If you are a resident of Manitoba and are having significant challenges with supporting yourself or your family, you may be eligible for the province’s Employment and Income Assistance (EIA) program.

EIA benefits are typically paid on the last week of each month. Combined with federal benefits such as the GST/HST credit and the Canada Child Benefit, families can earn $923 to $3,826 through EIA payments.

This article covers Manitoba EIA payment dates in detail, including the program’s categories, the amounts you can receive, and how to apply for the program.

Key Takeaways

- EIA payment dates apply to direct deposits. Cheques sent by mail may arrive a couple of days later.

- The EIA program has two active categories: EIA for single parents and EIA for general assistance. The eligibility requirements for each vary.

- The EIA program for individuals with disabilities has been converted to the Manitoba Disability Income Support Program, which pays higher benefits.

Manitoba EIA Payments Dates 2024

Manitoba welfare payments for 2024 are expected on these dates:

- January 29, 2024

- February 27, 2024

- March 27, 2024

- April 26, 2024

- May 29, 2024

- June 26, 2024

- July 29, 2024

These EIA payment dates apply to direct deposits. If you have not set up direct deposit payments, a cheque is sent in the mail and may arrive later.

In general, you can expect the funds in your bank account three business days before the end of each month.

Manitoba EIA Benefits for Single Parents

To qualify for EIA as a single parent, you must:

- Live in Manitoba and be 18 years or older

- Have custody of a dependant child or children, or be 7-9 months pregnant

- Be unmarried, separated, divorced, or widowed

- Meet the financial eligibility criteria (discussed later below)

How much will you get?

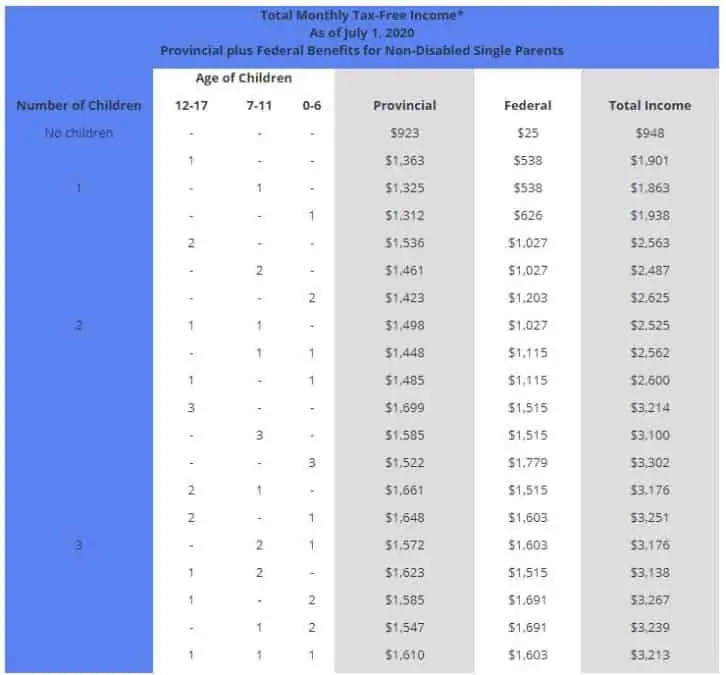

When provincial benefits (EIA and Rent Assist) and federal benefits (GST and HST Credit, Canada Child Benefit) are combined, you could receive the following amounts per month:

Manitoba EIA for Persons with Disabilities

The EIA program for persons with disabilities is being converted to the Manitoba Disability Income Support Program, which will pay higher benefits.

For the previous EIA service, individuals who are living with a disability may qualify for EIA if they:

- Live in Manitoba and are 18 years of age or older

- Have a mental or physical disability that is likely to last more than 90 days and the disability limits their ability to earn adequate income

- Meet the financial eligibility criteria

How much will you get?

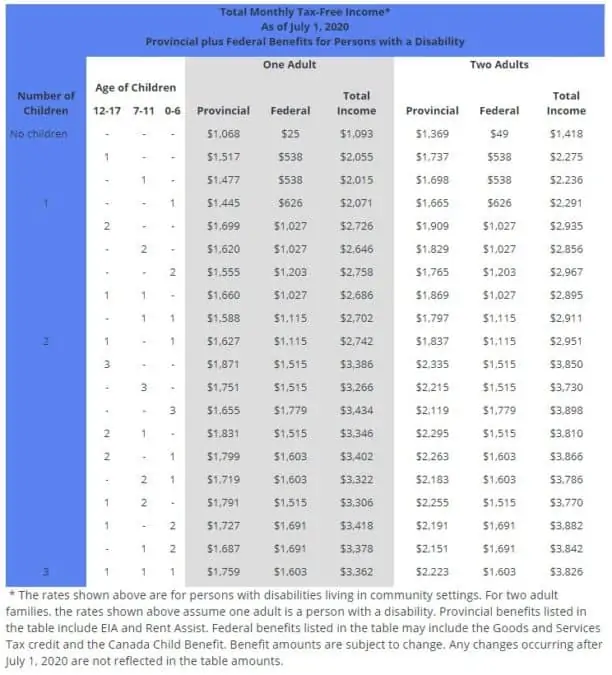

The combined provincial and federal benefits are shown in the table below.

Manitoba EIA for General Assistance

Manitobans can apply for EIA benefits in the general category if they meet the following requirements:

- Live in Manitoba and aged 18-65

- Do not have a disability and are either a single person without children or dependants; couple without children or dependants, or a two-parent family

- Meet the financial eligibility criteria

How much will you get?

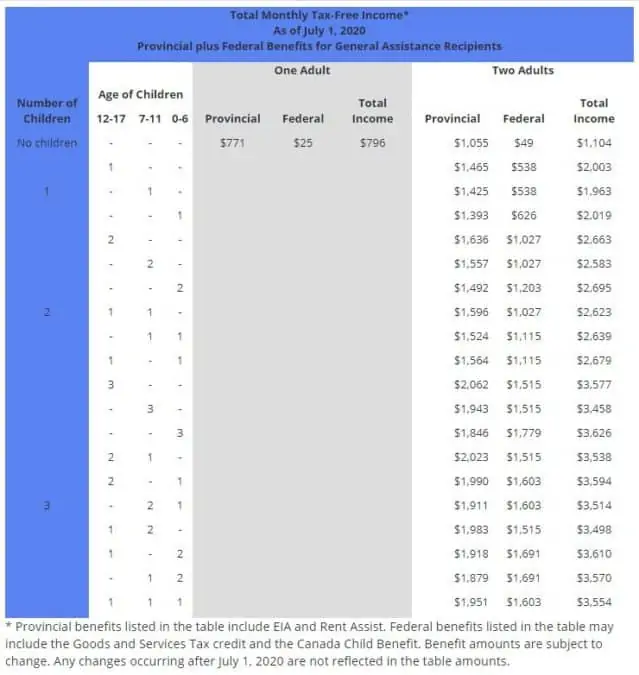

The income benefits for the current benefit payment period starting on July 1, 2020, are:

Manitoba EIA Explained

The Employment and Income Assistance Program provides money to low-income Manitobans who need financial assistance to meet their most basic needs.

In addition to providing money, i.e. income support, the program supports recipients in their search for employment and may also help with shelter depending on their circumstances.

When applying for EIA, you can do so under one of the following categories:

- EIA for single parents

- EIA for individuals with a disability

- EIA for general assistance

The eligibility requirements and income support provided vary based on the type of application you submit.

Related: Manitoba Tax Brackets and Rates.

EIA Financial Eligibility

To qualify for EIA, the cost of your basic monthly upkeep (or that of your family) must exceed your financial resources (income + assets).

When calculating how much money you need to cover basic needs, EIA looks at your family size, the age of family members, and how you are related to each other. The cost of ongoing medical care is also considered.

Income sources that impact your application include wages, child or spousal support payments, allowances, pensions, dividends interest income, inheritance, etc.

The following income sources are excluded: child benefit, tax credit refunds, RDSP withdrawals, foster home maintenance payments, gifts up to $100 ($500 if disabled), and a few others*.

Assets that impact your EIA eligibility include your investments, bank account balances, property, vehicles, collectibles, cash in hand, and insurance policies.

Assets such as your kid’s RESP account or trust funds (up to $40,000), money up to $4,000/person or $16,000 per family, and your main residence and vehicle.

When you start working, you can keep the first $200 in net monthly income, plus up to 30% of income earned exceeding $200 before your EIA benefit is reduced.

EIA Employment Assistance

EIA recipients are expected to find work unless deterred by a disability.

For those collecting EIA as single parents, this “work expectation” starts when all their children are at least 2 years old.

Recipients can access training programs and funding to cover childcare, telephone, and work-related expenses.

You may also get up to $25 per month to cover miscellaneous expenses and up to $100 per month if you work full-time.

When a single parent leaves EIA, they may be eligible for a health plan that covers prescription drugs, vision, and dental benefits for up to 2 years.

How To Apply for Manitoba EIA

You can apply for EIA online. After submitting your application, an EIA staff will contact you by phone to discuss further.

If you have questions, call 204-948-4000 (Winnipeg) or call toll-free at 1-855-944-8111 if you live outside Winnipeg.

EIA has offices in Winnipeg, Brandon, Beausejour, Selkirk, Portage La Prairie, Steinbach, Dauphin, Swan River, Flin Flon, The Pas, Morden, and Thompson.

You can view the address and phone numbers for these offices here. Email support is also available through [email protected].

If you are eligible for Rent Assist and EIA, both benefits are combined into one payment.

If your EIA application is rejected, you can submit an appeal to the Social Services Appeal Board within 30 days of the decision.

Manitoba Financial Benefits and Assistance Programs

In addition to EIA, low-income Manitobans may qualify for these benefits:

- Manitoba Child Benefit: Up to $420 per child per year ($35/month).

- Children’s Opti-Care Program: Available to families who receive the Manitoba Child Benefit. The cost of a child’s glasses may be covered up to $84 per child per year.

- Child Care Subsidy: Helps parents offset childcare costs (amount varies).

- Rent Assist: The maximum “rent assist” benefit is 75% of the median market rent.

- 55 PLUS Program: This benefit is paid every quarter to low-income Manitobans who are 55 or older. The maximum benefit is $161.80 for a single person or $173.90 per person in a married or common-law relationship.

- Manitoba Social Housing Program: This program provides subsidized housing to low-income residents.

For more information about these programs, visit the Manitoba Government’s website.

Related Reading:

your eia dates are only for regular eia and not disability

I applied for the Disability benefits.