The PC Financial Mastercard credit cards are excellent for earning PC Optimum points and free groceries if you regularly shop at Loblaw-owned or affiliated stores like the Real Canadian Superstore, Shoppers Drug Mart, No Frills, Zehrs, Valu-Mart, and Esso.

With rewards earning rates as high as 4.5% when you shop using your PC Financial World Elite Mastercard, the President’s Choice Financial Mastercard credit cards are great options if you are looking to apply for a no-fee cash back credit card in Canada.

This review covers the features, benefits, and eligibility requirements for the PC Financial Mastercard, PC Financial World Mastercard, and PC Financial World Elite Mastercard.

For more information on how PC Optimum points work and how to maximize your rewards, read my post here.

PC Financial Mastercard

The President’s Choice Financial Mastercard is the entry-level card in their series of cards and has the following specifications:

- Annual Fee: $0

- Income eligibility: None

- Purchase APR: 20.97%

- Cash Advance APR: 22.97%

1. Earn 25 PC Optimum points per $1 spent at Shoppers Drug Mart (2.5% rewards rate).

2. Earn 30 points per litre of gas purchased at Esso/Mobil stations.

3. Earn 20 points (2%) per $1 spent at PC Travel.

4. Earn 10 points (1%) per $1 spent everywhere else, including on groceries at Loblaw stores.

5. Free purchase security and extended warranty.

6. Free additional cards for family members (up to 4).

The PC Optimum points above include the points you earn as a regular PC Optimum member.

You can redeem your PC Optimum points starting from 10,000 points (equivalent to $10) for free groceries or products at any of the participating stores or online at Joe Fresh, Beauty Boutique, and PC Express.

PC Optimum rewards example using the base PC Financial Mastercard:

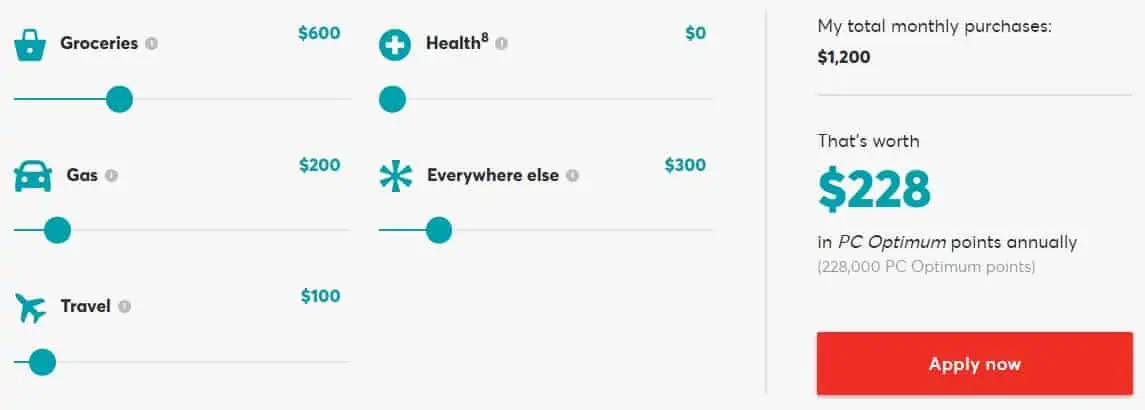

Assuming you spend $1,200 monthly using your card ($600 for groceries, $200 for gas, $100 for travel, and $300 for everything else), you will earn at least up to $156 in free groceries per year.

PC Financial World Mastercard

The President’s Choice Financial World Mastercard is a step up from their basic Mastercard offering and has the following specs:

- Annual fee: $0

- Income eligibility: $60,000 per year minimum personal income or $100,000 household income

- Cash advance APR: 22.97%

- Purchase APR: 20.97%

1. Earn 35 PC Optimum points per $1 spent at Shoppers Drug Mart (3.5% rewards rate).

2. Earn 30 points per litre of gas at Esso/Mobil stations.

3. Earn 20 points per $1 spent at PC Travel Services.

4. Earn 20 points per $1 spent in Loblaw grocery stores.

5. Earn 10 points per $1 on all other purchases.

6. 24/7 concierge services provided by Assurant Services Canada.

