For AimFinance, every Canadian should have access to credit. So, this personal loan lender has made it a mission to provide fair access to affordable credit.

By offering personal finance solutions like fast loans with bad credit, AimFinance gives customers flexible solutions that work for them.

In this Aim Finance review, we will look at its personal loan offering, how to apply, its pros and cons, and alternatives.

Key Takeaways

- AimFinance is a top personal lender offering unsecured personal loans from $1,000 to $5,000 to consumers in Ontario and BC.

- It offers a quick and easy loan process for personal loans. Terms range from 9-24 months, with an APR of 46.00%.

- AimFinance personal loans can be used for home improvements, debt payments, large purchases, unexpected expenses or any circumstance when you need funds fast.

What is AimFinance?

AimFinance is a personal lender based in Mont-Royal, Canada, offering personal loans or installment loans to consumers in Ontario and BC who are seeking affordable credit while providing personal finance advice to help customers improve their financial journey.

A personal loan is a fixed-rate installment loan that you can use for various purposes. It is a quick solution to obtaining funds when you need them.

AimFinance offers instant online personal loans for poor and bad credit. Personal loans are unsecured loans that let you borrow up to $5,000 when you qualify for the loans. Once your loan application gets approved, the money will be deposited in your bank account within 24-48 hours.

To make it easy for borrowers to obtain a loan, AimFinance requires only a simple application process and provides quick lending decisions to allow for faster transactions.

AimFinance Personal Loans

A personal loan from AimFinance is an unsecured loan that you can use to make home improvements, pay off debts, make a large purchase, or for unexpected expenses. It offers a quick solution when you need to get funds fast.

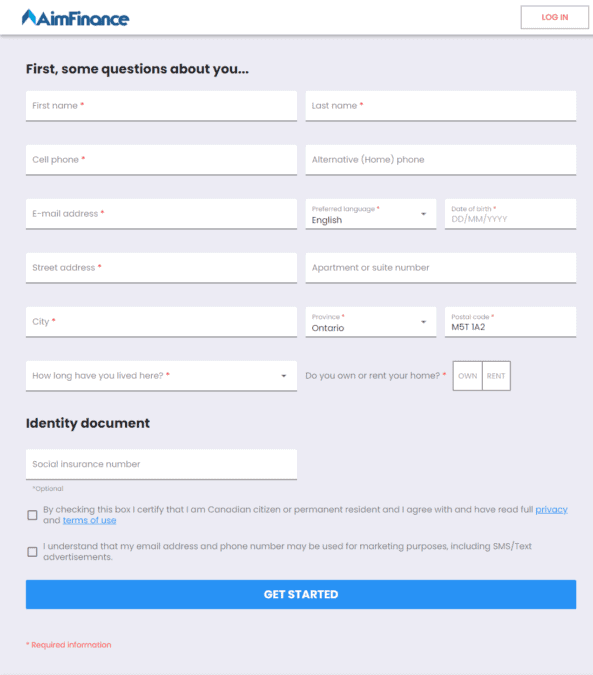

You can borrow anywhere from $1,000 to $5,000. When you apply for a personal loan, you must provide your personal and employment details. Once your loan is approved, AimFinance will deposit the funds in your bank account.

Even if you have bad credit, AimFinance works with borrowers with less-than-excellent credit and may lend them money based on evidence of a steady income instead of their credit score.

To apply for a personal loan, you must meet the following:

- Be 18 years or older

- Be a resident of Ontario or BC

- Provide proof of being a Canadian resident

- Have an active Canadian bank account (open three months or more) with access to online banking

- Minimum monthly income of $1,200

- Provide proof of steady income, such as pay stubs or direct deposit

- Direct deposit as employment payment

- Fair to good credit score

- Details about your monthly expenses

- A valid mobile phone number and email address

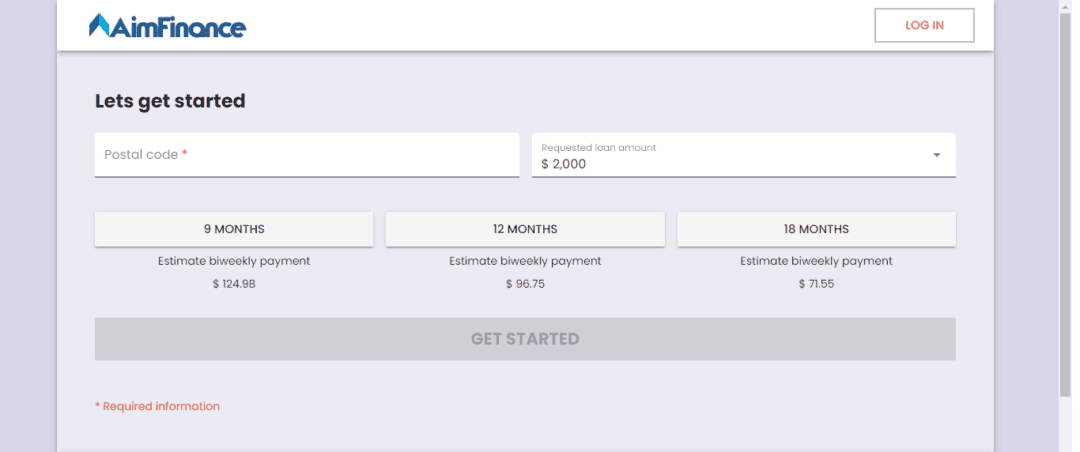

Personal loans from AimFinance have loan terms ranging from 9-24 months, based on the amount you borrow. Payments for your personal loan are due on scheduled income deposits.

How to Apply for an AimFinance Personal Loan

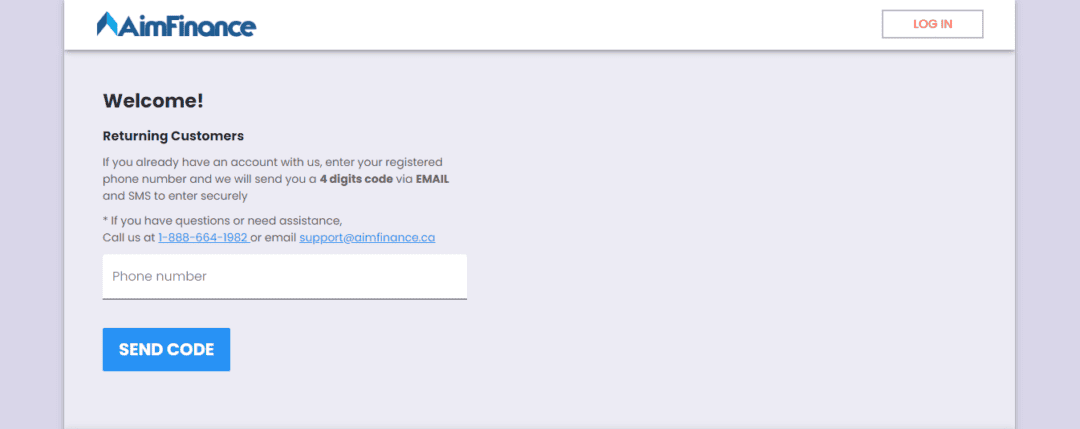

First off, register for an account at AimFinance.

To apply for an AimFinance personal loan, follow these steps:

- Go to the AimFinance website and click “Get Started” or “Apply Now” to load the “Lets get started” page.

- Enter your postal code, loan amount, and payment schedule. Click “Get Started.”

- Fill out the loan application form and click “Get Started.”

- Wait for approval from AimFinance. The lender will assess your creditworthiness, review your credit report, and verify your employment to determine your eligibility.

AimFinance may require you to complete a credit check and upload additional supporting documents, such as a bank statement or a utility bill. When calculating your loan approval limit, the lender will consider your credit score, current salary, spending habits, and debt-to-income ratio.

Once AimFinance approves your application, you will receive the funds within days. You can receive your funds through direct deposit via electronic funds transfer (EFT) within 24-48 hours.

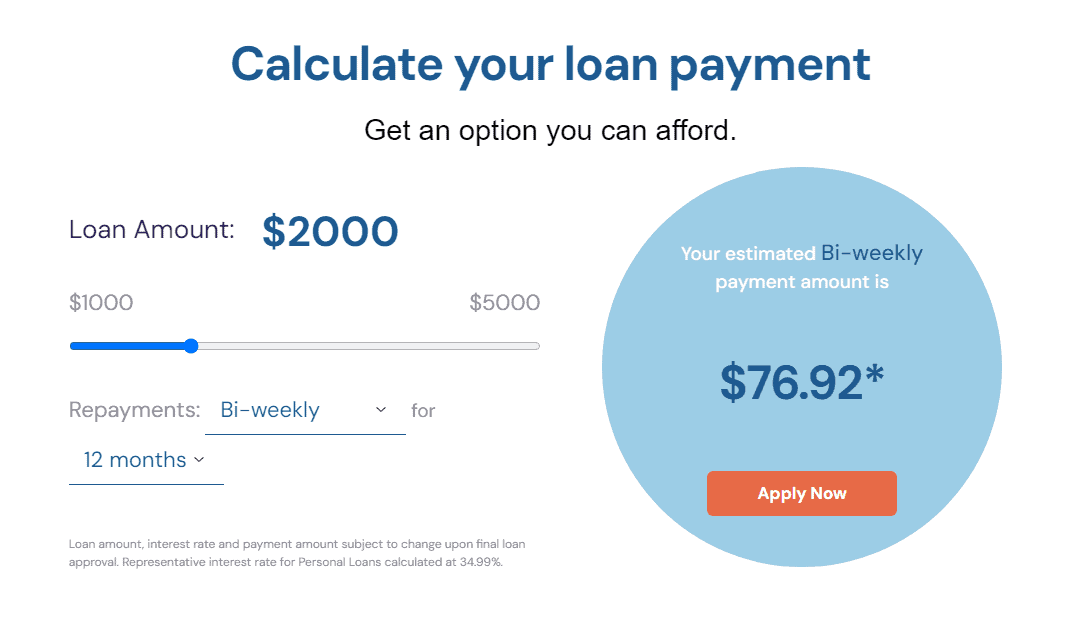

Loan Calculator

To get an idea of your loan payment amount, use the AimFinance loan calculator. Use the slider to choose your loan amount and select the payment terms to get the loan cost.

Before applying for an AimFinance personal loan, you can use the loan calculator to determine what you can afford.

AimFinance Personal Loan Interest Rate

Personal loans from AimFinance have an APR/Annual Interest Rate of 46.00%.

When using the AimFinance loan calculator to compare loan costs and determine your payments, note that the representative interest rate for personal loans is calculated at 34.99%.

Is AimFinance Safe and Legit?

AimFinance is a safe and legit company with a physical location at:

355-4480 Chemin de la Côte-de-Liesse

Mont-Royal, Québec H4N 2R1 Canada

Its contact details are as follows: Phone: 1-888-664-1982; Mon – Fri: 9am – 5pm (EST).

- Email address: [email protected]

- Contact form: https://aimfinance.ca/contact/

AimFinance protects the security and confidentiality of its clients’ personal information using industry-standard physical, technical, and administrative security measures.

Pros and Cons of AimFinance

The following are the pros and cons of an AimFinance personal loan:

Pros

- May improve your credit score if you pay on time and use the funds to pay off other debts

- You can use the borrowed money to spend on anything

- No application fee

- Quick and easy loan process

Cons

- High interest rate (46.00%)

- Borrowers with less-than-optimal credit scores often have higher interest rates

- Additional monthly expense

- Only available in Ontario and BC

AimFinance Alternatives

Below are alternatives to AimFinance that offer Canada loans online, including fast loans for bad credit and other loan types.

Depending on the lender, you may find an emergency loan for bad credit with guaranteed approval.

Loans Canada

Loans Canada is a loan search platform and comparison site that offers personal loans to borrowers with bad credit and other easy loans in Canada (online). Loan amounts range from $500-$35,000, with loan terms of 4-60 months and APRs ranging from 2.99%-46.96%.

Like AimFinance, Loans Canada requires a simple application process and provides quick approval and funding if you meet the requirements. Interest rates can also be high for borrowers with bad credit.

LoanConnect

LoanConnect is a search engine that provides access to unsecured personal loans from its partner lenders and providers of Canada loans online. Loan amounts are from $500-$50,000, loan repayment terms are 3-120 months, and APRs range from 6.99%-46.96%.

Loan pre-approval is quick, and fund release can be completed on the same day. Interest rates depend on your credit profile. Compared with AimFinance, LoanConnect is not a lender but a loan broker. It connects borrowers with lenders that fit their loan needs.

Fairstone Financial

For almost 100 years, Fairstone Financial has offered quick loans, including personal loans, to Canadians with fair to good credit scores. Loans range from $500-$25,000, with loan terms of 6-60 months and interest rates of 26.99%-39.99%.

The application process, approval, and funding are also quick at Fairstone Financial. As with AimFinance, it provides a loan calculator to help borrowers determine their loan costs before applying for a loan. Fairstone does not also charge prepayment penalties, like AimFinance.

Borrowell

Fintech company Borrowell is a loan comparison site that provides access to online marketplaces and lets borrowers compare personal loans at various lenders. It also offers free credit score and report monitoring from Equifax Canada.

Like AimFinance, Borrowell offers a quick and easy loan process and fast fund release after loan approval. Borrowell also provides a loan calculator onsite. Borrowell charges 1-5% of your loan amount as an origination fee and applies a $25 fee for non-sufficient funds.

Apart from AimFinance and its alternatives listed above, other lenders that provide quick online loans everywhere in Canada include Givemecashtogo and Lend For All.

FAQs

Taking out a personal loan may not significantly affect your credit score, but it will increase your debt. Missed payments, though, will cause your credit score to drop significantly.

If you take out a $5,000 loan for one year with an APR of 35%, your total loan cost would be $5,997.78. Your monthly payment would be $499.81.

Lenders typically check your credit score if you apply for a personal loan. Your credit score is one of the most crucial factors in a loan application, although it is just one of the requirements they look at to determine your eligibility. Two types of personal loans that do not require credit checks are payday loans and auto-title loans.