In a previous article, I discussed how to open a TD e-Series Funds account and the pros and cons of using the e-Series funds. I have also summarized the basics of the Registered Education Savings Plan (RESP).

When we had our first kid, we immediately opened an RESP account for him with RBC and invested in their Select Balanced Portfolio fund. At this time (late 2013), I was not too concerned about high Management Expense Ratios (MER) because I was very busy tackling my veterinary board exams.

I needed to pass the notoriously tough and expensive exams (nine exams in all) in order to obtain a license to practice veterinary medicine in Canada (Haha! I digress, I will talk about these experiences another day!).

We had set up our first kid’s RESP with a $500 initial contribution and bi-weekly contributions of $60. The plan was to set up a self-directed investing portfolio somewhere down the line when there was more time to do so.

July 2017 Update: I partly kept my promise and opened a new TD e-Series RESP account for our older kid. I left the RESP account at RBC open so we could keep the a-CESG he had previously received in the account (when we were still eligible for it). All his RESP contributions going forward will go to the new TD e-Series RESP account.

In 2015, I decided I needed to start utilizing my TFSA room. I had accumulated a TFSA contribution room of $31,000 at this time, having immigrated to Canada in 2011. While surfing the internet for an easy DIY investing solution for a TFSA, I stumbled on Dan Bortolotti’s Canadian Couch Potato blog.

After going through his article on model portfolios, I became interested in the TD e-Series funds because:

- I did not have a big chunk of money to invest.

- Making small automatic monthly contributions was the only way I could jump-start my TFSA.

- I am able to rebalance my portfolio as often as required.

Opening a TD TFSA e-Series account was my first foray into using the e-Series funds. When we had our second kid in 2016, we opened a TD e-Series RESP right away.

As described in my article here, we visited a TD branch and opened a mutual funds account. Thereafter, I mailed in the e-Series account conversion form. I did not get an email confirmation but did see that I could purchase e-Series funds on the account after about 2 weeks.

Note: While setting up the RESP mutual funds account, the financial advisor mentioned that the government grant money (Canada Education Savings Grant (CESG) can only be deposited by buying into a fund. She advised that the grant is used to buy the TD Comfort Balanced Portfolio. I did not bother asking her to do otherwise as my plan was to call the TD directly after converting the account into e-Series and requesting that the grant money is put in a money market fund.

One advantage of using the money market fund for any government grants is that they are not subject to the short-term trading fees/penalty and as such can easily be moved into other funds when you are re-balancing your portfolio.

My RESP Strategy

While answering the investor profile questionnaire, I set up my investing strategy to be growth-oriented, with a high-risk tolerance for portfolio volatility and loss of capital. This was important because I wanted the RESP account to be heavy on equities and light on fixed income (~80/90:20/10) until my son is at least 10 years old.

I modified Canadian Couch Potato’s format slightly to include some bonds initially – up to 20% maximum between ages 0 – 9 years. Thereafter, a 10% reduction in equities every year until 18 when the funds would be fully in fixed income (short-term bonds, GICs, and cash).

This is what I envisage the portfolio asset allocation would generally look like over time:

| Child’s Age | Maximum % Equities | Minimum % Fixed Income |

| 9 years or younger | 90 | 10 |

| 10 | 80 | 20 |

| 11 | 70 | 30 |

| 12 | 60 | 40 |

| 13 | 50 | 50 |

| 14 | 40 | 60 |

| 15 | 30 | 70 |

| 16 | 20 | 80 |

| 17 | 10 | 90 |

| 18 | 0 | 100 |

7 months after, a snapshot of the asset mix in the RESP account for our younger kid looked like this on December 31, 2016:

| Description | Quantity | Price ($) | Book cost ($) | Market value ($) | Unrealized gain or loss ($) | % of your holdings |

| CDN Money Mkt-I | 0.409 | 10.00 | 4.09 | 4.09 | 0 | 0.26% |

| CDN Bond Index-E | 21.817 | 11.55 | 258.40 | 251.99 | -6.41 | 16.27% |

| CDN Index-E | 19.221 | 24.95 | 466.11 | 479.56 | 13.45 | 30.97% |

| TD US Index-E | 8.92 | 52.22 | 439.39 | 465.80 | 26.41 | 30.08% |

| INTL Index-E | 28.208 | 12.30 | 336.93 | 346.96 | 10.03 | 22.41% |

| Total in CDN $ | $1,504.92 | $1,548.40 | $43.48 | 100.00% |

As you can see above, the RESP portfolio is over 80% in equities (comprising TD CDN Index-e, TD US Index-e, TD International Index-e) and less than 20% in bonds (TD CDN Bond Index-e) plus the TD CDN Money Market fund where Canada Education Savings Grant (CESG) is deposited.

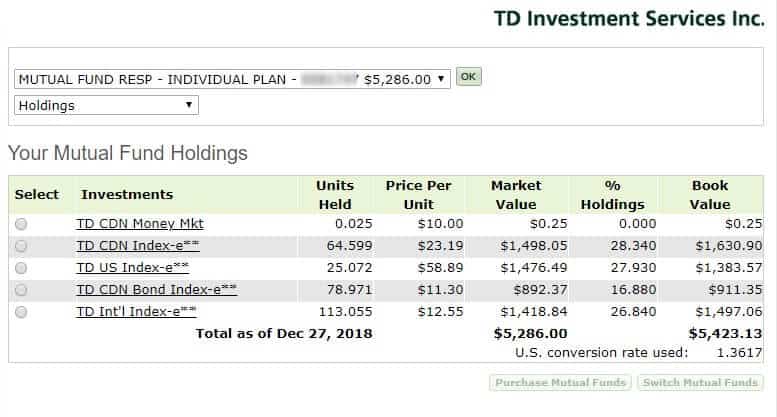

This is how the account looked in December 2018 (update):

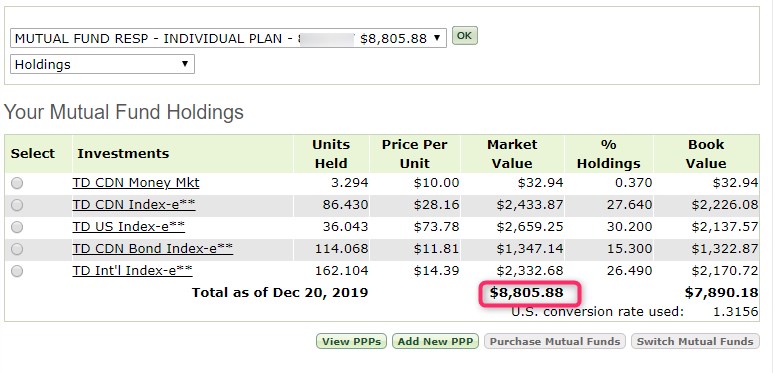

This is how the account looked in December 2019 (update):

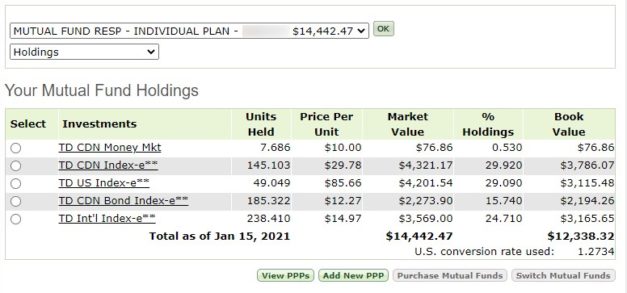

This is what the account looked like at the beginning of January 2021 (update):

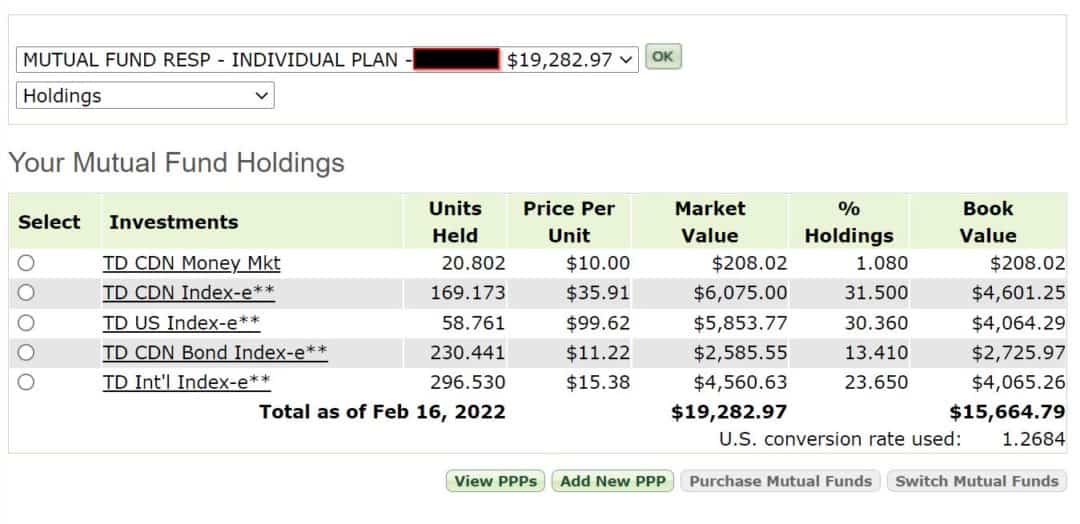

This is what the account looked like in January 2022 (update):

Portfolio Re-balancing

One aspect of DIY investing is the need to rebalance your portfolio manually when the portfolio asset allocations diverge from your target allocations. There are two approaches I take to bring back the portfolio to my desired asset mix:

- Funds Switching: Every quarter or so, I switch the grant money that has been deposited in the money market funds into buying funds that I want more of. Essentially what this means is that I “sell” or “withdraw” the funds in money market funds and use it to buy another fund that has fallen below its target allocation. For example, say TD US Index Fund-e has fallen from my desired level of 30% to 25%, then I will buy more of the fund using funds that have accumulated in the TD Money Market Fund. This method works well because there is no short-term trading penalty for withdrawing or switching money market funds.

- Annual Re-balancing: For my TFSA e-Series funds, I carry out an annual portfolio rebalancing by specifically buying more of one fund over the other so I can have the portfolio back to my original allocation of 80% Equities: 20% Bonds. The same approach would work for an RESP or RRSP e-Series account.

Other Things to Note

TD e-Series Funds are not A-CESG friendly: If you are eligible to receive the additional Canada Education Savings Grant (CESG), Canada Learning Bond, and other provincial education savings incentives, please note that TD e-Series funds do not support them. For these additional grants, you will need to open a separate account such as a term Guaranteed Investment Certificates (GIC) to receive the funds.

Set up a Pre-authorised Purchase Plan (PPP): You can set up a PPP for as little as $25/fund on a weekly, biweekly, monthly, or even less frequent basis. The funds are automatically applied to purchase funds according to your defined allocation. It makes your investing pretty easy and stress-free!

Final Thoughts

Using the Bank of Montreal’s Education Savings Calculator, a child born in 2016 would potentially require $96,518 or more to obtain a 4-year degree from the University of Calgary (for example) by 2034.

We would like to ensure that our kids do not get bogged down with heavy debt loads in their quest to obtain a university education. With this in mind, it is essential that we start putting money aside in an RESP. By starting early, we have compound interest on our side. Add the 20% additional government grants on RESP contributions (up to a lifetime maximum of $7,200 per child), and things are already starting to look up! 😉

I like hearing from my readers. If you have any thoughts or questions, please feel free to drop them in the comments section below.

For more recent updates on TD e-Series and RESP investing:

thanks for the article 🙂

Thanks for the article! We have a current RESP Mutual fund with TD that I am going to convert to E-series (mailing in the conversion form as you said). So once that happens I plan on contributing to the RESP regularly through e-series. How/where do you specify that the government matching fund goes into the money market fund?? Is that automatically? Thanks in advance for your help!!

@Newbie:

This article may be of help: https://www.savvynewcanadians.com/sample-td-e-series-portfolio-updated-2018/

The matching funds go into buying a mutual fund you specify. Sometimes they will by default just use one of their expensive mutual funds. You should let them know you want the funds to buy into the Money Market fund. This fund has a low MER and there are no fees for switching money in this fund to your e-Series funds when you are re-balancing.

Hi there, I was wondering if there were any advantages to using this strategy in a self managed TD directing investing account to reduce fees and lower MER. That is to buy the exact same index funds and equity allocations but not in a mutual fund account.

@Curious S: It would have the same impact on lowering your investment fees. The process is a bit similar on WebBroker. One thing to note, however, is that you will pay a quarterly maintenance fee of $25 for TD direct investing unless your account is $15K or more, or you set up a monthly automatic deposit of at least $100.

Hello, new to investing, but considering moving my TFSA balance to an ETF TSFA. My confusion is on opening a Questrade account, it appears to be in US dollars. I am Canadian and wish to buy the Canadian Vanguard VBAL. Will I be charged a conversion charge or why is is showing the amount in US dollars??

@Teresa: Questrade is actually a Canadian broker. Although they show your funds in CAD and USD, there is no actual conversion of your money nor a charge when you invest using Canadian funds.

Hello Enoch,

I was wondering about the portion of your first son’s RESP left in RBC. Did you still retain the balance in the select balanced fund or you switched the investment to another fund and will appreciate what fund you settled with and your reasoning behind your decision.

@UYI:

I left the funds in the same mutual fund. It’s balanced and the “newer” account I have opened for him using TD e-series funds is “aggressive” (about 90% equities) and will remain so for a while. Basically, the bond section of his RBC funds will continue to serve as a “balance” until later in the future when he gets nearer to needing the funds and I need to increase the safety components i.e. bonds/fixed income/GICs.

I could have also moved it to a different fund within RBC, but the mutual fund fees are generally high, and honestly, I really don’t care much for listening to their advisors try to sell me crap.

Thanks for this great article, following your article i was able to setup e-series funds RESP for my daughter as well in 80(Equities)-20(Bonds) proportion similar to yours. I have a question on the CESG grants…the grants that i receive goes in another mutual fund that i have opened and it looks like yours goes to the Money Market which you sell and distribute in e-series funds.

You mentioned in the article that “For example, say TD US Index Fund-e has fallen from my desired level of 30% to 25%, then I will buy more of the fund using funds that have accumulated in the TD Money Market Fund. This method works well because there is no short-term trading penalty for withdrawing or switching money market funds.”

This might be a dumb question when you mentioned TD US index has fallen, does that mean price per unit went down? or when its not performing well and that’s the time to buy? Will it be possible to provide an example.

@Tannu:

That’s a great question and I think this article below shows how I do that step-by-step:

https://www.savvynewcanadians.com/sample-td-e-series-portfolio-updated-2018/

Basically, it just means that one fund has now fallen below the target allocation you set for it and you can use your grant money or other monies to purchase more of that fund so that it comes back to your intended target allocation.

In a way, you are also right to think that the cost of the fund has fallen (or better still, the price of the others have increased at a faster rate. It doesn’t really matter. You buy more at a good price and enjoy dollar-cost-averaging.

@Enoch – thank you so much for this article. I have the same question about the self-managed TD Direct Investing account. I had gone the TD Mutual fund e-series RESP because of couch potato’s articles, but the money ended up going to a TD COmfort balanced mutual fund instead of the TD Canadian money market. If you do direct investing, it’s not possible to set up automatic prepayment plan correct? I had started to go this route for my 2nd child’s RESP but simply don’t have time to arrange to do monthly purchases on direct trading. IS there any significant advantage I’m missing that would make this extra time worth it?

@EagerInvestor: The accounts for both of my kids are on the old EasyWeb platform and I’m not sure how TD Direct works for the TD e-Series Funds. I would hope you can setup pre-authorized debit buys, but can’t say for sure. You can check out some of the comments on the article below to see what others have said about the new format:

https://www.savvynewcanadians.com/sample-td-e-series-portfolio-updated-2018/

Hello Enoch,

I was lucky enough to stumble upon Canadian Couch Pototo article on TD e-series about 10 years ago. I opened a TD e-series RESP for my child 100% equities (TD-US, Nasdaq, International, Europe) set up biweekly direct debits, randomly added lumpsums when I had extra cash, and just left it (no rebalancing etc). My child is now 16yrs, the value of the account is $94K (put in 53K). I want to move it all out of equities before end of 2021. In your article you mention that as your children gets closer to college years you would buy short term bonds, gics, and have cash. Are these short term bonds under TD-e series (or else where)? GICs – again are these within the TD umbrella (or elsewhere)? Cash -a basic savings account? What percentage would you put in GIC?, cash? bonds? Thank you.

@Pat: Those are excellent returns over time! I’m far from reaching the point where I need to start buying bonds/fixed income, etc, so haven’t yet thought that far ahead. I guess it will depend on the rates being offered by TD and elsewhere. Also, the asset allocation (cash, GIC, or bonds) will depend on market conditions at the time. If I were making that decision today, I would likely use a mix of all three.