This Wealthsimple Trade review covers how Canada’s first free online stock trading app works, its pros and cons, and how to get a welcome bonus.

Wealthsimple Trade is the Canadian answer to the popular Robinhood app in the United States.

While the app is not yet as versatile as Robinhood or Questrade and has shortcomings, Wealthsimple Trade delivers on no-minimum and zero-commission ETFs and stock trading for do-it-yourself investors.

Every day is a good day to cut down your investment fees. Canadians started with index funds, online discount brokerages, then robo-advisors, and now, you can buy and sell investment products online for zero fees while in complete control.

Wealthsimple Trade Review Summary

Wealthsimple Trade

-

Ease of use

-

Trading fees

-

Accounts

-

Investment products

Overall

Summary

Wealthsimple Trade is an online brokerage service that allows you to buy and sell thousands of stocks and ETFs on popular Canadian and U.S. exchanges without paying a fee.

Not too long ago, purchasing or selling a stock or ETF would cost you anywhere from $5 to as high as $30 per transaction. While discount brokerage platforms like Questrade and Qtrade offer commission-free ETFs trading on the buy-side, you pay a fee (up to $10/transaction) when you eventually sell. And for the big banks, you could also pay up to $10 per transaction, whether buying or selling.

If you are comfortable managing your investment portfolio, Wealthsimple Trade offers an opportunity to save on fees and maximize your returns. The app allows you to trade and invest inside a TFSA, RRSP or non-registered investment account.

Pros

- Unlimited $0 commission trades

- User-friendly app and desktop platform

- No minimum account balance required

- CIPF protection up to $1 million

- Invest in TFSA and personal non-registered accounts

- Sign-in using existing Wealthsimple credentials

- Sign-up bonus for new eligible accounts

- Offers USD accounts

Cons

- RESP, RRIF, and margin accounts are not available

- Real-time data costs $10 monthly

How Wealthsimple Trade Works

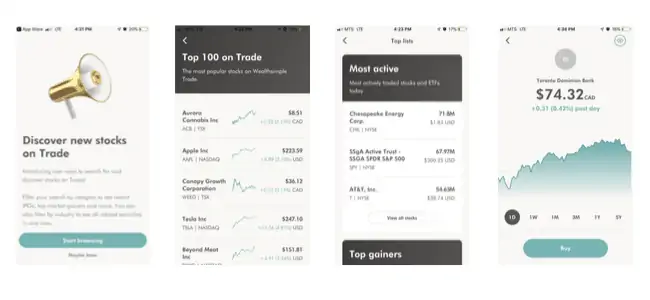

The Wealthsimple Trade app is available on iOS and Android. To get started:

- Open a Wealthsimple Trade account ($25 cash bonus link when you deposit $200).

- Download the Wealthsimple Trade app from the Apple or Google Play Stores and sign in with your Wealthsimple credentials. You can also use the desktop web interface.

- Choose an account type – TFSA, RRSP, or a non-registered personal account.

- Fund your account using a linked bank account and start trading.

The Wealthsimple Trade App currently lists thousands of Canadian and U.S. stocks and ETFs you can trade for free.

There is no account minimum, the interface is clean, and you can easily sign-up using your existing Wealthsimple account details.

Wealthsimple Trade Fees

There are no fees for buying and selling stocks and ETFs on the Wealthsimple Trade platform.

Opening or closing your account, withdrawing funds, electronic statements, and inactive accounts have a $0 fee. If you prefer a paper account statement, a $20 fee applies.

Wealthsimple recently introduced a premium service that offers access to real-time market data (snap quotes), no FX conversion fees (USD accounts), unlimited price alerts, and the ability to deposit up to $5,000 instantly.

The Wealthsimple Trade Plus service costs $10 per month.

How Does Wealthsimple Trade Make Money?

When you make USD trades on a regular Trade account, they charge the base conversion fee + 1.50%. This is a competitive rate, given that some brokerages charge upwards of 2% on foreign currency trades.

If you upgrade to Wealthsimple Plus, there is a $10 monthly fee.

Is Wealthsimple Trade Safe?

Wealthsimple Trade is a division of Canadian ShareOwner Investments Inc., a member of IIROC and the Canadian Investor Protection Fund (CIPF).

Their membership with CIPF means that your funds are protected against insolvency up to $1,000,000.

Cons of Wealthsimple Trade

Wealthsimple Trade does not offer advanced trading tools.

Also, if you are looking to trade options, currencies, bonds, mutual funds, or GICs, this platform does not offer them.

Lastly, RESP, LIRA, RRIF, and corporate investment accounts are unavailable.

Readers of Savvy New Canadians who sign up for a Wealthsimple Trade account receive a $25 cash bonus if they deposit at least $150 in their account within the first 45 days.

Wealthsimple Trade vs. Questrade

Questrade is the most popular online discount brokerage platform in Canada. Here’s how Wealthsimple Trade compares to Questrade:

1. Fees

Wealthsimple Trade has no fees for buying and selling stocks and ETFs.

Questrade does not charge a fee when you purchase ETFs; however, a minimum fee of $4.95 per trade applies when you sell. For stocks, you pay 1 cent/share and a minimum of $4.95/trade to a maximum of $9.95 per trade.

2. Financial Products

Wealthsimple Trade offers access to trade only U.S. and Canada-listed stocks and ETFs. Not all Canada or U.S.-listed stocks are available through the platform.

Questrade offers access to many more investment products like mutual funds, options, bonds, OTC assets, IPOs, international equities, GICs, precious metals (gold, silver), and more.

3. Accounts Offered

Wealthsimple Trade allows you to trade inside a TFSA, RRSP, or non-registered personal investment account. As per their website, other accounts are also in the works.

On the other hand, Questrade allows trading inside a TFSA, RRSP, RESP, margin account, LIRA, LIF, RIF, and corporate investment accounts.

If you use Wealthsimple’s robo-advisor service (Wealthsimple Invest), you get access to more accounts.

4. Trading Platform

Wealthsimple Trade and Questrade have smartphone apps available on iOS and Android. The Wealthsimple Trade app has a user-friendly interface; however, its functionality does not match that of Questrade.

Questrade offers a self-directed investor many more investing tools, charts, market analysis, and numbers to play around with.

You can access your Wealthsimple Trade account using the mobile app or desktop web interface, similar to Questrade.

5. Account Minimum

You can open a Wealthsimple Trade account with just $200 and start trading. For Questrade, a $1,000 minimum balance is required.

Learn more about Questrade in this Questrade review.

Wealthsimple Trade now offers fractional shares so you can purchase a slice of big companies without needing to pay thousands of dollars. This also makes it easy for retail investors to diversify their stock portfolios.

Who is Wealthsimple?

Wealthsimple is an online digital investment service that automates the investing process, so anyone can put their money into a professionally managed low-cost portfolio without requiring 6-figures.

Popularly referred to as a robo-advisor, Wealthsimple offers its clients customized portfolios to fit their risk tolerance and investment objectives.

The popularity of fintech firms like Wealthsimple is mostly due to their significantly lower management fees (compared to traditional mutual funds) and hassle-free investment offerings.

Wealthsimple was founded in 2014 and has hundreds of thousands of clients and over $15 billion in assets under management. Their headquarters is based in Toronto.

The Wealthsimple robo-advisor product differs from its brokerage business, and the company also offers a high-interest savings account.

Wealthsimple vs. Wealthsimple Trade

If you are looking to invest in ETFs, save on fees, and avoid the hassle of rebalancing your investment portfolio or carrying out market research, a robo-advisor like Wealthsimple can help you achieve your goals.

Wealthsimple Invest offers a digital investment service that includes:

- Globally diversified portfolios customized to meet your needs.

- Low management fees (compared to the big banks)

- Automatic rebalancing

- Dividend re-investing

- Free financial advice

- Spare change investing features

- TFSA, RRSP, RESP, RRIF, and non-registered investment accounts

- Socially responsible portfolios and more

On the other hand, if you’d rather be hands-on and prefer to assemble your portfolio using stocks and ETFs, Wealthsimple Trade offers a solution.

It should be noted that as a self-directed investor, you will not benefit from free professional advice. Also, you will need to ensure you are not over-trading and can keep your nerves steady when the financial markets suffer a setback.

Related Posts:

I have a question regarding Questwealth portfolios and other online brokers. What would happen to people’ investments if these organizations become insolvent?

@Joyce: They are members of CIPF which means that your investments are protected up to $1 million should the financial institution become insolvent.

This was very useful. Thanks for taking the time to put this together.

@Alton: You are welcome. I’m glad you found it to be useful.

Interesting review thank you for the comparison.

I would like to know whether you can purchase Vanguard all-asset allocation VGRO using Wealthsimple trade and how the fee plays out for the US portion of the ETF?

@Jacques: Yes, you can purchase VGRO on Wealthsimple Trade.

Thank you for this. With Wealthsimple Trade does having VGRO count as a US trade? Would you pay a conversion fee since some of the equities are us equities?

@Nat – see my response to Sean.

Following up on Jacques question – I understand you can purchas VGRO on Weathsimple Trade – but how about the 2nd part of his question…”and how the fee plays out for the US portion of the ETF?”

@Sean: As per Wealthsimple: “Wealthsimple Trade primarily makes money from the 1.5% currency conversion fee charged on Canadian to US dollar conversions (and vice versa) that are required to trade US-listed securities.”

“The only trading fee we charge is a currency exchange fee for USD trades of the daily corporate rate + 1.5% — most brokerages charge around 2% on top of this rate for currency conversion.”

From the WealthSimple website it looks like they support RRSP accounts – can you confirm this? For TFSA & RRSPs do the support transfers from existing accounts? What kind of market data do they provide (real-time or delayed quotes)? Do they allow trading of options (even non-margin e.g. covered calls or cash secured puts)?

@David: Best to call Wealthsimple to confirm the account transfers. I think it would depend on the kinds of assets you currently own and whether an in kind transfer can be done? Wealthsimple Trade does not currently support the trading of options.

Great article, just one question, you mentioned about buying a US listed stock that wealthsimpl;e charges a 1.5% conversion fee. But is there a way I can buy with USD itself without convesrion? Is it possible to store money in USD itself in a wealthsimple account?

@Bose: No, that was not possible the last time I checked.

So basically the more expensive the US-listed stock/ETF you buy the more expensive your fees are going to be? I guess there’s a point where these fees exceed the flat rate of other institutions?

Thank you so much for this. I’ve been looking for the best broker my friend in Canada can use to trade stock shares and options as well. It doesn’t look like Wealth Simple Trade offers trading options, do they? But Quest Trade does?

@Nnamdi: You are welcome. No, Wealthsimple does not offer options trading (currently only stocks and ETFs), however, Questrade does.

It’s great for low/no fee trades and etf trading but has many short comings. It takes FOREVER for money to be available to trade once you initiate a deposit and the stock availability is fairly poor being limited to NYSE, tax and some nadsq. However, even amongst these exchanges there are several stocks I was unable to find. I think I might try Questrade, it seems they are faster and less limited.

To creat an account on wealthsimpletrade app, they asked me personal information such as my Social Insurance Number which supposed to be confidential, I dont know is it safe to share this info? How they can guarantee my personal data wont share anywhere or being used?

@Arash: This is a requirement for financial institutions and prevents tax fraud, money laundering, etc.

