured version, which requires you to make a cash deposit as collateral in case you miss your payments.

No, Tim Hortons currently has no debit card. Its new division, Tim Financials, only provides the Tims Credit Card as part of its financial services.

Yes, using the Tims Rewards app, you can get a free drink or breakfast on the day of your birthday from Tim Hortons. It’s one of the many stores that offer birthday freebies in Canada.