A Registered Educational Savings Plan (RESP) is a government program that enables parents to save for their child’s post-secondary education.

You can make three types of withdrawals from an RESP:

- Educational Assistance Payments (EAP)

- Refund of Contributions (ROC)

- Accumulated Income Payments (AIP)

Educational Assistance Payments

An EAP refers to funds (excluding original contributions) paid out of an RESP to students (beneficiaries) to assist them in paying for their post-secondary education.

Funds making up an RESP generally include:

Contribution Amounts: This refers to monies contributed to the plan. Contributions are made by a subscriber (e.g. parent) using after-tax funds and, as such, are deemed non-taxable at withdrawal.

Non-Contribution Amounts: This refers to monies in an RESP that are derived from government grants (CESG), government bonds (CLB), provincial grants, and accumulated income earned (interest, capital gains, and dividends) on the account. This portion of the RESP is tax-sheltered until withdrawal.

EAP payments are made from the non-contributory portion of the RESP and exclude all original contributions made to the plan.

RESP EAP Withdrawals and Limits

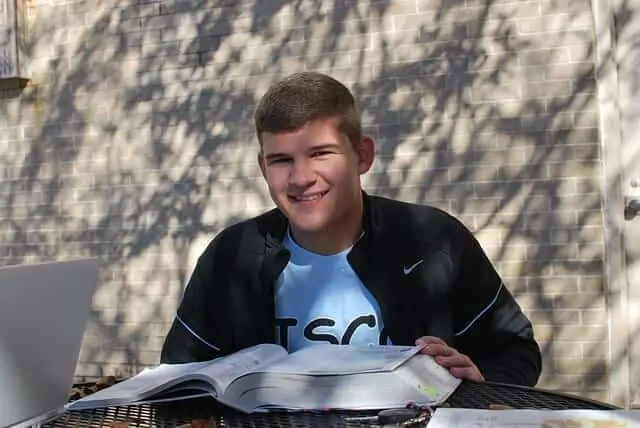

Following enrolling in a qualifying educational program and meeting other requirements, a student can start receiving educational assistance payments.

The educational program can be at a college, university, trade, vocational or technical school, or apprenticeship program.

RESP withdrawal rules set by the government for EAP withdrawals include:

- A student (beneficiary) can receive up to $5,000 during the first 13 weeks of enrollment in full-time studies.

- After the first 13 weeks of enrollment in full-time studies, EAP withdrawals are limited to an annual threshold limit of $26,860 (for 2023), provided that the student continues to qualify for the payment.

- If the student is not enrolled in a qualifying educational program for a 12-month period, the $5,000 limit once again applies.

- Students can receive up to $2,500 during the first 13 weeks of enrollment in part-time studies.

- Full-time studies in Canada must be at least 3 weeks long with 10 hours of classes per week. If outside Canada, it must be at least 3 weeks (University) or 13 weeks long (non-University) to qualify.

- There’s a lifetime limit of $7,200 in CESG funds per beneficiary.

Are Educational Assistance Payments Taxable?

When EAP monies are paid out to a student, they become taxable as they are derived from tax-sheltered funds (Grants, Bonds, Investment Income).

The bank or financial institution managing your RESP will issue your child a T4A slip which they will use in reporting the payments on their income tax return.

Since most students have little or no income, the EAP payments should result in very little or no taxes.

A bit about the other types of withdrawals that can be made from an RESP:

Refund of Contributions (ROC)

Parents can withdraw their direct contributions from the RESP at any time. Since the contributions were made using after-tax funds, they are not taxable upon withdrawal.

You can withdraw original contributions and add them to EAPs that go towards paying your child’s educational costs – only the EAP is taxed at the hands of your child.

When contributions are withdrawn, they are also referred to as Post-Secondary Education Payments (PSE).

Note: If the original contributions being withdrawn had generated a matching government grant, the grant must be repaid to the government (unless withdrawn by the child).

Accumulated Income Payments (AIP)

If your child does not utilize all the investment income earned on their RRSP, the remaining earnings can be paid out to you. Examples of scenarios when you can request an AIP withdrawal include:

- The RESP must have been open for at least 10 years, and the beneficiary must be at least 21 years old and not eligible to receive EAPs.

- The RESP is over 35 years old.

You can choose to receive an AIP as income or roll it over to your RRSP (or spousal RRSP). AIPs withdrawn as income are taxed at your marginal tax rate plus an additional 20% withholding tax (12% for Quebec residents).

Tax payable is much lower when you roll over AIP to your RRSP (up to $50,000), provided you have contribution room. You will be required to complete Form T1171. If you have specific questions regarding EAPs, please get in touch with Service Canada at 1-800-622-6232.

Concluding

RESPs are a great saving tool to lower the burden of ever-increasing post-secondary education tuition that your kids may incur in the future.

Matching government incentives (grant and bond) sweeten the deal by effectively giving you 20% or more in returns on your investment. These government incentives include the Canada Education Savings Grant (CESG) and Canada Learning Bond (CLB).

Also Read:

This topic hits close to home. I have my oldest is in second year university and the youngest will start next September. Tuition is $6400 per year books and the cost seem to rise faster than inflation. RESPs is a small way we can help are kids get a good start in life without a huge debt when they finish school.

@Steve. We still have ways to go before our kids go to university. However, I wonder what the tuition fees are going to be like then! That’s a lot of money, and I imagine that if they live away from home, that cost will greatly increase!

I believe in investing on education. This is one of the best things we can do for our children. I have a 5-yr old son and I am in my mid 40s. Looks like I have to put more on RESP if he were to go to university. I hope my current contribution amount keeps up with his education cost 10 or more years from now.

Hi Antonette!

Yes, education is a great way to invest in our children, and the RESP is a great way to save towards it. Tuition costs are definitely on the rise…hopefully, your RESP account does well and is able to cover most (if not all) of his tuition fees.

time to save more money for education of my younger brother now 🙂