Looking to buy cryptocurrency in Canada? This guide covers the best Canadian crypto exchanges you can use.

Investing in crypto is more than just jumping on any platform and exchanging your CAD fiat for digital currencies.

You want to consider the security, trading fees, liquidity, coin selection, customer support, and ease of use of the platform before committing to it.

After careful vetting, I summarize my top picks for the best crypto exchanges in Canada, including Bitbuy, Wealthsimple Crypto, NDAX, VirgoCX, Newton, and Netcoins.

My top recommendation for a low-cost and regulated crypto exchange is Bitbuy ($50 Free BTC offer).

Best Canadian Crypto Exchanges in 2024

| Crypto Exchange | Coin Selection | Fees | Best For |

| Bitbuy (best exchange) | 40+ | 0.00% to 2% trading fee; free fiat deposits | Beginners and experienced traders, advanced trading tools, staking, wealth management |

| VirgoCX | 50+ | Up to 2.50% fee; free fiat deposits/withdrawals | Beginner traders |

| Wealthsimple Crypto | 50+ | Up to 2%; free fiat deposits/withdrawals | Beginner and experienced traders (can also trade stocks & ETFs) |

| Newton | 50+ | Up to 2%; free fiat deposits/withdrawals | Beginner traders |

1. Bitbuy

Bitbuy Crypto Exchange

Get a $50 bonus if your initial deposit exceeds $250

Trade approx. 40 coins

Great for new & advanced traders

0% to 2% trading fee

Bitbuy is one of the oldest Bitcoin exchanges in Canada. Since its founding in 2016, the platform has been used by hundreds of thousands of Canadians to trade over $5 billion in digital assets.

As of this writing, Bitbuy supports over 40 coins, including Ethereum, Bitcoin, Stellar, EOS, Bitcoin Cash, AAVE, Chainlink, Litecoin, Avalanche, Polygon, Algorand, Axie Infinity, ApeCoin, Cosmos, Decentraland, Chiliz, Shiba Inu, Maker, NEAR, and more.

Funding: You can fund your account using Interac e-Transfer, bank wire, debit card, bill payment, and crypto deposits.

Trading fees: 0% to 2% trading fee, depending on account tier; free fiat deposits; crypto withdrawal fees vary.

Security: Bitbuy is a registered MSB with FINTRAC and keeps 90% of crypto assets in cold storage. It is approved by the Ontario Securities Commission and the Canadian Securities Administrators as a registered marketplace for crypto assets. It also implements 2FA to protect your account.

Sign up bonus: Get a $50 bonus when you make an initial deposit of at least $250 in your new account.

Highlights:

- First registered and regulated crypto exchange

- Has a versatile mobile app

- Offers ways to earn interest on your coins (staking)

- Competitive low trading fees

- Suitable for beginners and advanced crypto traders

- OTC desk for large trades

- Bitbuy API for advanced traders

- Private wealth solutions

2. VirgoCX

VirgoCX is a cryptocurrency exchange founded in 2018. It offers 60+ coins and can also be used to access the following services:

- NFT brokerage services

- OTC

- Foreign exchange

Funding: Interac e-Transfers, wire transfers, and crypto deposits.

VirgoCX is one of a few Canadian crypto exchanges to support multiple currencies (CAD and USD).

Trading fees: 0.50% to 2.50% trading fee; fiat withdrawals and deposits are free.

Security: VirgoCX is registered as a Money Service Business with FINTRAC. As per its website, it utilizes several security measures and policies to protect users’ accounts.

Sign up bonus: Get a $20 bonus when you deposit $100 worth of crypto assets ($5 after KYC and an extra $15 after depositing $100 or more). Learn more in this VirgoCX review.

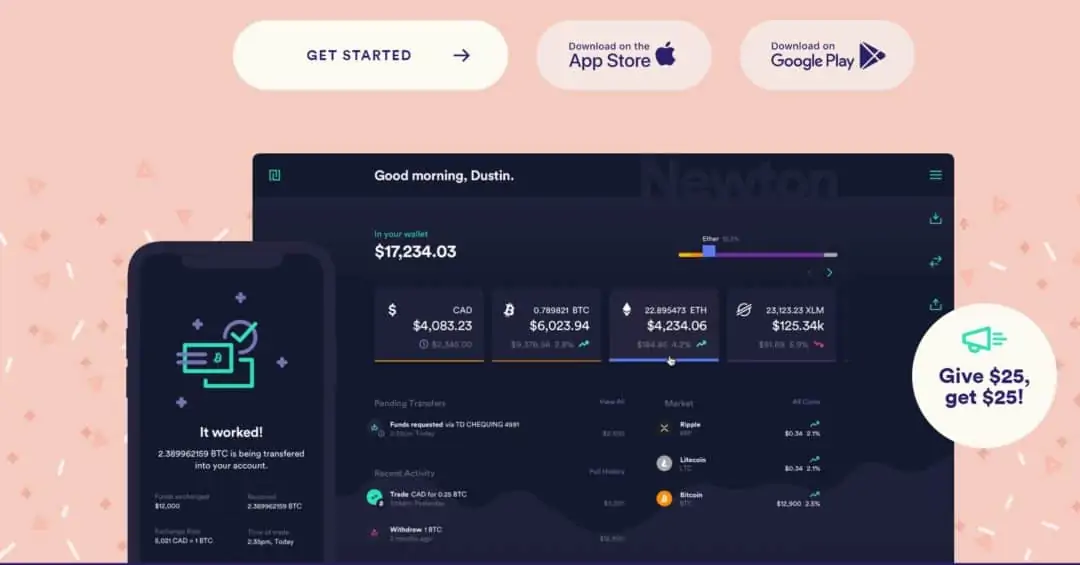

3. Newton Canada

Newton Crypto Exchange ranks as one of the best crypto brokerages in Canada with 60+ coins, including hard-to-find ones like AXS, OMG, ZEC, FTM, SHIB, GRT, SAND, CHZ, and UMA.

Newton is available via the web, and you can also download its mobile apps.

Funding: Interac e-Transfer, bank wire, and crypto deposits.

Trading fees: While Newton does not charge a commission for depositing or withdrawing fiat and crypto, you pay a price spread of up to 2.20% on buy and sell trades.

Security: Most coins are kept offline using institutional-grade cold storage. As per its website, Newton is PIPEDA-compliant and is registered with FINTRAC.

Sign-up bonus: Get a $25 bonus when you trade at least $100 worth of crypto.

This platform is best suited for beginners as it lacks advanced charting tools.

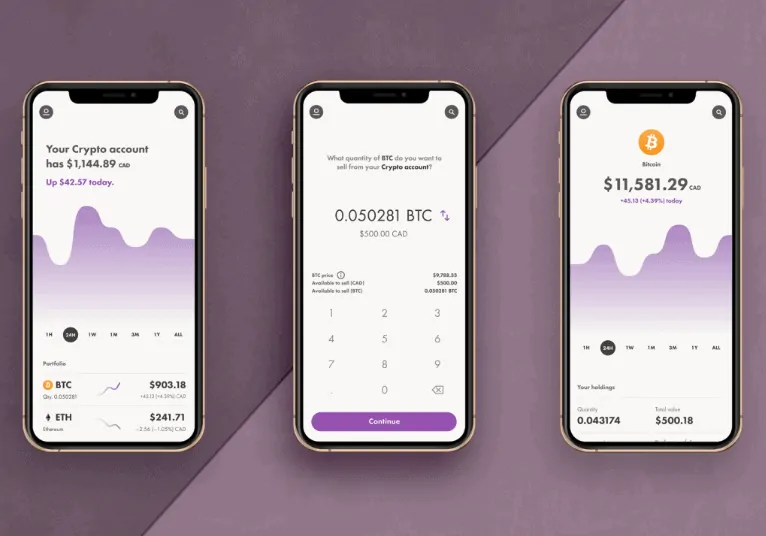

4. Wealthsimple Crypto

Wealthsimple Crypto is a solid crypto platform for newbies. It supports 50+ coins, including Ox, 1inch, Aave, Bitcoin, Cosmos, Curve, Doge, Litecoin, Ren, Shiba Inu, Polygon, Polkadot, and several others. And for stocks, you get access to the Wealthsimple Trade platform.

Funding: You can add fiat via bank transfer, debit card, and crypto deposits from an external wallet.

Trading fees: 2% fee per transaction.

Security: Wealthsimple Crypto is a regulated platform. It uses Gemini to keep assets in cold storage and partners with Coincover to keep your coins safe. Users can also set up 2FA to prevent unauthorized access to their accounts.

Sign-up bonus: Get a bonus after trading at least $150+ in your account within 30 days of registration.

Highlights:

- It has a versatile mobile app for iOS and Android devices

- Offers staking for some coins

- Quick verifications and same-day deposits

- Responsive support

5. CoinSmart

CoinSmart is now part of WonderFi and is not accepting new signups. If you’re looking for the best crypto experience in Canada, we recommend Bitbuy, another licensed Canadian cryptocurrency trading platform operated by the same parent company, WonderFi. With Bitbuy, you will get access to an improved experience on web and mobile, staking rewards, Private Wealth services, and an advanced trading interface.

The platform supports several digital assets, including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple, USDC, Stellar, Cardano, Chainlink, Shiba Inu, Uniswap, Dogecoin, Solana, Avalanche, Polygon, and EOS.

CoinSmart is also available in several European countries and the U.S.

Funding: Users can fund their accounts using Interac e-Transfer, bank wire, bank draft, credit and debit cards, and SEPA.

Trading fees: 0.20% trading fees. Other fees when you deposit fiat or withdraw fiat and cryptocurrency.

Security: Registered with FINTRAC as a Money Service Business (MSB) in Canada and as a restricted dealer with the Ontario Securities Commission (OSC). In the U.S., it is registered with FINCEN. CoinSmart recently joined TRUST, a group of crypto companies that have joined a universal standard to address anti-money laundering regulations.

Accounts in CoinSmart have assets protected using cold storage and 2-Factor Authentication (2FA).

Highlights:

- Has a mobile app for iOS and Android devices

- Competitive low trading fees

- Suitable for beginners and advanced crypto traders

- Instant verifications and same-day deposits

- 24/7 live support

Sign up bonus: Get a $50 bonus when your initial deposit is at least $250 (Bitbuy).

6. Kraken

Launched in 2011, Kraken is one of the best global crypto exchanges trusted by 9M+ users in Canada and 190+ other countries.

It offers cryptocurrency spot & margin trading of multiple coins, 65+ crypto futures contracts, crypto staking, and NFT trading.

Funding: You can fund your Kraken wallet with CAD, USD, or EUR via wire transfer, credit card, ACH transfer, e-transfer, Etana Custody, or crypto deposit from an external wallet.

Trading Fees: Kraken trading fees are volume-based, costing around 0.26% or more.

Security: Kraken is a FINTRAC-registered MSB in Canada that employs top security measures to safeguard user funds, including 2FA, SSL encryption, cold storage, and email confirmation for withdrawals.

Highlights:

- Several crypto assets

- 12+ staking assets

- An NFT marketplace to trade NFTs

- Margin trading

- Access 65+ multi-collateral futures contracts

- An OTC service to fill block trades of $100,000+

- 24/7 customer service via Live Chat, phone, and email

- Comprehensive educational center to learn all things crypto

- Advanced Kraken Pro mobile app to quickly and conveniently trade on the go

7. Coinbase

Coinbase is a well-established crypto exchange that has been around since 2012. It’s reputed for its top security, wide crypto selection, and global availability in many countries.

However, Coinbase is one of the crypto exchanges with a complex fee structure, and they are on the high side for small-volume traders.

Trading Fees: Coinbase Simple fees stand at $0.99 for orders of $10 or lower, $1.49 for orders between $10-$25, $1.99 for orders between $25-$50, and $2.99 for orders between $50-$200.

A percentage fee of 1.49% applies for orders above $200, and 3.99% for credit/debit card crypto purchases.

Maker fees on Coinbase Advanced start at 0.4% and decrease to 0%, while taker fees start at 0.6% and decrease to 0.05% as your trading volume increases from 10K to 400M+.

Security: 2FA, address whitelisting, Coinbase Vault, biometrics for mobile, Yubikey support, FDIC insurance up to $250K for USD balances.

Sign-up bonus: None.

Highlights:

- 100+ coins

- Stake and earn up to 10% APY on your idle crypto assets

- A beginner-friendly web interface and mobile app

- Borrow cash up to $1M with no credit check using Bitcoin as collateral

- Offers a crypto Visa debit card to spend your funds and earn crypto rewards

- An NFT marketplace to explore and trade NFTs

- A learn-earn program to learn about crypto and earn rewards

- Coinbase Simple and Coinbase Advanced to accommodate both newbies and pros

8. Crypto.com Canada

Crypto.com was founded in 2016 and has over 10 million users worldwide.