7. Free purchase protection and extended warranty.

8. Free additional cards – up to 4.

If you already have a PC Financial Mastercard, you can upgrade to the ‘World’ version without needing to meet the income requirements if you spend at least $15,000 using your card per year.

Assuming the same monthly spending I used earlier, you earn at least up to $228 in free groceries per year using the PC Financial World Mastercard.

PC Financial World Elite Mastercard

The President’s Choice Financial World Elite Mastercard is their top-of-the-line credit card. It is noteworthy as a ‘World Elite Mastercard’ with no annual fees.

- Annual fee: $0

- Income eligibility: $80,000 per year minimum personal income or $150,000 household income

- Purchase APR: 20.97%

- Cash advance APR: 22.97%

1. Earn 45 PC Optimum points per $1 spent at Shoppers Drug Mart (4.5% rewards rate).

2. Earn 30 points per $1 spent at Loblaws grocery stores (3% rewards rate).

3. Earn 30 points per litre of gas purchased at Esso/Mobil stations.

4. Earn 30 points per $1 spent on travel through PC Travel.

5. Earn 10 points per $1 spent on all other purchases.

6. Travel emergency medical insurance for trips up to 10 days if you are under age 65.

7. Car rental collision/loss damage waiver insurance for up to 31 consecutive days and an MSRP of $65,000.

8. Identity theft assistance and 24/7 concierge service.

9. Free purchase protection and extended warranty.

If you currently have either the PC Financial Mastercard or PC Financial World Mastercard, you can apply for the World Elite if you meet the income requirement and/or spend a minimum of $25,000 annually using your card.

Again, assuming the same monthly spending of $1,200 as above for the two other cards, you can easily earn $312 in free groceries using your PC Financial World Elite Mastercard.

PC Optimum App

PC Financial has a mobile app that makes it easy to manage your credit card, view your transactions, and check your PC Optimum points all in one place. The PC Financial app is available on iOS and Android, and it supports Google and Apple Pay.

In addition to the app, you can easily access your account online through their website.

Are the PC Financial Mastercards For You?

I personally use the PC Financial World Elite Mastercard and have averaged more than $500 per year in free groceries over the last 3 years.

The PC Optimum points calculations I showed earlier do not consider all the other opportunities to increase your rewards, e.g. through their weekly offers, bonus points events, and more.

If you are a PC Optimum member and purchase grocery or household items from Superstore, Loblaws, Independent, NoFrills, Fortinos, and Shoppers Drug Mart, the PC Financial Mastercards are excellent for increasing the value of free groceries you can score.

Other no-annual-fee cards that are worth considering if you are looking for no-fee cash back credit cards in Canada are:

Tangerine Money-Back Credit Card

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value); 1.95% balance transfer rate for 6 months.

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

Neo Credit card

Rewards: Average of 5% cash back at 12,000+ partners and a guaranteed minimum of 0.50% cash back across all purchases

Welcome offer: Get up to 15% cash back on your first-time purchases, plus a $25 welcome cash bonus.

Interest rates: 19.99% – 29.99% on purchases; 22.99% – 31.99% for cash advances.

Annual fee: $0

Let us know what you think about the line of PC Financial Mastercard credit cards in the comments.

PC Financial Mastercard Reviews

Overall

Summary

A review of the PC Financial Mastercard, PC Financial World Mastercard, and the PC Financial World Elite Mastercard. This review of the three PC Financial Mastercards covers their benefits and how to optimize free PC Optimum Points when you shop at Superstore, Shoppers Drug Mart, and wherever President’s Choice products are sold.

