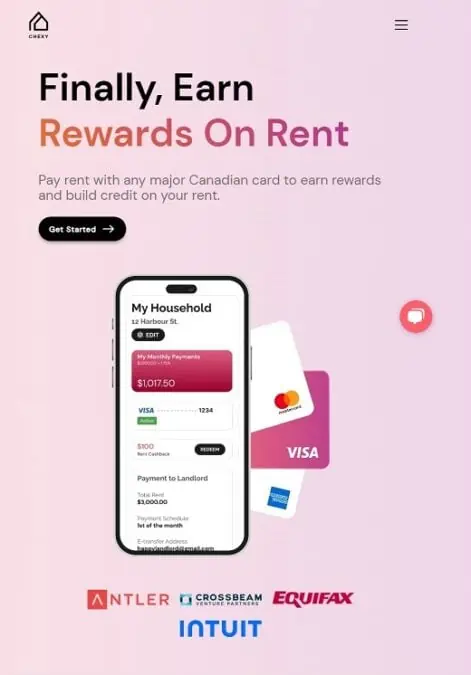

Paying rent with credit cards used to be unheard of. But with the Toronto, Ontario-based Chexy, you can now pay rent using credit cards and earn rewards.

Rent is a significant monthly expense. By using Chexy as a renter, you are able to leverage this payment to earn and build credit simultaneously.

In this Chexy Canada review, I will cover how Chexy works, its top features, and how Canadians can use it for credit building.

Key Takeaways

- Chexy is a tenant-facing payments platform that lets renters earn rewards and build credit on rent.

- The platform charges $1.75% of your rent for credit card payments and $1 per month for debit card payments.

- Chexy’s Credit Builder helps renters and newcomers to Canada build credit through rental payments.

What is Chexy?

Chexy is a tenant-facing payments platform that lets renters earn rewards and build credit on rent. Available everywhere in Canada, you can use it to pay your landlord using your credit card.

All you need to do is provide the required information (such as lease details, house address, landlord information, etc.) and credit card details each month. Chexy then makes an e-transfer to your landlord on rent day.

What differentiates Chexy from other online payment services is that it charges a lower fee – 1.75% versus 2.5% at third-party payment processors like Rentmoola – and offers features like the Rent Cashback program. Using Chexy requires no minimum term as well.

Currently, Chexy supports all major Canadian Visa and Mastercard credit cards and will soon support Amex.

Chexy Top Features

Chexy has some features that make it a unique platform renters can benefit from. Below are the top ones:

Rewards

Chexy Canada lets you earn rewards when you use your credit card to pay your rent. Your rewards will depend on the type of credit card you use.

Aside from credit card rewards, you can earn rewards in two main ways. The first is by connecting your preferred rewards card to pay your rent.

You can also earn Rent Cashback when you shop using the Chexy rewards marketplace. You can redeem your rewards against your next rent payment.

Another way is to refer a friend to pay their rent using Chexy.

Credit Builder Add-on

Credit Builder helps you build credit through on-time rent payments. Using this add-on helps build credit when you pay your rent promptly.

Chexy automatically reports your rent payments to Equifax each month, which the credit bureau adds to your credit report and uses in calculating your credit score.

As you maintain your on-time payments, your credit score improves faster. Over time, it will help you qualify for better loans, mortgages, and credit cards.

How Does Chexy Work for Renters?

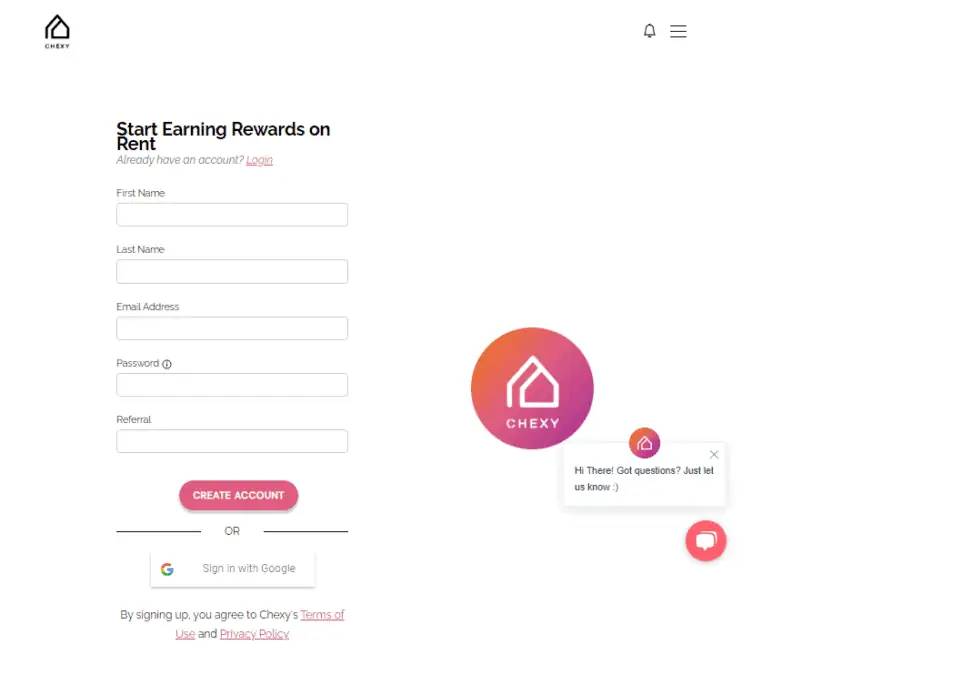

With Chexy, renters can easily pay their rent using a preferred credit card and earn rewards. To sign up at Chexy Canada:

- Go to the Chexy website and click “Get Started.”

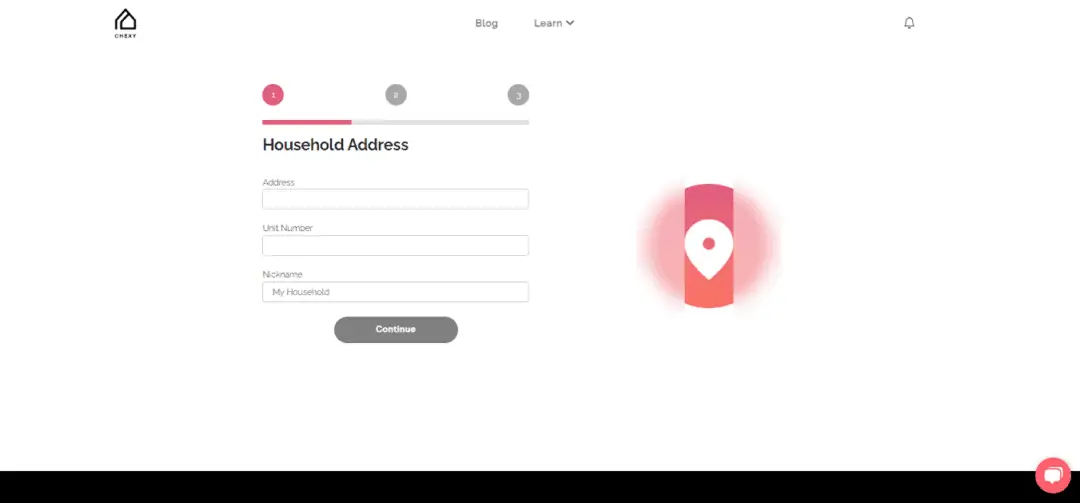

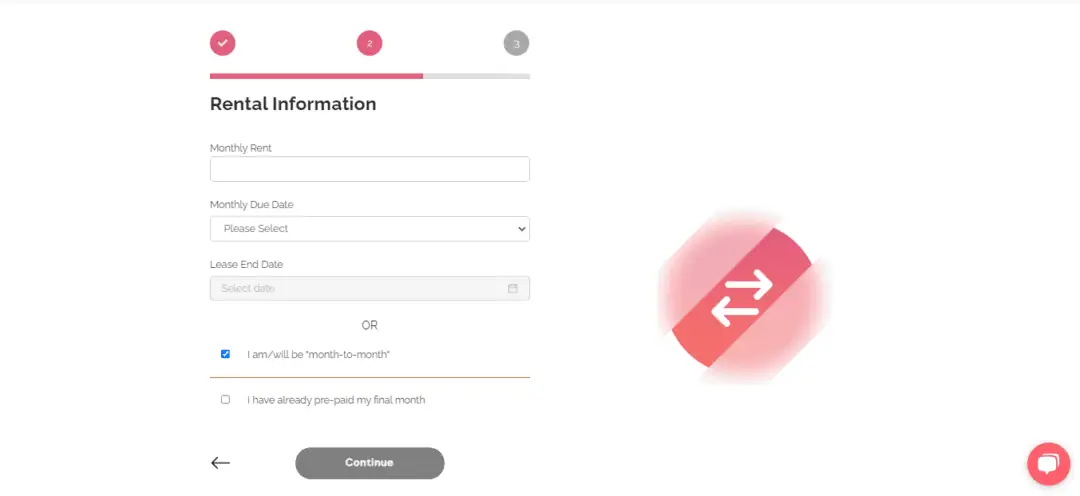

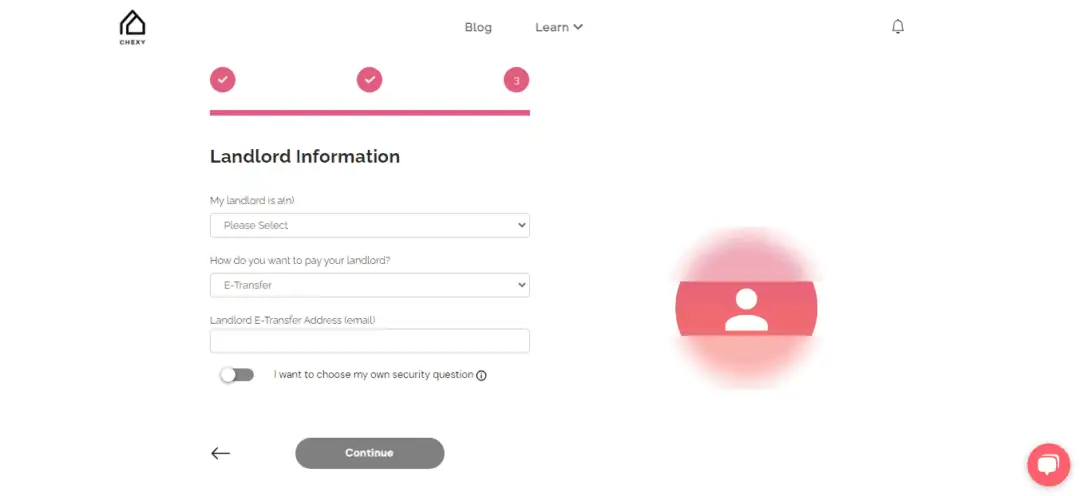

- Fill out the online form and provide the required details, such as household address, rental, and landlord information.

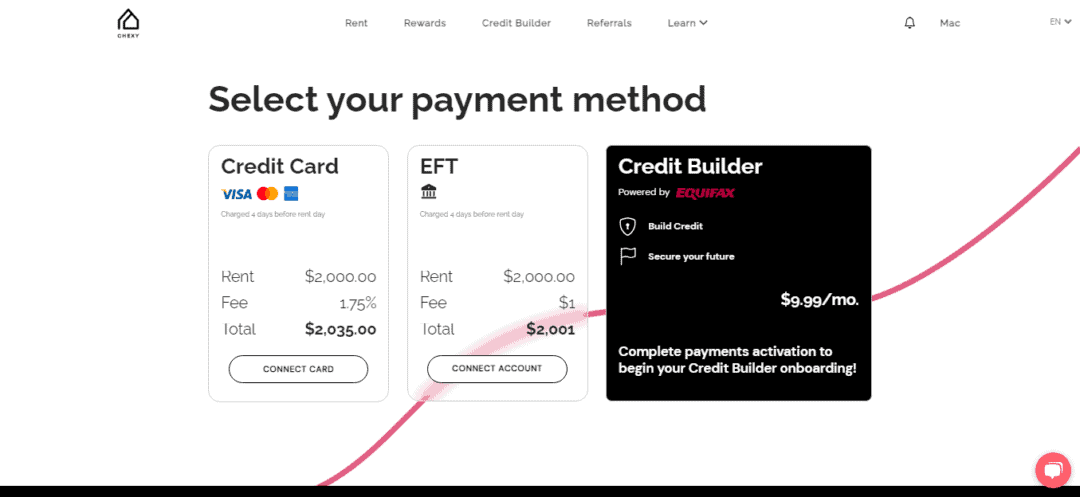

- Select your payment method and click “Connect Card.”

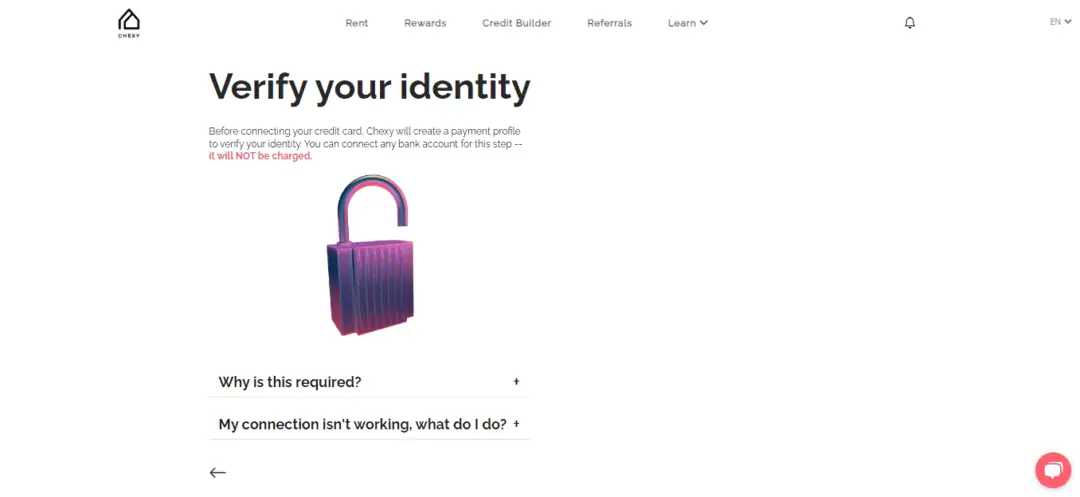

- Verify your identity to enable Chexy to create your payment profile.

- Click “Connect to my bank account” and enter your banking details.

- Complete the final check.

How Does Chexy Work for Landlords?

Chexy offers free and easy rent collection for landlords. It allows them to accept card payments for free while tenants pay $1 per month to use Chexy to pay their rent.

Through Chexy, landlords get the following benefits:

- Rental payments made directly through direct deposits or e-transfers

- Automatic recording of payments and generation of reports that landlords can download anytime

- Automated rental income reports for taxes

- Easy viewing of rental cash flows and delinquencies

- Tracker for rent increases and deposits

- Tenants auto-pay

- High daily limits

- Automated payment notifications and reminders

To use Chexy, landlords must sign up and invite their tenants to register. Once registered, they can easily keep track of rent payments through notifications.

If you are a landlord, you can use Chexy for landlords through these steps:

- Add your units to your portfolio and enter information about your leases.

- Provide your Interac e-transfer or direct deposit details to your account.

- Invite your tenants to use Chexy when paying rent.

This feature will be available in Fall 2023. Landlords who want to join the waitlist can sign up on this page.

How to Pay Rent Through Chexy

To pay rent through Chexy, follow these steps:

- Create your account at Chexy.co.

- Upload your lease. Provide information about your rent amount and due date.

- Connect your preferred Canadian Visa, Mastercard, Amex, or debit card.

- Set up your Credit Build subscription.

Once you complete the steps and link your preferred supported Canadian card, Chexy will charge your card monthly and e-transfer the rent amount to your landlord.

Chexy will automatically charge your card 4 days before rent day and send the payment to your landlord on rent day.

It will typically send the e-transfer on rent day at 12 PM EST. It may sometimes take up to a few hours, but delivery will be complete by 5 PM EST.

If your landlord does not have auto-deposit, provide your own security question and answer or have Chexy automatically generate it.

Chexy supports rent payments up to $10,000 per month.

Payment Options

Chexy gives you two payment options to pay your rent:

- Debit card. When you use a debit card with Chexy, the payment will be deducted directly from your chequing account. You will not, however, earn rewards or points from your card issuer since debit cards do not normally offer rewards programs.

- Credit card. When you use your credit card to pay rent through Chexy, you can earn points, cashback or other rewards. It also allows you to make automated payments, easily split payments with your roommate, and earn rent cashback with partner brands.

Every time you pay your rent using your credit card, Chexy will share your rent payment information with Canada’s largest credit bureau, Equifax, which will then include the data in credit reports and use it in calculating your credit scores.

What Rewards Can You Get with Chexy?

The rewards you earn will depend on the credit card you use to pay your rent. Choose from among the cards Chexy recommends for better rewards. Below are some of the recommended cards:

- American Express®* Aeroplan® Reserve Card

- Rewards on rent – Earn 1.25X the points with Chexy

- 3X Points – Earn 3 points for every $1 spend on Air Canada or Air Canada Vacations purchases*

- Access to Maple Leaf Lounge™* – Complimentary access to some Maple Leaf Lounges in North America

- American Express Cobalt® Card

- Rewards On Rent – Earn 1X the points with Chexy; use your points as a statement credit on any purchase

- Transfer your points to airline and hotel partners

- SimplyCash® Preferred Card from American Express

- Rewards On Rent – Earn 2% cash back with Chexy

- 4% cash back on gas purchases

- American Express online promotional offers

- Marriott Bonvoy® American Express®* Card

- Rewards On Rent – Earn 2X the points with Chexy

- Earn 2x the points on all other Card purchases*

- Enjoy an Annual Free Night Award after your Card anniversary each year*

How Much Can You Earn?

Below is a table showing your annual rewards for various Chexy-recommended credit cards, annual Chexy fees and how much you can earn if your monthly rental is $2,000.

| Credit Cards You Can Use | Annual Rewards | Annual Chexy Fee (1.75%) | How Much You Can Earn |

| Amex Platinum, Amex Green Card, Amex Gold, Amex Platinum | $528 | $420 | $108 |

| AMEX Aeroplan Reserve, TD Aeroplan Visa Infinite Privilege, CIBC Aeroplan Visa Infinite Privilege, AMEX Aeroplan Air Canada Airline Charge Cards, TD Aeroplan Visa Infinite | $504 | $420 | $84 |

| Scotia Momentum Visa Infinite, Scotia Platinum AMEX | $240 | $420 | -$180 |

| BMO Ascend World Elite Mastercard | $161 | $420 | -$259 |

| TD First Class Travel Visa Infinite | $120 | $420 | -$300 |

Chexy Fees

Chexy charges $1.75% of your rent for credit card payments and $1 per month for debit card payments. If you opt in to Credit Builder, the fee is $9.99.

Pros and Cons of Chexy

Pros

- Earn rewards when paying using your credit card

- The Rent Cashback program lets you earn cash back you can use for rent payments

- Low debit fees at $1 per month

- A referral program that lets you earn up to $2,000

- No need for landlords to sign up

- Uses rent payments and the Credit Builder to strengthen your credit profile

- Reinforces your creditworthiness over time

- Enhances your chances of securing future loans, mortgages and other financial products

Cons

- If you do not pay off your credit card balance in full each month, credit card interest fees can offset any rewards you earn from paying your rent using Chexy.

- Chexy charges $9.99 for its Credit Builder program.

- No option to pay using PayPal (for those who do not like sharing their credit card information)

- No mobile app

Is Chexy Legit?

Chexy is a legitimate service offering a tenant-facing payments platform enabling renters to make monthly rental payments through their credit cards like the Chexy AmEx, earn rewards and cash back, make automated payments, and build credit on their rent.

Based in Toronto, ON, Chexy Inc. was founded in 2022 by Lizaveta Akhvledziani (CEO), Abtine Monavvari (CPO), and Ben Gigone (CTO). Chexy’s funding came from investors like Crossbeam Ventures, Groundbreak Ventures, and Ferst Capital Partners.

Chexy support can be contacted through their support page.

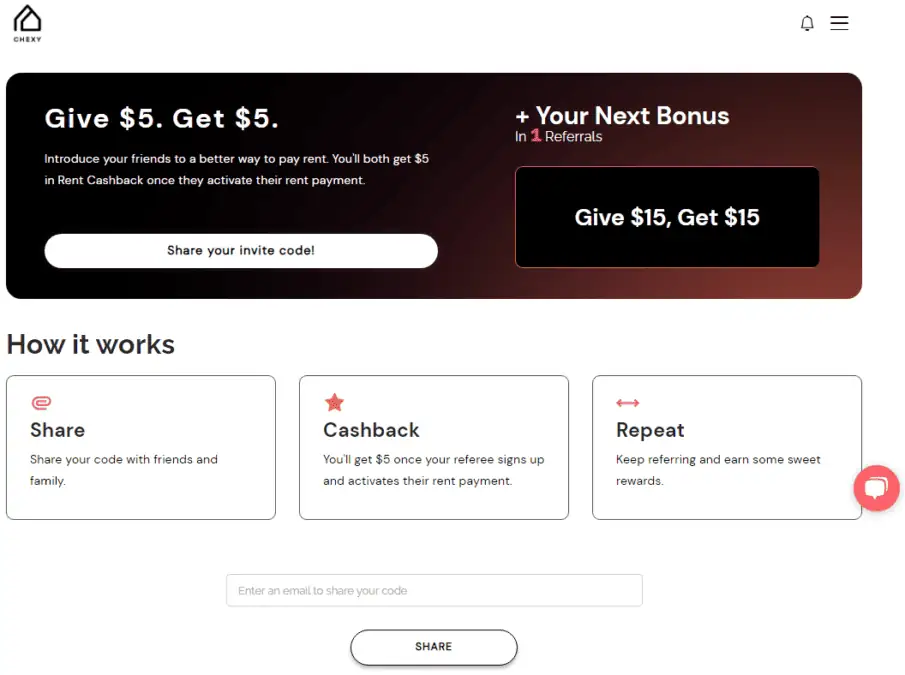

Chexy Referral Program

The Chexy referral program is a referral system that lets you earn rewards and cashback from paying rent through Chexy.

To join the program, create an account at Chexy and get a unique referral link and code to share with your family and friends using your personal dashboard.

After your referred friend or family creates an account and connects a payment method, you will both receive $5 in rent cashback.

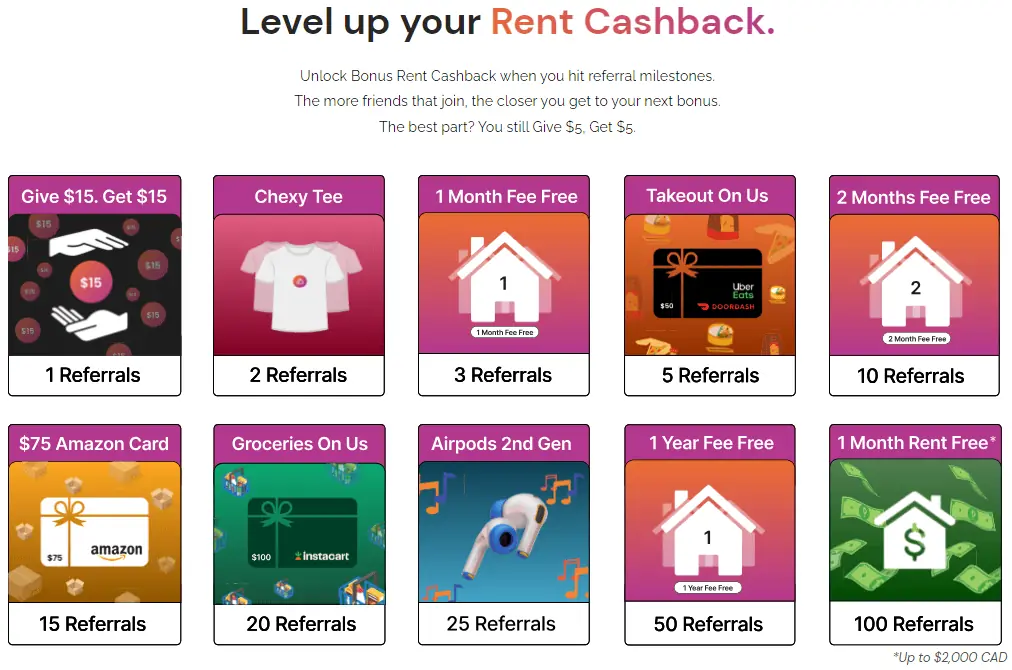

The referral system also comes with a milestones feature that provides added perks if you refer a particular number of friends:

After accumulating $10 in rent cashback, you can redeem it on your next month’s rent. Redeem the reward directly from your Chexy dashboard.

Whenever you reach each milestone, Chexy will give an additional rent cashback, in addition to the rent cashback you earn for every successful referral.

Is Chexy Worth It?

Chexy offers a platform that allows you to pay rent using your credit card, earn rewards on your monthly rent payments, and earn cash back.

If rent is one of your biggest expenses, Chexy would be a worthwhile platform to join. If you want to improve your credit score fast, the platform could be your way to work towards better credit.

More importantly, Chexy helps build your credit and improves your credit profile over time through full, on-time monthly payments.

So, is Chexy worth it?

Yes, if you pay rent and want to improve your credit profile through prompt and complete payments while earning cashback.

FAQs

You can pay rent using any major Canadian card if your landlord accepts it. Always remember to pay off your balance in full each month to avoid getting charged with interest on the balance.

If you prefer cashback instead of points, the American Express SimplyCash Preferred Card would make an excellent choice. It lets you earn 2% on rent payments, gives you a high earning rate on your daily purchases, 4% cash back on gas and groceries, and 2% on everything else.

It can positively or negatively impact your credit score, depending on whether you are actively reporting your rent payments to a credit bureau or if you have unpaid rent that goes to collections. If you make full and on-time payments every month, it will positively impact your credit score. Another way it can affect your credit score is through an increased credit utilization ratio, or your total debt compared with your total available credit.

While paying your mortgage using a credit card can earn you lots of points, it is not a common method. Most lenders do not accept it as a form of payment due to high merchant fees and because taking on more debt to pay a debt can be risky. That said, third-party payment services like PaySimply let you pay your mortgage using your credit card and charge a 2.5% fee on all credit card payments.

Isn’t this wrong? Scotiabank has 4% cashback and Chexy charges 1.75%… therefore we get 2.25% p/ month