Key Takeaways

- Moka helps you save money and improve your finances by taking your spare change and investing it in a diversified portfolio.

- At only $15 per month, Moka 360 offers additional benefits like helping you with debt repayment, bill negotiation, financial coaching, and more..

- You can also earn double the cash back and discounts from brands like Ubereats, HelloFresh, Apple Music, and Warby Parker, and get a refund if you don’t get value for your money.

The Moka app allows you to start investing for your future, even if all you can spare is loose change.

Like Acorns in the United States and Wealthsimple Roundup in Canada, Moka automatically rounds up your purchases and invests the difference in a diversified investment portfolio.

After rebranding from Mylo to Moka in 2020, the app now also offers a premium service referred to as Moka 360.

This personalized financial service helps Canadians to earn cash back, pay off debt, save on everyday bills, and access unbiased financial advice.

If you have heard of the Trim Financial app in the U.S., Moka 360 is similar and offers more features. Simply put, it works like your personal financial assistant and comes with a remarkable guarantee.

This Moka 360 review covers its benefits, fees, downsides, and everything else you need to know.

Related: Moka Investing App Review.

How Does Moka Work?

The Moka app is your quintessential spare charge investing app.

When you sign up for an account and connect your bank account, Moka rounds up your purchases to the nearest dollar and invests the difference on your behalf.

It is that simple.

You can create financial goals, e.g. retirement savings, round up your spending and invest the difference, and/or invest lump sum deposits or multiples of your round-up.

Your funds are invested using low-cost ETF portfolios that are designed to fit your risk tolerance and investment objectives.

You can invest using non-registered, TFSA, or RRSP accounts. Socially Responsible Investing options are also available.

A regular Moka account also offers:

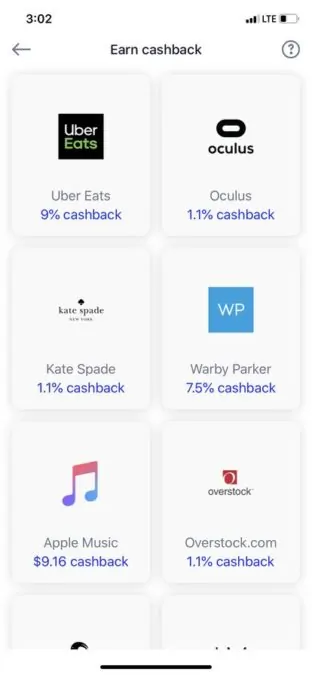

Cash Back: When you shop at participating retailers through the app, you earn cash back and discounts. Some of the offers available at the time of this writing include:

- UberEats: 9%

- Apple Music: $9.16

- Warby Parker: 7.5%

- Oculus: 1.1%

Also known as Perks, you can claim cash back offers multiple times. The cash back earned goes towards meeting your financial goals.

Referral Rewards: Moka users can invite their friends and family members to sign up and start saving. When they join using your Moka referral link, you both get a $5 bonus.

Related: How To Invest in Canada.

What is Moka 360?

Moka 360 is a premium service that takes your financial planning to another level.

As per its name, this service aims to give you a well-rounded grasp of your finances, including savings, investing, debt management, and more.

How Does Moka 360 Work?

Here’s what you get:

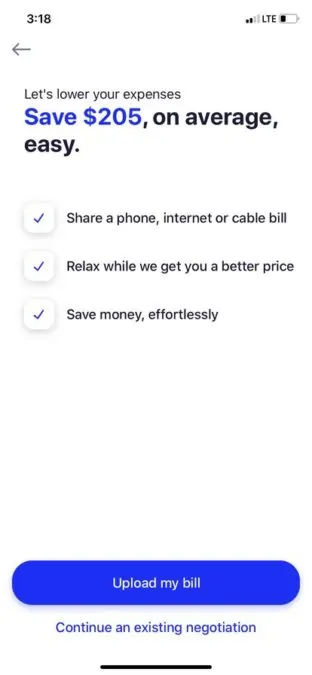

Bill Negotiation: Moka 360 helps you to negotiate a lower monthly bill for things like your internet, cable, and phone service.

Simply upload your current bill, and Moka will do the rest. It is estimated that the average user saves $205 on average through bill negotiation each year.

You may even be able to add on extra services or features for a lower cost.

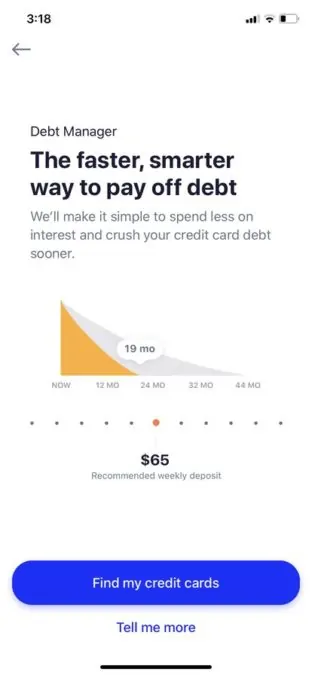

Debt Repayment: If you are struggling to pay off credit card debt, Moka 360 simplifies the process by helping you to set up a repayment plan that saves you money in the long run. You also become debt-free faster.

Have you heard about the Debt Avalanche method of debt repayment? Moka 360 helps you to implement it automatically.

As per Moka, you could save up to $1,400 per year using this feature alone.

Double Cash Back Earnings: You earn double the cash back as a Moka 360 subscriber. For example, if the regular cash back offer is 5%, Moka 360 doubles it up, giving you 10% back.

More importantly, you can use an offer as often as you want while it is live on the app.

Financial Coaching: Perhaps the most worthwhile offering by Moka 360 is access to advice from a financial coach.

Have a question about your finances? Simply ask it in the app, and a financial expert will give you answers.

What does Moka Cost?

How much do you pay in fees to use Moka? For a regular Moka account, the fee is $4.99 per month, and this includes automated investing and cash back features.

For Moka 360, the fee is $15 per month, and this service includes all the features of a regular Moka account, plus four others, i.e.

- Bill negotiation

- Debt repayment plan

- Double the cash back

- Access to financial coaching

Related: Best Stock Trading Apps in Canada.

Moka 360 Guarantee

Moka 360 is a bit pricy. At $180 per year, how are you certain you are getting value for your money?

Being highly cost-conscious myself, I took a look and liked that they provide a guarantee that I’d at least earn my fees back.

The Moka 360 guarantee offers a 200% money-back assurance as follows:

- If you don’t save at least what you paid in fees (i.e. $180 for a year), they will refund your fees, plus a $180 cash bonus.

Overall, you will get $360 back if the service doesn’t pay for itself. Note that to claim this guarantee, you must have subscribed to Moka 360 for at least 12 consecutive months.

Is the Moka App Safe?

Moka is a legitimate financial company backed by some of the largest financial institutions in Canada.

The app uses 256-bit encryption to protect your personal information, similar to what many other financial institutions and big banks use.

As for the money in your account, it is held by a custodian that is insured by the Canadian Investor Protection Fund (CIPF).

Downsides of the Moka App

- Moka 360 is expensive

- The investment service is limited to ETF products

- Debt repayment does not include credit building

Is Moka 360 Worth It?

I have been a user of Moka (formerly Mylo) since the summer of 2018 and find it a great way to invest without feeling the pinch.

If you want to save money effortlessly, this app does that for you.

If all you are investing is spare change, the monthly fees are a bit on the high side for a small account, and you may be able to cut your fees by using a no-minimum balance robo-advisor.

That said, if you plan on making regular lump-sum deposits and taking advantage of the cash back feature, it is definitely worth checking out.

I was recently offered a free Moka 360 account (for review) for one year, and I love the features it offers so far.

It is great that Moka 360 comes with a 200% money-back guarantee. If you don’t save at least the $180 you paid in fees, don’t hesitate to ask for a fee refund plus an extra $180!

Mylo 360 FAQs

Mylo was rebranded as Moka in 2020 after it launched in Europe (France).

You can send a withdrawal request within the app and specify how much you are withdrawing. There are no fees to take out money.

No. A standard Moka account costs $4.99 monthly, while Moka 360 has a $15 monthly fee.

In Canada, Moka and Wealthsimple Roundup offer micro-investing features. If you are looking at saving your loose change, the KOHO app also does that.

To close your account, email [email protected], and they will help you with your request.