You can check your credit score for free online using the Loans Canada platform.

In addition, this loans comparison site allows you to compare rates for various types of personal and business loans.

Loans Canada Free Credit Score

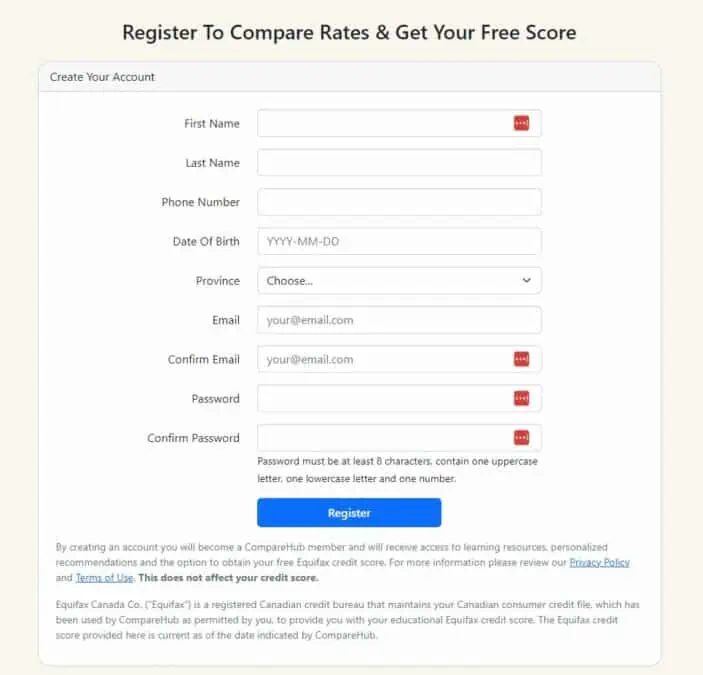

To access your Equifax credit score, create an account on CompareHub.

CompareHub is a Loans Canada service that is an authorized reseller of the Equifax Risk Score.

A free account gives you access to your free Equifax credit score. This credit check is a ‘soft check’ and does not impact your credit score.

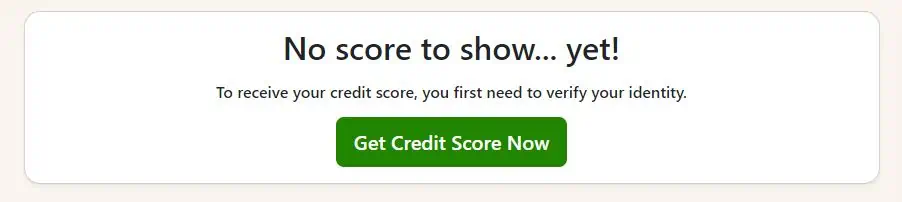

Verify your identity to access your score.

Your credit score will range between 300 and 900. A credit score of 300 to 559 is poor, 560 to 659 is fair, 660 to 724 is good, and 725 to 900 is very good to excellent.

A higher credit score makes it easy to qualify for credit at competitive terms.

On your dashboard, you can easily compare rates for personal, credit building, mortgage, debt relief, and auto loans.

Low Credit Score Loans in Canada

While it can be challenging to get a loan from Canadian banks if you have poor credit, these alternative lending platforms and loan comparison sites can help:

- Loans Canada

- Loanz

- Loan Connect

Loans Canada

Loans Canada is a loan comparison platform for all kinds of personal loans, car loans, debt consolidation loans, and bad credit loans. This company holds an A+ accreditation with the Better Business Bureau and features multiple lenders on its website.

Interest rate: 2.99% to 46.96%

Loan term: 3-60 months.

Maximum loan amount: Up to $50,000.

Eligibility: Resident of Canada and employed for at least 3 months with proof of income.

On Loans Canada’s website

How To Get Your Credit Report

Your credit report is compiled by TransUnion and Equifax.

TransUnion offers a credit monitoring service that gives access to your credit report and score. This service costs $24.95 monthly unless you reside in Quebec.

You can also request a free Consumer Disclosure document that includes all the information on your credit report. This document can be viewed or downloaded from TransUnion’s website.

Equifax now offers free online credit scores and reports to Canadians. If you want to add credit monitoring and identity theft protection, the service costs $24.95 monthly.

FAQs

You need a credit score of at least 660 to qualify for a regular loan. Borrowers with lower credit scores can still qualify for secured or bad credit loans.

You can get a perfect credit score of 900 by making payments on time, keeping a low credit utilization rate, leaving old credit accounts open and in good standing, and having a varied credit file.

The average Canadian credit score is around 650.

A bad credit score ranges from 300 to 559.

Related: