You know payday loans are bad, right? However, life happens, and sometimes that 652% APR payday loan appears to be the only way to access cash when you need it fast.

A payday loan is an unsecured short-term loan that’s offered with extremely high-interest rates.

Payday lenders generally offer between $100 and $1,500 for a term ranging from 2 weeks to 2 months.

The interest rate you pay is based on a 14-day repayment plan, and the maximum they can charge in each province is as follows:

| Province | Interest Rate (2-week term) | Fees per $100 (2 weeks) | APR |

| Alberta | 15% | $15 | 391% |

| Manitoba | 17% | $17 | 443% |

| British Columbia | 15% | $15 | 443% |

| Ontario | 15% | $15 | 391% |

| Nova Scotia | 19% | $19 | 495% |

| Saskatchewan | 17% | $17 | 443% |

| New Brunswick | 15% | $15 | 391% |

| Newfoundland and Labrador | 21% | $21 | 548% |

| Prince Edward Island | 25% | $25 | 652% |

So, when your cash advance loan is advertised at a 17% rate, the equivalent annual percentage interest rate is actually 443%.

Payday loans are easy to apply for. You don’t need to have a good credit score, and collateral is not required.

That said, these ‘predatory’ loans often end up sucking people into a vicious cycle of debt. And there is no such thing as a payday loan with low fees.

Payday Loan Alternatives

Some alternatives to payday loans are:

1. Get a Personal Loan

While your bank or credit union may be unwilling to offer you a personal loan if you have a poor credit score, you may have better luck with an online lender that offers installment or personal loans.

Each time you apply for a loan and a lender pulls your credit profile, the hard inquiry negatively impacts your credit score.

You can use a loan comparisons site like Loans Canada or Loanz to compare rates across several loan companies at once and avoid submitting multiple applications.

If you have a good credit score, start your loan search with your bank or credit union, as they are more likely to give you better interest rates.

Loans Canada

Loans Canada is a loan comparison platform for all kinds of personal loans, car loans, debt consolidation loans, and bad credit loans. It has partnerships with some of Canada’s largest lenders and offers free access to your Equifax credit score.

Interest rate: 2.99% to 46.96%.

Loan term: 4-60 months.

Maximum loan amount: Up to $50,000.

Related: LoanConnect Canada Review.

2. Use Your Credit Card

A credit card cash advance will cost you; however, the interest rate is much cheaper than the average payday loan.

For example, if you withdraw cash at an ATM using your credit card, you may have to pay a cash advance fee (e.g. $5) plus the cash advance interest rate (e.g. 22.99%).

Here are some bad credit score credit card options. You can also check out these credit cards that have a low-interest rate for cash advances and balance transfers.

Aim to pay off your credit card balance as soon as possible.

3. Get a Line of Credit

If you already have a line of credit, you can draw on it to pay your bills.

Alternatively, if you have equity in your home, you can apply for a Home Equity Line of Credit (HELOC). It will cost you a lot less than a payday loan.

4. Get a Guarantor Loan

If you don’t qualify for a personal loan and can’t provide collateral for a secured loan, another option is to apply for a guarantor loan.

Guarantor loans don’t rely on your credit score; however, you will need a “guarantor” who agrees to pay back the loan if you default.

These loans are not cheap either; however, they are not as costly as payday loans.

5. Try a Side Hustle

Instead of taking on extra debt, perhaps you could use a side gig to make extra money.

Here are some work from home jobs to consider. You can also try these food delivery jobs for access to quick cash.

6. Use a Payday Advance App

KOHO Early Payroll gives you access to $100 three days before your paycheque.

The KOHO reloadable Mastercard is one of the best cash back cards in Canada, with up to 5% cash back on purchases.

When you open an account here, you get a $20 bonus after making your first purchase with the card. You can also use the STACK Mastercard to benefit from a similar feature.

7. Use Overdraft Protection

If you have overdraft protection on your chequing account, you can withdraw more than you have in your account and avoid a Non-Sufficient Fund fee.

Overdraft protection has limits, and you will pay an overdraft fee (monthly or per use) and interest (up to 22% per annum).

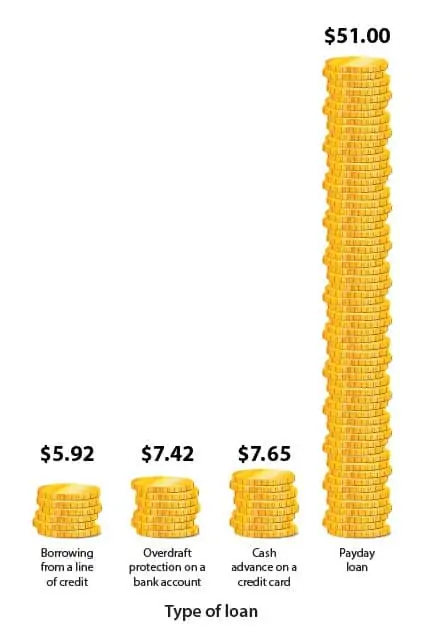

Below is an example showing how a $300 payday loan costing $17 per $100 compares to payday loan alternatives:

The illustration assumes a:

- Line of credit with $5 administration fees and 8% annual interest rate.

- Overdraft protection with a $5 fee and 21% annual interest rate

- Cash advance credit card with a $5 fee and 23% annual interest rate

8. Get a Loan From Friends or Family

Check whether your friends or family members are willing or able to give you a loan.

Pay back the loan as soon as possible, or you risk damaging your friendship.

9. Have an Emergency Fund

An emergency fund should be a part of your budgeting strategy.

While experts advise that your emergency fund should be equivalent to 3-6 months’ worth of expenses, any amount can help.

Keep your emergency savings in a high-interest savings account where it has a chance to grow.

10. Use a Micro-Investing or Savings App

Investing or saving money when you have a tight budget can be challenging, and this is where micro-investing or savings apps come to play.

They round up your purchases and save the difference.

For example, if you purchase a cup of coffee for $2.20, a roundup app like Moka or Wealthsimple rounds it up to $3.00 and saves or invests the $0.80 difference.

What Else?

The above options can help you avoid payday loans and the high-interest rates they charge.

If you are having significant difficulties with managing your debt, a financial advisor or accredited credit counsellor may be able to help you chart a plan for getting back on your feet.