This CoinSmart review covers how it works, assets offered, fees, pros and cons, whether it is safe, and how it compares to competitors like Bitbuy, NDAX, and Wealthsimple Crypto.

CoinSmart is one of the best cryptocurrency exchanges in Canada, offering easy access to cryptocurrency trading using Canadian dollars and other fiats.

While cryptocurrencies like Bitcoin and Ethereum have been around for a while, last year marked a new front in their popularity.

Digital currencies may be the future, or they may become obsolete just as fast as they have become popular. The jury is still out.

What is obvious is that Canadians no longer lack access to a cryptocurrency platform that is versatile enough for both beginners and experienced traders.

CoinSmart Canada Overview

Update: CoinSmart is now part of WonderFi and is not accepting new signups. If you’re looking for the best crypto experience in Canada, we recommend signing up for Bitbuy, a licensed Canadian cryptocurrency trading platform operated by the same parent company, WonderFi.

With Bitbuy, you will get access to an improved experience on the web and mobile, staking rewards, Private Wealth services, and an advanced trading interface. You can also buy and sell around 40 popular crypto assets.

Bitbuy offers our readers a $50 bonus when they sign up and make a first deposit of at least $250.

Bitbuy Crypto Exchange

Get a $50 bonus if your initial deposit exceeds $250

Trade approx. 40 coins

Great for new & advanced traders

0% to 2% trading fee

CoinSmart was founded in 2018 by Justin Hartzman and Jeremy Koven in Toronto. It caters to Canadians looking to trade various crypto assets using the Canadian dollar.

The platform is available in multiple European countries and accepts US dollars and Euros deposits.

In addition to its standard cryptocurrency trading services, CoinSmart offers Over-The-Counter trading services for large-volume traders and institutional investors.

CoinSmart offers user-friendly mobile apps for iOS and Android devices and is publicly traded on the NEO Exchange under the ticker SMRT.

The company recently joined the Travel Rule Universal Solution Technology (TRUST) to boost its anti-money laundering (AML) efforts.

CoinSmart – Summary of Features

- CoinSmart is now part of Bitbuy

- Access to 16 coins, including Bitcoin, Ethereum, Litecoin, Polkadot, Shiba Inu, Chainlink, Uniswap, Polygon, Avalanche, Solana, and more

- $50 welcome bonus

- One-click trading for beginners and access to advanced charting and order types for experienced traders

- 24/7 customer support

- SmartSecurity with over 95% of coins in cold storage and 2 Factor Authentication

- Competitive fees on deposits, withdrawals, and trading

- Registered Money Service Business (MSB) with FINTRAC

- Offers credit and debit card funding

- Multiple fiat currencies

How Does CoinSmart Work?

It is easy to get started on CoinSmart.

You can sign up here (including a $50 bonus when your first deposit is $250 or more) and provide the required registration details (name, email address, phone number, date of birth, and address).

The platform offers “instant verification” through Equifax, which means you can usually begin trading within minutes.

If they are unable to verify your identity instantly, you can upload some documents to have it done manually:

- Copy of your government-issued ID (front and back)

- A selfie with you holding the same ID and a piece of paper with the word “CoinSmart” and dated

- A copy of a recent utility bill with your name and address.

This documentation is required to comply with the KYC requirements of the Ontario Securities Commission.

You can fund your new account using Interac e-Transfer, electronic fund transfer, bank wire, cryptocurrency, and bank draft. You can also buy crypto using your credit card.

Crypto Assets on CoinSmart

You can trade the following coins on CoinSmart Canada:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- USD Coin (USDC)

- Bitcoin Cash (BCH)

- Stellar (XLM)

- Cardano (ADA)

- EOS

- NEO

- Polkadot

- Uniswap

- Shiba Inu

- Chainlink

- Polygon

- Avalanche

- Solana

CoinSmart Fees

The fees you pay each time you transact on a cryptocurrency exchange impact your investment returns.

The fees you pay when you buy/sell crypto, deposit fiat or crypto, and make withdrawals on CoinSmart are:

| Funding Method | Deposit | Withdrawal | Fees | Processing Time |

| Interac e-Transfer | $100 min; $10,000 max | $50 min; $9,999 max | 0$ fee on $2000+; 1.5% fee on $100-$1999 (deposits); 1% withdrawal | Same day |

| Bank wire | $10,000 min; $5 million max | $15,000 min; $5 million max | 0% fee for deposits; 1% fee for withdrawals ($15 minimum) | Same day for deposits; 1-5 days for withdrawals |

| Credit/Debit cards | $50 USD min; $10,000 USD max | N/A | Starting from 6.75% fee | Instant processing |

| Electronic Funds Transfer | N/A | $50 min; $15,000 max | 1% fee ($15 minimum) | 1-5 days processing |

Cryptocurrency withdrawals cost:

- BTC: 0.00025

- ETH: 0.003

- LTC: 0.001

- USDC: 10.00

- BCH: 0.0001

- ADA: 0.30

- NEO: 0.00

- EOS: 0.0005

- XLM: 0.00003

- DOT: 0.20

- SHIB: 1,000,000

- LINK: 0.8

- UNI: 1.5

- SOL: 0.01

- AVAX: 0.05

The trading commissions are straightforward.

When you trade between CAD and any cryptocurrency, a 0.20% fee is incurred. The same fee applies when you make a crypto asset trade that involves Bitcoin.

For trades between altcoins not involving Bitcoin, the trading fee is 0.30%.

Related: Bitbuy Canada Review.

Pros and Cons of CoinSmart

Pros

- Instant verification for new clients

- Deposits are credited on the same day it is received

- Versatile platform for beginners and pros

- 24/7 support available

- Competitive trading fees

- Has a referral program

- Publicly traded company

- Has apps for iOS and Android devices

- One of the best crypto exchanges in Canada

Cons

- Fiat withdrawals take 1-5 business days

Is CoinSmart Safe And Legit?

That said, CoinSmart is a legitimate company in Canada. As per the ‘security’ section on its website, it is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a Money Service Business.

To protect your coins from hackers, the company keeps most of them in cold wallets where they have no access to the internet. This practice is the industry- standard for ensuring crypto asset security, and CoinSmart uses Bitgo wallets.

Fiat currencies deposited by clients are held at Canadian banks.

Finally, you must set up Google 2 Factor Authentication and enter a 6-digit code anytime you log in to your account.

For more details about what the platform offers regarding protection for your account, the risks you take when you trade, and their privacy terms, check the CoinSmart website.

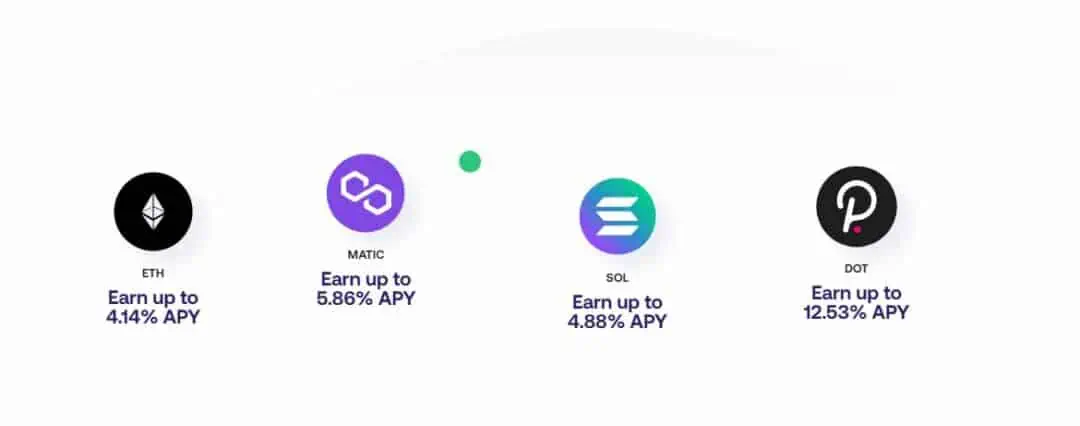

CoinSmart Staking

CoinSmart is introducing staking soon, as per its website, so that you can earn interest on your coin holdings.

CoinSmart Referral Program

CoinSmart has a referral program you can use to earn extra cash.

When a friend opens an account through your referral code or link, and they deposit at least $100, you both get $15 CAD.

The referral bonus is credited within five business days.

With our exclusive CoinSmart referral code, you receive a $50 welcome bonus after depositing $250 or more into your new account.

CoinSmart vs. Bitbuy vs. NDAX vs. Wealthsimple Crypto

How does CoinSmart compare to other cryptocurrency trading platforms in Canada?

| Features | CoinSmart | NDAX | Bitbuy | Wealthsimple Crypto |

| Coins Offered | BTC, ETH, LTC, USDC, BCH, XLM, ADA, DOT, EOS, UNI, SHIB, etc. Now a part of Bitbuy | BTC, ETH, XLM, LTC, EOS, LINK, USDT, DOGE, ADA, XRP, and more | BTC, ETH, LTC, BCH, XLM, EOS, AAVE, etc. | BTC, ETH, LTC, BCH, UNI, DOGE, and several other coins |

| Funding options | Interac e-Transfer, bank wire, bank draft, credit/debit card | Interac e-Transfer, bank draft, and bank wire | Interac e-Transfer; bank wire | Electronic fund transfer |

| Fees | 0.20% trading fees; some on deposits/withdrawals | 0.20% trading fee; free deposits; flat-rate fee for withdrawals | 0% to 2% trading fees; free fiat deposits | 1.5% trading fee; no commission on deposits and withdrawals |

| CIPF/CDIC insurance | No | No | No | No |

| Security | 95% cold storage; 2FA | 95% cold storage, 2FA | 90% cold storage; 2FA | Coin held with a regulated custodian – Gemini |

| Referral program | Yes | Yes | Yes | Yes |

| Learn more | Visit | Review | Review | Review |

Coinsmart Review FAQs

CoinSmart is one of the best crypto exchanges in Canada. It is registered with Canadian regulatory authorities, including FINTRAC. It uses some of the best security measures to protect your account.

Cash withdrawals from CoinSmart take 1 to 5 business days. Crypto withdrawals are much faster.

CoinSmart is based in Toronto, Canada. It operates in Canada and several European countries.

Yes, CoinSmart has delisted Ripple XRP, and you can no longer trade it on the platform.

Yes, you can use CoinSmart crypto wallets to hold your crypto assets, including BTC, ETH, SOL, AVAX, and several others.

Disclaimer: Cryptocurrency is a volatile and speculative investment. If you decide to invest, we recommend you do your own research and only commit funds you can afford to lose. The author may own one or more of the crypto assets mentioned in this article.

CoinSmart review 2022

Overall

Summary

You can use CoinSmart to buy cryptocurrencies like Bitcoin, Ethereum, Litecoin, Solana, Tether, Uniswap, Polkadot, and Bitcoin Cash in Canada. This CoinSmart review covers what you need to know about the platform.

Pros

- Instant verification for new clients

- Fast deposits

- Beginner-friendly platform

- Advanced technical tools for pros

- 24/7 live support available

- Competitive trading fees

- Referral bonus

- Mobile app

Cons

- Fiat withdrawals take 1-5 business days