Are you looking to buy Bitcoin in Canada? This in-depth guide covers where and how to buy bitcoin and the best cryptocurrency exchanges that offer it in Canada.

Bitcoin is the world’s most popular digital currency and the strongest contender for a decentralized currency that could rival fiat money as a legal tender someday.

When you consider that the Canadian dollar (i.e. fiat currency) we use to conduct everyday buy and sell transactions has no intrinsic value other than that bestowed upon it by the government, the concept of electronic money begins to take shape.

Fiat money is a currency (a medium of exchange) established as money, often by government regulation, but that does not have intrinsic value (value independent of the nominal value, such as a precious metal might have). Fiat money does not have use value (inherent utility, such as a cow or beaver pelt might have), and has value only because a government maintains its value, or because parties engaging in exchange agree on its value.

Wikipedia

Bitcoin and altcoins such as Ether, Litecoin, and XRP are somewhat similar to fiat currencies. Simply put, their intrinsic value is tied to the value placed on them by users.

Other factors determining cryptocurrency values include their supply, demand, acceptability, cost of mining them, and government regulation or lack thereof.

Read on to learn about Bitcoin, how to buy Bitcoin in Canada in 2024, and whether it is safe and legal.

Key Takeaways: You can buy bitcoin in Canada using cryptocurrency exchanges like CoinSmart, Wealthsimple Crypto, Bitbuy, NDAX, VirgoCX and Crypto.com. Bitcoin trading is legal in Canada, and profits are taxable as capital gains or as income, if you are classified as a day trader.

How and Where To Buy Bitcoin in Canada

There are several ways to buy Bitcoin in Canada.

Your options include buying it from an online cryptocurrency exchange (e.g. CoinSmart, Bitbuy, and NDAX), a cryptocurrency broker, or a crypto trading platform (e.g. Wealthsimple Crypto, Newton, and VirgoCX), or at a Bitcoin ATM.

There are also ways to purchase Bitcoin through peer-to-peer (P2P) networks or Over-the-Counter (OTC).

1. Coinsmart

Coinsmart is a cryptocurrency exchange offering the major cryptocurrency coins to Canadians. It is based in Toronto and is one of only a few crypto platforms that allows you to buy Bitcoin in Canada using a credit card. CoinSmart is now a part of Bitbuy.

New clients get verified within minutes, and advanced traders access charting, limit trades, and more.

- Great for: Beginners and Advanced traders.

- Coins offered: 16 types, including BTC, ETH, LTC, EOS, XLM, ADA, USDT, SHIB, UNI, DOT, LINK, SOL, MATIC, AVAX, and BCH.

- Account funding options: Interac e-transfer, bank wire, bank draft, credit, and debit cards.

- Trading fees: 0.20% for CAD to cryptocurrency trades, free fiat deposits, and a 1% fee on CAD withdrawals.

- App: Available on iOS and web interface on all devices.

- Promotion: Get a $50 bonus when you open and fund a new account with at least $250.

- Review: CoinSmart review.

Is Coinsmart Safe?

Coinsmart is ranked as the best place to buy bitcoin and other cryptocurrencies in Canada on this list.

It uses 2FA and SSL encryption to protect your account. 95% or more of the coins on the platform are kept in cold storage wallets, and as per the website, your fiat funds are kept in Canadian banks.

Pros of Coinsmart

- Quick verification of new clients within minutes

- Supports credit card funding

- Offers 16 popular coins

- 24/7 support

- Access to an advanced trading platform

- Access to multiple fiat currencies

- Great for beginners and experts

Cons of Coinsmart

- Assets on the platform are not insured by CIPF or CDIC

- Fees on some deposits and withdrawals

CoinSmart Crypto Exchange (now Bitbuy)

Top crypto exchange in Canada (now Bitbuy)

Great for new & advanced traders

Competitive trading fees

Get a $50 bonus when you deposit $250

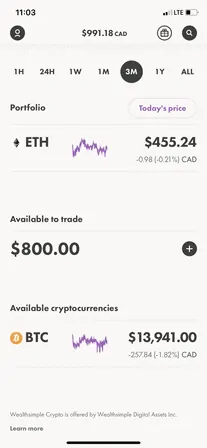

2. Wealthsimple Crypto

Wealthsimple Crypto is the first regulated cryptocurrency platform in Canada, having received authorization to operate from the Canadian Securities Administrators (CSA).

If you are not familiar with Wealthsimple, it is the most popular online wealth management platform in Canada.

Wealthsimple Crypto is a simple and secure way to buy and sell Bitcoin, Ethereum, and several other coins from your phone. Its UX is particularly optimized for beginners who are new to digital currency trading.

After signing up for a Wealthsimple Crypto account and funding your account, you can trade cryptocurrency via the app in just a few clicks.

Wealthsimple Crypto works like a broker. When you put in an order to purchase or sell crypto, they connect you to a market maker(s) who finds the best price available on the largest exchanges.

Your crypto holdings are then held with a regulated custodian (Gemini), which keeps your cryptocurrency secure in cold storage.

- Best bitcoin trading platform for beginners

- Coins offered: 50+ coins, including BTC, ETH, BAT, MANA, COMP, ADA, KNC, MKR, DOT, CRV, YFI, SNX, UNI, and several others.

- Account funding options: Bank transfer, debit card, crypto deposit

- Trading fees: Spread on buy and sell prices (1.5%-2%); no fees for withdrawals or deposits

- App: Available on iOS and Android

- Promotion: $25 bonus when you deposit at least $200 within 30 days of account opening

- Review: Wealthsimple Crypto review

Is Wealthsimple Crypto Safe?

Cryptocurrency trading is risky, so there is that.

With regards to the security afforded your account, Wealthsimple Digital Assets (the company offering Wealthsimple Crypto) is registered as a restricted dealer in all jurisdictions of Canada except Quebec. In Quebec, the company is registered as a derivatives dealer.

Your Crypto assets (i.e. Bitcoin and Ethereum) are held in cold storage by Gemini Trust Company LLC. Gemini uses FIPS 140-2 Level 3-rated or higher hardware security modules (HSMs) and is subject to regulation by the New York Department of Financial Services.

Gemini has $200 million in cold storage insurance. Its CEO and President are the Winklevoss twins (co-founders of Facebook).

Pros of Wealthsimple Crypto

This account offers several benefits, including:

- You can sign up and create an account within minutes

- There are no account minimums, and you do not pay a fee to deposit or withdraw your funds

- Wealthsimple Crypto is regulated and owned by a reputable company

- The app offers instant trades and real-time quotes

- Their custodian, Gemini, is a trusted name in the cryptocurrency space

- Wealthsimple Trade and Wealthsimple Crypto are accessible through the same app, making life easier for you if you also plan to purchase stocks and ETFs using a discount brokerage platform.

- The platform is available in all 13 provinces and territories in Canada

Cons of Wealthsimple Crypto

The main downside of Wealthsimple Crypto is:

- Price spread is on the high side

How To Open an Account With Wealthsimple Crypto

To open an account, you must be at least 18 years of age, have a social insurance number, and be a resident of Canada.

If you are not already a Wealthsimple client, you will need to verify your identity in line with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) requirements.

3. Bitbuy

Bitbuy is a top-rated Cryptocurrency exchange in Canada that offers buy and sell trades in Bitcoin, Ethereum, Litecoin, Bitcoin Cash, EOS, XRP, Chainlink, Aave, Stellar, and many more. It was founded in 2016 and operates out of Toronto.

Getting started is a breeze. After creating an account, you can fund it using Interac e-transfer and bank wire to begin trading.

- Great for: Beginners and advanced traders.

- Coins offered: BTC, ETH, LTC, EOS, XLM, BCH, LINK, AAVE, and several others (40+).

- Account funding options: Interac e-transfer and bank wire.

- Trading fees: Up to 2% trading fee; free CAD deposits; fees vary for crypto and fiat withdrawals.

- App: Available on iOS and Android.

- Promotion: Get a $50 bonus when you open an account and make an initial deposit exceeding $250.

- Review: Read my detailed Bitbuy review.

Is Bitbuy Safe?

Bitbuy uses 2-factor authentication and SSL encryption to secure your account. It is registered with FINTRAC as a Money Service Business, and 90% of its coins are kept in cold storage.

Pros of Bitbuy

- Quick sign-up and instant verification

- Offers multiple coins

- Offers multiple trading platforms, including mobile and advanced trading tools for pros (including OTC trading)

- You can access various order types and real-time quotes

- Offers staking

- Welcome bonus

Cons of Bitbuy

- Your assets are not insured by CIPF or CDIC

- Does not support credit card funding

4. Newton

Newton is a cryptocurrency brokerage and one of the best platforms to buy bitcoin in Canada as a beginner. It is a Canada-based company and offers a wide selection of crypto assets to choose from.

Creating an account is easy, with instant verification for most registrants.

- Great for: Beginners

- Coins offered: 70+ coins, including many of the popular ones (Bitcoin, Ethereum, Axie Infinity, OMG Network, Avalanche, Decentraland, Hedera, UMA, Synthetix, and several others)

- Account funding options: Interac e-Transfer and bank wire

- Trading fees: The spread on buy and sell prices is up to 2.20%; fiat deposits and withdrawals are free

- App: Available on iOS and Android

- Promotion: Get a $25 bonus when you fund your account and trade at least $100 worth of crypto.

- Review: Newton crypto review.

Newton is constantly adding new coins, making it easy to buy less popular coins without joining a foreign-based platform.

Also, you can quickly move your crypto assets on Newton offline to your personal hardware wallet.

5. NDAX

The National Digital Asset Exchange (NDAX) offers an easy-to-use platform to trade 30+ cryptocurrencies in Canada. It is also one of the cheapest places to buy Bitcoin, with low trading fees.

The platform is available on all devices, and advanced traders can utilize its advanced charting tools and order types.

- Great for: Beginners and Advanced traders.

- Coins offered: 30+ types, including BTC, ETH, LTC, EOS, XRP, XLM, LINK, USDT, ADA, DOGE, UNI, COMP, AAVE, DOT, SHIB, FTM, LUNA, AVAX, MATIC, AXS, and more.

- Account funding options: Interac e-transfer, bank wire transfer, and bank draft.

- Trading fees: 0.20% for buy and sell trades; free fiat deposits; flat fee for CAD withdrawals; and there are varying fees for crypto withdrawals.

- App: Available on iOS and web interface on all devices.

- Promotion: Get $10 when you open and fund a new account with at least $100.

- Review: NDAX review.

Is NDAX Safe?

95% to 98% of the digital assets on NDAX are in cold storage, and the platform uses 2FA and SSL to protect your account. Multiple signatories are required to transfer funds out of cold storage.

NDAX is a registered Money Service Business and complies with rules set by FINTRAC.

Pros of NDAX

- Offers access to 30+ crypto coins

- Offers instant ID verification

- 24/7 access to customer support

- Access to advanced trading tools

Cons of NDAX

- Your securities are not protected by CIPF or CDIC

- It does not offer credit card funding

- There is a fee for some deposits and withdrawals

6. Crypto.com

Crypto.com is one of the world’s largest cryptocurrency exchanges, with over 10 million users in 90+ countries.

Based in Hong Kong, Crypto.com was founded in 2016 and supports 150+ coins, including all the popular ones and some lesser-known coins.

In addition to trading crypto, this platform has several other products, including its own line of metal Visa credit cards, Crypto Earn (stake coins and earn), crypto loans, margin trading, DeFi, NFTs, and derivatives trading for advanced traders.

- Great for: Experienced traders and those looking for a wide selection of digital assets

- Coins offered: 150+

- Trading fees: Varies depending on your membership tier level up to 0.40% (other fees may apply).

- Funding options: Cryptocurrency deposits, bank transfer, credit/debit card

- Security: 2FA, cold storage, encryption

- Promotion: Get a $25 bonus when you stake enough Crypto.com Coin (CRO) for a Crypto.com Visa credit card (Ruby Steel and up). You can also use this referral code (ypa22jvaeg)

- Review: Crypto.com review.

7. Coinbase

Coinbase is a cryptocurrency brokerage platform based in the United States and open to members from 102 countries.

It has over 1,000 employees, 35+ million users, and has traded more than $200 billion worth of cryptocurrency.

- Coins offered: Several popular coins (50+)

- Trading fees: Varies based on your location and include a spread (~0.50%), cost of funding option (up to 3.99%), and a Coinbase Fee for transactions below $200 (expensive)

- Funding options: Credit and debit card, bank account, wire transfer, and cryptocurrency

- Security: 98% cold storage, 2-step verification, hot wallet holdings are insured

Coinbase has a crypto exchange, Coinbase Pro, with lower trading fees, charting tools, and advanced options.

8. Bitcoin ATM

You can purchase Bitcoin at a vending machine specifically designed for buying and selling cryptocurrency. Generally, you should already have a Bitcoin address where your Bitcoin will be deposited, and you pay using cash.

Some Bitcoin ATMs also allow you to exchange Bitcoin for cash.

The commissions charged by Bitcoin ATMs are typically higher than what you’d pay on an exchange.

There are more than 1,800 Bitcoin ATMs in Canada. You can locate the ones in your area here.

Other Bitcoin Crypto Exchanges

You can also buy and sell Bitcoin in Canada using these crypto exchanges and trading platforms.

9. VirgoCX

VirgoCX is a cryptocurrency exchange in Canada that offers 60+ popular coins and various other crypto-related services. Trading fees are included in the price spread and are up to 2.50%. Crypto withdrawal fees vary. Get a $20 bonus when you deposit $100 or more.

10. Netcoins

This crypto brokerage supports 10+ coins and is owned by BIGG Digital Assets, a company that is listed on the CSE. The trading fee is 0.50%. Deposits are free, and crypto withdrawal fees vary. Get a $25 bonus when you trade $100 worth of crypto.

11. KuCoin

This exchange is available in more than 200 countries and has more than 10 million users. It offers advanced features and its own utility coin, KuCoin Shares. Trading fees on the platform are up 0.10%.

12. Paxful

This is a peer-to-peer platform for buying, selling, and trading various digital currencies, including bitcoin. Service fees are up to 5%.

13. LocalCryptos

This is another decentralized crypto P2P marketplace where you can buy and sell bitcoin, Ethereum, and other popular crypto coins directly with others. Fees are up to 0.75%.

14. Binance

Binance is one of the largest cryptocurrency exchanges in the world, with an average volume of $2 billion in trades per day. Note that it is no longer accepting new clients in Canada.

The company was founded by Changpeng Zhao and is based in Malta.

If you want an advanced cryptocurrency platform to buy bitcoin or one that makes it easy to trade hundreds of crypto pairs, this platform may work for you. It also offers a derivatives crypto market with futures contracts and options.

- Coins offered: 350+

- Trading fees: Depends on your membership tier; up to 0.1%

- Funding options: Cryptocurrency, Interac e-Transfer, debit card, credit card, third-party payments, bank deposit with SEPA

- Security: 2FA, Withdrawal Address Management, and cold storage

Binance also offers an OTC platform for large trades and has its own mobile wallet, Trust Wallet.

Bitcoin ETFs

You can gain exposure to Bitcoin by buying an ETF that holds the digital currency directly. This removes the need to store your Bitcoin on a hardware wallet and keeps your assets in a regulated brokerage.

The top bitcoin ETFs in Canada are:

15. Purpose Bitcoin ETF: This bitcoin ETF trades on the Toronto Stock Exchange (TSX) under the ticker BTCC. It has both hedged and non-hedged versions. The management fee is 1%.

16. Evolve Bitcoin ETF: Trades on the TSX under the ticker EBIT and has both Canadian and US dollar versions. The management fee is 0.75%.

17. CI Galaxy Bitcoin ETF: This bitcoin ETF is managed by CI Investments and Galaxy Digital Capital Management. Trades under the ticker BTCX and has a 0.40% management fee.

18. 3iQ CoinShares Bitcoin ETF: Offered by 3iQ and CoinShares, this bitcoin ETF trades under the ticker BTCQ and has a management fee of 1%.

19. NinePoint Bitcoin ETF: It is available in CAD and USD and trades as BITC on the TSX. The management fee for this bitcoin ETF is 0.70%.

20. Evolve Cryptocurrencies ETF: You can even gain exposure to Bitcoin and Ethereum using an ETF that holds both of them. A good option is the Evolve Cryptocurrencies ETF (ETC). It has a management fee of 0.75%.

Bitcoin Explained

Bitcoin is what comes to mind when you think about digital currencies. It is a cryptocurrency invented in 2008 by a person or group of persons known as Satoshi Nakamoto.

The ‘crypto’ in cryptocurrency refers to using cryptography to create new units of cryptocurrency and verify and secure transactions on the peer-to-peer network.

Since Bitcoin is decentralized, no Central Bank or intermediary is involved, and the system relies on technology and code. This decentralization has also made it a target of hackers, and it has been used to fund various illegal activities, including terrorism and money laundering.

New Bitcoin is created by Bitcoin miners who use high-speed computers to solve complex mathematical problems.

In exchange for adding new records to the public ledger (also called Blockchain) and verifying transactions in the network, a miner is rewarded with Bitcoin tokens.

The maximum amount of Bitcoin that can ever be mined is 21 million. You can purchase tiny units of Bitcoin, with the smallest amount equal to 0.00000001 BTC (also referred to as 1 Satoshi).

Bitcoin is traded under the symbol BTC or XBT, and its value changes throughout the day, similar to stock prices on an exchange.

The highest value of 1 Bitcoin was reached on November 10, 2021, when it sold for an all-time high of $68,789.63 USD.

How To Store Your Bitcoin

Bitcoin is stored in a wallet that can be installed on your computer or phone. You can also use a hardware wallet or even a paper wallet.

A wallet works like a traditional wallet or bank account and contains your private and public keys.

Your public key is the string of alphanumeric symbols you provide to someone who is sending you Bitcoin. Your private key is what gives you access to your coins, and you should guard it carefully.

If your private key is compromised, you can lose all your funds.

The four main types of Bitcoin wallets are:

- Desktop wallets

- Mobile wallets

- Web wallets

- Hardware wallets

Hardware wallets are offline (aka cold storage) and are the most secure type of wallet. They can be a bit expensive compared to software wallets.

You can also simply print off your private and public keys and corresponding QR codes on paper and store them safely.

Bitcoin trading platforms like Coinsmart, Wealthsimple Crypto, and NDAX keep your cryptocurrency in cold storage with their custodians or exchange partners.

Is Bitcoin Trading Legal in Canada?

It is legal to buy, sell, and spend Bitcoin in Canada. However, the Financial Consumer Agency of Canada wants you to know that Bitcoin and other cryptocurrencies are not legal tender in Canada.

Only banknotes issued by the Bank of Canada under the Bank of Canada Act and coins issued under the Royal Canadian Mint Act are considered to be legal tender.

This does not stop you from using Bitcoin to pay for goods and services wherever it is accepted as a means of payment.

Also, it is perfectly legal to buy and sell Bitcoin and make a profit or capital gain when you sell your coin for more than you paid for it.

If you are tech-savvy enough to indulge in Bitcoin mining, this activity is also legal in Canada. I should note that as the competition has increased over time, Bitcoin mining has become a lot more expensive.

Pros and Cons of Trading Bitcoin in Canada

There are many advantages and disadvantages of trading Bitcoin in Canada.

Pros of Bitcoin

- Bitcoin has the largest market capitalization among cryptocurrencies and is easy to buy and sell, i.e. it is liquid

- Its acceptance as a means of payment for goods and services has increased, and it has real-life utility. You can also exchange Bitcoin for fiat currencies, e.g. CAD, USD, EUR, GBP, and others

- You can make money trading Bitcoin if you buy low and sell high

- It has a finite supply which infers it should be able to hold intrinsic value over the long term. This also makes it less sensitive to inflation

- It is a decentralized system and is theoretically not subject to the whims and caprices of any Central Bank

- Bitcoin offers in-built privacy protections, and transactions are anonymous

Cons of Bitcoin

- The value of Bitcoin fluctuates wildly, and often there are no concrete fundamentals to explain the big movements in price

- Hackers can steal Bitcoin from wallets, especially those online. Stolen digital currencies are often not recoverable. You can also lose your keys and access to your coins

- There is limited regulatory oversight of digital currencies by the government. So, if you are a victim of fraud, you may have limited recourse to get your money back

- Your funds are not protected by Canada Deposit Insurance Corporation (CDIC) or the Canadian Investor Protection Fund (CIPF)

- There are lots of competing alternative coins (alt-coins), and many Initial Coin Offerings (ICOs) are introduced each day. As the numbers increase, Bitcoin becomes less dominant

- Bitcoin is not accepted as a means of payment by most businesses, and it is banned in a few countries

- Bitcoin mining uses a lot of electricity (energy) which is detrimental to the environment

Is Bitcoin Safe?

Bitcoin is a speculative investment, and you should not trade it using funds you cannot afford to lose.

Having lost thousands of dollars day-trading S&P 500, NASDAQ, and Dow Jones Industrial Average (DJIA) e-mini futures in the early 2000s, I’m no stranger to speculative investments and high-risk trading.

These days, only a negligible portion of my net worth goes towards non-traditional assets (e.g. Bitcoin and P2P lending). My portfolio is composed mainly of hassle-free one-ticket ETFs.

Bitcoin and other cryptocurrencies can make you a lot of money, but you can also lose 100% of your investments.

An excellent example of how this can happen is Quadriga. When this cryptocurrency exchange went belly-up in 2019 following the alleged death of its founder, Gerald Cotten, customers lost $215 million.

I lost approximately $600 or so in Ether when this happened.

In addition to unscrupulous exchanges, there is also a challenge with hackers who steal Bitcoin from exchanges through ransomware and other fraudulent means.

As per this Forbes article, over $4 billion worth of cryptocurrencies was stolen in the first half of 2019 alone.

It goes without saying that Bitcoin trading is a very risky venture and you should only invest in it after doing your due diligence.

To decrease the chances that you could lose your funds, use a regulated cryptocurrency trading platform and avoid leaving your Bitcoin in a hot wallet.

Bitcoin Taxation in Canada

Gains from cryptocurrency trading are taxable in Canada. As per the Canada Revenue Agency (CRA), cryptocurrency is treated as a commodity under the Income Tax Act.

How you report the gains or income from digital currencies depends on whether you are:

- Accepting payments in cryptocurrencies

- Trading cryptocurrencies, or

- Mining cryptocurrencies

Let us start with the business owner who accepts Bitcoin as a means of payment. In this case, the value of Bitcoin received is reported as business income for tax purposes.

To figure out the value of the transaction, you can use the exchange rate available at the time of the transaction in Canadian dollars.

If your business is registered to collect GST/HST, you must also collect and remit this tax amount.

Infrequent Bitcoin users may also have to pay taxes on Bitcoin usage.

For example, if you bought Bitcoin to pay for goods and services and it increases in value, you must declare a capital gain when you dispose of it. The same applies to buy-and-hold investors.

Capital gains are taxed differently from income. Only 50% of your gains are added to your taxable income for the year.

If you incur a loss, it is treated as a capital loss and can be offset against capital gains for the year or any of the preceding three years.

If CRA classifies you as a day trader based on the nature and frequency of your transactions, your profits may be taxable as business income.

Cryptocurrency miners who are deemed to be conducting a business will have to report profits as taxable income.

There are many angles to how the CRA considers cryptocurrency profits. For instance, taxable income or capital gains may also be generated when you exchange one cryptocurrency for another, e.g. Bitcoin for Ethereum.

You can check this CRA guide for more information.

How To Buy Bitcoin in Canada: CoinSmart vs Wealthsimple Crypto vs Bitbuy

| Features | Wealthsimple Crypto | Coinsmart | NDAX | Bitbuy |

|---|---|---|---|---|

| Cryptocurrency offered | BTC, ETH, UNI, AAVE, LTC, COMP, BCH, DOGE, CRV, KNC, BAL, SNX, MKR, YFI, BAT, BCH, & more (50+ types) | BTC, ETH, LTC, EOS, XRP, XLM, NEO, ADA, USDT, BCH, UNI, & more (16+ types) – now Bitbuy | BTC, ETH, LTC, EOS, XRP, XLM, LINK, USDT, ADA, DOGE, UNI, DOT, COMP, AAVE, & more | BTC, ETH, LTC, EOS, XRP, XLM, BCH, LINK, AAVE, & more |

| Funding methods | Bank transfer, crypto deposits | Interac e-Transfer, bank transfer, credit card, bank draft, crypto | Interac e-Transfer, bank draft, bank wire, crypto | Interac e-transfer; bank wire, crypto |

| Fiat currency accepted | CAD | CAD and USD | CAD | CAD |

| Cold wallet storage | Gemini Trust Company, LLC | Coinsmart | NDAX | Bitbuy |

| Trading fees | 1.5%-2% price spread; no deposit or withdrawal fees | 0.20% for CAD-crypto; free deposits; | 0.20% for trades; $4.99 flat fee for CAD withdrawals; crypto deposits are free | Up to 2% per trade; |

| Promotion | Get $25 when you join and deposit $150 or more | Get $50 when you sign up and deposit at least $200 | – | Get a $50 bonus with a minimum initial deposit of $250 |

| Other offerings | Robo-advisor and brokerage platform; high-interest savings account; tax software | Advanced charting and order types for advanced traders | Advanced charting and order types for advanced traders | Advanced charting for pro traders |

| Learn more | Learn more | Learn more | Learn more | Learn more |

*Terms and conditions apply.

Buy Bitcoin in Canada FAQ

The best crypto exchange to buy bitcoin in Canada is Bitbuy.

The top crypto trading app for beginners in Canada is Bitbuy. You can access advanced trading tools, order types, and low fees.

Before investing in bitcoin, you will need to open an account at an exchange or brokerage platform that supports it. Fund your account with fiat currency and place an order to buy bitcoin. You can leave your bitcoin on the exchange or move it offline to a hardware wallet.

You can either buy bitcoin directly or invest in bitcoin using a Bitcoin ETF. Bitcoin ETFs are sold on regular stock trading platforms.

Disclaimer: Cryptocurrency is a volatile and speculative investment. If you decide to invest, we recommend you do your own research and only commit funds you can afford to lose. The author may own one or more of the crypto assets mentioned in this article.

Hi Enoch! Hope all is well. I like the article. I only started investing in Crypto currencies in November of this year. You have all solid points, but some comments don’t make sense to me. Such as, “Bitcoin mining uses a lot of electricity (energy) which is detrimental to the environment”. I’d like to hear your facts on this and why it is not considered that banks, and their infrastructure, are exempt from getting such a comment made about them?

Also, ” it has been used to fund various illegal activities including terrorism and money laundering”. Again, it is as if you’re saying the general public are oblivious to these activities with fiat currency, and yet the moment they hear that something bad was funded by crypto currency they scorn it. I’m no economist, but I would like to know why this is included in your description of what Bitcoin is? This has nothing to do with what it is, however it just proves that it is as real as fiat currency in that the bad people of the world will use it for bad.

Case and Point: A company makes teddy bears to donate to sick children; A drug dealer places drugs in a teddy bear for distribution….

I don’t see how this has anything to do with what a Teddy Bear is intended for.

Can you hold Bitcoin funds in an RRSP? i.e. QBTC?

Or, is that not allowed according to the CRA?

Good question. I’m not 100% certain. Since it has been packaged as an ETF, I’d say yes, but will have to dig further. The QBTC has been on my radar as well, although, I am considering it for a non-registered account.

What kind of “how to buy bitcoin in canada” article doesn’t even cover which banks allow debit and/or credit card purchases to these registered crypto vendors? From what I can gather none of them do.

Bianance has Canada as a restricted country for a some time now. You might want to double check your research.

@Trudy: No, only Ontarians are prevented from using it for now.