An excellent online tax software like H&R Block can make your tax filing easier and less expensive.

This H&R Block review guide looks at what you can do using the service, the pros and cons, and whether it is a suitable option for filing your taxes in Canada this year.

What is H&R Block?

H&R Block has decades of experience helping people prepare their taxes.

You may be familiar with H&R Block as a place to physically deliver your tax forms and meet with a tax advisor. But you can also use their online tax software to file your return from home.

It offers many features and services, which we’ll look at in more detail in the next section.

H&R Block Products and Pricing

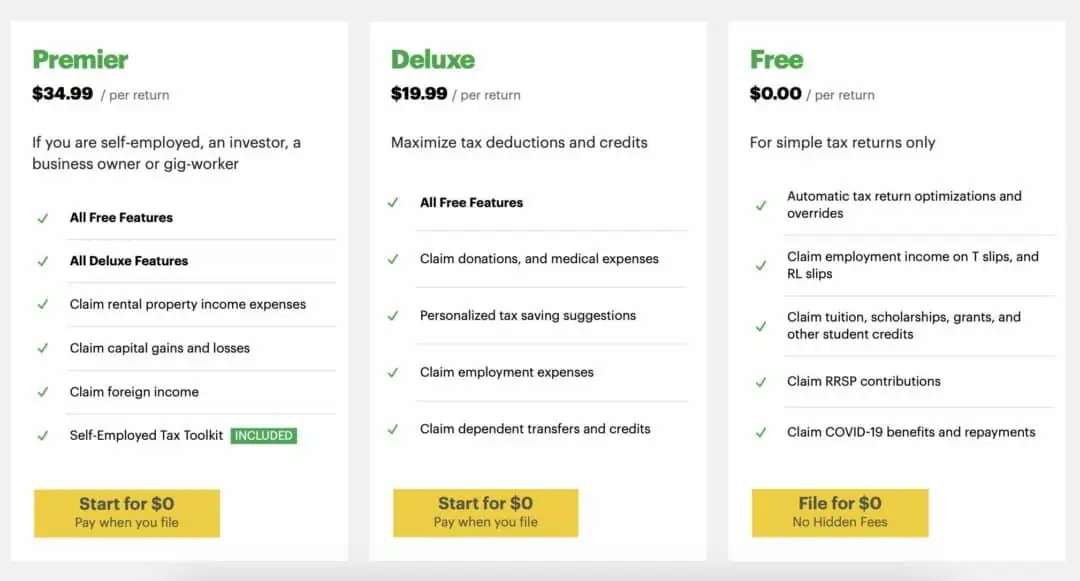

If you want to file your tax return online, there are three plans to choose from: Free, Assistance and Protection.

Free Plan

The Free plan is suitable for most people but is limited to basic tax returns. It covers unemployment income, interest and dividend income, student loan interest deductions, child tax credits, and more.

It connects with NETFILE, the online filing system of the CRA, so there is no need to export documents anywhere.

The software guides you through the screens and provides pointers on how to fill out each section. You can also import PDFs from your previous returns.

Deluxe Plan

The Deluxe plan costs $19.99 per return and contains everything in the Free plan and some extras.

These include donations, medical expenses, personalized suggestions, employment expenses, and dependent transfers and credits.

Premier Plan

The Premier plan costs $34.99 per return and contains everything offered in the other two plans, plus some more advanced features.

These include rental property income expenses, claim capital gains and losses, and foreign income. The Self-Employed Tax Toolkit is also included in this plan.

Add-Ons

You can also choose several add-ons to your plan for an additional cost. One is Audit Protection, where tax experts will provide personalized assistance and help with paperwork should you be audited.

The Free Second Look is another option. You can take up to three years of tax returns into an office, and a Tax Expert will review them for missed credits or deductions. This might have led to you paying more, reducing your refund. They then file adjustments with the CRA to get back any money.

The Online Estate Plan is another additional service you can order online or purchase in an office. You will get help completing your will, power of attorney and more. The individual cost is $59.95, and the cost for a couple is $89.95.

Which Plan Should I Choose?

It depends on your needs and your current situation. However, the Free Plan is suitable for most people unless you need something more comprehensive.

Look at what is covered in the plans above and decide which meets your requirements. However, if you do not have much experience with tax returns and are not comfortable doing it yourself, you could visit an office in person instead.

Related: CloudTax Review.

Ways to File Taxes With H&R Block

There are several options for filing taxes with H&R Block:

Online

This is the do-it-yourself option that you can do from home. When you sign up for one of the above plans, the software will walk you through the process, but you can get additional help if needed. Choose one of the plans above to get started.

In-Person

The in-person option is where you can visit your nearest H&R Block office to get help filing your tax return. You can book an appointment over the phone or online, or just visit without an appointment and talk directly with a Tax Expert.

Drop-Off

Another easy option is to visit your nearest office and drop off all your documents with a Tax Expert during office hours. You can follow a tax checklist to ensure you have everything, and there is no need to make an appointment.

The Tax Expert will then get in touch for an interview and to review your tax return.

Upload Remotely

This is similar to the Drop-Off service, but you can do everything from home instead. You can upload documents securely and communicate with your Tax Expert online or over the phone, and they will then prepare and file your return.

H&R Block vs TurboTax

H&R Block is not the only tax filing service in Canada. There are several you can choose from, and TurboTax is one of the most popular.

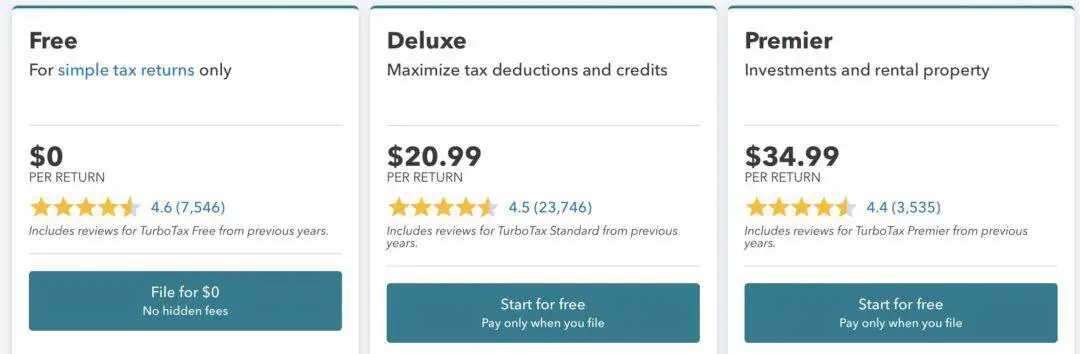

With TurboTax, you can file your taxes online yourself, and it offers three plans: Free, Deluxe ($20.99 per return) and Premier ($34.99 per return). These are almost the same prices offered by H&R Block.

Alternatively, you can opt for a Full Service.

With this service, a tax expert does everything for you. The Basic service is $69.99 per return, Deluxe costs $99.99 and includes optimization of your return, and Premier costs $149.99 for more complex tax returns.

There’s also a Self-Employed plan, which costs from $49.99 to $249.99 per return.

One big difference is that, with TurboTax, all communication is online or in person. H&R Block, on the other hand, gives you the option of meeting in person or dropping off your documents at your nearest office.

Get a 15% discount at TurboTax.

Related: You can learn more about TurboTax in this definitive guide.

Benefits of H&R Block

H&R Block provides several excellent benefits when you choose to use this service to file your tax return in Canada:

- It’s an affordable service, offering free returns and paid services starting at $19.99 per return, which is very reasonable.

- It allows you to meet with a Tax Expert in person.

- Filing a return is quick and straightforward, and it walks you through all the steps.

- H&R Block provides good security and uses data encryption to store your data securely.

- You only pay when you file your return online, so you can start the process for free.

- It offers a free return for people 25 and under, but you have to pay extra for add-ons and extra features.

- It has decades of experience, so you can trust that they know what they are doing.

- The website is easy to use and navigate.

- H&R Block is NETFILE certified, so you can easily import your tax information and file your return with the CRA directly.

- The Maximum Refund Guarantee means if you get a larger refund using another service, it will reimburse the license fee or purchase price.

Downsides of H&R Block

- The Free Plan is a bit limited and does not cover things like donations and medical expenses.

Is H&R Block for You?

H&R Block is a good option for filing your tax returns in Canada.

If you only have a basic tax return, the free service may be fine, and you get the advantage of knowing that you are using an experienced company with an excellent reputation.

There are many reasons to recommend using it. You may prefer to use a competing service like TurboTax, but this comes down to personal preference more than anything.

The step-by-step guidance is clear and makes the whole process simple. But if you think you might need some additional help and want access to an experienced tax expert, H&R Block is also a good option.

FAQs

The cheapest option with H&R Block is free, which is hard to beat. But the paid options are comprehensive and offer something for everyone, depending on how complex your tax return is.

H&R Block has a long history and is a reputable service. If you enter the information accurately, there is a very low chance of a mistake being made. There is also an optional Peace of Mind Extended Service Plan providing three years of coverage.

The two services are very similar and have similar prices if you are filing your return online. If you want to file a return in person, H&R Block allows you to do this, while TurboTax does not.

When you file your tax return online, the return is sent to the CRA as soon as you are ready. But you will then need to wait for them to send the refund, and that usually means about eight business days.

Related: Check out the best free tax return software and how tax returns work in Canada.

I ditched Turbo Tax last year due to limitations in handling T5008 slip downloads from CRA. See my comments in the Turbo Tax Review post.

H&R Block service worked for me and my T5008 slips.