While it is not based in Canada, Crypto.com is available to residents of Canada who can also apply for their Crypto Visa card.

It supports 150+ coins and offers staking rewards, DeFi, NFTs, and more.

Funding: Bank transfer, debit card, credit card, and crypto deposits.

Trading fees: Up to 0.50%, depending on your account tier.

Security: 100% of users’ cryptocurrencies are stored offline in cold storage. Fiat is held at regulated banks, and transactions are protected by multi-factor authentication.

Learn more in this detailed review of Crypto.com.

9. NDAX

No list of the best crypto exchanges in Canada is complete without mentioning NDAX.

NDAX supports 30+ coins, including Bitcoin, Ether, Litecoin, EOS, Dogecoin, Cardano, Shiba Inu, The Graph, Compound, MATIC, USDC, Polkadot, and several others.

It is available on all devices, including mobile phones, where its iOS and Android apps work well.

Funding: NDAX users can add Canadian dollars using Interac e-Transfer, wire transfer, and bank draft. Crypto deposits are also supported.

Trading fees: 0.20% for both buy and sell trades. Fiat and crypto deposits are free; a flat fee applies to fiat and crypto withdrawals.

Security: NDAX is registered with FINTRAC as an MSB in Canada. It keeps users’ fiat at a “Canadian Crown-owned financial institution” and uses cold storage and 2FA to protect your account.

Top Crypto Exchanges in Canada

In addition to the list of the best crypto exchanges in Canada above, you can also take a look at the following ones:

10. Shakepay: This long-standing crypto platform supports Bitcoin and Ethereum trading. Variable fees. Get a $5 bonus or read review.

11. Netcoins: Support 30+ digital currencies with a 0.50% trading fee plus a hidden spread fee.

12. Coinsquare: Founded in 2014 and supports several coins. Its trading fees are not as competitive. Read review.

13. Gemini: This is a regulated crypto site based in the U.S. and is also available in Canada. Its fee structure is not as competitive as the others I have listed.

14. KuCoin: One of the largest exchanges in the world with millions of users. Fees up to 0.1% depending on your account tier.

15. Coinberry

Coinberry was founded in 2017 and is based in Toronto. It supports 15+ coins, including BTC, ETH, LTC, DOGE, XLM, LINK, BAT, and more. Coinberry is now a part of Bitbuy.

Funding: Interac e-Transfer and wire transfer.

Trading fees: Up to 2.50% price spread per transaction; fiat deposits and withdrawals are free.

Security: Coinberry is registered as an MSB with FINTRAC in Canada. It keeps most coins in cold storage via Gemini Trust Company LLC, a regulated custodian. Accounts are also protected using 2FA.

Note that you can only withdraw specific coins on Coinberry (BTC, LTC, XRP, and ETH). Others can only be withdrawn as fiat.

Crypto Exchanges No Longer Operating in Canada

Binance Canada

The world’s largest cryptocurrency trading platform is no longer available in Canada.

It has the largest selection of coins of any of the platforms in my ranking of crypto exchanges in Canada, with 350+ coins and tokens.

More experienced crypto traders can also use Binance to access crypto derivates and staking.

Funding: Multiple currencies are supported; fund using credit/debit cards, bank transfers, and crypto deposits.

Trading fees: 0.02% to 0.10% for spot trading.

Security: Uses various security strategies to protect your account, including cold storage and 2FA. Learn more in this detailed Binance review.

Methodology:

To choose the best crypto exchanges in Canada, Savvy New Canadians rates cryptocurrency exchanges and apps based on their coin offerings, trading and transaction fees, ease of use, access to advanced trading tools, user interface, company reputation, security measures, funding options, and other features. While these crypto trading platforms are some of the top ones on the market, they may not be right for you. Visit the company’s websites using the links to read their current terms and conditions before applying.

How To Trade Cryptocurrency in Canada

Want to buy and sell crypto? You will need to first open a cryptocurrency exchange account.

After verifying your identity, fund your new account with Canadian dollars (fiat) or transfer your existing coins from an external wallet or crypto exchange. Some of the best crypto trading platforms accept multiple fiat currencies.

These new funds or coins you have deposited are what you use to purchase the cryptocurrency assets of your choice.

Like any standard exchange or brokerage account, place ‘buy’ trades to acquire new tokens or ‘sell’ trades to dispose of them.

While the default strategy is to leave your crypto assets in your exchange account wallet, it is recommended that you transfer your assets offline when they become significant.

Offline cold storage wallets like Ledger Nano X and Trezor are readily available.

Some other strategies for trading cryptocurrencies include buying them at a crypto ATM or directly from someone else using a P2P crypto service.

What to Look For in the Best Crypto Exchanges in Canada

When looking for the best crypto exchanges in Canada, you should carefully consider these factors:

Trading fees: How much does each transaction cost? If the trading fees are high, it could dampen your overall returns.

User-friendliness: Beginners should avoid advanced trading platforms that are littered with charts and options. While these exchanges offer more flexibility, the options can be overwhelming if you are just learning about crypto.

Funding options: Make sure the exchange supports funding options that best suit your needs. For example, a mix of bank transfer, Interac e-Transfer, and crypto deposits is best. Also, check whether there are fees for each of the funding options.

Regulation: While no crypto exchange in Canada currently offers CIPF (Canadian Investor Protection Fund) protection, check whether they are licensed to operate, and the types of asset protection available.

Security: For maximum security of your assets, you want to be able to move them offline into a hardware wallet like Ledger. Confirm that the exchange uses cold storage to protect users’ coins and find out what they have for privacy protection, account security, insurance, and more.

Trading tools: Experienced crypto traders may need access to charting tools, various order types, live order book, OTC desk, and more.

Customer support: Is 24/7 customer service provided? Is it clear on the website how to contact support and when they are available to provide live responses?

Coins selections: With over 21,000 coins in the crypto universe, the more a platform supports, the better it may be if you dabble in multiple assets.

Is Cryptocurrency Legal in Canada?

Cryptocurrency exchanges can operate legally in Canada, and you can trade crypto without breaking the law.

That said, cryptocurrencies are not legal tender in Canada. Here’s the government’s take on them.

While you can currently make purchases using crypto, there is no direction on how future government regulation may impact the industry.

Bitbuy Crypto Exchange

Get a $50 bonus if your initial deposit exceeds $250

Trade approx. 40 coins

Great for new & advanced traders

0% to 2% trading fee

Best Crypto Exchange Canada FAQs

The best crypto exchange in Canada for beginners is Bitbuy. It has an intuitive user interface, a lengthy selection of coins, and supports multiple securities. For advanced traders, the best crypto exchange in Canada is Bitbuy or CoinSmart.

One of the cheapest crypto exchanges in Canada is Bitbuy. It offers free fiat deposits, and crypto trading fees range from 0.00% to 2%.

I consider Bitbuy and Wealthsimple Crypto the best crypto trading platforms for beginners.

Binance has the most versatile crypto app with features that allow you to buy crypto, join pools, stake for interest, and trade derivatives. However, it is no longer available in Canada. For a Canadian exchange that has no regulatory bans, consider Bitbuy.

Bitbuy is Canada’s best crypto exchange for day trading crypto, with its live order book and trading tools. CoinSmart, Coinbase, and NDAX are also very good.

The best crypto exchange in Ontario is Bitbuy. It is registered as a marketplace for crypto assets with the Ontario Securities Commission and a money service business with FINTRAC.

One of the safest crypto exchanges in Canada is Bitbuy. Others include Wealthsimple Crypto and CoinSmart. These crypto exchanges keep most of their coin holdings in cold storage to protect them from hackers. That said, no crypto exchange is 100% safe, and you should consider holding your assets in self-custody.

Yes, Bitbuy is a legal crypto exchange in Canada. All the cryptocurrency exchanges listed in this post can offer services legally in Canada.

Related

- Best Bitcoin Wallets

- Best Apps To Buy Bitcoin

- Best Crypto Stocks in Canada

- Bitcoin Guide for Beginners

Disclaimer: Cryptocurrency is a volatile and speculative investment. If you decide to invest, we recommend you do your own research and only commit funds you can afford to lose. The author may own one or more of the crypto assets mentioned in this article.