My reply to this is, I have a PC Mastercard that I consistently use to shop at Superstore. The question is, is it even worth the points you get? Well, no it isn’t! The interest you pay on the card negates the amount you get back. It’s a money grab. They suck you in saying that you will make all these points! And true you make points. However, as I previously stated, the interest on the card is higher than what the points are worth.

@Jackie: You don’t pay interest on the card if you don’t carry a balance beyond the 21-day grace period. All credit cards charge interest fees if you carry a rolling balance and, yes, that interest fee is likely more expensive than any points or rewards you earn.

I am a long time customer and have recently experienced the worst customer service from PC Financial. Locked card, declined transactions, long wait times for customer service. I would not recommend their cards.

The absolute worst customer service I have ever experienced. Rude service, ridiculous wait times. Restricts many online purchases. I have other cards. This one is going in the shredder today…

@Rob Kellar,

Yup. No more to say other than quote you.

The absolute worst customer service I have ever experienced. Rude service, ridiculous wait times. Restricts many online purchases.

I’m curious if Mastercard reviews its card providers and the service that they provide.

You will get your call connected hours later to be told that they are transferring you to a higher escalated department. They make certain to state that it will not be long at all, and even if you try to interrupt them, or halt the next action.. it is useless.. The first agent puts you into a new que, and its another hour or more wait. It is criminal the way that we are treated!

Horrid and shabby customer service. Do not even bother calling 1 866 246 7262, it will take you nowhere. You will just waste many hours of your life that you cannot get back. Not worth the grocery points. After many years of using this card I just decided to close my account after receiving horrendous customer service from them.

I have had this card with them for over 7 years. I may have been late to pay maybe a hand full of times. My credit limit was $2900. I’ve been using it and making payment monthly. I made a payment of $2600 towards my card after selling my camper. Went to use my card at the dentist and was declined. Checked my balance and my limit was dropped to $1000. This is their response. “We make every effort to ensure that your President’s Choice Financial® Mastercard® meets your needs. Due to your recent account history, we have decided that a lower credit limit would better suit your requirements at this time. Your credit limit has been lowered, effective immediately.” First off, as a loyal paying customer, how in fn hell is the drop in limit meet my needs… no way in hell it does. AND HOW WOULD A DROP IN CREDIT LIMIT BETTER SUIT MY NEEDS. WHEN I NEEDED THEM THE MOST, I WASN’T ABLE TO PAY MY $1600 DENTAL SURGERY. I had to empty what little savings I had after taking my kid to sick kids hospital. DONT WAIST YOUR TIME ON THIS CARD… THEY ARE A JOKE OF A COMPANIE. I will be avoiding every company that offers PC Optimum point. GO…YOURSELVES PC.

The most frustrating customer service I have ever had to deal with. I have probably spent 8 hours in total trying to get a hold of somebody, and majority of the time I’m just hung up on while being transferred. I’ve been told on numerous occasions that I would receive a call within 24 to 48 hours from supervisor, and 5 days later I got a call which I happen to miss. So I called back in minutes after and said “I just missed a call from management, Can you please transfer me. I was told I would get a call back within three to five business days.

On top of this I have provided two different instances of fraud on my card, they have decided to ignore it because I had given the merchant my credit card number for a transaction previously.

I would advise anyone else who is thinking of getting a PC financial Mastercard to go with somebody else, this is by far the most frustrating credit card interaction I’ve ever had.

I am cancelling my card as soon as I use my PC grocery points.

Lastly Stephen – D638AS, was not helpful at all. I asked him to explain what he just read off the paper because it was unclear what he was referring to and he just re-read the same line numerous times as pretty rude about it. It seemed as if he was only able to read a script. While I tried to explain a few things going on with the case he kept interrupting me, and I don’t mean once or twice, majority of the conversation was him trying to talk over me.

Hopefully they recorded the call for “quality assurance”