The iShares Core MSCI All Country World ex Canada Index ETF (XAW) invests in thousands of stocks worldwide, capturing about 85% of the “global equity opportunity” outside Canada.

As an investor, this ETF simplifies the process of portfolio diversification while cutting your costs to the bare bones.

When using a commission-free trading platform like Wealthsimple Trade and Questrade, you can also buy XAW for free and save on trading fees.

This XAW review covers its asset holdings, performance, fees, how to buy it in Canada, and how it compares to similar ETFs like VXC, VGRO, VEQT, and XEQT.

What is XAW?

XAW or iShares Core MSCI All Country World ex Canada Index ETF is an all-stock portfolio from BlackRock Canada.

It is designed for investors looking to own US, international, and emerging market equities and aims to replicate the performance of the MSCI ACWI ex Canada IMI Index.

As its name suggests, XAW does not hold any Canadian stocks.

If you have above-average risk tolerance and a long-term strategy, this ETF exposes you to equity growth in 22 developed markets and 27 emerging market countries.

Key facts for XAW as of March 2023 include:

- Inception date: February 10, 2015

- Number of ETFs: 6 holdings

- Number of stocks: 9,094 holdings

- Net assets: $1.810 billion

- 12-month trailing yield: 1.70% (as of March 9, 2023)

- Distribution yield: 1.70% (as of March 9, 2023)

- Management fee: 0.20%

- Management Expense Ratio (MER): 0.22%

- Eligible accounts: Registered and non-registered accounts

- Listing currency: CAD

XAW has a “low-to-medium” risk rating.

XAW Asset Holdings

XAW is a fund of funds and invests in other BlackRock equity ETFs. As of this writing, its asset allocation was 98.7% stocks and 0.13% cash in both US and Canadian dollars, with these underlying ETFs:

| XAW Fund Holdings | Allocation |

| iShares Core S&P 500 ETF (IVV) | 51.48% |

| iShares MSCI EAFE IMI Index (XEF) | 27.83% |

| iShares Core MSCI Emerging Markets (IEMG) | 11.22% |

| iShares Core S&P Mid-Cap ETF (IJH) | 3.88% |

| iShares Core S&P Total U.S. Stock (ITOT) | 3.13% |

| iShares Core S&P Small-Cap ETF (IJR) | 2.34% |

These 6 ETFs combined hold 9,094 stocks with a sector allocation of the following as of March 2023:

- Information technology (20.57%)

- Financials (14.26)

- Healthcare (12.12%)

- Industrials (11.41%)

- Consumer discretionary (11.29%)

- Consumer staples (7.25%)

- Communication (6.59%)

- Materials (5.17%)

- Energy (4.64%)

- Real estate (3.21%)

- Utilities (2.95%)

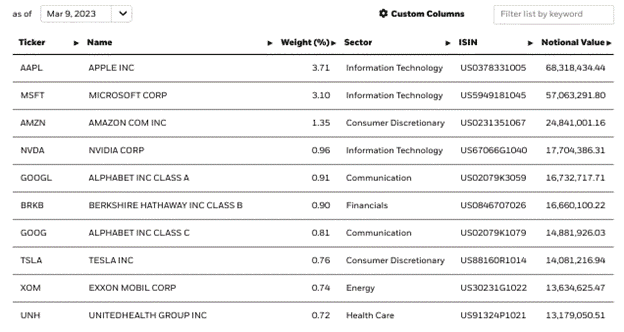

The top 10 individual stock holdings for XAW as of March 2023 are:

As the image above shows, well-known companies like Apple, Microsoft, Tesla, Amazon, NVIDIA, and Alphabet top the list.

Unlike the typical balanced or conservative portfolio, XAW does not hold bonds, so you can expect it to have a more volatile performance in rough market conditions.

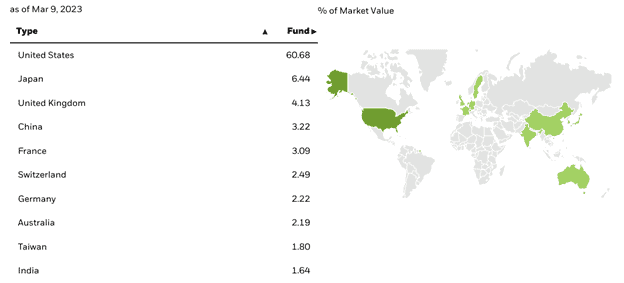

XAW is also globally diversified across several countries, including Japan, China, France, Germany, Switzerland, Australia, Taiwan, and the UK.

XAW ETF Returns and Performance

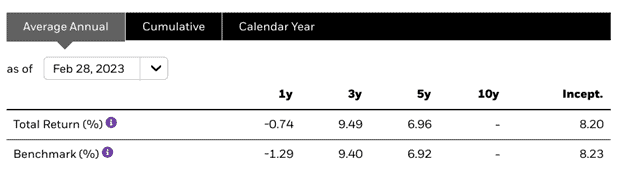

XAW has been around since 2015, and you can track its performance since then.

Assuming that you invested a hypothetical $10,000 on February 10, 2015, your portfolio will have grown as follows:

This ETF has had an average annual return of -0.74% in the last year, 9.49% in the last 3 years, and 8.20% since inception.

XAW Dividends

XAW distributes dividends to investors twice a year which is otherwise known as a semi-annual basis.

Its distribution yield as of March 2023, is 1.70%, and it has an identical 12-month trailing yield of 1.70%.

XAW ETF Fees

XAW has a 0.20% management fee and an MER of 0.22%.

Compared to the average fee of 1.98% you pay for comparable equity mutual funds, this ETF portfolio is a lot cheaper.

How does it compare to robo-advisors? The average robo-advisor charges 0.70% in combined management fees and ETF MERs.

If you are comfortable rebalancing your investment portfolio, purchasing ETFs (e.g. XAW) directly using an online brokerage platform can be cheaper.

If you prefer automatic rebalancing of the various components in your portfolio, a robo-advisor like Wealthsimple Invest or Questwealth works much better.

Note that if you intend to have an all-equity portfolio excluding Canadian stocks, a XAW-only portfolio does not require manual rebalancing.

Pros

- Provides global diversification (over 9,000 stocks)

- Lower fees than comparable mutual funds

- Hassle-free management if that’s all you have in your portfolio

- Can easily buy on Wealthsimple Trade or Questrade commission-free

Cons

- 100% stock portfolio comes with increased volatility

- Can potentially save on XAW’s MER fees by purchasing the individual underlying ETFs

- Not suitable for risk-averse investors

XAW vs. VXC

VXC aka Vanguard FTSE Global All Cap ex Canada Index ETF is an all-in-one stock portfolio similar to XAW. Both ETFs exclude Canadian equities.

As of January 31, 2023, VXC held 11,440 stocks and had a 60.40% exposure to the U.S. market, followed by Japan at 6.5%.

Its asset holdings are concentrated across the following sectors:

- Technology (19.9%)

- Financials (14.5%)

- Consumer discretionary (14.2%)

- Industrials (14.1%)

- Healthcare (12.1%)

- Consumer Staples (6.4%)

- Energy (5.0%)

- Basic Materials (4.4%)

- Real Estate (3.5%)

- Utilities (3.2%)

- Telecommunications (2.7%)

VXC has a 0.20% management fee and 0.21% MER.

XAW vs. VGRO

VGRO, aka Vanguard Growth ETF Portfolio is an asset allocation (all-in-one) ETF offered by Vanguard Canada.

It is designed to provide long-term capital growth and constitutes approximately 80% stocks and 20% bonds. This is unlike XAW, which is 100% stocks.

VGRO holds seven other Vanguard ETFs, including two focused on the Canadian stock and bond markets. These holdings include:

- Vanguard U.S. Total Market Index ETF (34.69%)

- Vanguard FTSE Canada All Cap Index ETF (24.11%)

- Vanguard FTSE Developed All Cap ex North America Index ETF (16.22%)

- Vanguard Canadian Aggregate Bond Index ETF (11.34%)

- Vanguard FTSE Emerging Markets All Cap Index ETF (5.83%)

- Vanguard Global ex-U.S. Aggregate Bond Index ETF (CAD-Hedged) (3.96%)

- Vanguard U.S. Aggregate Bond Index ETF (CAD-Hedged) (3.85%)

The management fee for VGRO is 0.22%, and MER is 0.24%. Learn more in this VGRO review.

XAW vs. VEQT

VEQT is Vanguard’s all-equity assets allocation ETF portfolio. Like XAW, it is made up of 100% stocks. However, it also invests in the Canadian market.

VEQT is globally diversified across 51 markets and comprises 13,625 stocks in 4 different Vanguard ETFs. These ETFs are:

- Vanguard U.S. Total Market Index ETF (42.11%)

- Vanguard FTSE Canada All Cap Index ETF (30.40%)

- Vanguard FTSE Developed All Cap ex North America Index ETF (19.97%)

- Vanguard FTSE Emerging Markets All Cap Index ETF (7.52%)

It has a management fee of 0.22% and an MER of 0.24%. Learn more in my VEQT review.

XAW vs. XEQT

If you are looking for an iShares all-stock ETF portfolio that includes Canadian stocks, XEQT is a great option. XEQT aka iShares Core Equity ETF portfolio comprises four other iShares ETFs (ITOT, XIC, XEF, and IEMG).

It has exposure to the U.S. (43.75%) and Canadian (24.05%) markets and several others, with 9,380 stocks as of March 2023.

XEQT has a 0.18% management fee and 0.20% MER. Get more details in this XEQT review.

How To Buy XAW ETF in Canada

You can purchase XAW on any of the popular brokerage platforms in Canada. If you want to save on trading commissions, our top options are Wealthsimple Trade and Questrade.

1. Wealthsimple Trade:

This platform offers free ($0) purchases of thousands of stocks and ETFs.

Simply search for the stock’s ticker symbol, e.g. “XAW,” and enter your preferred price or accept the current market price, enter the number of XAW ETFs you want to buy, and place your trade.

Readers of Savvy New Canadians get a cash bonus via our exclusive promo link after trading their first $150 in stocks or ETFs.

Wealthsimple Trade

Trade stocks, ETFs, and options

Excellent trading platform for beginners

Deposit $150+ to get a $25 cash bonus

Transfer fees waived up to $150

2. Questrade:

This platform supports stocks, ETFs, foreign currency, options, and bond trades. ETF purchases are free; however, you pay a small fee when you sell.

To get started, sign up here (includes $50 in free trade credit when you deposit at least $1,000 in your account).

Questrade is available on all devices.

Questrade

Trade stocks, ETFs, options, FX, bonds, CFDs, mutual funds, etc.

Get $50 trade credit with $1,000 funding

Low and competitive trading fees

No quarterly inactivity fees

Access to advanced tools and trading data

Top platform for advanced traders

Transfer fees waived

Is XAW a Good Investment?

XAW offers global diversification across thousands of stocks for those seeking long-term growth outside of Canada.

It can be held alongside other investments or on its own, depending on your investment objectives.

While I generally prefer VEQT or XEQT for all-stock, no-hassle ETF portfolios, your needs may differ, and XAW could be just what you need.

Here is a summary of the best ETFs in Canada for other considerations.

XAW ETF Review

Overall

Summary

XAW is an all-equity iShares ETF from BlackRock Canada. This XAW ETF review covers its asset allocation, returns, fees, pros, cons, and how to buy it in Canada.

Pros

- Provides global diversification

- Lower fees than mutual funds

- Can buy commission free on several brokerages

Cons

- Higher volatitlity

- Not suitable for risk-averse investors