Quick Answer

- The BC Income Assistance payments encompass both a “support allowance” and a “shelter allowance.” The amount you’ll receive for each depends on your family size and financial situation.

- Single individuals can receive up to $1,060 monthly from this program, while couples with no dependents can receive up to $1,650.

- Eligible recipients may also be eligible to receive financial support to cover expenses for essential needs such as bus passes, transportation, and health supplements.

Income assistance benefits in British Columbia are available to residents who need financial help and have no other resources to cover basic needs.

In addition to this financial support, eligible applicants can also access health coverage, supplements, and other supports.

This article covers the BC income assistance dates in 2024, how much you can get based on the current rates, and how to apply.

BC Income Assistance Payment Dates 2024

Income Assistance dates for BC in 2024 are:

| Benefit Month | Income Assistance Date |

| February 2024 | January 17, 2024 |

| March 2024 | February 14, 2024 |

| April | March 20, 2024 |

| May | April 17, 2024 |

| June | May 15, 2024 |

| July | June 19, 2024 |

| August | July 17, 2024 |

| September | August 21, 2024 |

| October | September 18, 2024 |

| November | October 23, 2024 |

| December | November 20, 2024 |

| January 2025 | December 18, 2024 |

These BC income assistance dates correspond with when benefits are deposited in your bank account if you are set up for direct deposits.

You receive payments on a Wednesday 1-2 weeks before the benefit month.

BC’s PWD disability benefit is also paid on these dates in 2024.

BC Income Assistance Cheque Dates 2024

You can also receive income assistance benefits by cheque. These cheques are delivered to your local Service BC office earlier.

Income assistance cheques are dated, so you can deposit them on the same day as direct deposits.

BC Income Assistance Explained

Income assistance programs in Canada are designed to provide financial support to those in dire financial need.

Also known as ‘welfare,’ these programs typically include access to:

- Financial support to pay for basic needs, such as food, shelter, and clothing

- Allowances that cover supplements and services that are needed to ensure the physical and social well-being of the recipient

- Employment supports

BC income assistance is paid out monthly.

Other provincial income assistance programs in BC include the Persons with Disabilities benefits (PWD) and the Persons with Persistent and Multiple Barriers to employment benefit (PPMB).

BC Income Assistance Benefits

Financial support is provided under “support allowance” and ‘shelter allowance”.

How much you receive in total will depend on your family situation, the age of your children, the type of shelter, and more.

In addition to support and shelter, eligible applicants can access general supplements and programs with coverage for:

- Bus passes

- Camp fees

- Christmas expenses

- Funeral costs

- Guide and service dogs

- Pet damage deposits

- Prenatal shelter

- Security deposits

- Transportation

- Travel

- Utility security deposits

- Co-op share purchase and more

Health supplements are also available to eligible recipients and may include coverage for:

- Alcohol and drug treatment

- Diet supplements

- Extended medical therapies

- Medical equipment

- Medical transportation

- Infant formula

- Optical services

- Pharmacare

- Tube feeding

- Dental and orthodontic services

- Alternative hearing assistance and more

Employment support is also provided through WorkBC Employment Services.

They assist clients in finding employment or increase their chances of becoming employed by providing access to training, etc.

When leaving assistance after getting a job, you may qualify to keep some benefits, such as dental and vision care for kids.

BC Income Assistance Amounts in 2024

The maximum financial benefit you can qualify for varies with the size of your family and your situation.

For example, a single person can receive up to $1,060. This amount includes $560 in support allowance and $500 in shelter allowance.

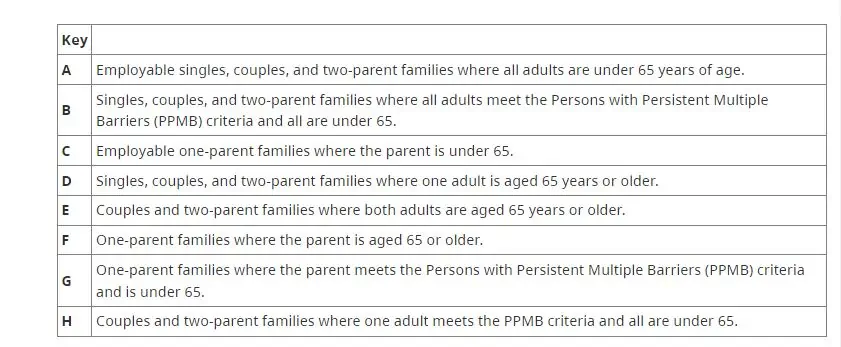

You can use the income assistance table rate below to estimate your benefit amount:

Support Allowance:

| Unit Size | A | B | C | D | E | F | G | H |

|---|---|---|---|---|---|---|---|---|

| 1 | $560 | $610 | N/A | $860 | N/A | N/A | N/A | N/A |

| 2 | $955 | $1,055 | $710 | $1,255 | $1,505 | $1,010 | $760 | $1,005 |

| 3 | $1,055 | $1,155 | $710 | $1,355 | $1,605 | $1,010 | $760 | $1,105 |

| 4 | $1,055 | $1,155 | $710 | $1,355 | $1,605 | $1,010 | $760 | $1,105 |

| 5 | $1,055 | $1,155 | $710 | $1,355 | $1,605 | $1,010 | $760 | $1,105 |

| 6 | $1,055 | $1,155 | $710 | $1,355 | $1,605 | $1,010 | $760 | $1,105 |

| 7 | $1,055 | $1,155 | $710 | $1,355 | $1,605 | $1,010 | $760 | $1,105 |

Shelter Allowance:

| Size of Family Unit | Minimum Shelter Allowance | Maximum Shelter Allowance |

|---|---|---|

| 1 person | $75 | $500 |

| 2 persons | $150 | $695 |

| 3 persons | $200 | $790 |

| 4 persons | $225 | $840 |

| 5 persons | $250 | $890 |

| 6 persons | $275 | $940 |

| 7 persons | $300 | $990 |

Families with children under age 19 may qualify for a monthly child benefits top-up supplement.

The minimum shelter allowance increases by an extra $25 for each additional dependent when the unit size exceeds 7.

And maximum shelter allowance benefits increase by an extra $50 for each additional dependent when the unit size exceeds 7.

As shown in the tables above, you can receive a maximum of:

- $1,060 if you are single

- $1,650 if you and your spouse are receiving income assistance and have no children

- $1,405 if you are a single parent with one child, etc.

BC Income Assistance Eligibility Requirements

You may be eligible for income assistance in BC if you can’t work, have lost your job, or are working, and your income is insufficient to cover your basic needs.

Assistance is also available if you need urgent access to food, shelter, or medical support.

If you are receiving income assistance for the first time, you will be required to actively search for work for at least 3 weeks. The same work search requirement applies to those who are returning to income assistance.

Work search requirements are waived in some cases, such as when there is a physical or mental condition that prevents a client from working or if a client is unable to work legally in Canada.

If you cannot find work, an intake worker will conduct an eligibility assessment to determine whether you qualify for income assistance.

If you don’t meet the eligibility requirements for income or disability assistance, you may still qualify for financial support. This month-to-month temporary benefit is referred to as “Hardship Assistance.”

How To Apply For BC Income Assistance

You can apply for BC income assistance online using the My Self Serve online portal.

Alternatively, you can visit your local ministry office or call 1-866-866-0800.

Offices are located in different communities, including:

- Vancouver

- Vancouver Island/Coast

- Lower Mainland/South Coast

- Fraser Valley

- Thompson-Okanagan/Kootenay

- Cariboo/Nechako/North Coast/Northeast regions

When applying, you will need to provide information about your income, assets, family, shelter costs, bank balance, debts, eligibility for EI, etc.

You should also have your social insurance number handy.

What if your Income Assistance Application is Denied?

If your income or disability assistance application is denied, you can request a reconsideration.

You have up to 20 days after a decision is made to file a reconsideration request. Contact your local office or call 1-866-866-0800 for the form.

If you disagree with the outcome following a reconsideration, you can file an appeal.

BC Income Assistance Increase in 2024

Income assistance and disability payments were increased in the 2021 budget, with a hike of $175 per month.

Eligible recipients also saw an increase in the BC Family Benefit in January, February and March 2023 by as much as $58.33 per child for each month.

Related: