Exchange-Traded Funds like VIU are an excellent way for individual investors to gain exposure to collections of individual assets.

Rather than having to research and pick individual stocks or funds, investment companies like Vanguard do all this work for you for a small fee.

You might think that a collection of individual assets in one fund sounds like a mutual fund, and you’re right. Exchange-Traded Funds differ slightly from mutual funds and, in the long run, are much more beneficial to investors.

ETFs are tremendous investing tools, especially for beginners. For most people, trying to beat the market by buying and selling stocks is a losing proposition. Over time, buying and holding a portfolio of balanced ETFs is one of the surest ways to ensure long-term gains.

The VIU review covers its holdings, performance, fees, pros and cons, and how it compares to similar Canadian ETFs like XEF, XAW, and VXC.

What is VIU?

VIU (Vanguard FTSE Dev All Cap ex North America Index ETF) is an ETF managed by Vanguard that provides a balanced portfolio of global equities from developed countries.

While that sounds similar to a long list of other balanced ETFs, VIU ETF holdings exclude any companies that trade on the US and Canadian markets.

The VIU ETF incorporates a passive fund management style while using an efficient and cost-effective process to manage assets. VIU’s inception date was on December 1, 2015, and it pays a quarterly distribution of its dividends.

By only including stocks from international markets, VIU is an excellent way for Canadian and American investors to gain exposure to foreign markets.

This is important because some brokerages do not provide access to these markets, so buying an ETF like VIU is one of the only ways for those investors to access these foreign companies.

Key Facts for the VIU ETF

Some key facts for VIU as of March 2023 include the following:

- Inception date: December 1, 2015

- Number of stocks: 3,865

- Price/Earnings Ratio: 12.2x

- Price/Book Ratio: 1.5x

- Return on Equity: 11.3%

- Earnings Growth Rate: 7.9%

- Management fee: 0.20%

- MER: 0.23%

- Assets under management: $3.28 billion

- 12-month trailing yield: 2.59%

- Distribution yield: 2.49%

- Distribution frequency: Quarterly

- Eligible accounts: RRSP, TFSA, RRIF, TFSA, DPSP, RDSP

- Currency: CAD

VIU Holdings

VIU is an all-stock ETF with 3,865 stocks, primarily from Europe (58.8%) and the Asia Pacific (40.20%).

The ETF also has 71.49% of its stocks in large-cap companies, which likely means that the fund will be fairly stable, with mostly blue-chip stocks carrying the portfolio’s weight.

Specifically, the median market cap of all companies included in VIU is $47.8 billion, which is certainly on the high end, especially without any mega-cap US stocks included.

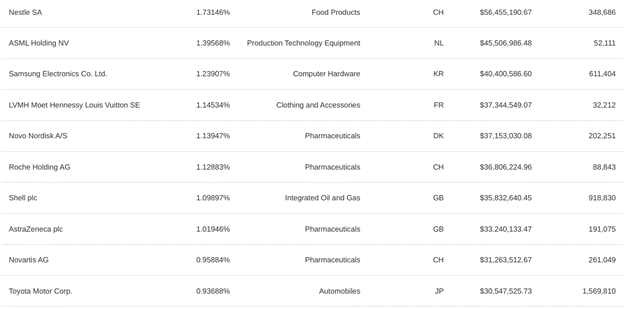

The top 10 holdings in VIU have some familiar names there, even for North American investors.

Nestle, Samsung, ASML, and Toyota are all household names in North America, so that should help some investors feel a little more comfortable with the companies included in the VIU ETF.

Investing in foreign markets and companies isn’t always easy, but VIU does a nice job of mixing in global brands with strong and steady performers.

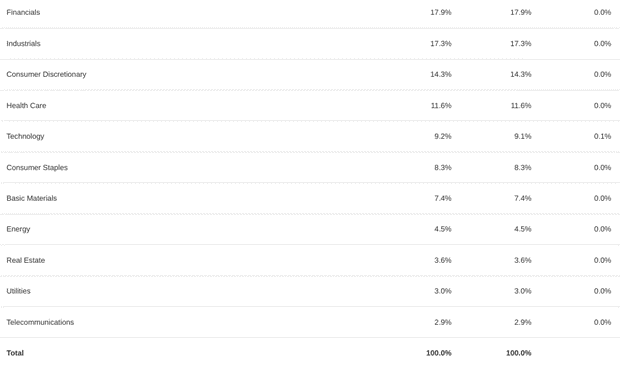

In terms of the sector weight, we can see here that VIU is quite balanced, with industrials, healthcare, and consumer discretionary making up the three largest positions within the fund.

Growth investors will likely notice that tech stocks only comprise about 9% of the VIU portfolio. The fund is focused on stable performance and steady gains, so it is not surprising that Vanguard has included mostly value sectors in the VIU ETF.

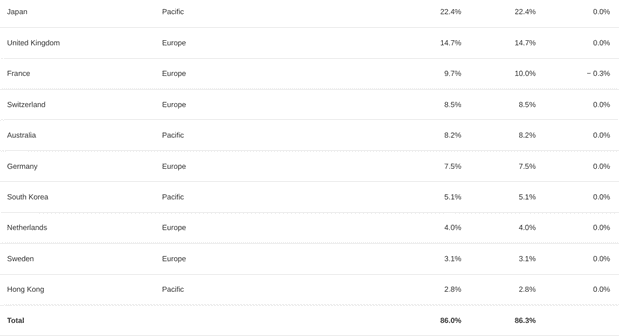

Finally, you can see the breakdown of each region here by country, with most companies trading in Japan and the United Kingdom.

VIU Returns and Performance

A $10,000 investment in VIU at its inception would have returned just short of $14,000 at the end of March 2023.

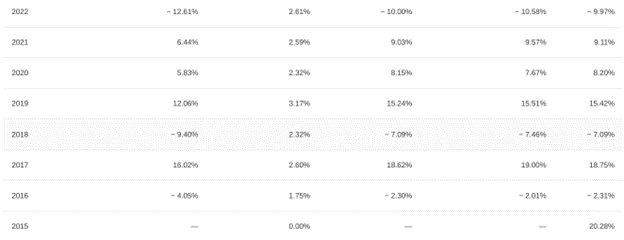

Some quick math tells us that this is approximately a 40% gain over eight years or, on average, about 4.98% per year, which is the average annual return for the fund. As with most funds, 2022 was a setback for VIU, with a -10% return for the fund’s largest annual loss since its inception.

Another way to track the performance of an ETF is by looking at its annual return by NAV or Net Asset Value compared with its return from the market price.

As you can see, returns have been all over the map for VIU, which is indicative of stronger and weaker years for each foreign economy.

VIU Fees

As with most ETFs, VIU has some very reasonable fees. The management fee is only 0.20%, and the VIU MER or Management Expense Ratio is 0.23%.

These fees are a bit higher than some other ETFs, which can have fees as low as 0.05%.

This could be because this ETF holds foreign stocks, and more research and effort are needed to go into the stock selections. Vanguard is also likely subject to some foreign market fees, which are then passed onto the investor.

Still, the rates are much lower than the average equity fund manager for a mutual fund in Canada, which is about 1.9%.

Pros of VIU

- Investors can gain access to otherwise inaccessible foreign markets

- The management fee and MER are much lower than a mutual fund

- A diverse set of different markets means you are not just reliant on one economy

Cons of VIU

- Foreign companies generally do not grow as fast as US-based companies

- The companies in the portfolio are relatively safe and not high-growth companies

- The management fee and MER are higher than other ETFs

VIU vs XEF

XEF.TO is the foreign market ETF offered by Blackrock’s popular iShares ETF service. It is otherwise known as the iShares CORE MSCI EAFE IMI Index ETF.

There are some fundamental differences, including a much lower portfolio of stocks with only 2,606.

The region mix is also different, with XEF including a higher percentage of its weight in stocks from France (11.11% vs. 9.7% for VIU) and not including South Korea at all.

XEF surprisingly has the exact same fee structure as VIU, with a management fee of 0.20% and an MER of 0.22%.

The dividend payout is semi-annually compared to the VIU dividend which is paid out quarterly. This means shareholders will only receive distributions twice each year. But the most glaring difference is performance.

Even though XEF launched two years before VIU, it has returned more than 100% on an initial investment of CAD $10,000 since inception. This outperforms VIU, which has only returned shy of CAD $14,000.

Learn more about this fund in our detailed XEF review.

VIU vs XAW

XAW.TO is another ETF from iShares that covers global markets excluding Canada. Unlike VIU, XAW uses an all-ETF portfolio strategy. This fund is known as the iShares Core MSCI All Country World ex Canada Index ETF.

This means that XAW comprises six different iShares ETFs and some cash. The largest component is IVV or the iShares Core S&P 500 ETF which accounts for 51.48% of the holdings.

The management fee and MER of XAW are also 0.20% and 0.22%, respectively, matching VIU.

Another major difference between the two ETFs is that XAW is focused on the US and emerging markets, while VIU is focused on developed markets.

A staggering 60.68% of XAW is in US equities, but it also includes positions in China, Taiwan, and India, which are not included in the VIU ETF.

Learn more about what XAW offers in this review.

VIU vs VXC

VXC.TO, or the Vanguard FTSE All Cap ex Canada Index ETF is very similar structurally to the iShares ETF XAW. This Vanguard ETF has a 60.4% allocation to US stocks while also including China and other emerging markets like Taiwan.

VXC has a slightly lower MER at 0.21% but maintains the same 0.20% management fee that VIU has.

Not surprisingly, with US stocks involved the VXC’s weight is dominated by mega-cap tech stocks. The fund holds a 68.05% allocation in large-cap companies. VXC holds a 19.9% weight in technology stocks, with financials and consumer discretionary coming in second and third respectively.

The VXC holds a whooping 11,440 different stocks included in the fund, with a median market cap of $84.3 billion.

How to Buy Vanguard VIU ETF in Canada

Below are some of the cheapest ways to buy VIU in Canada.

1. Questrade

Buying shares of VIU on Questrade is a simple process. All you need to do is head to the buy/sell screen and enter the ticker symbol ‘VIU.’

The platform will prompt you to select the number of shares of VIU you wish to order. Finally, select ‘market price’ to get the current price per share of VIU, and then click on buy.

New users get $50 in free trades when they sign up here and fund their accounts with $1,000 or more.

Questrade

Trade stocks, ETFs, options, etc.

Low and competitive trading fees

Top platform for advanced traders

Get $50 trade credit with $1,000 funding

2. Wealthsimple

Wealthsimple Trade is another popular trading platform that has lower fees than brokerage accounts at big banks.

On Wealthsimple, type in the ticker symbol ‘VIU’ in the search bar at the top.

After finding the ETF, the right-hand side of the page should have a Place Order option. Select the number of shares of VIU and choose ‘market price’, then click on buy.

A great platform for new investors, Wealthsimple is also offering a cash bonus to new users after they conduct $150 worth of trades.

Wealthsimple Trade

Trade stocks, ETFs, and options

Excellent trading platform for beginners

Deposit $150+ to get a $25 cash bonus

Transfer fees waived up to $150

Is VIU a Good Buy?

Investors interested in gaining exposure to foreign companies that trade on foreign markets will be wise to invest in VIU.

It is an ETF from a trusted brand with reasonably low fees and a proven track record of success in its eight years since inception.

VIU is an excellent addition to any well-diversified portfolio, particularly one already heavily invested in Canadian and US stocks.

VIU ETF FAQs

VEA is another Vanguard ETF that tracks developed markets. The main difference between VIU and VEA is that VEA includes Canadian stocks but not US stocks. VIU excludes both Canadian and US stocks from its fund.

Yes, VIU pays a quarterly dividend. The current annual yield of the VIU dividend is 2.10% with a trailing 12-month yield of 1.72% as of January 31, 2023.

No, VIU is not hedged. This means that price changes of the VIU ETF are going to be impacted by currency fluctuations.

Related: