With the launch of the Aeroplan program a few years ago, American Express introduced three new Amex Aeroplan credit cards.

One of these is the American Express Aeroplan Reserve Card, which is considered the top-of-the-line option with great travel perks and benefits.

This American Express Aeroplan Reserve Card review covers the benefits, Aeroplan rewards program, how to apply for the card, and alternatives.

American Express Aeroplan Reserve Card – At a Glance

American Express Aeroplan Reserve Card

Rewards: Earn 3x Aeroplan pts on Air Canada purchases; 2x pts dining & food delivery; 1.25x pts everywhere else.

Welcome offer: NA

Interest rates: 20.99% on purchases and 21.99% on cash advances.

Annual fee: $599

- $599 annual fee

- 20.99% interest rate on purchases

- 21.99% interest rate on funds advances

- Earn 3x Aeroplan points on eligible Air Canada purchases

- Earn 2x Aeroplan points on dining and food delivery purchases in Canada

- Earn 1.25x Aeroplan points on everything else

- Travel with Air Canada airport benefits

- Made with precision cut and engraved 13 g metal

American Express Aeroplan Reserve Card Benefits

The American Express Aeroplan Reserve Card Canada offers a series of welcome bonuses, which include:

- For each monthly billing period that you spend $2,000 or more, earn 7,500 Aeroplan points up to 45,000 points total (for the first 6 months).

- You get an extra 35,000 Aeroplan points when you spend $6,000 in net purchases between 13 and 16 months of Cardmembership.

- Earn 5,000 Aeroplan points for each Additional Aeroplan Reserve Card with an annual fee added to your account at the time of application up to a maximum of 2 approved Additional Cards. This can add up to 10,000 bonus points.

Other American Express Aeroplan Reserve Card benefits include:

Earn Points You Can Use to Travel

With this card, you’ll:

- Earn 3x the points on eligible Air Canada flights, vacations, hotels, and car rentals

- Earn 2x the points on eligible dining and food delivery purchases within Canada and eligible Rocky Mountaineer purchases

- Earn 1.25x the points on all other purchases

You can also pay with your American Express Aeroplan Reserve Card at over 150 eligible partners and 170 online retailers via the Aeroplan eStore to earn 2x the points.

Air Canada Travel Benefits

When you spend $25,000 before your card anniversary date, you’ll receive an Annual Worldwide Companion Pass, which allows you to buy an Air Canada economy class flight ticket for a companion at a set price from $99 to $599.

You and up to 8 people travelling on the same reservation get priority airport check-in, baggage handling, and boarding. As well, this card gives you access to select Air Canada Maple Leaf airport lounges and cafes in North America with a same-day departing ticket.

Airport Benefits

With Priority Pass, you get access to many airport lounges across the world, and you can also skip the line at security during peak hours by accessing the Priority Security Lane at Toronto Pearson International Airport.

Redeem Your Points

You can use your points on flights to over 200 destinations on Air Canada and over 1,300 destinations with airline partners.

You can also redeem for hotels, vacation packages, car rentals, and more.

Travel Insurance

Out-of-country/province emergency medical coverage – get coverage of up to $5,000,000 for the first 15 days of your trip while outside your Canadian province for eligible emergency medical expenses (for those under 65 years old).

Trip cancellation insurance – if you cancel your trip for an eligible reason before the date of departure, you’ll be reimbursed for the non-refundable portion of your travel arrangements (up to $1,500 per person, for a maximum of $3,000 for each insured person)

Flight delay insurance – if delayed or denied boarding for 4 hours or more, you can receive up to $1,000 in coverage for all expenses related to accommodation, dining, and sundry items purchased within 48 hours.

Hotel burglary insurance – if your accommodation is burglarized, you can get up to $1,000 in coverage against the loss of most personal items.

Stolen or lost baggage insurance – for checked-in or carry-on baggage and personal items, you will be covered for up to $1,000 for loss or damage.

Travel accident insurance – get up to $500,000 of Accidental Death and Dismemberment Insurance when you fully charge your tickets to your American Express Aeroplan Reserve Card.

Car rental theft and damage insurance – for car rentals of 48 days or less, you can be covered for up to $85,000 for theft, loss, and damage of the rental car.

Emergency assistance – eligible cardholders get access to worldwide emergency medical assistance services and legal referrals.

American Express Experiences and Events

With American Express, you get access to Front Of The Line Presale tickets and Reserved tickets to concerts, theatre productions, restaurants, and special events.

Get various special events and offers, such as advance movie screenings and theatre packages, as well as special access to food festivals, curated events, private shopping experiences, and exclusive online offers.

Shopping Coverage

Buyer’s Assurance Protection Plan – When charging eligible items to your American Express Aeroplan Reserve Card, your coverage can automatically extend the manufacturer’s original warranty up to one year.

Purchase Protection Plan – You will be insured for eligible items for 90 days from the date of the purchase if accidental damage or theft occurs (up to $1000).

Downsides of the American Express Aeroplan Reserve Card

The American Express Aeroplan Reserve Card has quite a high missed payment interest rate.

If you miss 2 payments within 12 months, it will increase to 25.99% for the next 12 billing periods. If you miss 3 payments within 12 months, the interest rate will increase to 28.99% for the next 12 billing periods.

Another downside is the American Express Aeroplan Reserve Card annual fee, which is $599 per year for a basic card and $199 for any supplemental cards.

How To Apply for the American Express Aeroplan Reserve Card

To apply for this card, click here.

You must:

- Be the age of majority in your province or territory

- Be a Canadian resident

- Have a Canadian credit file

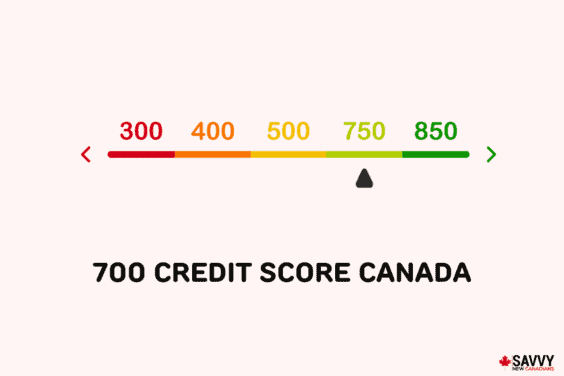

The American Express Aeroplan Reserve Card credit score requirement is 740+, which means you should have good to excellent standing credit for approval.

Aeroplan Rewards Program and How To Redeem Aeroplan Points

All the points you earn with your American Express Aeroplan Reserve Card can be redeemed on flight rewards, hotel bookings, car rentals, and more.

To redeem your Aeroplan points, you can do so on the Air Canada website.

Alternatives to the American Express Aeroplan Reserve Card

Other similar credit cards for earning and redeeming points include the following.

American Express Aeroplan Reserve Card vs. AMEX Cobalt Card

The AMEX Cobalt Card has a monthly fee of $12.99 with no cost for additional cards. The interest rate is 20.99% on purchases, and 21.99% on funds advances.

You earn:

- 5 points for every $1 spent at eligible restaurants, cafes, bars, and food delivery in Canada

- 3 points for every $1 spent on eligible streaming subscriptions in Canada

- 2 points for every $1 spent on eligible travel, transit, and gas purchases in Canada

- 1 point for every $1 spent on everything else

You can redeem your points towards any card purchases, flights through the Fixed Points Travel Program, Amazon.ca purchases, and gift cards and merchandise on membershiprewards.ca.

Learn more in our full review of the card.

American Express Cobalt Card

Rewards: Earn 5x pts per $1 spent on food & drinks; 3x pts on streaming subscriptions; 2x pts on travel; 1x pts everywhere else.

Welcome offer: Get up to 15,000 bonus points in the first year.

Interest rates: 20.99% on purchases and 21.99% on cash advances.

Annual fee: $155.88

American Express Aeroplan Reserve Card vs. American Express Platinum Card

The American Express Platinum Card is a credit card with no pre-set spending limit. It has a $799 annual fee, with a $250 annual fee for additional Platinum cards and a $0 to $50 annual fee for additional Gold cards.

You earn 2 points for every $1 spent on eligible dining and food delivery in Canada and 1 point for every $1 spent on all other purchases. You get 1 additional Membership Rewards point for every $1 spent on hotel or car rental bookings with American Express Travel.

Learn more in this review.

The American Express Platinum Card

Rewards: Earn 2 pts per $1 spent on dining & food delivery; 2pts per $1 spent on travel; 1pt/$1 everywhere else.

Welcome offer: NA

Interest rates: N/A. Check card details for penalty APRs.

Annual fee: $799

American Express Aeroplan Reserve Card vs. CIBC Aeroplan Visa Infinite Privilege Card

The CIBC Aeroplan Visa Infinite Privilege Card has a $599 annual fee with a $149 annual fee for each additional card.

The interest rate is 20.99% for purchases and 22.99% for cash. The minimum annual income to be eligible for this card is $150,000 per individual or $200,000 per household.

You earn:

- 1.5 points for every $1 spent on gas, groceries, dining, and travel

- 2 points for every $1 spent directly with Air Canada

- 1.25 points for every $1 spent on all other purchases

- 2x the points at over 150 Aeroplan partners and 170 online retailers through the Aeroplan eStore

Is the American Express Aeroplan Reserve Card For You?

If you love to travel and are a loyal Air Canada customer, the American Express Aeroplan Reserve Card might be for you. There is a generous welcome bonus along with many chances to earn and redeem Aeroplan points while travelling.

However, there is a steep annual fee, and you need to make sure you can pay your card on time every month. If you do not, your interest rate will increase for the next 12 months.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

Related:

- Tangerine Money-Back Credit Card vs BMO Cash Back Mastercard

- Instant Approval Credit Cards In Canada

- Vanilla Prepaid Card Review

American Express Aeroplan Reserve Card Review

Overall

Summary

The American Express Aeroplan Reserve Card is a premium metal travel credit card in Canada. This American Express Aeroplan Reserve Card review covers how it works, benefits, cons, and alternatives.