When you have bad credit, it can be challenging to find a lender who will trust you enough to extend a line of credit to you. That might be the case with traditional banks, but not so with alternative lenders.

In this article, I will enumerate six of the best lines of credit for bad credit in Canada, how much you can qualify and the eligibility requirements.

Key Takeaways

- The six best lines of credit for bad credit in Canada are from Loans Canada, LoanConnect, FatCatLoans, Mogo, Cash Money and Fora Line of Credit.

- Credit limits for lines of credit for people with bad credit range from $300 to $50,000.

- If you are looking for alternatives to a line of credit for bad credit, consider bad credit loans, secured credit cards or payday loans.

Best Lines of Credit for Bad Credit in Canada

| Line of Credit Lender | Credit Limit | Loan Terms | APR | Fund Release | Availability |

| Loans Canada | $300-$50,000 | Open (depends on the lender you choose) | 6.99% – 46.96% | 1-3 business days | All of Canada |

| LoanConnect | $500-$50,000 | 6-60 months | 6.99% – 46.96% | In as little as 12 hours | All provinces in Canada |

| FatCatLoans | $1,000 – $50,000 | Open (depends on the lender you choose) | Depends on the lender and your overall financial situation | 1-2 business days | All provinces in Canada |

| MogoMini Line of Credit | $1,000 – $3,500 | No fixed period | 47.42% | Immediately available | AB, BC, MB, NB, NF, NS, NT, NU, ON, PEI, SK |

| Cash Money | $500 – $10,000 | Open-ended | APR/Annual Interest Rate of 46.93% | Immediately available if in-store; as little as 15 minutes if through Interac e-Transfer | BC, MB, NF, NS, ON, SK |

| Fora Line of Credit | $1,000 – $10,000 | Open-ended | 19.9% to 46.9% | As soon as the same business day | AlB, BC, NB, NL, NS, ON, and SK |

Below are six of the best providers of lines of credit for bad credit that can offer quick approvals.

1. Loans Canada

Loans Canada is an independent loan search and financial services comparison platform founded in 2012. It uses a proprietary solution matching technology to match borrowers with lenders offering the best possible loan solution for their needs.

With its largest provider network in Canada, the platform offers fast, no-obligation applications and approval to borrowers with good and bad credit. You only need to apply once to get multiple options from lenders matching what you are looking for.

Among its many offerings are unsecured lines of credit for bad credit. Loans Canada has partnered with over 60 lenders to provide easy applications and fast approval without fees. It is, however, not a direct lender. If you have bad credit, rates are often higher.

Find out more about Loans Canada in this review.

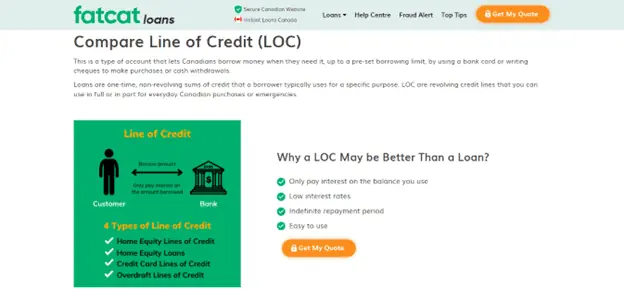

2. FatCatLoans

FatCat Loans is an online platform that matches customer applications with lenders in its network based on information submitted via online applications. Its network includes lenders who loan to people with poor credit scores.

You only need to apply once to access loans from different lenders. The application and approval process is fast. Funds can be available on the same day. Depending on the network of its lender in its network, it may offer an instant line of credit with no credit check.

As with Loans Canada and LoanConnect, FatCat Loans is not a direct lender. Interest rates may also be higher. Lenders in the FatCat Loans network may perform a credit check to assess a borrower’s eligibility and capability to repay the loan on time.

3. LoanConnect

LoanConnect describes itself as the search engine for loans, having partnered with various lenders across Canada to provide loans for diverse financial situations. One application yields a multitude of loan options in minutes.

Whether you have excellent, good, or poor credit, LoanConnect gives you lending options that suit your needs. Choose a loan and complete the application on the lender’s website.

Ontario-based LoanConnect is not a direct lender, but it connects you with providers of bad credit loans online and ensures a straightforward application and approval process and fast release of funds. Lenders may apply higher rates to borrowers with bad credit.

For more information, read this LoanConnect guide.

4. MogoMini Line of Credit

Mogo offers lines of credit for bad credit in Canada through the MogoMini Line of Credit. It is a flexible line of credit available to borrowers with bad credit and low income. It offers a no-obligation line of credit pre-approval in three minutes without affecting your credit score.

Create a MogoAccount to get a no-obligation line of credit pre-approval. Withdraw funds only as needed and repay your outstanding principal with no fixed period. Pay interest only on funds you use. You can pay the outstanding principal in full at any time with no penalty.

The MogoMini Line of Credit has a high interest rate, so it is best to repay it as soon as possible. Late payments may be charged with NSF fees or a funds transfer charge.

5. Cash Money

Cash Money is a Toronto-based lender offering an option for Canadians with various credit scores – including those with bad credit – to get a line of credit. You only need to apply once for a line of credit (online or in-store) and borrow from it as often as you need to.

You can get a cash advance by using the Cash Money mobile app, signing into your account online and visiting a Cash Money branch.

The amount you borrow from your line of credit will be charged a daily interest rate, which can be high. Other charges, such as late payment and default penalty fees, may also apply.

6. Fora Line of Credit

Fora is an online lender that provides credit solutions such as the Fora Line of Credit. It is available to individuals with various financial profiles, including bad credit.

The lender provides an online experience from application to approval. It has no origination fees, draw fees, late fees or annual fees. The product is ideal for people who need fast access to flexible funding but do not qualify with a regular lender.

The Fora line of credit for people with bad credit can have high interest rates. Because it is open-ended, you will pay more interest if you make only the minimum payment.

What is a Line of Credit for Bad Credit in Canada?

A line of credit is like cash on demand. It is a revolving, flexible loan that you can borrow as needed, up to a preset borrowing limit, which you repay immediately or over time. It often has an indefinite repayment period. You only pay interest on the balance you use.

Lines of credit for bad credit come with loan terms and conditions designed for people who do not meet the credit score requirements of traditional lenders.

Usually offered by providers of bad credit loans online, a LOC for bad credit is often extended to individuals with a steady source of income or who can demonstrate their capability to make monthly payments on time.

How to Get a Line of Credit for Bad Credit

Obtaining a line of credit for bad credit is possible by finding alternative or online lenders with more lenient eligibility requirements than traditional financial institutions. They often accept applications from borrowers with bad credit.

Here are the ways you can get a line of credit if you have a poor credit score:

- Find alternative lenders. Many alternative or online lenders specialize in working with bad credit borrowers and offer a line of credit for bad credit or an instant line of credit with no credit check.

- Compare your options. Compare their eligibility requirements, line of credit amounts and interest rates.

- Submit your application. Complete the online application form and provide the requisite personal details and information about your income.

- Include supporting documents. If you meet the eligibility requirements, submit the required documentation, including valid identification, bank account details, proof of income and personal information.

- Get the funds. Once your bad credit loan gets approval, the lender will send you the funds via Interac e-Transfer or deposit it into your account.

Pros and Cons of Lines of Credit for Bad Credit

Getting a line of credit for bad credit borrowers in Canada can have advantages and disadvantages.

Pros

- Cash is available when you need it, up to a certain amount.

- Fast access to funds

- Builds your credit

- May lower your credit utilization rate if you do not borrow the entire amount available, which improves your credit score

- Paying your balance in full on time helps you avoid paying interest.

Cons

- Since you have bad credit, you may likely pay a higher interest rate than if you have strong credit.

- Applying for a line of credit may negatively impact your credit score since the lender may initiate a hard inquiry.

- Making minimum payments increases the interest you pay and extends the life of the loan.

- It may increase your credit utilization ratio and negatively impact your credit score.

- Late payments also negatively affect your credit.

Alternatives to a Line of Credit for Bad Credit

If you are undecided about whether a line of credit suits you, consider these alternatives:

Bad Credit Loans

Bad credit loans with instant approval are available to borrowers with low credit scores and who cannot obtain loans elsewhere. If you can manage it properly, a bad credit loan can improve your credit score when it is added to your credit mix and payment history and when you consolidate your credit card debt using the loan.

But as these loans are riskier, expect higher interest rates and fees. Depending on the lender, providing collateral may also help you get approval. Should you use a bad credit loan, shop around and compare loan offers to find the most suitable deal.

Payday Loans

Payday loans give you quick access to cash when you need it. Applying and getting approval is easy since there are fewer requirements. Plus, you can get the funds fast. If you have bad credit, a payday loan would be something you can easily get.

They are, however, expensive and potentially risky. But if you use it properly, it can help cover unexpected expenses. The trick is to resort to a payday loan only when necessary. Otherwise, it is best to use other alternatives.

Secured Credit Card

Secured credit cards are ideal alternatives for people with bad credit. They are inexpensive, easy to qualify and can help improve your credit score. With this card, you provide a security deposit that reduces the risk, making it one of the easiest options.

Finding a guaranteed line of credit for bad credit can be difficult because most lenders do not always assure approval since you need to show you have eligible income. Also, secured credit cards for bad credit may not always come with perks and benefits and have higher annual fees and interest rates. Do comparison shopping to find the best-secured credit card.

FAQs

You need a credit score of 660 to qualify for a line of credit. When you have at least this score, banks will perceive you as lower risk, helping you get approval.

Depending on your lender, you can get a line of credit in as fast as 15 minutes if you choose to get your funds via e-transfer. Some offer to release funds within 12 hours or in 1 business day.

It can be difficult to get a loan with this score since it is in the Poor range. It indicates either a lack of credit history or previous credit issues.

A secured loan is the easiest to get with bad credit since you will offer your lender an asset as collateral, putting the lender at less risk than an unsecured loan. Secured loans are often available to borrowers with poor or no credit history.

Related: LendDirect Review.