ClearScore provides access to free credit score checks in Canada, the United Kingdom, South Africa, New Zealand and Australia.

While you can get your credit score directly from a credit bureau like TransUnion for a fee, financial technology companies like ClearScore and Credit Karma offer this service free of charge.

In addition to providing free credit score updates, you can also use ClearScore to access your credit report and for identity protection monitoring. You’ll also get tips to help you improve and unlock better credit deals with lower interest rates.

This ClearScore Canada review covers how it works, and whether it is safe, legit, and accurate.

What is ClearScore Canada?

ClearScore expanded into the Canadian market in 2022 and now has over 90,000 users in the country.

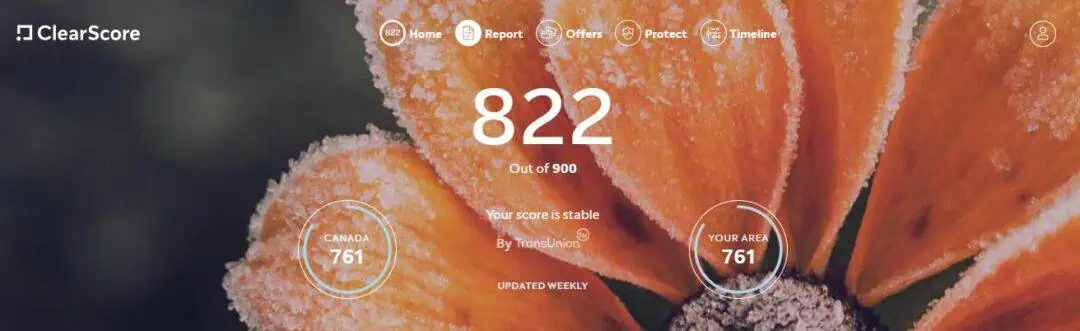

Users get access to their TransUnion credit score and credit report using ClearScore’s website or mobile app. This data is updated weekly, making it easy to track your score over time.

How ClearScore Credit Check Works

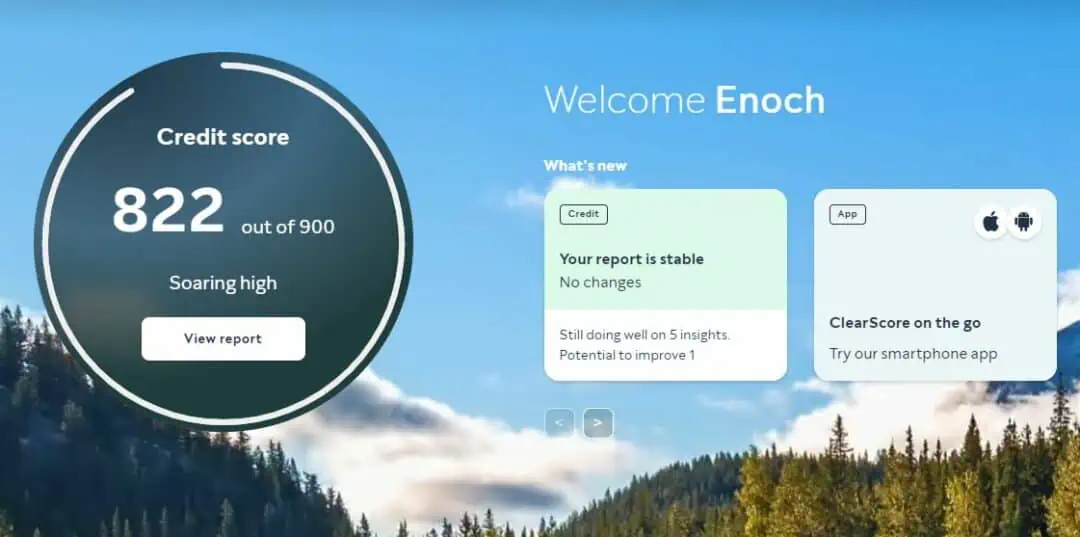

I signed up for ClearScore to assess how the platform works. Onboarding was easy and fast, taking me around 3 minutes from entering my email to seeing my credit score.

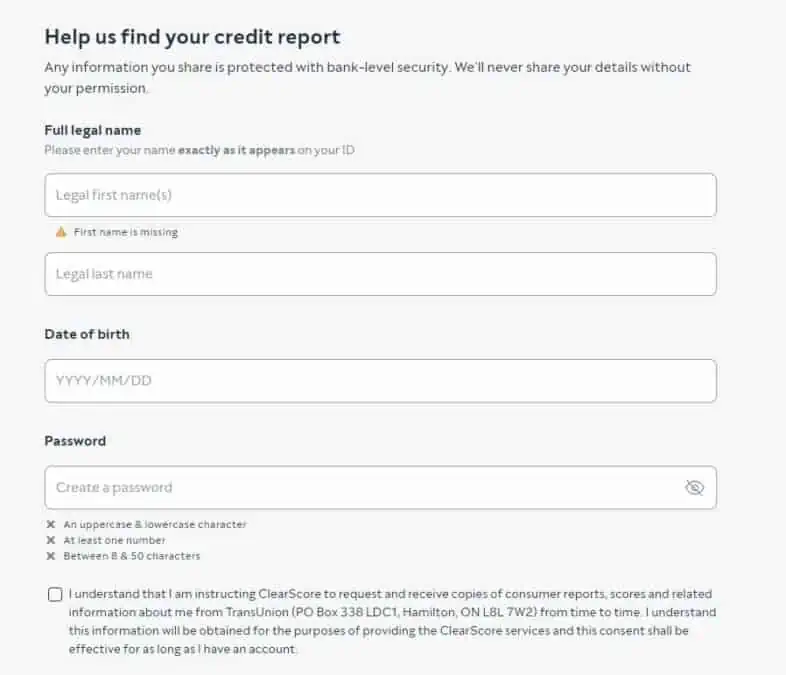

Below are the steps I followed to check my credit score on ClearScore:

Step 1: Entered my email on the sign up form at ClearScore.ca.

Step 2: I filled out the form with my name and date of birth and created a password.

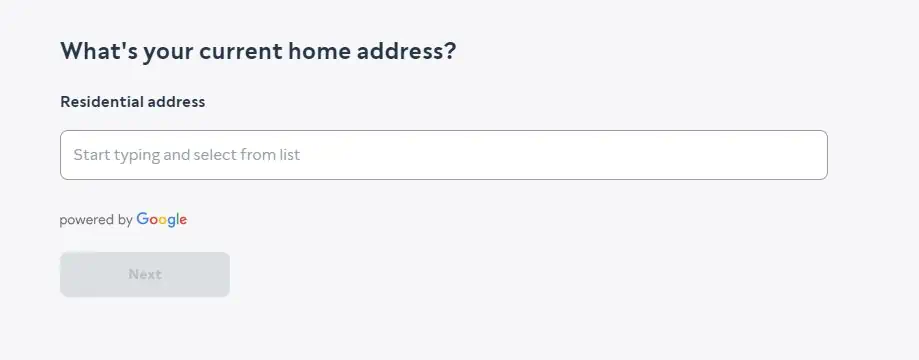

Step 3: I entered my home address and clicked on “Next.”

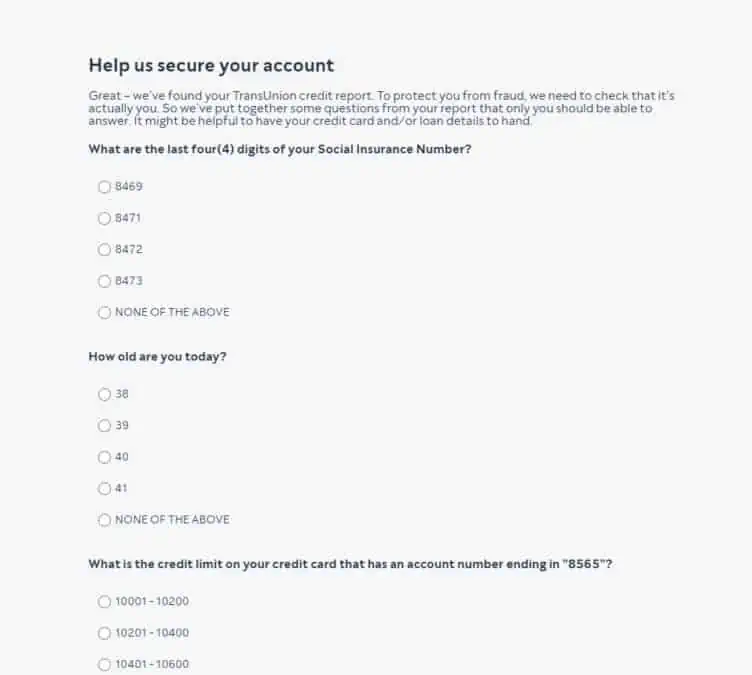

Step 4: I was required to answer a few questions to confirm my identity.

All done! I could now view my TransUnion score at 822 out of 900.

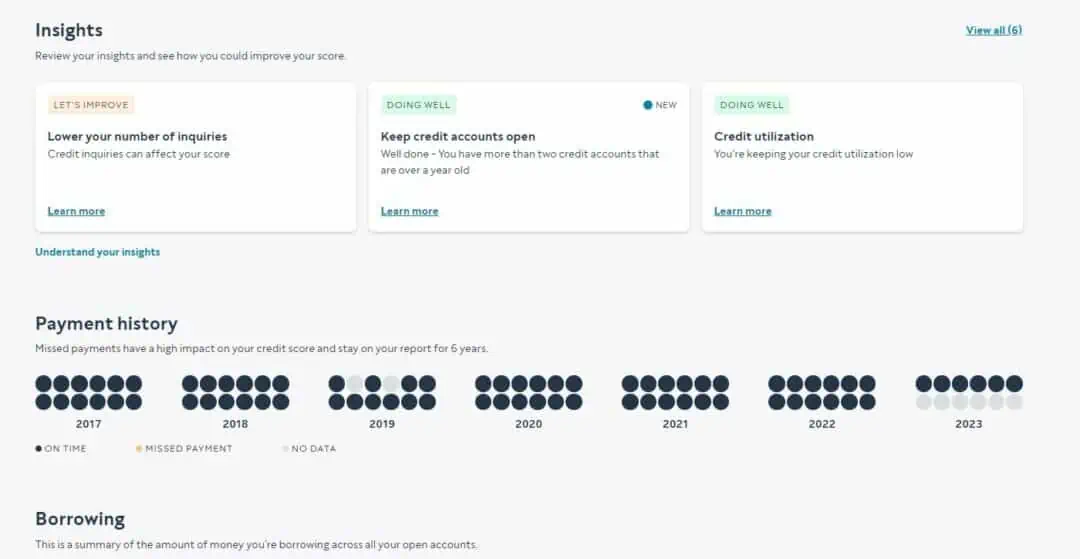

But that’s not all. ClearScore also provides a credit report showing credit inquiries impacting your score, open credit accounts, credit utilization, payment history, and more.

You can easily view the balances on your credit card and loan accounts.

At the top of the credit report page, ClearScore displays what I assume is the average credit score in Canada and your area. It is unclear if this is accurate, as I wouldn’t expect them to be the same.

ClearScore Identity Protection Monitoring

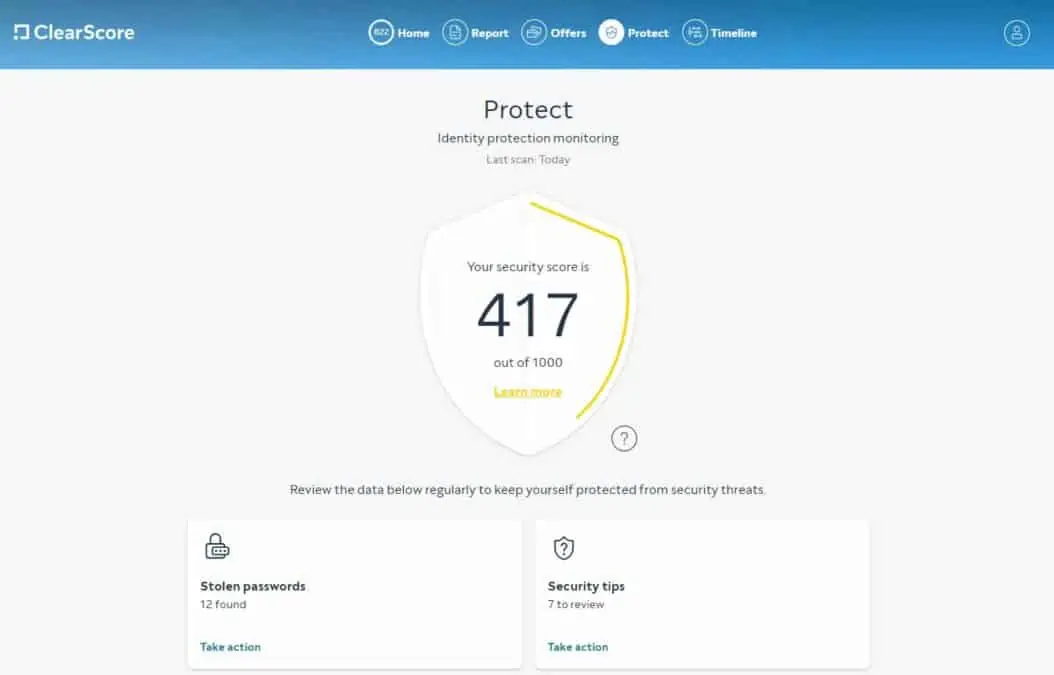

On your dashboard, navigate to the “Protect” tab to view your security score.

Here you will find details of your passwords that have been exposed in data breaches, security tips, and more.

ClearScore Offers

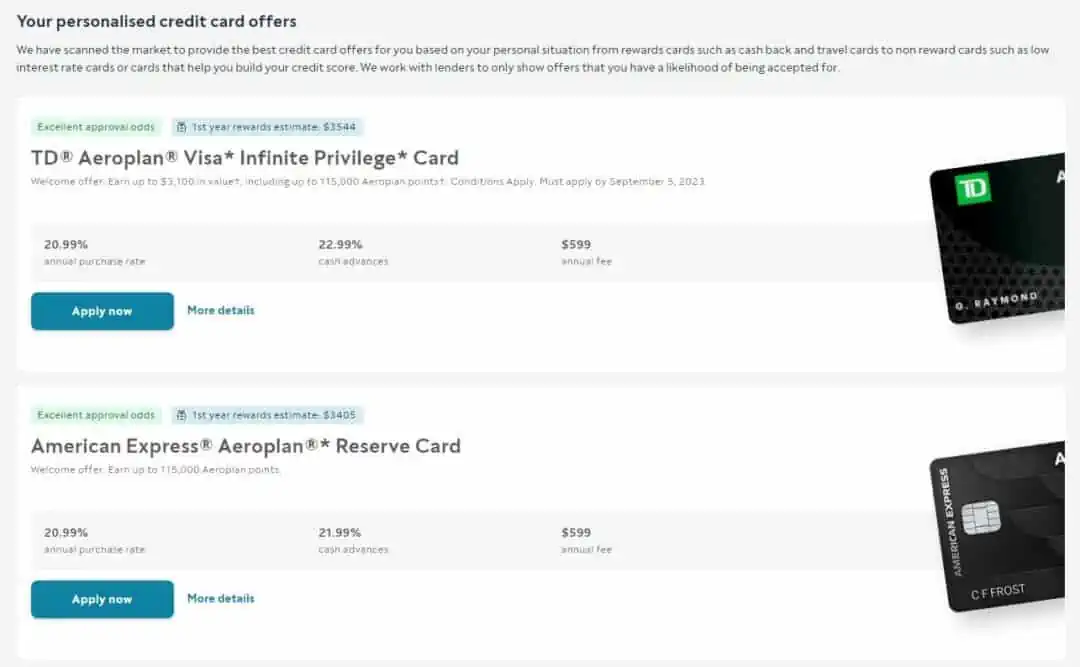

Check the ClearScore marketplace for offers you can qualify for. This page lists credit cards, loans, and mortgages from various lenders.

ClearScore uses your credit profile to find financial products that might be a good fit for you.

And on the offers page, products are ordered based on what you’re likely to be approved for and which ones offer the most value. You can also instantly see how much you will earn in everyday credit card rewards.

Is ClearScore Accurate?

The credit score provided to you by ClearScore is pulled directly from TransUnion, which is one of the main credit bureaus in Canada.

So, yes, your score on ClearScore is accurate. If you compare your credit score with what’s on Equifax, it may be different, as both TransUnion and Equifax use different scoring algorithms.

Is ClearScore Safe and Legit?

ClearScore is a legit company that provides free credit scores and reports. It operates in multiple countries and has more than 19 million users globally.

As per the company, it uses 256-bit encryption and bank-level security to protect your account.

It is also partnered with several leading financial institutions in Canada.

ClearScore’s registered office in Canada is at 199 Bay Street, Toronto, Ontario, M5L 1A9.

A Good ClearScore Score

The credit score you view on ClearScore Canada ranges between 300 and 900.

A credit score between 660 and 724 is considered “good,” 725-759 is “very good,” and 760 and above are “excellent.”

In general, credit score ranges are categorized as follows:

- 300 – 559: Poor

- 560 – 659: Fair

- 660 – 724: Good

- 725 – 759: Very Good

- 760 – 900: Excellent

ClearScore User Reviews

My first impression of ClearScore is positive and many other users seem to like it.

On Trustpilot, it has a 4.4/5 rating from over 10,500 reviews. On the App Store, it scores 4.7/5, and on the Google Play Store, it is 3.7/5.

ClearScore Alternatives

Borrowell, KOHO, and Loans Canada are the top alternatives you can consider when looking to access your credit score for free.

Borrowell vs ClearScore

Borrowell pulls your credit score from Equifax and updates it weekly. It is used by over 2 million people and also includes a marketplace to compare various credit products.

In addition to credit score checks, Borrowell offers a credit builder program that costs $10-$50 monthly.

Here’s a detailed review.

KOHO Credit Builder vs. ClearScore

KOHO is one of the best prepaid cards in Canada that offers up to 1% cashback on your purchases.

It has several plans, including a free account. In addition to earning cashback, you can add on the KOHO credit builder product to help you build credit history and improve your score.

This service costs $7-$10 monthly and also provides your updated Equifax credit score every month.

Loans Canada vs. ClearScore

Like Borrowell, Loans Canada provides free access to your Equifax score. You can also use the platform to compare loan rates from various lenders.

The Loans Canada platform is used by over 1.5 million Canadians. Learn more here.

ClearScore Summary

ClearScore gives over 19 million users access to their credit score and report online for free. It has mobile apps for iOS and Android devices and uses bank-level security to protect your personal information.

The company makes money by recommending credit cards, mortgages and loan products that match your credit profile.

Pros:

- ClearScore is free to use.

- Ongoing access to TransUnion credit score and report.

- Personalized credit offers.

- Free identity protection monitoring.

- Easy-to-use mobile app.

Cons:

- They send emails with credit card offers.

- Only shows a TransUnion score.

- Not available in Quebec.

ClearScore Canada FAQs

Yes, ClearScore is completely free to use in Canada.

No, the ClearScore credit score check in Canada is pulled from TransUnion.

No, using ClearScore Canada to check your credit information does not impact your credit score.

No, ClearScore pulls your credit history using a ‘soft check’, which won’t affect your credit rating.

Related: