Equifax is one of the two main credit bureaus in Canada.

Along with TransUnion, both credit reporting agencies aggregate consumer financial data into the credit report and credit score information used by banks, credit unions, insurance companies, and other financial institutions.

This Equifax Canada review covers its free credit report and score products, dispute process, credit monitoring, customer service, and more.

What is Equifax Canada?

Equifax is a credit bureau founded in 1899 in the United States. It operates in 25 countries and is traded on the New Your Stock Exchange under the “EFX” ticker symbol.

In addition to providing credit reports, Equifax helps businesses with financial marketing, identity and fraud solutions, and data analytics services. Its main competitors globally are TransUnion and Experian.

Equifax Canada Products and Services

Consumers can visit Equifax to access their:

- Credit score

- Credit report

And to sign up for credit monitoring.

Business clients get access to more than 70 products with coverage for various industries, including automotive, retail, insurance, credit unions, telecom, banks, and brokerages.

Equifax Canada Free Credit Report

You can access your Equifax credit report free of charge by creating an account online and verifying your identity.

This credit report is updated monthly and includes:

- Identity information: Name, date of birth, Social Insurance Number (SIN), employment, and address.

- Credit information: Payment history for each credit account you have opened, such as credit cards and personal loans.

- Credit inquiries: Including soft and hard inquiries. Soft inquiries are not visible to lenders.

- Public information: Bankruptcies, collections, court judgements, etc.

Equifax Free Credit Score

A credit score is a three-digit number that is a snapshot of your creditworthiness. Lenders use your credit score to assess how much risk they take when they grant you credit.

The credit score range for Equifax Canada is 300-900, and it is categorized as:

- Excellent credit score: 760+

- Very good credit score: 725 – 759

- Good credit score: 660 – 724

- Fair credit score: 560 – 659

- Poor credit score: 300 – 559

Equifax calculates your credit score based on several factors, including your payment history, credit utilization rate, length of your credit history, number of hard inquiries on your credit file, and the information available in public records.

Payment history has the most impact on your credit score at 35%, followed by your credit utilization ratio at around 30%.

Unlike TransUnion, you can access your credit score free of charge via Equifax in all Canadian provinces and Territories.

Equifax Canada Credit Monitoring

Equifax Canada has two credit monitoring products:

- Equifax Complete Premier, and

- Equifax Complete Friends and Family

| Features | Equifax Complete Premier | Equifax Complete Friends and Family |

| Monthly fee | $19.99 | $29.95 |

| Identity theft assistance/restoration | Yes | Yes |

| WebScan | Yes | Yes |

| Lost wallet assistance | Yes | Yes |

| Credit report monitoring (Equifax) | Yes | Yes |

| Credit score monitoring (Equifax) | Yes | Yes |

| Access to credit report | Daily | Daily |

| Access to credit score | Daily | Daily |

| Display credit score trend | Yes | Yes |

| Identity theft insurance | Up to $1 million | Up to $1 million |

| Includes second adult | No | Yes |

Equifax Canada Dispute Process

If you find inaccurate information on your Equifax credit report, you can file a dispute to have the information corrected.

The process takes 10-20 days, depending on whether you file your dispute electronically or by mail.

For online submissions, you can visit here.

For mail submissions, send your documentation to Equifax Canada Co., National Consumer Relations, Box 190, Montreal, Quebec H1S 2Z2.

You will need to provide documents to very your identity (such as a driver’s license), address (such as a utility bill), account details, and other supporting information (e.g. bankruptcy discharge or release letter from a collection agency).

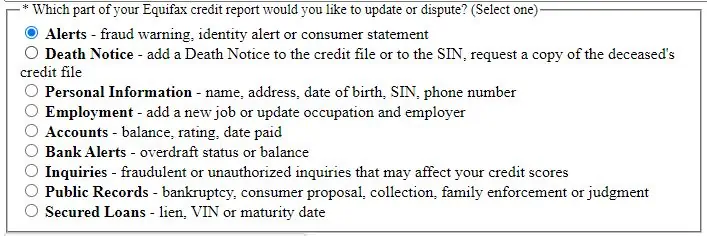

You should also indicate which part of your Equifax credit report is being disputed. The section you can choose from are:

The paper form for disputing inaccuracies can be found here.

How To Contact Equifax

You can contact Equifax by phone at 1-800-465-7166.

The company also has an office for in-person service at 5700 Yonge St. Concourse Level, Toronto, ON M2M 4K2 (temporarily closed).

Free Equifax Credit Score Checks in Canada

Financial institutions that provide access to free Equifax credit score checks are:

| Financial Institution | Update Frequency | Report and Score |

| Borrowell | Weekly | Yes |

| CIBC | Every 3 months | Score only |

| Loans Canada | Monthly | Score only |

Equifax vs. TransUnion Canada

Equifax and TransUnion are the two main credit bureaus for consumer credit reporting in Canada.

While Equifax offers free credit score checks, you can only access your TransUnion score directly by subscribing to its credit monitoring service.

Your Equifax and TransUnion credit scores may be different because they use different proprietary scoring models. And some financial institutions only report to one credit bureau.

FAQs

You can get your Equifax credit report and credit score for free in Canada.

Banks that use Equifax include BMO, Scotiabank, CIBC, TD, and HSBC.

TransUnion and Equifax use different scoring models, and your credit score from the two credit bureaus may vary.

A good Equifax credit score is 660 or higher.

The cost of Equifax’s credit monitoring service in Canada is $19.95 per month.

Related: