An RESP is a government program that helps parents to save for their child’s post-secondary education. The savings plan is particularly attractive since the government chips in 20 cents for every dollar you contribute up to a maximum of $500 in grants per year.

This grant, referred to as the Canada Education Savings Grant (CESG) is essentially 20% in returns on your investment and should be taken seriously.

A while back, I published an article on how to open a TD e-Series account and showcased a sample RESP investment account using e-Series funds. In this current write-up, I use my youngest kid’s RESP account as an example and provide an update on investment strategies for a TD e-Series RESP portfolio.

Note that if you are opening a new account, you can now purchase the e-Series only through a TD Direct Investment Account.

Asset Allocation and Strategy for an e-Series RESP Portfolio

My RESP strategy and asset allocation are designed to vary depending on the age of my kids and how close they are to needing the funds for their education.

It starts out with an aggressive asset allocation (Growth), i.e. using a majority of equity (80% or greater when they are still very young. Between ages 1 and 10, there’s still lots of time left on the investment horizon, and I want to take maximum advantage of the growth that equities/stocks offer.

From 10 years and older, I plan to start reducing the proportion of stocks by 10 percentage points every year until they are 18 years old. Between ages 12-14, the portfolio becomes balanced (50% equities: 50% bonds), give or take, and from 15 years and older, it becomes decidedly conservative (Safety).

At 18 years of age, the entire portfolio is invested in the money market, i.e. short-term loans, GICs, cash, etc.

Table 1: Asset Allocation

| Child’s Age | Maximum % Equities | Minimum % Fixed Income |

| 9 years or younger | 90 | 10 |

| 10 | 80 | 20 |

| 11 | 70 | 30 |

| 12 | 60 | 40 |

| 13 | 50 | 50 |

| 14 | 40 | 60 |

| 15 | 30 | 70 |

| 16 | 20 | 80 |

| 17 | 10 | 90 |

| 18 | 0 | 100 |

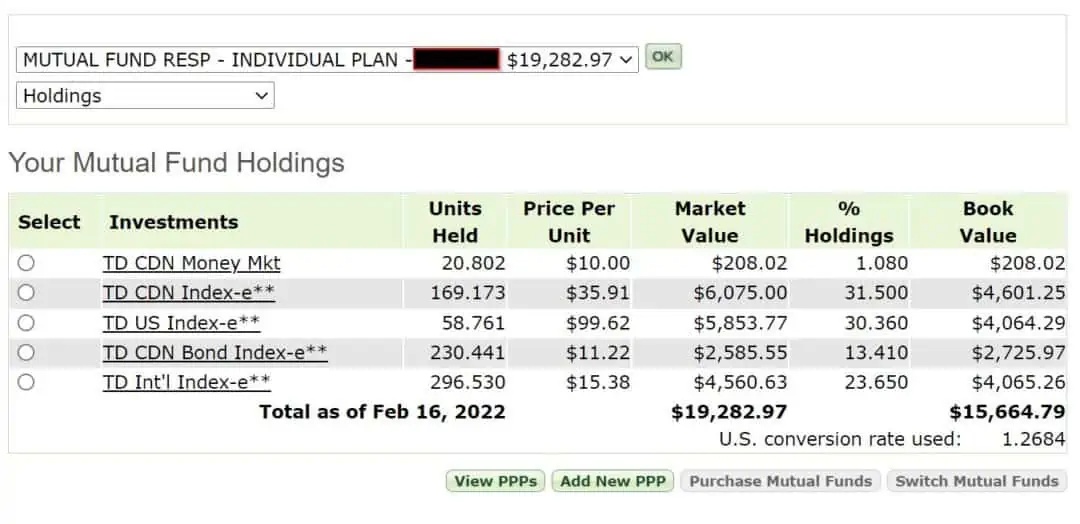

Table 2: This is a snapshot of the RESP account as of February 2022 (at approx. 5 years and 10 months old). I will be using the money market funds to rebalance and increase the international equities component.

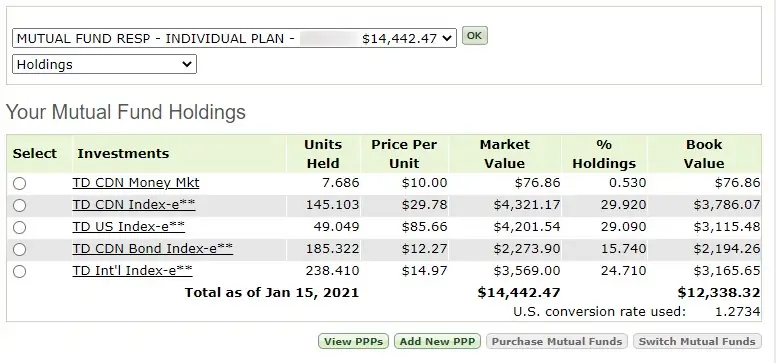

Table 3: Below is a snapshot of the account as of the end of January 2021 (at approx. 4 years and 8 months old). The bond component has gone up, and I will be adding funds to the international equities fund by moving funds from the money market fund to it for the next little while.

While we had set up pre-authorized contributions of $2,300 for the year per child, we were able to make extra contributions in 2020 when the kids were forced to stay home during the pandemic. At the time, we funnelled their daycare fees to the RESP account.

Investment return in 2020 was 12.22%.

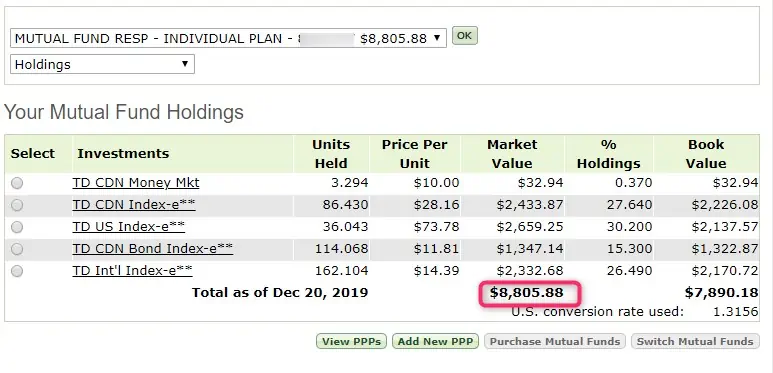

Table 4: Snapshot of asset mix in sample RESP account on December 20, 2019 (about 3 years and 7 months after opening). The market value is now at $8,805.88. As you can see, the bond component is currently over 15%, so I will be redirecting CESG money to the CAD/USD index in the coming months to keep the fixed income at 10% or so.

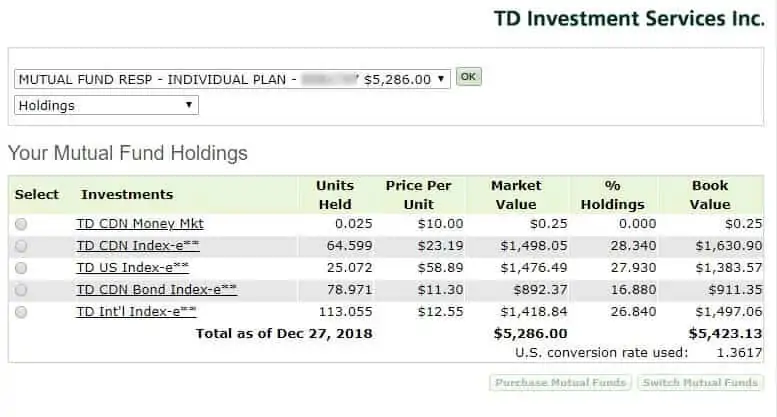

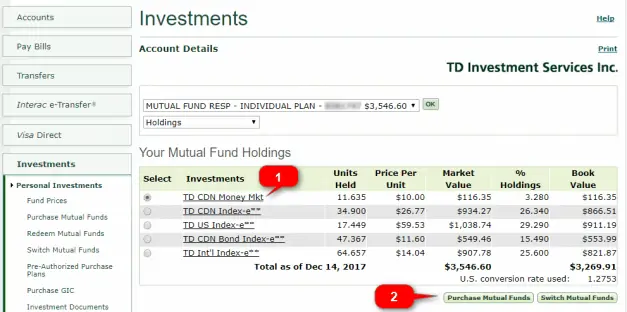

Table 5: Snapshot of asset mix in sample RESP account on December 28, 2018 (2 years and 7 months after opening).

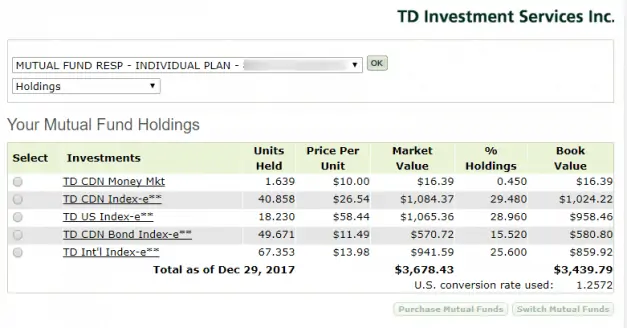

Table 6: Snapshot of asset mix in sample RESP account on December 30, 2017 (19 months after opening).

We are currently contributing approximately $1,920/year to this particular account (2017), a bit less than the $2,500 that is eligible for grants per annum.

This is what my target (desired) asset allocation looks like for RESP account #2 (ideally):

- TD CDN Bond Index: 10%

- TD Canadian Index: 30%

- TD U.S. Index: 30%

- TD International Index:30%

- TD CDN Money Mkt: 0%

Since the recipient is less than 2 years of age, my asset allocation is very aggressive and growth-oriented.

As you can see above, the current allocation at year’s end has strayed a bit from my preferred mix. As such any new funds deposited in the Money Market Fund will go to buying TD International Index. This is known as re-balancing and I show an example of how it’s done later in this article.

This is what the same RESP portfolio looked like in December 2016:

| Description | Quantity | Price ($) | Book cost ($) | Market value ($) | Unrealized gain or loss ($) | % of your holdings |

| CDN Money Mkt-I | 0.409 | 10.00 | 4.09 | 4.09 | 0 | 0.26% |

| CDN Bond Index-E | 21.817 | 11.55 | 258.40 | 251.99 | -6.41 | 16.27% |

| CDN Index-E | 19.221 | 24.95 | 466.11 | 479.56 | 13.45 | 30.97% |

| TD US Index-E | 8.92 | 52.22 | 439.39 | 465.80 | 26.41 | 30.08% |

| INTL Index-E | 28.208 | 12.30 | 336.93 | 346.96 | 10.03 | 22.41% |

| Total in CDN $ | $1,504.92 | $1,548.40 | $43.48 | 100.00% |

Related: The TFSA Contribution Limit

TD e-Series RESP Portfolio Rebalancing

A portfolio designed using index funds or ETFs will need to be reviewed and rebalanced at least once every year. This is because over time, the different funds will perform differently, and your portfolio’s asset allocation may start to differ significantly from your target allocation.

There are several ways you can re-balance your TD RESP e-Series portfolio.

My Strategy – Use Grant Money to Rebalance

The TD CDN Money Market Fund is where all the government grant is deposited, and every 4-6 months or so, I use the funds that have accumulated here to re-balance the portfolio – by buying more of whichever fund is out of sync, i.e. falling behind the target asset allocation.

Note: Sometimes, your grant money may get deposited in a different fund (such as one of the TD Comfort Portfolios). What you want is the Money Market Fund because they are not subject to short-term trading fees/penalty and as such can easily be moved into other funds when you are re-balancing your portfolio. Also, the MER is lower. You can always call TD and ask them to make any changes required.

This is how this works:

Step A:

1. Log into your TD account to see if you have money accumulated in the Money Market Fund.

2. Click on the “Switch Mutual Funds” button. This will take you to Step B, where you choose which fund you want to switch over.

Step B:

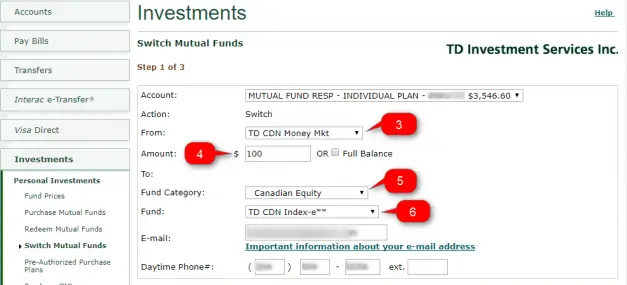

3. Choose the fund you are switching “from” – in this case, it is the TD CDN Money Market.

4. Enter the amount you would like to transfer or “switch” from the fund chosen in #3, or tick “full balance” if you want to switch over all the money you have in the fund.

5. Choose the general fund category you are switching into, e.g. U.S. Equity, Canadian Equity, etc.

6. Choose the specific fund within the fund category chosen in #5 that you want the funds being switched to go into. For this example, I chose TD Canadian Index-e as its allocation had fallen well below my preferred level (30%). Ensure that whatever fund you are choosing has the “index-e” that denotes an e-Series fund attached to its name.

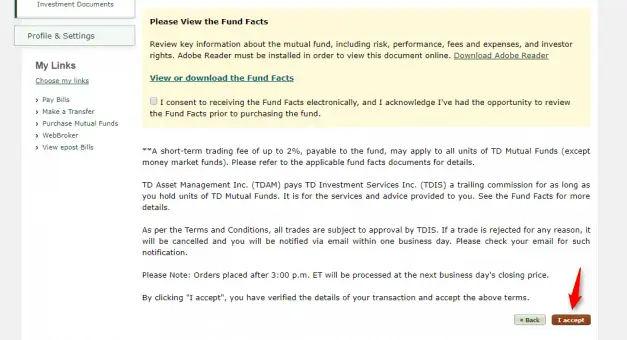

Step C:

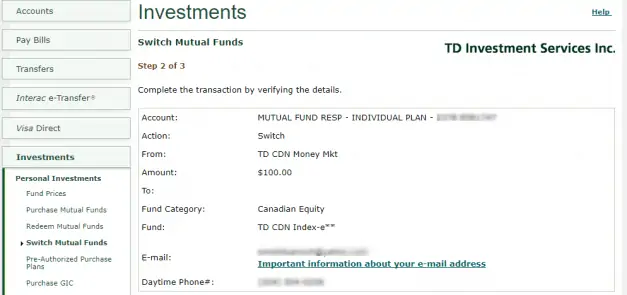

The next window asks you to verify your transaction, which is that you want to move money from one fund (in this example: TD CDN Money Mkt) to buy more of another fund (in this example: TD Canadian Index-e). You will be asked to consent to receive the Funds Facts electronically, after which you can click on the “I accept” button at the bottom of the page.

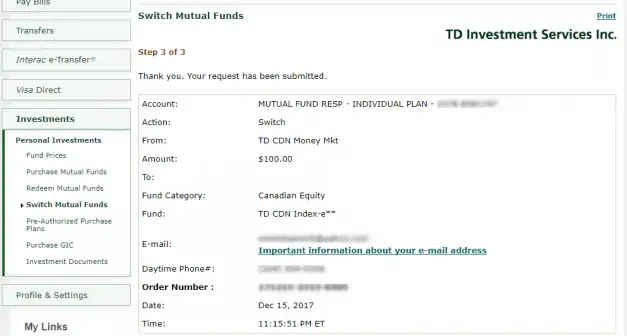

And the final window confirms your transaction.

In addition to the method detailed above, i.e. buying more of the lagging fund (a fund with less percentage than desired) with grant money accumulated in the Money Market fund, other strategies include:

- You can redirect new investment funds to buy the lagging fund and balance your portfolio back to the desired asset allocation. Or,

- You can switch a portion of a better-performing fund (the fund with more percentage than desired) and use it to buy more of the lagging fund.

There’s no cost to purchasing new funds or switching over funds on the TD platform.

You may also be interested in:

- How To Invest Your RESP

- A Review of Tangerine Investment Funds

- A Review of TD e-Series Funds

- A Guide To Index Investing For Newbies

- A Complete Guide To Robo-Advisors in Canada

Want to invest your RESP at low-cost and without the hassle? Check out Canada’s most popular robo-advisor, Wealthsimple, and get a bonus when you open an account.

Hey Enoch,

Very comprehensive plan; it looks solid! Kind of like a lifecycle fund like the ones used in retirement accounts, but on a time-compressed scenario. We have similar plans here in the US, though I don’t know of any where the government chips in.

Though, here in Florida, there is a low-cost plan (the Florida prepaid) that’s something like ~$200 per month or less (if you start investing from birth). If you make the payments, your kid’s college tuition is guaranteed to be fully prepaid when they’re ready for school. The catch is that your kid must go to a public college in Florida – otherwise you can cash out, but the money probably won’t fully cover tuition out of state.

My wife and I plan to have kids soon – time to start reading up on this stuff 🙂

Cheers,

Miguel

Hey Miguel,

First time I’m hearing about this type of college-tuition plan in Florida… I guess it’s better than not having any options. College tuition can add up to become very significant, so any form of assistance or aid is always welcome.

Best wishes to you guys whenever you choose to start making them babies! 🙂

This is a great post! This is a very similar plan to what we are doing 🙂 Awe you have two young children? One under 2? That must keep you busy!!

@GYM: Thanks. Yes, two young kids and they are a handful for sure! LOL

@ Steve. Yes, we are hoping that starting early will go a long way to lower the burden of college education. Thanks for stopping by.

Hi Enoch, what should I do about the Canada learning bond? It has to stay in a seperare account.

@Katie:

The TD e-Series Funds are not A-CESG friendly i.e. If you are eligible to receive the additional Canada Education Savings Grant (CESG), Canada Learning Bond and other provincial education savings incentives, you may need to go a further step and open a separate account such as a term Guaranteed Investment Certificates (GIC) to receive these funds.

This was the case the last time I checked with TD a few years ago…however things may have changed and maybe they have now stepped up and made things easier for their clients.

Thanks for stopping by!

Thanks for replying. So how would I divide my contribution to make sure I receive all the grants? Does does mean I can invest part of it in the eseries and part of it with a GIC?

I have not tried this strategy before, so not sure. To make things easier for you, another option is to open a “normal” RESP with TD or another bank, where you can get the Canada Learning bond deposited (initial $500 and annual $100) and just contribute a minimum to that account…the CLB does not require any contribution from you to the plan to qualify. Then, open your TD e-series as a second RESP account for the same child, and get the benefits of managing your main RESP funds cheap (i.e. low MER).

I hope this is not confusing? The TD eseries are generally not accommodating of the a-CESG/CLB.

Thank you, I believe that is the best plan as well. I will try to do that and see how it goes. It’s to bad TD is not very accommodating in that regard.

Hi Enoch, love the comprehensive summary. This has really helped me -switching to the money market fund really simplifies the rebalancing because you don’t have to think about avoiding the trading fees.

A question: do you have any calculators that help you rebalance the portfolio quickly?

Hi @ Eric Hamilton: Happy to hear that this was useful to you!

No, I don’t have a calculator I currently use. So far, I simply wait till I have $100 or so in the money market fund and simply switch it to the fund that is trailing behind its target allocation. This usually works out to give me an allocation that’s close to what I want. Sometimes I need to switch twice or more if it’s really lagging behind.

I guess you can also calculate the precise percentages, but I have been a bit lazy on that front. 🙂

With the additional CESG and the Canada learning bonds, what account do you have those in? Can you transfer them to the index funds?

@ Chelsea:

The TD e-Series Funds are generally not A-CESG friendly i.e. If you are eligible to receive the additional Canada Education Savings Grant (CESG), Canada Learning Bond, and other provincial education savings money, you may need to go a further step and open a separate account such as a term Guaranteed Investment Certificates (GIC) to receive these funds.

Better to ask them to see what options they have available to accept these additional monies.

Cheers.

Thanks for all the work you do on this website, Enoch!

I too have just made the switch of my son’s RESP to TD e-series and I encountered problems with the A-CESG grant as well. The TD representative said that the A-CESG grant needs to be in a term deposit account. Furthermore, the first $500 that produces the A-CESG grant *must* also be in the term deposit account. Thus, in essence, this decreases my contribution limit in my e-series account from $2500/year to $2000/year.

Is this what you are experiencing as well?

@ Simon:

I became ineligible for the a-CESG shortly after opening the TD RESP e-Series account for my kids, so do not really know how they treat your first $500 contribution.

I would say ask a different advisor or call them by phone so you can get a response from 2-3 different people. From my experience, not all TD reps know enough about the e-Series.

If it turns out that you indeed need to make a $500 contribution every year into a term deposit account (e.g. GICs), then one option to manage the issue could be to make that account your “fixed income” or “bond” portion of your portfolio and invest all the remaining funds in equities (stocks) or tweak as required to keep your preferred asset allocation.

For example, if you want to hold a portfolio that is 25% bonds and 75% stocks, then your $500:$2000 split does that. Of course, this also presents some challenges since it means you can’t start out with a super-aggressive portfolio, such as one with a 10% bonds vs 90% equities ratio.

You may have to weigh the savings in investment fees vs. money you get from a-CESG vs. traditional mutual funds to see what works better for you.

Hi Enoch,

you may have already answered these question few times but i am having trouble looking at different pages so may be appreciate if you can answer it again in one post.

i want to contribute $2500 annually to receive $500 CESG and other grants into RESP. Now as you mentioned TD eseries is not grant friendly, would i be able to transfer the funds from regular RESP account where contributions and grants are done or i need to separately open TD eseries account and contribute extra on top of what i am doing in RESP?

I hope you can clarify.

@Jasdeep:

Are you expecting to receive the additional CESG (A-CESG) and Canada Learning Bond? If so, TD does not currently process that in your e-Series account directly (last I checked). If your income level makes you ineligible for the a-CESG and CLB, then this is not an issue and your regular grant will deposit without any hassles.

If you will be receiving the additional grants, other readers have mentioned that you can receive it in a separate term deposit account (e.g. GIC). I have not personally used the e-Series while receiving a-CESG, so it is difficult to give you a definitive answer.

I would suggest asking the TD reps about how to go around this issue. I’m surprised they’ve not solved the problem since it’s obviously an ongoing challenge for many folks.

thank you for your information. However i have another question – Do you know what is the ROR for eseries funds? I could not find this information in the branch.

If you can share the growth rate of your plan that will be great.

Thanks.

Hi Enoch,

Are you recommending using TD or Tangerine for a newborn?

@Erik: Either one works, depending on how comfortable you are with rebalancing. TD e-series require some rebalancing (like once a year) while Tangerine is automatically rebalanced. TD e-series funds have lower management fees.

Hi Enoch,

I scrape the web pretty hard looking at investing strategies. This post is the most clear, descriptive and comprehensive one I have seen for the development of a solid RESP investing strategy. Really well done.

No questions! 🙂

@Trevor: Thanks for your feedback. Glad you found it useful!

I delivered my application to convert my Canada Trust account mutual fund account to a on-line e-series account on January 31 2020.

I was informed by the Branch Manager that they NO LONGER allow that as of January 21 2020.

They said that I would have to apply to open an TD INVESTOR ACCOUNT if I want to purchase e-series funds.

Accounts less than 15,000 would be charged $120.00 per year maintenance fee.

@Ger: I will look into this further. I couldn’t find any mention of it anywhere online, however, another reader has mentioned the same thing.

Hi Enoch, thanks for the comprehensive guides! I’m 24 years old and I currently have a TD Mutual Fund RSP holding $10,500. I have a few questions.

I’m saving this money for myself since kids aren’t on my radar for a while, should I stick with the mutual funds or switch over to the E-series?

If I switch to the TD E-series funds account, what happens to the $10,500?

Will I have to choose the bonds/equities i want to invest in before switching over, or will the money be waiting for me to invest it?

Thanks again for the work you do

@Nick: From what I have heard recently, it appears that you now have to use TD Direct to purchase the e-Series for new accounts.

Generally, you can save on management fees by using lower-cost e-Series funds in your RSP portfolio as opposed to the more expensive mutual funds. You can easily mimic the same level of risk you are taking in your portfolio by allocating 4 of the e-Series funds accordingly.

Given the recent updates (which I’m not too familiar with), I’m not sure how converting your current account to e-Series will work. I suppose you can simply move over your current holdings like-for-like to TD Direct Investment (assuming you are currently using EasyWeb). Open a new RSP e-Series account on TD Direct and start purchasing e-Series from there.

This post may help: https://letstalkaboutmoney.ca/step-step-buy-td-e-series-index-funds-td-direct-investment/

With regards to the RSP mutual funds, I have no idea if you can still convert those without triggering a sale and/or taxes of some kind.

TD Direct charges a quarterly fee of $25 or so if your total account balance is below $15K. If you have contribution room, you may want to buy enough e-Series funds to grow your account up to that level so you can save on the fees. Both your mutual funds and e-Series funds will count towards calculating your balance.

Hope this helps.

Hi

Thank you for such an insightful article.

I do planned too as well on moving my daughter’s RESP to Td Direct Investing and will follow similar to that shown portfolio.

I do have a question though. Using those indexes you indicated, I noticed that that after the minimum $100 initial investment, the subsequent is $100 minimum. To maintain that percentage allocation, I would pretty have to invest $400 each month. Unfortunately, I don’t have that much extra cash to invest into the funds. What would you suggest for someone like me who can’t afford to give out that much monthly? It would seems like it would negate the “couch potato” principles only because I have to monitor where the money goes, every time I use that $100 monthly contribution.

Are all indexes are like that, having minimum subsequent dollar to invest?

The reason I planned to moved from actively managed fund to direct investing is solely because of lower MER fees. But in doing so, for someone like me that can only afford small monthly contribution is not able to split that amount into 4 ways.

@HC: Is $100 the minimum you can invest per fund on TD Direct Investing? I still use the TD easy web platform (grandfathered) and the minimum is $25. Confirm that it is a minimum of $100 first…If that is the case, you may have to set your pre-authorized debits (contributions) to maybe every 3 months etc. when the funds have accumulated. Hopefully, the minimum is not that high!

Thank you Enoch for such a simple and detailed explanation. Being a new dad, I have been scrapping the web for information on RESPs. The e series were always on my radar, but I still was trying to see what else was out there. I think your blog hits the right spots and helped me arriving at my decision!

@Rohan: Glad it helped!

Cheers, Enoch

Great article and just what I needed to see… I have 2 kids (4.5 and 1.5) and to this point have been putting everything for both into a comfort portfolio only. 100% of the funds for bothe RESPs has been put in one fund for the entirety of their lives (silly I know).

I will be rebalancing both shortly to switch to high growth on both, given their respective ages. For both children, I deposit $100 bi-weekly which gets me just above the $2,500 maximum for CESG each year. I wonder… How would your strategy differ if you were making bi-weekly contributions? Would you have the $100 contribution + the CESG amounts go into the Money Market Funds and then re-balance monthly? quarterly?

Thanks and appreciate the post!

@Ryan: When you say high growth portfolio, are you referring to a portfolio made up of individual e-Series mutual funds such as the one in my example above (mix of US, CDN, Intl. equities and bonds)? If so, then I would set up a pre-authorized debit (PAD) from TD to have the $100 split automatically into the asset ratio you want. For example: If I plan on keeping an 80% equity to 20% bond ratio for now then I could theoretically set up the PAD to be distributed as $30 US e-index, $25 CDN e-index, $25 Int’l e-index, $20 CDN bond e-index.

The CESG amount goes to the Money Market Funds and every quarter I would use the amount to purchase one or more of the index funds depending on how they have performed. Typically, this means I use it to buy more of the asset that has fallen below the % I would like it to be. For example, if CDN index-e is now 20% of the entire portfolio instead of the 25% I prefer, then I may buy more of CDN index-e, etc.

If your plan is to replace one TD Comfort Portfolio with another, then this strategy is not required. You simply change the portfolio to another managed one (balanced, aggressive, growth, conservative, etc.) and your biweekly contributions get deposited in that fund, including your CESG (i think). There won’t be a need to rebalance anything as you are already paying them to do that with the almost 2% MER you are paying annually.

Hope this makes sense.

@Enoch – Thanks! Sorry yes I was referring to the example you’ve laid out. Sounds like I need to make a trip into the branch to fix the PADs and how the CESG is directed! I’m not sure switching out one comfort portfolio for another achieves the same re-balancing as the child ages (save for moving to a lower-risk comfort portfolio).

Hello,

I just want to clarify the use of the e series account. So you have a normal money market fund account to get CESG and an e- series to invest the money the way you want ? Do you deposit to two separate accounts then? I want to open an e- series TD RESP account to take advantage of the market but need to know whether I need another account? I want to be able to get the CESG.

Thanks

Hi. I just recently moved my daugters RESP into TD-index eseries. I know you mentione “to redirect the CESG money..”.

In my monthly statement CESG money is showing up into my statements, as cash. How do I redirect that into the other account in the portfolio?

thank you in advance

Hi Enoch,

Thank you for this detailed explanation. I am alittle confused about the TD money market fund. I asked the TD DI phone rep if I could have the CESG deposited in a money market fund. He said that it would be deposited as cash into the RESP account and then I would have to buy units of the fund. Am I missing something? It does not make sense to me (I have just opened an RESP DI account).

Thanks

@Sawanee: I assume that means the same thing. Once you have the cash sitting in your account, you can use it to purchase your preferred TD e-Series fund. I haven’t used TD Direct Investing for the eSeries, so can’t say for sure how they process it there. I would still expect it to be deposited in a money market fund. If that doesn’t happen and it’s not in a cash account, I’d suggest you reach out to them again. Unfortunately, many of their staff have no idea how this works.

Hi, just to clarify:

I have RESP portfolio that consists of: TD index eseries 90% equity & td index eseries 10 % bond. My next question is, can I open and add money market fund into this portfolio for the CESG money to be deposited? Secondly, how do I redirect the CESG from bein deposited to cash to this account? Can I do that directly through td direct investing? Hopefully this makes sense.

thank you in advance again.\

Hi there,

How would you go about contributing to a family plan with respect to varying ages of the beneficiaries. For example, I have a 5 year old and a 9 year old. I currently l contribute monthly. I’d like to be more aggressive for the younger one and less so for the older child, however everything is listed under one account in the family plan.

Thanks for your insights.

My child just turned 16, resp has been in td e series in US, Nasdaq, intl, DJIA. Done very well. What options do we have to move to safer options since college will be in 2 years time? Move all funds out of td e-series and put into a savings account? Other options? Thank you.