I wanna do this also but I dont have lots of fund I can start $100 right on wealthsimple..? Not on w-trade.? But I’m not the one who will pick the the stock.? Is this long term.? I wanna learn more

Hey, thanks for this. Do you have a referral code instead of the link? Tried using it and didn’t work.

Thanks,

@Will: The link works when you click through and open an account. The promo code is automatically applied and when you deposit and trade $100 or more in stocks, you get a $25 bonus. Cheers.

This was a very informative summary, thank you! Is it possible to get the sign up bonus offers on Wealthsimple Trade ($25) and on Wealthsimple Invest ($100)?

@Cedric: Good question. I’m not sure if you can claim both bonuses given that you will have one sign-in info for both accounts. Unlikely.

Great summary. I am wondering if I can convert a certain amount of money to USD so I only have to pay the 1.5% once? Then I can invest as needed into US stocks.

@Ian: You can’t hold USD cash on Wealthsimple Trade at this time. Questrade could work for the strategy you are proposing.

Would I be able to buy stocks from the pink sheets?

I opened a wealthsimple account by following your link but did not receive a $35 sign up bonus. What did I miss?

@Kevin: The bonus is applied after you have deposited and traded at least $100 in stocks or crypto.

I am planning to transfer my TFSA and RRSP accounts from TD (currently in TD e-series mutual funds with average mer = 0.33%) to Wealthsimple Trade and will be purchasing the equivalent ETFs once the funds are transferred over (mer = 0.08%). I like to keep things simple, but I don’t mind keeping these tax advantaged accounts with Wealthsimple Trade (rather than Wealthsimple Investing) because the taxes/accounting is simple enough for me to deal with.

However, I will have extra money to open and invest in a non-registered account, so my question is this… Should I…

1) Open the non-registered account with Wealthsimple Trade and purchase my ETFs (average mer = 0.08%) in this account, similar to my plan for my TFSA and RRSP accounts (I don’t trade the ETFs, just buy and hold long term)

2) Open the non-registered account with Wealthsimple Investing and use their Growth robo portfolio (fee = 0.5%) in order to benefit from the free divided re-investing, automatic rebalancing, and tax services.

I guess I’m wondering if the savings from automatic dividend re-investing, automatic rebalancing, and tax services (because this will be a non-registered account) will be worth the higher fee? Is there a threshold account balance at which it would be worth choosing the Wealthsimple Trade over Wealthsimple Investing for a non-registered account?

Thanks so much!

@Jen: I think it all comes down to convenience and consistency. Will you actually have the time to rebalance when needed? Will you try to time the market when making ETF purchases (i.e. try to buy when you think the price is low)? If you are comfortable with buying and rebalancing and are stocking up for the long term, you could potentially save on fees with WT. Also, depending on your balances in these accounts, the fee savings can be significant over time. That said, the convenience of having someone else do the buying and rebalancing may outweigh the costs if you end up not rebalancing when you should. Mind you, if you are using an all-in-one ETF, self-directed trading becomes even easier.

I opened a Wealthsimple Trade account, but I forgot to use your link. Apparently, it’s not too late though. In the app, in the REWARDS section, I can choose I WAS REFERRED BY A FRIEND. It then asks for a referral code. Do you know what that would be?

@Jeff: The referral link in the article is what gets you the $150 offer. That said, you can use this referral code (E0U3RG) to get two free stocks since there’s no way to use the link after opening your account.

Does WS offer DRIP accounts? I have noticed different financial brokers have different values when the dividends are converted, can you explain why this is. I have seen sometimes the values are close to each other from the 3 brokers that I use, while other times they are substantially different. I have an opinion on this but would like to hear from a professional. Thank you for your reply

@HARV: Wealthsimple Trade does not offer DRIP, but you get automatic re-investing with Wealthsimple Invest.

The differences you see may be due to the FX rates being used, but I can’t say for sure.

l will like to know if you manage individual portfolio

@Ken: No, I do not offer this service. Cheers.